Start By Taking Baby Steps

You dont have to save the full cost of college. If you set your goal to save 100% of your childrens future college costs, you may get sticker shock. The sheer magnitude of the cost of attendance might cause you to give up in dismay.

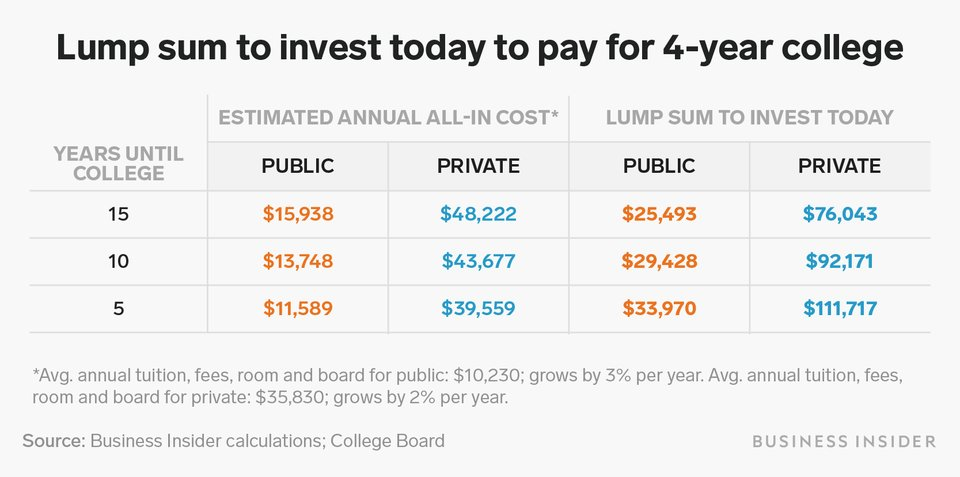

Instead, set your sights a little lower and break up the college savings goal into baby steps, such as how much you need to save per month instead of one big lump sum. If you start saving from birth, the monthly contribution is about 0.3% of the college savings goal. For every $10,000 in college costs, you need to save only about $25 to $35 per month from the day your baby is born.

FREE TOOL: Calculate how much you should be saving per month

Consider Your Loan Options

When youre applying for student loans, you have two main options: private and federal. Private loans could have variable or fixed rates, and they usually dont have flexible repayment options.

Federal loans come from the government, have borrower protections with fixed rates, and include the ability to lower or even postpone payments if you run into financial hardship. As a result, its essential to research all your options and see which ones best suit your situation.

Facts About The Rising Cost Of College Tuition

College costs have increased faster than inflation since 1981, reports the U.S. Bureau of Labor Statistics. That makes estimating how much money you need for college a bit tricky. Not to mention, prices can vary drastically depending on the college. Nonetheless, the cost of higher education has become increasingly transparent, providing you the tools you need to calculate the amount you will need.

You May Like: Glendale Community College Az Jobs

How Much Does Four Years Of College Cost

Over the years, college has evolved from a choice made by some to an expectation for nearly everyone. At high school graduations, schools will even read off information about the colleges that students are planning to attend. Going to college has become the societal norm, to the point where it is almost strange, unwise, and often even unacceptable to decide against higher education.

There is an obvious reason for this trend. Many people believe that opting out of going to college will make it more difficult for a person to find employment, advance their career, and make money throughout their lifetime. A college degree, in comparison, opens up the job market, unlocks paths to advancement, and leads to higher salaries.

None of these beliefs are expressly incorrect. Many employers will make a four-year degree a prerequisite for most positions. These positions require specific skills and education that are usually not covered in high school. Employers are willing to pay extra for those skills, meaning that salaries areon averagehigher for college-educated professionals than they are for people who merely hold high school diplomas.

How Can I Save Money

Websites such as FastWeb and Scholarship.com can help you find and apply for scholarships for which you are eligible.

Filling out the FAFSA, which every college applicant is required to do, will determine if you are eligible for financial aid.

College students can save a lot of money on textbooks by buying them used. Sites such as and AbeBooks.com can help however, make sure you shop by the ISBN and not by the title as there are many editions of each textbook and professors are usually specific about the one they use.

Consider taking the route of a community college first. Community college credits can easily transfer over to a state college. By going this route, youll be able to save during your first two years of school.

Advertising Disclosure: This content may include referral links. Please read our disclosure policy for more info.

Read Also: What Colleges Are Still Accepting Applications For Fall 2021

Bottom Line: Save As Much As You Can

When it comes down to it, you’ll need to reconcile your numbers with what you can truly afford. Saving for college is important, but it needs to work with your other priorities, like saving for retirement or building an emergency fund.

Be sure you’re doing all you can, though. Cutting expenses to save an additional $25 a week could have a huge impact in the long runand make it less likely that you’ll struggle financially when it’s time for college.

Can You Get Money For Going To College

Yes, really. We take a look at the most commonways students can get paid for attending college,including corporate tuition reimbursements, career-specific tuitionbenefits, college financial aid, no-loan colleges,even scholarships and grants.

Moreover, how much money do you get for going to college?

Tuition at a public four-year college can averagebetween over $9,000 per year for in-state students to almost$23,000 per year for out-of-state students. Tuition at a privatefour-year college can average over $31,000 per year. Thecost of books is usually quite low, compared to tuition andhousing.

Also Know, can you go to college with no money? Unless you‘ve made the decision to attend ano– or low-cost school, it’s possible that you‘llneed to borrow money to pay for college. But studentloans from the federal government or a private lender should beyour last resort. Federal loans are the easy answer to how to goto college with no money and bad credit.

People also ask, do I get money for going to college UK?

Literally, you don’t get paid to go to college inthe UK. But you will receive plenty of financialsupport during your studies to cover education-related costs in theforms of bursaries, the majority of which don’t need to bepaid back.

Where do you get paid to go to school?

You May Like Also

Recommended Reading: How Much Is My College Book Worth

Top 10 Tips For Saving Money In College

College costs vary drastically, so prospective students should compare tuition prices among schools and apply for financial aid. A 529 College Savings Plan may prove helpful in saving money for college. See below for 10 cost-cutting tips that can lower college expenses.

Many students save money in college by fulfilling prerequisite credits or degrees at community colleges before transferring to four-year schools. According to EducationData.org, in-district community college tuition averages $3,340 annually â considerably less than the overall annual tuition rate of $10,560 for all in-state public institutions.

New textbooks often cost $50-$100, but students can save money by ordering used or digital textbooks through sites like BookFinder.com and Amazon.com.

Given the high costs of gas prices, commuter students often save money by using bus, trolley, subway, and/or train systems to get to school. Finding housing close to campus can also reduce commuting expenses.

Most schools offer several meal plans in different price ranges. Many students save money by choosing a lower-cost meal plan and eating some meals at home. Students can also shop at affordable grocery stores and cook their own food to save money.

Many colleges offer free services, such as health clinic care, counseling, career planning, and campus recreation. Students can save money by using these free, on-campus services instead of paying for similar services at off-campus locations.

Ideal Salary Needed To Afford College In Your State Without Loans

College is pricey see how much you need to make to afford it. Student Loans 101

Americans have been taking on more and more debt to keep up with the rising cost of college. According to research group EducationData.org, Americans owe $1.73 trillion in student loan debt. But how much would you have to earn to avoid or help your children avoid the college debt trap and live comfortably while doing so?

See: These Elite Colleges Went Virtual But Raised Tuition Anyway

GOBankingRates surveyed the cost of living, mortgage rates and college costs using College Board data on the average price of in-state tuition and fees at public four-year institutions to calculate what you need to earn to pay for college without loans.

Read Also: What Colleges Are Still Accepting Applications

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Average Cost Of Room & Board

The determining factor in the cost of room and board is whether the student lives on or off campus.

- At 4-year institutions, the cost of room and board ranges from $10,216 to $11,945.

- At public 4-year institutions, students living on campus pay an average of $11,451 annually for room and board off-campus boarders pay $10,781.

- At private, nonprofit institutions, on-campus boarders pay an average of $12,682 per academic year students living off campus pay $9,762.

- At private, for-profit institutions, on-campus room and board averages $10,654 students living off campus pay an average of $8,027.

Don’t Miss: Do I Need Ged To Go To Community College

Estimate How Much Money You Need

The first step in determining how much money you should borrow for college is figuring out what you need to spend. While its not easy to calculate this cost, its a crucial step.

Dont make the mistake of looking just at tuition and fees and thinking thats how much you need to pay for college. You also have to consider books, supplies, room and board, and transportation costs.

Most schools will show the cost of tuition and fees on their website, and you can find college cost calculators online that give you an idea of how much other expenses will run.

Attend A Work College

A work college is another way to get a free college education or, at the very least, substantially discounted tuition. Just as the name suggests, these colleges, which are generally four-year liberal arts institutions, provide educational opportunities as well as valuable work experience.

But be aware, all students must participate in a comprehensive work-learning service for all four years of enrollment. In other words, all resident students have jobs. Often the jobs are on campus, but sometimes the employment may be off campus. Specific program details vary by college.

All participating work colleges are approved and supervised by the U.S. Department of Education and are required to meet specific federal standards.

You May Like: What College Accepts The Lowest Gpa

Apply For Financial Aid And Grants

- Potential savings: Varies

If youve exhausted your scholarship search, applying for federal financial aid and college grants should be your next step. Like with scholarships, grants dont have to be repaid.

Depending on the cost of the school you attend, your total financial aid and grants could add up to the full cost of attendance.

What grants could I get?

For example, if youre an undergraduate student with financial need, you might qualify for a Pell Grant. For the 2020-21 academic year, the maximum you could be awarded with a Pell Grant is $6,345.

To apply for federal aid and determine your eligibility, youll need to fill out the Free Application for Federal Student Aid . The information you provide in the FAFSA is used to calculate your Expected Family Contribution , which is the amount your family is expected to contribute to your education costs.

Your EFC, year in school, enrollment status, dependency status, and schools cost of attendance will be used to determine the aid you qualify for.

After you submit the FAFSA, your school will send you a financial aid award letter detailing what financial aid is available to you. You can then choose which aid youd like to accept, such as grants and federal student loans.

Say No To Student Loans

When you complete the FAFSA, youll start getting offers from banks that will be more than happy to help you pay for college. In fact, some financial advisors actually tell their clients to count on paying for part of their college expenses with student loans. Listen, its this advice that has led Americans to carrying around 1.58 trillion in federal student loan debt.6

Bottom line? Debt is a threat to your kids financial futures. Student loans only help your kids start out in the negative. But get this: Going through college debt-free really is possible.

These lenders claim theyre more than willing to help you out. Lets look at the real costs of that so-called student loan help. In 2020, the average student loan borrower carried about $38,792 in student debt.7

So, what will paying off that debt look like?

Assuming you have a 10-year payment plan and an interest rate of 6%, youd be paying just over $400 a month. And throughout those 10 years, youd pay almost $13,000 in interest. So, that help in the form of a nearly $39,000 loan cost you almost $52,000. If you do the 20-year payment plan, youd pay only $278 a month, but youd end up paying close to $30,000 in interestalmost the original loan amount! Paying nearly double for a degree? No, thank you!

Read Also: What Size Are College Dorm Beds

Best Ways To Save For College

Instead of saving in a traditional bank account, there are plenty of options for investing your money so you can take advantage of compound returns. An important college savings caveat is that, depending on the strategy you use, investment earnings will add to your total savings.

A 529 plan, for instance, is a tax-advantaged education investment account that individual states offer. Some states give residents a tax break for using their home account, but you can choose any plan you like. As you would in a 401 or an individual retirement account, you can typically choose your own funds to invest in or opt for a mix of funds targeted toward your childs anticipated college start date. That will ensure your investments arent too risky or too conservative.

If you save each month in a 529 plan, you could contribute less per month and save the same total amount when your child goes to college. In our example from above, youd have to save $209 per month for 13 years to reach about $44,000 in savings, if your investments receive a 6% average annual returna reasonable goal based on historical stock market returns. Thats about $96 less per month than if you didnt invest your money.

The Amount You Will Actually Pay In College Costs

You have heard that it costs a lot of money to send a child to college, but you also know that the benefit is well worth the sacrifices your family makes. The advertised amounts you see online are seldom what most families end up paying, though.

To determine the impact paying for a college education will have on your family, start with a general idea of your costs. These include the cost of applying to college, which is sometimes higher than many parents expect. When you add up the costs of campus visits, tests, application fees, and outside professional advice, you could be out several thousand dollars before the first acceptance letter even arrives. Then there are the actual costs of attending.

Also Check: How Much Does It Cost To Go To Berkeley College

Talk To Your Child About Finances And College Costs Early

Your child may be the one attending college, but parents tend to foot most of the bill including extras like traveling to and from campus, setting up a dorm room, and clothes for college.

Parents also have to make house and car payments, insurance, pay medical costs, buy food and clothes, save for retirement and a rainy day fund, take care of pets everything.

You may think you dont need to talk to your children about the cost of college. Parents often think that children wont understand finances and shouldnt be bothered with knowing about the familys income.

Wrong.

Its crucial that parents sit down and have the talk about college costs and the familys finances.

Many students think they will land at their dream school with good grades, and if they cant afford it, loans and scholarships will pave the way. Many students also dont understand that their parents will most likely have to co-sign private student loans. .

If a student doesnt graduate, the parents are stuck repaying the loan.

In our survey, 75% of parents said they had talked to their children about the cost of college.

These parents have made a smart decision to discuss college because children should know how to set realistic expectations about college and understand the options for affordable colleges.

But what if youre a parent and dont want to share your budget with your children?

One parent who responded to the survey said,

How Much Does College Cost

Spread the Knowledge. Share:

When thinking about the price of college, people often focus on college tuition costs. But the total price tag can include additional expenses ranging from housing and transportation to school supplies. Let’s take a look at the average costs behind a year of college.

In its 2020 report, Trends in College Pricing and Student Aid, the College Board reports that a moderate college budget for an in-state student attending a four-year public college in 2020-2021 averages $26,820. For out-of-state students at public colleges, the average budget comes to $43,280, and for students attending private colleges, the average budget is $54,880.

Source: College Board, Trends in College Pricing and Student Aid, 2020.

Recommended Reading: Is Ashworth College Recognized By Employers