The True Cost Of College

The federal government requires that all U.S. colleges and universities publish their annual cost of attendance . The COA includes tuition and fees, room and board, books and supplies, transportation, and personal expenses. If you already have a list of colleges in mind, knowing their COAs can give you some idea of how their costs compare.

But its important to note that a colleges official cost of attendance is like the suggested retail price of a product thats frequently sold at a discount or like the sticker price on a new car. The reality is that many students and parents pay considerably less.

Whats more useful to know is the colleges net price, after taking into account any grants and scholarships for which the student may be eligible. While student loans are also touted as financial aid, unlike grants and scholarships, they eventually have to be paid back with interest. Rather than reducing your cost, student loans increase it in the long run.

The College Boards Trends in College Pricing report shows the stunning difference between what many colleges say they charge and what they actually charge. For the 20192020 school year, for example, the average published tuition, fees, and room and board at four-year public and private colleges looked like this:

- Public four-year : $21,950

- Private nonprofit four-year: $49,870

But the average net prices, after accounting for grant aid and tax benefits, looked like this:

- Public four-year : $15,380

Much better, right?

Open A College Savings Account

If your parents or guardians didn’t open a college savings account for you, consider opening one yourself. Putting money aside specifically for college means you won’t be tempted to pull out the money for other purposes, like a vacation.

A 529 plan, for example, remains a popular option among college students.

“The great thing about a 529 plan is that you do not pay taxes on its value as long as you use the money for educational expenses,” explains Barnhardt. “So if you are going to use savings to pay for your college expenses, it might make sense to put the money into a 529 plan instead.”

College savings accounts differ from normal savings accounts and have certain eligibility requirements. These requirements differ depending on the type of account. Some may maintain annual contribution limits, while others may set certain income requirements.

Overcoming A Late Start

Parents who arent able to start saving right away may face a bigger savings challenge as college approaches.

If you start saving for college once your child has already started school, you may need to set aside more than $250 a month to achieve your target. The typical child starts kindergarten at age 5, and with just 13 years to save for college, parents would need to set aside $325 a month to save enough to cover 50% of the cost of four years of public collegeassuming the same $23,000 annual price tag in todays dollars. Consider repurposing money that was being spent on daycare to go into the college fund once the child is in school for a full day.

Parents who begin saving for their childs college in middle school, typically around age 11, have even less time to save. With just seven years until college, parents would need to set aside more than $450 a month to achieve their 50% target. This amount is likely out of reach for many household budgets, so the best strategy may be to save as much as you can, then assess your situation in the final years before your child reaches college age.

No matter how many years you have left, you can get a better sense of your situation by visiting the College Savings Planner and entering the values that match your scenario.

Read Also: Can I Still Enroll In College This Year

Best Ways To Save For College

Instead of saving in a traditional bank account, there are plenty of options for investing your money so you can take advantage of compound returns. An important college savings caveat is that, depending on the strategy you use, investment earnings will add to your total savings.

A 529 plan, for instance, is a tax-advantaged education investment account that individual states offer. Some states give residents a tax break for using their home account, but you can choose any plan you like. As you would in a 401 or an individual retirement account, you can typically choose your own funds to invest in or opt for a mix of funds targeted toward your childs anticipated college start date. That will ensure your investments arent too risky or too conservative.

If you save each month in a 529 plan, you could contribute less per month and save the same total amount when your child goes to college. In our example from above, youd have to save $209 per month for 13 years to reach about $44,000 in savings, if your investments receive a 6% average annual returna reasonable goal based on historical stock market returns. Thats about $96 less per month than if you didnt invest your money.

Your College Saving Options

If your family is not already putting aside money to pay for your college education, its not too late to get started with special savings accounts for education costs.

These accounts allow your money to grow in two ways. First, they offer interest a profit you make from the money youve invested in the account. Second, the interest you make from these accounts is not taxed, unlike that in a regular interest-earning savings account. Here are the details about two programs designed to help you and your family save money for college.

Recommended Reading: What College Has The Best Football Program

Start Early And With Whatever You Can

The most important part of saving for college is investing as early as possible. Since compound interest is interest earned on both the initial investment and the interest you’ve accumulated, your gains will be much larger if you start investing at birth.

You can think about it like this: With compound interest, an initial investment of $1,000 will yield earnings of $100 after one year if there’s a 10% interest rate that’s compounded annually. Your second year, you’ll earn an additional $110 because you’ll be receiving 10% interest on the $1,100 you’ve accumulated.

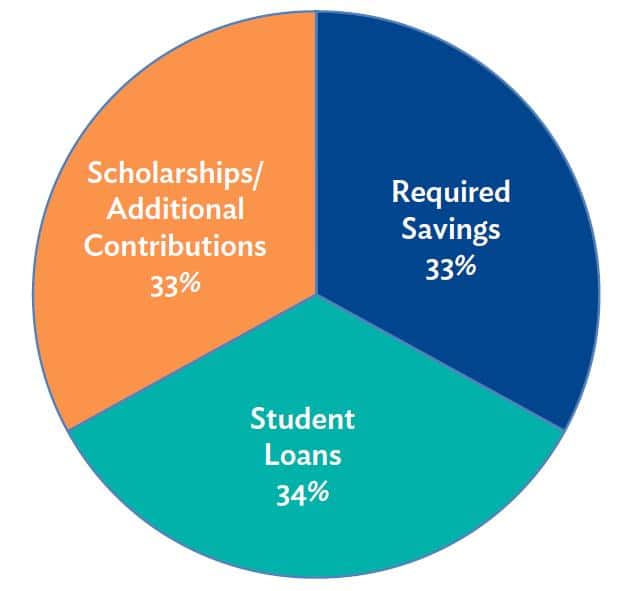

Kantrowitz recommends the one-third rule as a rough guide for how much parents should be saving: one-third of the cost of a four-year college education will come from parent’s income and financial aid, one-third from savings and investments and one-third from student loans. Once you decide what percentage of your child’s college education you’re willing to fund, you’ll have to figure out how much that will cost you each month.

According to Kantrowitz, about one-third of your college savings will come from your investments if you start investing at birth. However, if you start investing when your child is in high school, only one-tenth of your college savings will come from your investments. In other words, your college savings will be nearly three times bigger if you started investing at birth than if you started in high school.

How Much Should I Save

Experts recommend a savings plan for a childs education that covers 1/3 of college costs through savings, 1/3 from current income and 1/3 through loans. Since all colleges have different costs, it can be tricky to determine exactly how much you need to put away. A good rule of thumb is to save $250 per month for an in-state public college education, $400 per month for an out-of-state public college, and $500 per month for a private, non-profit school. To boost your savings, divert half of any yearly bonuses or other windfalls you may get into your college savings account.

Don’t Miss: When Do College Credits Expire

Set Up Automatic Transfers

Setting up automatic transfers means you don’t need to consciously make the decision to set money aside into a savings account. Instead, an automatic transfer will regularly move money from your checking account into your savings account.

This is a good option for anyone who might have a part- or full-time job and who can afford to take a set amount of money out of their checking account on a monthly basis.

Automatic transfers also work well for people who are a bit more forgetful about their personal finances and could use an automated savings system.

How Much Youll Pay And How Youll Pay For It

You may be asking yourself, if I save for 50% of the cost, how will the rest of the college price tag be covered? Its important to understand that the published cost of college is often not what students will actually pay. As a result, your savings strategy should factor in every potential source of funding available, including:

Financial aid

Grants and scholarships can help make the actual net price of college lower than the published cost. For example, the average actual net price for a public, four-year institution was $19,490 in the 20202021 academic year, according to College Board data. That total is 27% lower than the published price. Grants and scholarships dont need to be repaidthey essentially provide a discount on tuition. Some of this institutional aid is merit-based, and some is based on need.

Even if you dont think your income will qualify you for aid, it is potentially worth factoring it into your savings plan as financial assistance may not be based on income alone, says Young.

Sticker Price vs. Actual Price

For most students, grants and scholarships can reduce the actual price ofcollege by a significant margin.

| PUBLIC, FOUR-YEAR SCHOOL |

A Potential Funding Plan for College

Parents and students may not need to cover 100% of the cost of college.Instead, consider the many sources of potential funding that can help you achieveyour goal.

Recommended Reading: Is Criminal Justice Hard In College

How Often And How Much Should I Contribute To College Savings

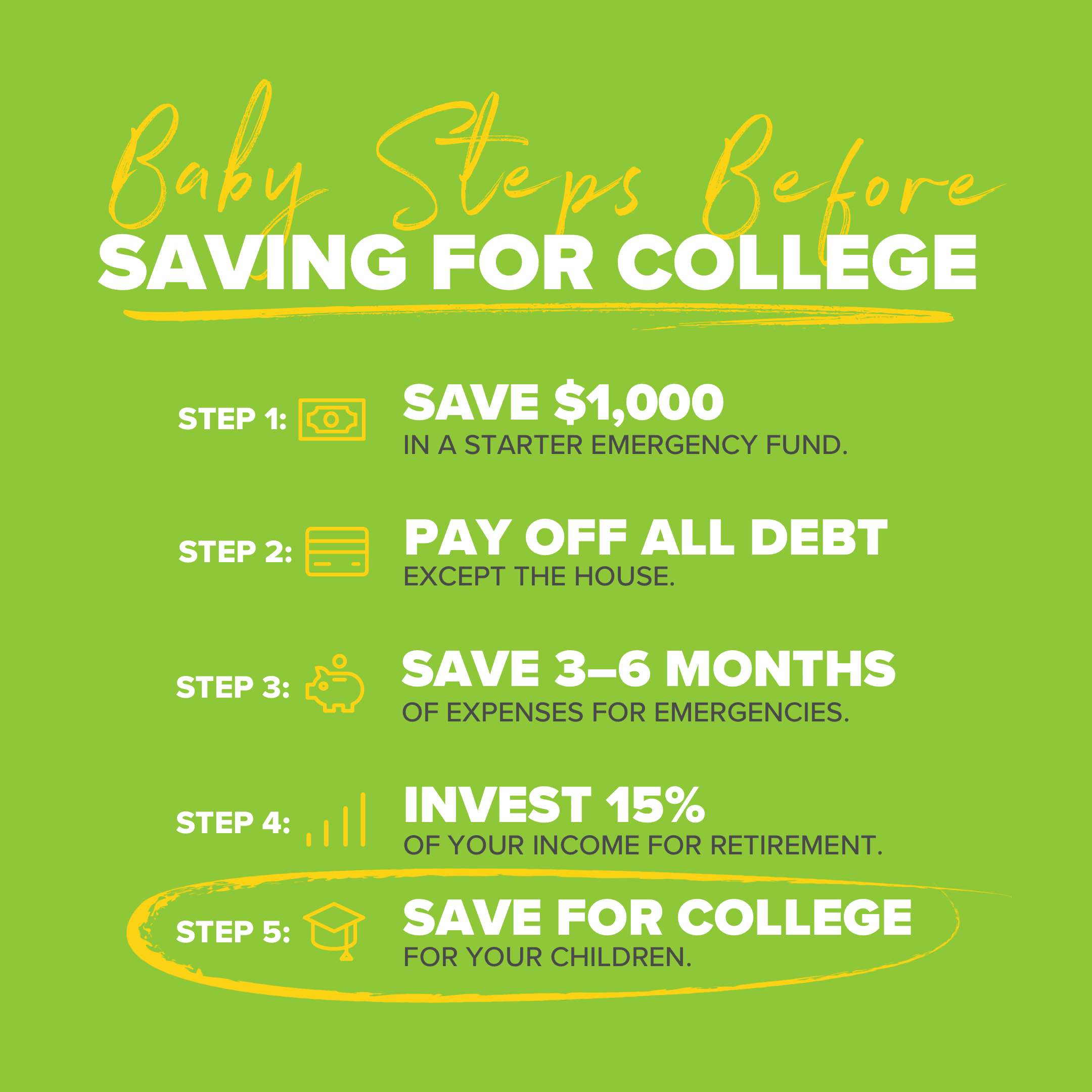

It helps if you break down the college costs into baby steps, such as the amount youll need to save per day or per month.

For example, saving a dollar a day starting at birth will yield $10,000 by the time your child enrolls in college. Spare change can really add up.

Saving $250 a month will be enough to cover a third of the cost of sending a baby born today to an in-state 4-year public college. Thats a bit less than what the average family spends per month on eating out at restaurants. Save $450 a month for an out-of-state 4-year public college and $550 a month for a private 4-year college.

But, even if you cant save that much, save what you can. Everything you save will save you money. Its also easier to increase the amount you save after you get started.

In addition to contributing monthly to a childs college savings, you should also consider giving the gift of college instead of toys and other presents on birthdays and holidays. When your family and friends ask for gift ideas, suggest Gift of College gift cards. After all, the child is more likely to play in the box the toy came in than with the toy itself. So, just give them a box to play in and contribute the rest to college savings.

Are You Saving Too Much For Your Kids College

Whether you’re over-funding a 529 plan or prioritizing college savings over your own financial … security, saving too much for college can be costly.

getty

With the average cost of college nearing $33,000 per year, few parents have concerns about saving too much for their kids’ college. But that doesn’t mean they shouldn’t be. Whether you’re over-funding a 529 plan and risk incurring taxes and penalties or prioritizing college savings over your own financial security, saving too much for college can be costly. Here’s how to tell if you’re saving too much for your kids’ college and what you can do about it.

Read Also: How Much Is The Lvn Program At American Career College

How Much Should I Save For College Monthly

You should save as much as you can afford for your childs education, without hurting your quality of life. Ideally, you should save at least $250 per month if you anticipate your child attending an in-state college , $450 per month for an out-of-state public four-year college, and $550 per month for a private non-profit four-year college, from birth to college enrollment.

Prioritizing College Savings Over Your Retirement Sets The Wrong Example

Parents can be pretty selfless when it comes to their kids. But it’s important not to sacrifice your own financial health in the process. After all, there are no loans for retirement. Saving for the cost of a four-year college education is challenging, but nowhere near as hard as paying for 30 years of expenses in retirement. If you get too far behind, there isn’t always time to catch up. You can only spend a dollar once and over-extending to help your student may mean you’ll be the one needing help down the road.

Also, kids learn about money from their parents, so it’s essential to set a good example. Getting behind on your bills to pay tuition or putting your retirement security in jeopardy to afford something out of reach may send the wrong message. Make no mistake: education is really important, as is helping your children secure their own financial future. But depending on your financial situation, it may not be realistic to give kids a blank check for college. And it does nothing to teach kids about evaluating cost-benefit trade-offs, sticking to a budget, or living within their means.

How to fix it

Don’t Miss: Where Can I Watch College Football

Education Savings Account Or Education Ira

An ESA works a lot like a Roth IRA, except that its for education expenses. It allows you to invest up to $2,000 per year, per child. Plus, it grows tax-free! If you put away $2,000 a year starting when your child is born, by the time they turn 18, you would have invested $36,000. Its hard to say exactly what the rate of growth is with an ESA because it varies based on the investments in the account. But at the average stock rate of 12%, that $36,000 would grow to around $126,000 by the time the child starts school. Congratulations, you more than tripled your investment, and now Junior doesnt have to worry about paying for tuition!

We like the ESA account because its likely a much higher rate of return than youd get in a regular savings accountand you wont have to pay taxes when you withdraw the money to pay for education expenses. An ESA isnt just for college tuition either. It can be used for K-12 private school tuition, vocational school or things like textbooks, school supplies or tutoring If your child doesnt end up needing it, you can transfer the money to a sibling for their school.

Why We Like It:

- Higher rate of return than a regular savings account

Why We Dont:

- Contributions are limited to $2,000 per year

- You must be within the income limit to qualify

- The amount must be used by the beneficiary by age 30

Why Save For College

Before we get to the how of saving for college, we should discuss the why.

College is a worthwhile investment in your childs future. Not only do college graduates get good jobs, earn more money and have lower unemployment rates, but they are happier and healthier than people with just a high school diploma.

Saving for college provides the family with financial advantages when paying for college. Families who dont save for college may qualify for slightly more financial aid, but the families who save for college have more money overall to pay for college.

Lets consider one of the most common myths about saving for college, that youll miss out on financial aid if you save for college. It is true that your childs financial aid package will be slightly reduced, but the impact is minimal and the college savings is still worthwhile. For example, if you save $10,000 for college the right way, eligibility for need-based financial aid will be reduced by at most $564. That still leaves you with $9,436 more to pay for college costs.

There are several other reasons why parents should save for their childrens college education. College savings are the antidote to student loan debt. College savings can reduce or eliminate student loan debt.

College savings also make college more affordable. College savings provide flexibility in college choice, allowing the student to choose a college that is more expensive than the family could otherwise afford.

Also Check: How Can I Get My College Paid For

How Much Should You Save For College

Paying for college can put a tremendous burden on a familys finances. However, when you start saving for college early, it becomes a more attainable goal. Taking advantage of a college saving plan offers tax-free withdrawals so you can keep all of your earnings. Calculating how much you need to save for college depends on the cost of the college and several other factors. Heres a breakdown to help you stay on the savings track. Contacting a financial advisor who understands the ins and outs of paying for college can also ease associated financial pressures.

Choose The Right Goal For You Then Get Started

When it comes to paying for college, the earlier you begin, the better. But getting started can be overwhelming. The price of college is risingthe cost of college has grown faster than the overall basket of goods and services that people generally buy since 1980and theres a host of other unknowns to plan for. Should you choose a public or private university? Should you stay in-state or go out of state? Could your child get scholarships? What about grad school?

Luckily, you dont need to know the answers to all these questions to start saving. Here are a few strategies for deciding how much to save for college.

Don’t Miss: How To Sign Up To Get Mail From Colleges