How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Paying For College With College Ave

If youre looking for a reputable private student loan lender, College Ave should be on your list. Offering low-interest rates and different repayment options, College Ave offers you flexibility that will be especially valuable after graduation.

However, its a good idea to compare offers from multiple lenders before making a decision. Use Purefys Compare Rates tool to receive offers from several different student loan lenders at once. That way, youll know for sure you are getting a great deal.

College Ave Customer Service

College Ave has customer service agents available to help during the application process and beyond. As a measure of improving service to users, the company attempts to make loan information clear up front, with personalization so borrowers can tailor loans to fit their individual needs.

College Ave has partnered with Nationwide Bank and University Accounting Service to help with loan servicing and payment processing. Depending on which stage your loan may be in, you could be provided either of their loan servicers contact information for assistance.

Also Check: Is Taylor College In Belleview Fl Accredited

Apply For A College Ave Student Loan

Applying for a College Ave student loan is simple. Start by entering your college/university;to see if it matches the list of schools College Ave provides loans for on our website. Then simply click on Apply Now to be taken to the application page.

You will be prompted to furnish personal information that College Ave will use to determine your eligibility based on creditworthiness. You are strongly encouraged to apply with a cosigner to improve the odds of getting approved, or to potentially qualify for a lower rate.

Should You Apply For A College Ave Student Loan

College Ave is a great choice if you are looking for student loans that are designed to fit your budget and your financial goals. Have a question? They have helpful customer servicescheck out their hours here: collegeavestudentloans.com/contact/.;In addition to loans, College Ave has a generous scholarship program through which they offer $1,000 to one winner every month.;

Before you choose College Ave,;or any lender, be sure youve done your research. Shop around to compare rates, terms, and repayment options. College Raptor can help you do just that! With our free;Student Loan Finder,;you can see lenders and rates side by side so you can find the ideal student loan.

- Compare pre-qualified rates from up to 7 lenders

- 1.04% starting APR on variable loans with auto-debit

- 3.34% starting APR on fixed loans with auto-debit

- 520 year terms available

- Standard,;deferred and interest-only repayment plans available

- Borrow up to 100% of your schools cost of attendance

Disclosures

Be advised that the owner of this website may receive a referral fee from its advertising partners.

Recommended Reading: How Do College Coaches Make Offers

How To Apply For College Ave Student Loans

The College Ave application process can be completed in under three minutes on the company’s;website. Youll need to at least know your Social Security number, school name, estimated annual income and intended amount to complete it. The application process starts with pre-qualification, which lets you;see what your rates could be like .

Once pre-qualification is complete, you have the ability to customize the loan to better fit your needs by modifying repayment terms, rates, payment types and other factors. Repayment options include:

- Full principal and interest payment

- Interest-only payment

- Flat payment

- Deferred payment

Once you have a loan youre happy with, you can finalize your application online as well. If your credit score is less than ideal, which is common for students, youll likely need a cosigner to get approved. International students are also required to have a cosigner.

College Ave Student Loan Refinance

A refinance loan from College Ave may be a great solution if youre looking to quality for a lower interest rate or reduce your monthly payment. Or it could help if youre simply trying to streamline your repayment and the number of parties you currently deal with. College Ave does not charge an origination or application fee for their refinance loan , and you can include both your federal and private loans. Or you can refinance a single loan. The minimum amount you can refinance is $5,000.

You can check out our other website to apply for the College Ave Student Loans Refi. You may also want to calculate the potential savings impact of refinancing by using our Student Loan Refinance Calculator.

Don’t Miss: How To Borrow For College

College Ave Review Vs Discover Review

College Ave has a lower minimum APR to Discover, and both have similar maximum APRs. College Ave may be the better choice if you have an excellent credit history.;

Discover has only one standard term available on its undergraduate student loans, 15 years, while you can choose from term lengths of five, eight, 10, and 15 years with College Ave.;

How To Apply For A Loan With College Ave

College Aves application process is completely online. It allows you to apply from any device and find out if your loan is approved in just three minutes, according to the lender. The entire process, from application to sending money, takes 10 business days or longer.

In order to apply, youll need to gather information like your Social Security number, your estimated annual income, your school name and the amount youd like to borrow. Youll see your interest rate once youre approved.

Heres what the process looks like when applying for a student loan through College Ave:

Don’t Miss: What Good Paying Job Without College

What Do I Need To Qualify

To qualify for a Collage Ave undergraduate student loan, you need to meet the following criteria:

- US citizen or permanent resident or apply with a cosigner who is

- Enrolled in a degree program at an eligible school

- Maintain satisfactory academic progress, as reported by your school

- Meet additional eligibility and credit requirements or have a cosigner who does

How to qualify for refinancing

Heres what youll need to meet when it comes to refinancing with College Ave:

- Graduate of an approved Title IV undergraduate or graduate program

- At least 18 years old

- US citizen or a permanent resident of the US

- Not a resident of Maine

What states is College Ave available in?

College Ave undergraduate student loans are available in all 50 states as long as you attend an eligible school. Student loan refinancing is not available in Maine.

How Does College Ave Student Loans Work

College Aves loans can pay for 100% of your school-certified cost of attendance, up to $80,000 per year. This can include expenses like supplies, room, board, transportation, tuition and fees. Interested students and parents can get pre-qualified and apply on the companys website.

College Ave Student Loans has five main offerings:

- Undergraduate loans

- Career loans

- Refinancing loans

Career loans are specifically for trade schools or career training opportunities, and they may include cash-back rewards.

Recommended Reading: How Do You Get College Transcripts

How Does This Loan Compare

| Rates from ixWhile Savingforcollege.com strives to keep the information up to date, the lender rates, terms and other information are subject to change at any time. | Fixed: | |

|---|---|---|

| 5 years, 8 years, 10 years, 15 years | 5 years, 7 years, 10 years, 12 years, 15 years | Up to 15 years |

| Yes, after 24 months on-time payments | Yes, after 24 months on-time payments | None |

| Read Review |

College Ave Refinance Eligibility Requirements

To qualify for refinancing with College Ave, all borrowers must meet the criteria below.

- Citizenship Requirement: U.S. citizenship or permanent residence.

- Income Requirement: $38,000 annual minimum.

- 650 minimum.

- Graduation Requirement: associates degree or above.

- Location Requirement: within the United States, excluding Maine.

Additional restrictions apply for specific individuals and loans.

- The refinance limit is $300,000 for graduates with degrees in medicine, pharmacy, dentistry, or veterinary medicine.

- Those with undergraduate or other graduate degrees may refinance up to $150,000.

- Disclosures reference a debt-to-income ratio but do not specify limits.

- In order to refinance a loan, the loan must not have delinquent status.

Read Also: How To Raise Money For College

Is College Ave Trustworthy

College Ave is a Better Business Bureau-accredited company that has an A+ in trustworthiness from the BBB. The BBB evaluates trustworthiness by looking at business’ replies to consumer complaints, honesty in advertising, and clarity about business practices.;

That said, you won’t necessarily have a great relationship with College Ave just because the business has a top-notch BBB rating. You should check in with your friends and family and ask them about their experiences with the lender and read customer reviews online.;

College Ave doesn’t have any recent public controversies, so you might decide you’re comfortable taking out a student loan with the company.;

How To Apply For A College Ave Student Loan

The application process for a College Ave student loan is quick and easy. If you select College Ave as a lender in our Compare Rates tool, youll be taken straight into their application. From there, the site will prompt you to enter the necessary information. You should be prepared to enter the following:

- Your Social Security number

- Your selected schools name

- How much youd like to borrow

- Your estimated financial assistance

According to the company, you can find out if youre approved for a loan in as little as three minutes.

Don’t Miss: Does Beauty School Count As College

Compare Your Actual Prequalified Rates In 2 Minutes

**************

At Purefy, we do our best to keep all information, including rates, as up to date as possible. Keep in mind that each private student loan refinancing lender has different eligibility criteria. Your actual rate, payment and savings may be different based on credit history, actual interest rate, loan amount, and term, including your co-signer . If applying with a co-signer, lenders typically use the higher credit score between the borrower and the co-signer for approval purposes. All loans are subject to credit approval by the lender.

Purefys comparison platform is not offered or endorsed by any college or university. Purefy is not affiliated with and does not endorse any college or university listed on this website.

You should review the benefits of your federal student loan; it may offer specific benefits that a private refinance/consolidation loan may not offer. If you work in the private sector, are in the military or taking advantage of a federal department of relief program, such as income based repayment or public service forgiveness, you may not want to refinance, as these benefits do not transfer to private refinance/consolidation loans.

Purefy reserves the right to modify or discontinue products and benefits at any time without notice.

Private Loan Pros And Cons

Private loans allow borrowers to take out larger amounts, can help supplement federal aid, are typically dispersed quickly, and enable prospective borrowers to include a co-signer to improve the interest rate. They also can be used for educational expenses beyond tuition, books, and housing.;

However, its important to remember that each lender will have different repayment rules. Credit history matters with private loans and your credit score will impact your interest rate. Private loans are not tax-deductible, and borrowers arent usually offered loan forgiveness or an income-based repayment plan. Private loans will never be less expensive than federal loans, so always explore that option first.;

If, however, a private loan is the right route for you, potential borrowers should consider the following:;

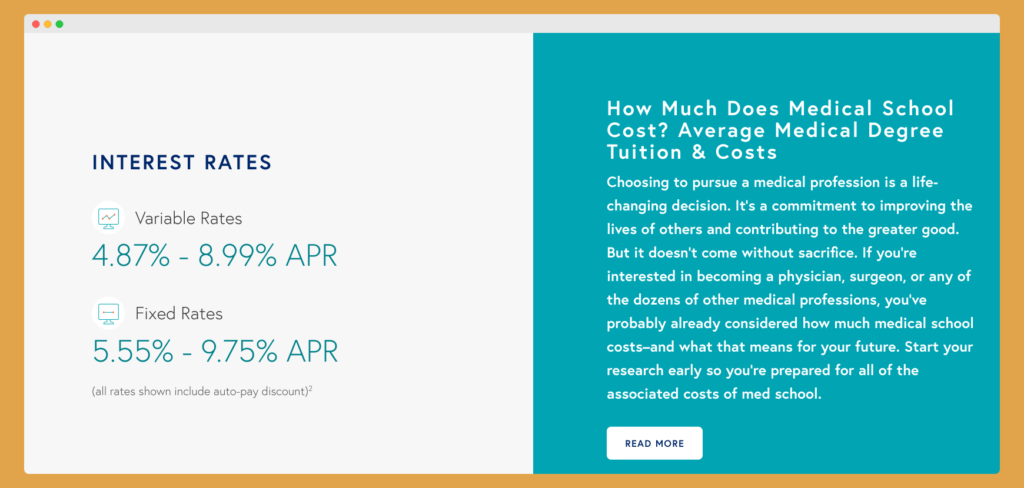

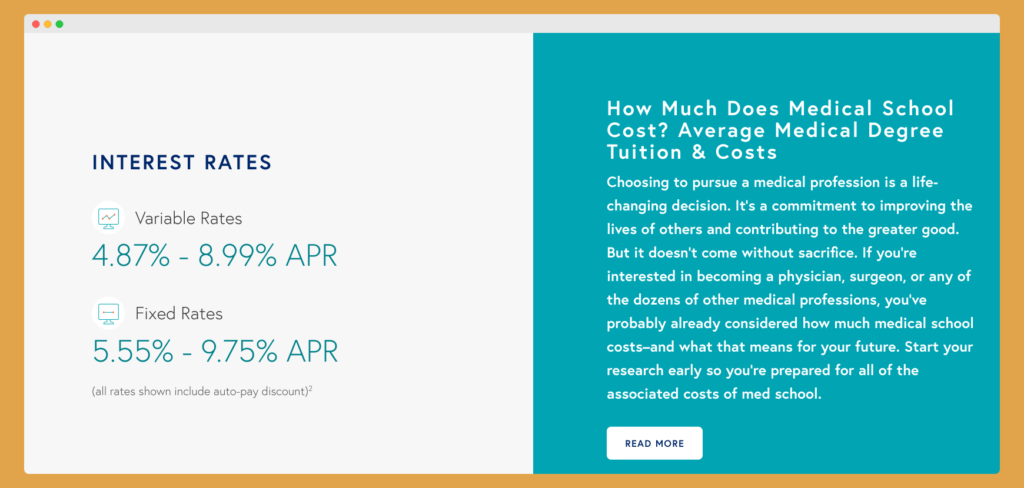

- What are the interest rates?

- Look for any immediate discounts you receive, as well as discounts you cant lose over the term of the loan

- Can you include a co-signer? Including a co-signer, even when you qualify on your own, can mean lower interest rates which save money and help your credit score

- Pick the shortest repayment terms possible to reduce the amount of interest you pay

- Make sure not to apply for too many loans this can lower your credit rating

You May Like: How To Find What To Major In College

College Ave Student Loan Refinancing Eligibility Requirements

College Ave will refinance both federal and private loans ranging from $5,000 to $300,000, depending on your degree.

In order to be eligible for refinancing with College Ave, you will need a good credit score and repayment history. However, the company doesnt display a minimum credit score on its website.

College Ave Key Facts

| Once approved, you can typically expect disbursement in 10-14 days |

| Types of Loans Offered |

| Graduate Student Loans: Loans to help you pursue a postgraduate, masters, or doctoral degree. College Ave also provides loans that cover up to 100% of the cost for professional degrees in MBA/Business School, Medical School, Dental School, and Law School |

| Parent Loans: Choose to receive up to $2,500 of the loan directly in order to cover expenses such as books, electronics, or other dorm/school related supplies. |

| Career Loans with Success Rewards: Covers 100% of the cost of attendance for associate, bachelor, and graduate programs at select colleges and universities. Complete your program of study and receive $150 cash back as a statement credit on your loan principal. |

| Refinance Loans: Refinance loan amounts as low as $5,000. The maximum amount that can be refinanced is $150,000 for all undergraduate and graduate degrees and $300,000 for those with medical, dental, veterinary, or pharmacy doctorate degrees. |

College Ave Company Information

College Ave was founded in 2014 by former Sallie Mae executives as an online lender exclusively dedicated to providing private student loan options for graduates and undergraduates, as well as refinancing loans and loans for career degrees.

Read Also: What Are The Top Online Colleges

Benefits Of College Ave Student Loans

1. It has flexible repayment options

College Ave offers flexible repayment options, making it easier to afford your payments. Repayment terms can be five, eight, 10, or 15 years in length, and there are different payment plans to choose from:

- Full principal and interest payment: With this option, you start paying against the accrued interest and principal right away. This approach has the lowest overall cost.

- Interest-only payment: While youre in school, you only pay the interest charges each month.

- Flat payment: To reduce your accrued interest, you pay a flat $25 per month while in school.

- Deferred payment: While in school, you dont have to make payments. However, youll pay more in interest over the length of your loan.

2. You dont need to be enrolled half-time

Most student loan lenders require borrowers to be enrolled at an eligible institution at least half-time to qualify for a loan. College Ave is different. To be eligible for a loan, you just need to enroll at a qualifying school, even if its just for a couple of classes. That means College Ave is a great option for working students who dont qualify for loans from other lenders.

3. Parents can get cash for expenses

With College Ave parent loans, you can get up to $2,500 upfront to pay for necessary expenses. That can come in handy if you need to buy supplies or put down a security deposit on an apartment off-campus.

College Ave Parent Loan

As a parent, you may elect to borrow on behalf of your child instead of having them borrow, and possibly cosign for them. College Ave offers a private parent loan with an opportunity to receive up to $2,500 delivered straight to you to assist with extra educational expenses. The loan will still be certified by your son or daughters school, and the bulk of the loan funds will be sent to the college or university.

Also Check: How To Get Your College Loans Forgiven

Who Qualifies To Apply

College Ave offers instant pre-qualification status and interest rate ranges. If you decide to move forward with a full loan application, the process is also streamlined and simple.

Before applying, consider the typical eligibility requirements you need to meet to qualify for a loan. For in-school student loans, you’ll need to be at least 18 years old, a US citizen or permanent resident and attending an accredited school. Any students, regardless of enrollment status, can apply for loans. But you’ll need to be enrolled at least half-time to qualify for in-school deferment.

For refinancing, College Ave does have a graduation requirement. However, it’s more flexible than other lenders in that it doesn’t require a bachelor’s degree. This could make it a great option for borrowers who stopped their education after earning their associate’s degree.

College Ave Repayment And Loan Term Options

With College Ave youll have options, both in how to repay your loan as well as how long youll be paying the loan back. Its what makes the lender stand out from other private student loan providers.

College Ave has four different repayment options, each with its own pros and cons:

- Start paying full principal and interest as soon as you receive your first loan statement. This option offers the lowest overall cost over the life of the loan. However, youll be responsible for a high monthly payment while still in school.

- Pay interest only. Youll have moderate monthly payment while still in school, reducing interest but not loan principal.

- Make a flat payment of $25 a month. This payment goes to reducing your accumulated interest and offers the lowest in-school payment option.

- Defer your payment until after you graduate. You wont need to make any payments while youre in school but will pay more in interest over the life of the loan. You can defer payment while you are enrolled at least half time in school, and payments wont begin until six months after either graduating or dropping below half-time enrollment. For medical school graduates, payments can be deferred up to 36 months after leaving school.

For undergraduate and parent loans, you can opt for any repayment term of between 5 and 15 years, whereas refinance loans and medical, dental and law school students can choose a loan repayment term of anywhere between 5 and 20 years.

You May Like: When To Apply For Financial Aid For College