Housing And Accommodations In Canada

Canadian students often choose to live on campus during their 1st year of post-secondary education. As an international student, this option may appeal to you, too. Its a great way to meet friends and connect with other students.

If youre sending your child to Canada for high school or an exchange program, theyll likely stay with a Canadian family as part of a homestay program. Some private high schools in Canada offer dormitory housing to allow students to live, eat and sleep at the school.

This section answers important questions about college and university housing, including:

To find out more about planning for the costs of housing in Canada, visit our Prepare your budget page.

Living Off Campus In Private Housing

If you choose to live off campus, the rental price may be lower than living in residence. Keep in mind, however, that youll need to pay for additional items, including: ;

- Furniture

- Bedding and towels

- Internet connection

- Cable television or streaming service

Laundry machines may be available onsite. If not, you can take your clothing to a laundromat and pay to wash and dry your clothes.

The benefits of living in private housing can include feeling that you:

- Have more freedom

- Are integrating into Canadian society

You may also find that shared housing options will save you money.

Grants For Living Expenses

One of the biggest suppliers of grant money and financial aid for college students is the federal government. There are several types of federal grants that are considered need-based.;

A need-based grant offers money based on your expected family contribution , which is determined when you fill out and submit your Free Application for Federal Student Aid . If the FAFSA shows you have extreme financial need, you may qualify for grant funds that can be used to cover the cost of attendance at your chosen school.

Federal government grants include the following:

- Federal Pell Grant: This program for undergraduate students can award up to $6,195 for the 2019-20 academic year.

- Federal Supplemental Educational Opportunity Grant : This is awarded on top of Pell Grant funds through participating schools and can provide up to $4,000 per year.

- Teacher Assistance for College and Higher Education Grant: This grant is for students enrolled in teaching programs with a commitment to a term of service in a high-need field in a low-income school. It can offer up to $3,752 per year for grants disbursed between Oct. 1, 2018, and Oct. 1, 2019.

- Iraq and Afghanistan Service Grant: This grant is provided to students who lost a parent in Iraq or Afghanistan in the line of duty after 9/11. It can provide up to $5,717 per year for grants disbursed between Oct. 1, 2018, and Oct. 1, 2019.

You May Like: Do Colleges Offer Health Insurance

Do You Have To Declare An Inheritance On Your Fafsa

Off-campus housing can be a good choice for students who plan to attend school year-round, want to get away from the noise and distractions inherent in dorm life or who need to establish a rental history. However, while living in an off-campus house or apartment can be beneficial, it takes planning and a good budget to ensure you can pay rent and other monthly expenses on time.

Keys To Roommate Success

Living with a roommate for the first time â especially someone you likely didnât know before starting school â can be a tough transition, to say the least. While first year students typically are assigned a random roommate, the tips listed below can help navigate any roommate relationship and make the experience an enjoyable one.

Read Also: How Much Does One College Class Cost

Other Deferrals Of Due Dates And Late Fees

Students who anticipate using any of the following to pay their housing fees should contact Housing to request additional extensions to late fees:

- Florida Vocational Rehabilitation tuition or housing assistance.

- Florida Blind Services tuition or housing assistance.

- Veterans Administration or GI Bill housing assistance only.

- Third party payors that require finalized enrollment to process payments .

Housing Terms In Canada

When you choose private housing, youll need to know the definitions of housing terms that are common and unique to Canada.

Bachelor apartment: An apartment comprised of 1 large room that acts as your bedroom and living room. It includes a kitchen area and bathroom.

Duplex: A building that contains 2 living spaces or apartments.

Single-detached: A building that contains only 1 living space, perhaps on 2 or 3 storeys. If the building is only 1 storey, its called a bungalow.

Private room: A room in a persons home. When you rent a private room, you get access to a shared kitchen, bathroom and sometimes other parts of the home, such as the living room. This can be an affordable way to rent. Some homeowners may also include board with your private room. This means they will provide you with 1 or more meals per day.

Den: A small room, with or without a door. Many apartments consist of 1 bedroom, plus den. You could use a den as a living room, office or for storage.

Ensuite : A bathroom that you can directly access from the bedroom. Some apartments have an ensuite bathroom and a 2nd bathroom for guests.

Powder room: A small bathroom with only a toilet and sink . A full bathroom always includes a shower or bathtub.

AC: Air-conditioner. Many parts of Canada are hot in the summer, but not all apartments or homes have AC.

Lease: A contract between you and your landlord that sets out the rent and how long you will live in the apartment or house.

Read Also: Tmcc Ged

Housing Assistance For Students

Paying for housing while in school is a major expense, but grants and scholarships can be used to help students cover this cost. Complete the Free Application for Federal Student Aid to get awards from the federal government, and look for options from your state and college to help pay for student housing.

College students struggle with paying for school and maintaining a reasonable quality of life. Thats why several housing programs have been developed to help college students secure housing they can afford.

What Do I Need To Know About My Fees

Check your fee invoice included in your registration package for the required non-refundable deposit amount and due date, the full tuition fee amount and the balance of fees due date. Paying your deposit on time secures your spot in the program and by paying your fees on time you will avoid late fees.

A non-refundable deposit will be required each term. The balance of your tuition fees will be due on the 10th day of term.

Recommended Reading: When Should You Start Applying For College

Can Student Loans Be Used To Pay Rent

Student loans can be used to pay for room and board, which includes both on- and off-campus housing. So the short answer is yes, students can use money from their loans to pay monthly rent for apartments and other forms of residence away from campus.

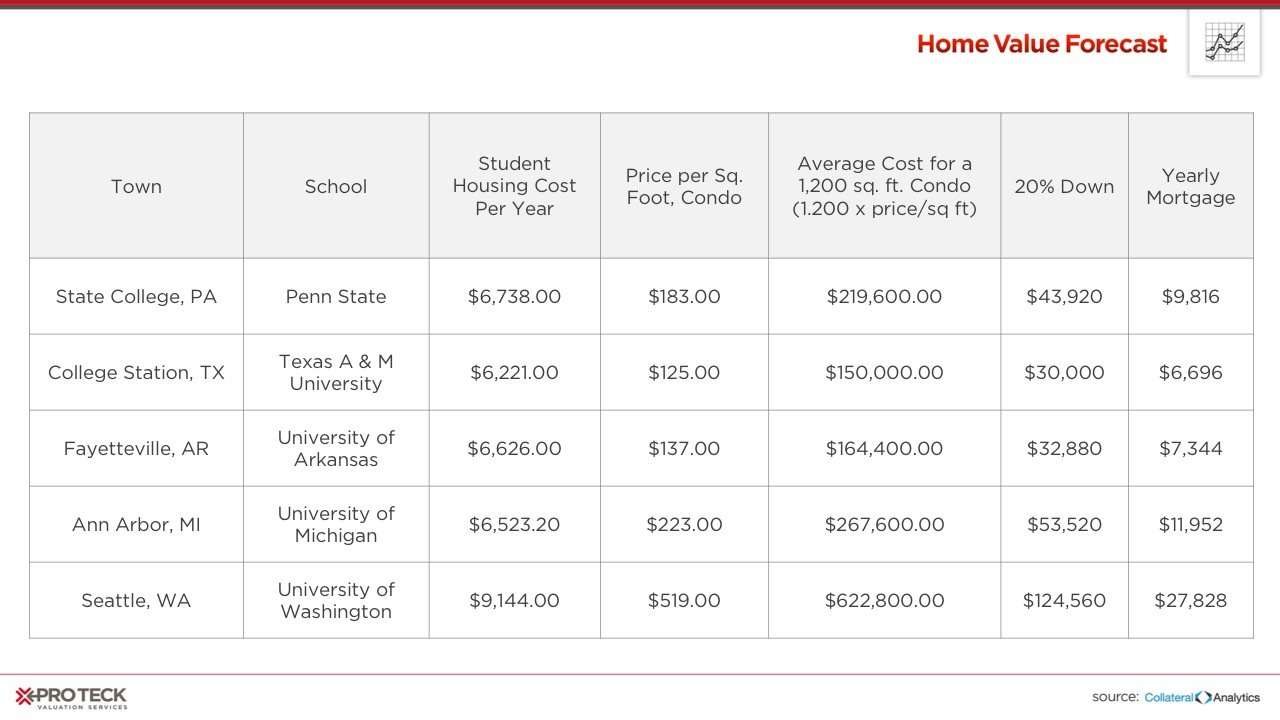

However, the housing location that a student chooses can dramatically impact the cost of a college education. Student loan debt is at an all-time high with students owing roughly $1.5 trillion in student loans as of February 2019, according to Forbes. And with the escalating costs of tuition and housing, the number of student loan borrowerscurrently pegged at 44 millionis likely to continue to rise nationwide. Today, more than ever, students need to stretch their college loans as far as they can to cover as much of the tuition and housing expenses as possible.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Do Native Americans Get Free College

Do Staff Members Reside In The Residence Hall

There are three staff members that reside within the residence hall, which includes a Resident Director and two Resident Assistants. The Resident Director is a Lehman College staff member whose role is to establish and maintain a small residence hall community conducive to the academic and personal growth of each resident living within the student housing, consistent with the goals and objectives of Lehman College. Resident Assistants are student leaders who have been trained as peer resources for residents. The “RAs” have knowledge of Lehman College and they will help in the development of constructive relationships among residents at the Lehman College Bedford Park Residence. Students interested in becoming RAs should contact the Division of Student Affairs in Shuster Hall room 204 for an application and explanation of the selection process.

You May Qualify For Government Assistance

There are a few different ways you can get government assistance for your college housing costs.;

For veterans and service members, the GI Bill covers tuition and fees, and it includes a housing allowance and textbook stipend.;

Section 8 housing could be an option for college students, however, there are limitations. If youre under age 24, you may need to reference your parents income information on your Section 8 application. The traditional income requirements apply to college students who are over age 24. ;

College students can also get help paying utility bills from the Low-Income Home Energy Assistance Program .;

Section 42 is another method to reduce your housing costs. Rather than paying the market rates for your housing, the program limits your total rent and utility costs to 30 percent of your monthly income. There are restrictions on eligibility. For example, the program doesnt usually apply to full-time college students who live alone or groups of students living together.

Also Check: What College Is In Terre Haute Indiana

Look Out For Student Co

If your schools financial aid office cant give you a leg up on how to pay for college housing, it could at least point you in the direction of affordable off-campus options. It might have a physical or digital bulletin board of listings, for example.

Better yet, your school might be located near a student housing co-op. These are community-oriented, member-managed properties. The North American Students of Cooperation hosts a map of properties spanning the United States.

The savings with a student housing co-op could be significant. For example, room and board in a studio apartment through the Berkeley Student Cooperative costs $6,864 for the school year versus room and board in a University of California, Berkeley residence hall, which costs $17,952 in 2020-2021.

How Do I Apply For Housing For Fall 2021

Applications are available online or in Shuster 204. All complete applications are to be submitted to Shuster 204 .

A completed application consists of:

- Lehman College Student Housing Application with applicants information

- $25 check/money order for your non-refundable application fee

*Housing is on a first come first serve basis. In its sole discretion, the College reserves the right to initiate a lottery process, at which time you will be notified of the procedure.*

Recommended Reading: Can I Sell My College Books

Paid And Registered Requirements

All students are required to register for a minimum of 12 credit hours to receive and maintain a room assignment.;Students who drop below 12 credit hours at any time can have their room assignment canceled until they register for a minimum of 12 credit hours.;

The Housing and Residence Life Office requires that a student be registered for a minimum of 12 credit hours and their bill paid in full before permitted to check-in. Setting up an installment plan through the Enrollment Services Office or accepting sufficient financial aid to cover your bill will satisfy the paid portion of the paid and registered requirement.

Consider Staying At Home

If youre attending a local school, living at home could erase the cost of a room. And you could skip the schools meal plan.

Sleeping and eating under the same roof as your parents might not seem like the so-called college experience. But if doing so allows you to worry less about money and focus more on classes, its worth considering.

Transportation to and from campus could cut into your savings, so make sure you live close enough to make it work. However, if you find yourself paying for student car insurance, big gas bills and on-campus parking, you might reconsider this strategy.

Also Check: How Many College Credits

Housing Options For College Students: On & Off Campus Living

In many cases, college is the first time students will live away from their parents or family. Making the right decision about where to live and the type of housing to move into is a crucial step in ensuring a successful college transition. With so many options both on and off-campus, the process of finding the perfect place can be daunting. The comprehensive information below can help equip students and their families with the knowledge necessary to make an informed decision on where to live during college.

- At San Diego State University, students who live on campus their first two years have a continuation rate of 90 percent, while those who move off-campus after one year have a rate of 70 percent. 58 percent of students who never live on campus continue their studies.

- 99% At numerous universities, many students live on campus all four years of their undergraduate degree. At Harvard University, 99 percent of all undergraduates live on campus.

- According to a report by the U.S. Census Bureau, between 2009-2011 approximately 63 percent of students lived with their families while undertaking postsecondary education, while 25 percent lived off-campus but not with relatives. Overall, 12 percent of students live in residence halls or group quarters.

Get Roommates To Split Rent

For students living on-campus or in off-campus apartments, having more roommates usually means youll pay less rent.;

For example, the 2020 median rent for a one-bedroom is $961 per month. For a two-bedroom, the median rent is $1,192, which would be just $596 if splitting it with a roommate. Thats a 38 percent savings!

Savvy college students can further reduce their living expenses with additional roommates. Couples or close friends can live with two people per bedroom, further reducing the rent that each individual pays.; Plus, some apartments have extra rooms that could be used as bedrooms.;

Read Also: Native American Free College Education

How Does Florida Prepaid Housing Work

The Florida Prepaid Dormitory Plan covers the cost of a standard, double occupancy, and air-conditioned residence hall. At FAU, this covers our standard doubles in Glades Park Towers and Heritage Park Towers. Florida Prepaid determines these rates each year, and if your assigned hall room is more expensive, you must pay the difference in cost on your balance. Should you have further questions about your plan to see if your housing is covered, please contact Florida Prepaid at 1-800-552-4723.

Qualified 529 Plan Expenses

With a;529 college savings plan, investments;grow tax-deferred and are not taxed when withdrawn;to pay for;qualified higher education expenses, including tuition, fees, textbooks, supplies and equipment required for enrollment, special needs services and, in some cases, room and board costs. You can use money in a 529 savings plan to make student loan payments. If funds are used for non-qualified purchases, the earnings portion of the distribution will incur ordinary income tax plus a 10% penalty.

For room and board expenses to be considered qualified, the student has to be enrolled in an;eligible college program;on at least a half-time basis. Qualified room and board costs can include both on- and off-campus housing costs, as long as they were incurred during an academic period during which the student is enrolled or accepted for enrollment in a degree or certificate program or another program leading to a recognized education credential.

Enrollment in a;study abroad program counts, so long as it is approved for credit by the students home college or university. Rent incurred during the summer months is also considered qualified when the student is enrolled at least half-time.

Don’t Miss: Who Buys Books Back

A Parent Loan For Undergraduate Students

An independent student or a parent who meets credit requirements can apply for a federal loan called a Parent Loan for Undergraduate Students, more commonly referred to as a PLUS loan. Because you can use these funds to pay for off-campus housing, this is a good option if you dont qualify for federal assistance or do qualify but do not receive a refund. Because such loans cant exceed the total cost of attendance, the U.S. Department of Education allows each school to determine the maximum that a parent can borrow.

Tap Into Your Schools Resources

Four-year schools typically help students find off-campus housing. Search your schools website for its related department or office and get in touch. In addition to pointing you in the direction of potential living situations, it could offer helpful tips, including how to build a resume for potential landlords.

Youd also be wise to touch base with your schools financial aid office to discuss how living off campus could affect your aid package. In the typical college award letter, your school estimates the cost of living as part of its overall cost of attendance.

Unfortunately, those estimates could be incorrect. In fact, as of three years ago, more than 40% of colleges report a COL thats at least 20% above or below their counties estimates, according to a report by the Wisconsin HOPE Lab.

And the situation may not be improving. A 2019 report from the University of Pennsylvanias Graduate School of Education showed that the net price calculators provided online by many colleges and universities often contain out-of-date data instead of information from the current year.

Lets say your school projects youll need $5,000 for living expenses but you actually need $6,000. That presents a problem because you could become ineligible for another $1,000 in financial aid if youve already met the schools cost of attendance.

Also Check: How To Get Noticed By College Football Scouts