Priority Deadlines And Late Applications

Complete your financial aid application by the priority deadline of and to ensure your financial aid eligibility has been determined before classes start.;Late financial aid applicants may need to pay tuition and fees;if their financial aid award is not finalized by the start of the semester.;If you become eligible for aid later in the semester, you may be reimbursed to the extent your aid covers your bill.

Get Your Certification And Disbursement Of Financial Aid

Once you have accepted your awards, the financial aid department will begin processing your aid. Funds are disbursed after the drop/add period. All steps must be completed to facilitate the delivery of funds to your student account and any credit balance refunded. Disbursement notification is sent to your student email. If a credit balance occurs, funds will be refunded within 14 days of this notice.

Applying For Financial Aid

- Research financial aid programs early. There are many different types of , and available, totaling billions of dollars. Start researching during your sophomore and junior years of high school, or one to two years before you plan to start college. You can find information at this website; at your high schools counseling office; at your college’s financial aid office; at public libraries; or at various lending institutions.

- Early in your high school senior year, or one year before you start college, contact the financial aid offices at the colleges of your choice for deadlines and additional documents that may be required.

- Complete a , which is available to complete online and offers mobile-friendly options or in paper format, as soon after October 1 as possible. You must submit this form in order to be considered for all federal financial aid programs, most institutional programs, and most , including the .

- Students report their 2019 income information on the 2021-22 FAFSA.

- Further details regarding how to obtain the tax information needed to complete the FAFSA are provided on the page.

- If you are an Illinois student who is not eligible for federal financial aid , you may apply for a MAP grant using the online Alternative Application for Illinois Financial Aid, which is patterned after the FAFSA. For more information, visit the page of this website, and talk with your high school counselor or the financial aid office at your college or university.

Recommended Reading: How To Find What To Major In College

How To Apply For Merit Scholarships

Start searching for scholarships as soon as possible. The sooner you start searching for scholarships, the fewer deadlines you will miss.

- There are scholarships you can win in younger grades, not just during your senior year in high school.

- Some scholarships have deadlines in the fall, not just during the spring.

- Continue searching for scholarships even after you enroll in college, as there are some scholarships that are open only to current college students.

Search for scholarships on free scholarship matching sites. The best scholarship databases are free.

- Dont pay a fee to search for scholarships or to apply for scholarships.

- If you have to pay money to get money, its probably a scam.

To increase your chances of winning a scholarship, apply to every scholarship for which you are eligible.

How Much Does College Or University School Really Cost In Canada

As you probably already know, going to college or university is a big investment. A study conducted by Macleans in 2018 found that a university education in Canada costs $19,498 per year on average. And college tuition rates arent far behind, depending on what you study.

Beyond tuition fees, which make up 34% of the average annual cost above, there are a handful of additional expenses to consider during your time in college or university. Heres a breakdown of the remaining factors that contribute to the average annual cost of post-secondary education in Canada, based on the answers of 23,348 students surveyed for the Macleans study:

- Rent: $8,000

- Public transit: $390

- Extracurricular activities: $195

Students who live at home while going to school can save a good chunk of money, saving about half the amount, spending $9,300 a year on average. Here are more tips on saving money for university and college students in Canada.

Recommended Reading: Is Carrington College Nationally Accredited

Menu Guides And Resources

Harvard College Admissions Office and Griffin Financial Aid Office

86 Brattle Street

If you are located in the European Union, Iceland, Liechtenstein or Norway , please for additional information about ways that certain Harvard University Schools, Centers, units and controlled entities, including this one, may collect, use, and share information about you.

S To Apply For Financial Aid

Watch the video below for answers to frequently asked questions.;

Don’t Miss: Is College Free In Canada

Apply For Financial Aid With Cappex

With our introduction on how to apply for financial aid for college now complete, you should have a better idea on how to get started securing funds for the next step. Whether you are looking to pursue need-based aid, merit-based aid, or both, your ticket to extra money for college is just a few steps away. Want to learn more about college admissions and funding? Ready to start applying? here on Cappex.

What If A School Rejects Your Financial Aid Application Use Donotpay To Appeal

In case a school rejects your financial aid application or doesnt offer enough money, you have the right to send an appeal letter. Future freshmen dont have time to waste on sending an appeal letter to each school they apply to.

That is where DoNotPay steps in! We can generate an appeal letter for you in minutes. You only need to follow a few simple steps:

We will generate your financial aid appeal letter and mail it to the schools financial aid office in your stead!

You can also visit our Learning Center to find more information about the requirements for getting financial aid and how long you can keep receiving it. Check out the table below for detailed guides to the financial aid programs on different universities:

| University of California, Santa Cruz Financial Aid |

Don’t Miss: What Should I Bring To College Dorm

Should I Apply For Financial Aid After I Get Accepted Or Before

The financial aid process may heap more stress atop an already trying time for many high schoolers. However, if done correctly, financial aid applications can be completed without stress. The months leading up to your freshman year of college will whiz by. It can seem like theres not enough time to do everything. Because of this feeling, it is important to plan ahead, knowing exactly when your deadlines are for each step of the financial aid process.

For college expenses not covered by scholarships and federal loans, College Raptor has partnered with Sallie Mae to bring you loans with great repayment options and competitive rates.

Many students have asked the question, When, exactly, should I apply for financial aid? The truth of the matter is that theres no hard-and-fast answer. Depending on your schedule and personal financial standing, you may want to apply as soon as possible, or you may be able to wait for a longer amount of time. Looking at the facts and statistics will help you and your family reach a decision.

Reach Out To Experts And Utilize Online Resources

As youre wrapping your head around the process involved for financial aid, it helps to know what resources are at your disposal.

One of the first places to start is with experts. High school guidance counselors and college financial aid officers are there to help students plan for a successful future and find financial aid. They provide individualized advice based on a students academic and financial situation. A counselor will also be aware of scholarships, financial aid or tuition-assistance programs specific to a students school, community or state.

There is also a wealth of online information available to students and parents on how to apply for financial aid. For instance, you could get started with

- The help section of the FAFSA.ed.gov site, which answers many tricky questions parents and students might have.

- The College Financing Plan from the U.S. Department of Education, which helps students quickly understand and compare financial aid offers from different colleges.

Read Also: Do Technical College Credits Transfer To University

Types Of Student Loans

Student loans are from the federal government or from private sources, such as a bank, credit union, state agency, or school. Learn the differences between federal and private loans before considering a loan.

Federal Student Loans

If you need to borrow money to pay for college or career school, start with federal student loans. Theyre more affordable than private loans.

Types of Federal Student Loan Programs – The William D. Ford Federal Direct Loan Program offers four types of Direct Loans:;;;;

- Direct Subsidized Loans are made to eligible undergraduate students based on financial need.

- Direct Unsubsidized Loans are made to eligible undergraduate, graduate, and professional students, and are not based on financial need.

- Direct PLUS Loans are made to graduate or professional students and parents of dependent undergraduate students.

- Direct Consolidation Loans allow you to combine all of your eligible federal student loans into a single loan with a single loan servicer.

Eligibility – You must be enrolled at a school that participates in the school loan program, and meet the general eligibility requirements.

How to apply – Complete the Free Application for Federal Student Aid or FAFSA. Watch this video to learn more about what happens after submitting your FAFSA.

Private Student Loans

Deal With Companies Hassle

If you love to shop and you want to make the experience as easy and enjoyable as possible, youre in the right place! DoNotPay provides you with various features that allow you to accomplish just that.

You dont have to struggle trying to reach customer support or figuring out how to claim a warranty or file an insurance claim by yourself. You can cancel any subscription, , and discover how to use every last penny from your gift cards in minutes!

In case you made a purchase, but your package is missing, dont fret! Finding your missing parcel is only a few clicks away.

Read Also: How To Raise Money For College

Welcome To The Oxnard College Financial Aid

We offer programs and services to help;meet some;of your;educational costs. Financial aid applications are accepted throughout the academic year but we encourage you to apply as soon as possible.

The Financial Aid Office is comprised of dedicated financial aid professionals committed to serving students and provide them information to secure the necessary financial resources to meet their educational objectives. Financial aid awards are subject to availability of funds, eligibility for funds, enrollment status and financial need.

If you need help paying your enrollment fees or other expenses, financial aid;in the form of grants and federal work-study;is available to eligible students. The California College Promise Grant is available to California residents. View the VCCCD Code of Conduct/Conflict of Interest Policy here.

Changes and updated to financial aid status will be displayed on the student portal and in portal e-mail. Financial aid requirements can be viewed by logging in to your my.vcccd.edu;student portal.;

Financial Aid Goals and Objectives :

- Provide student centered service, information, and identify financing options to students seeking financial assistance

- Maintain efforts to minimize the student loan default rate

- Identify, outreach to, and increase both financial aid participation and student access to locally defined un-served and underserved student populations

- Increase awareness on campus and at local high schools of financial aid

Students will;:

Forecast Your Potential Financial Aid

You dont have to wait until your FAFSA is filed and processed to get an idea of what kind of financial aid and assistance you can expect. You can use the FAFSA4caster tool to project the amount of financial aid for which youd be eligible.

It can also be helpful to understand how the Department of Educations office of Federal Student Aid uses the information on the FAFSA to decide how much aid each student gets.

The financial details are used to calculate your Expected Family Contribution . This is the Federal Student Aid office estimate of what your family should reasonably be able to pay toward college costs, based on these factors:

- The familys taxed and untaxed income and benefits

- Financial assets, including college savings

- Family size

- Number of family members attending college concurrently

You can use free online tools like the College Boards to estimate your EFC.

Generally, the FAFSA compares your EFC to the costs youll face in college your cost of attendance and offers financial aid to help bridge that gap. Heres the general formula to illustrate:

Cost of attendance EFC = Financial need

The higher your EFC, the less financial aid you will receive. Unfortunately, according to Randolph, There isnt too much a student can do to change their financial circumstances. However, Randolph noted it is possible to maximize aid eligibility and lessen your EFC if you plan well in advance.

Recommended Reading: Who Buys Back Used College Textbooks

Other Steps To Take To Get Financial Aid

- All new and returning students must have a current admissions application on file with the Admissions Office. New students must have their final official high school transcript, GED® certificate, homeschooling record or ATB Alternative on file. Transfer students must have ALL FINAL OFFICIAL transcripts from any and all institutions of higher education on file with the Admissions Office.

How to Renew Your FAFSA® Application

The Free Application for Federal Student Aid form applies to a single academic year. That means you need to submit a FAFSA® each yearand make sure you meet the FAFSA® deadlines for state and college aid to maximize the aid you could receive.

When you log in to renew your FAFSA® form, its prefilled with certain information from the prior academic year. Youll need to provide new income and tax information and update any information that may have changed.

Follow These Instructions to Renew Your FAFSA® Form

- Log in with your FSA ID username and password at fafsa.gov. Learn what to do if you forgot your FSA ID username or password.

- Note: If you log in as a student on the myStudentAid mobile app and are eligible for a FAFSA® renewal, the renewal form automatically displays.

- Update any prefilled information that has changed, and provide the requested financial information.

- Sign and submit the FAFSA® renewal.

The 2021-2022 is for the following semesters: Fall 2021, Spring 2022 and Summer 2022

- Have your and/or your spouses/ parent income handy for 2019

There Are Some Shortcuts

The FAFSA is notorious for being confusing, especially when it comes to filling out financial info.

“For example, students applying for financial aid for the beginning of the 2020-2021 academic year, the tax year with which the FAFSA will assess their need is 2018,” they said. So that means that if you’re getting ready to apply for the next school year, the info you need to supply is for the last tax year.;

If you want to save time and effort, FAFSA offers an option to use what’s called the IRS Data Retrieval Tool. This tool collects parents and/or students tax figures and pre-fills them into the FAFSA. “This helps to mitigate errors.”

Also? It can save you a ton of time.

You May Like: What Size Are College Dorm Beds

Reviewing And Accepting Your Financial Aid Offer

You can check the status of your financial aid application in MyMC by clicking on the Financial Aid tab. After your file is complete at MC, the financial aid counselor or financial aid specialist reviews and approves it. The award decision is posted to your MyMC online account. Files are reviewed and awarded based on the date they are received and completed.;

What Is Financial Aid For College

College financial aid refers to the money that students get as help for paying education-related expenses. There are several financial aid options, as explained below:

Recommended Reading: Is Rhema Bible College Accredited

Determine Your Financial Situation

The first step in figuring out what you need in terms of financial aid is having an honest look at your familys financial situation. Are you able and willing to cover the cost of tuition?

Having a clear understanding of your financial situation and establishing realistic expectations is essential to moving forward in pursuing other forms of financial aid.

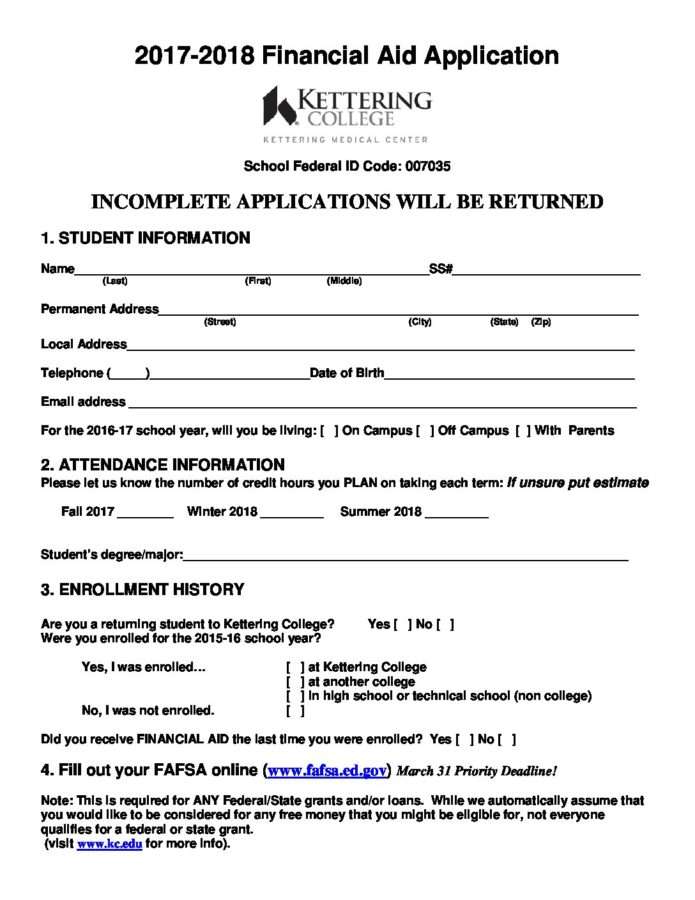

Fill In Student Information

Once you have your FSA ID, you can begin applying for the FAFSA online or via the app. Choose the form youd like to complete most likely the upcoming school year, and begin filling out the student demographic section. This section asks for your information, such as your name, age, and date of birth.

Youll also be prompted to enter the schools youre interested in attending. Make sure to enter all schools you are considering so that you get the maximum aid youre entitled to receive from each one.

For the dependency section, youll be asked questions that determine whether youre a dependent of your parents or not, for financial aid purposes.

Also Check: What Do Firefighters Study In College