Ask: What Are The Federal Student Loan Limits

Many families dont realize their students cant borrow everything need to cover college costs via federal student loans. There are thresholds. Students are allowed to borrow $5,500 for their first year, $6,500 for the second year, and $7,500 each for their third and fourth year. They can take an additional $4,000 for a fifth year if necessary for a total of $31,000.;

Use Grants If You Qualify

A 2018 NerdWallet study found high school graduates who don’t complete the FAFSA leave behind billions of dollars in unclaimed federal Pell Grant money.

Dont make that mistake. As long as you submit the FAFSA and renew it each year youre enrolled in school, youll receive Pell money if youre eligible for it.

In addition to the Pell program, the federal government offers several other types of grants, which dont need to be paid back. Many states have grant programs, too. Use this map on the Education Department website to find the agencies in your state that administer college grants. Then look up and apply to state grant programs you may qualify for.

» MORE:Guide to grants for college

Borrow Strategically Through Student Loans

For some students, financial aid is the only reason they can complete a degree rather than dropping out of college. For others, financial aid helps them leave school with some student loans but limits the debt to a manageable amount.

If you still have a gap between financial aid and the total cost of attending college, student loans can be an option to make up the difference.

Listed below are the types of loans you might see on a financial aid award letter. Its generally best to prioritize the loans listed first :

Be smart and strategic about how you use student loans. Borrow only what you need to cover college costs after using all other aid.

Recommended Reading: Can You Transfer College Credits Out Of State

Pick A Repayment Plan

Kevin Miyazaki/Redux

Joe and Lauren Quigley Scogin Mayo

Failing to repay your student loans will haunt you long after youve forgotten the name of your freshman roommate. A default on federal student loans triggers late fees, additional interest and other costs that will inflate the amount you owe. The default will appear on your credit report, affecting your ability to borrow money for a house or a car. The government may withhold your tax refund and may even garnish your wages or withhold Social Security benefits. In most cases, you cant discharge your federal student loans if you declare bankruptcy.

Fortunately, you dont have to get into that kind of trouble in the first place. Federal loans offer options that make payments more affordable or let you stop payments altogether for a time.

Borrowers with federal loans who work for the government or a nonprofit for 10 years may qualify to have the balance of their loans forgiven.

Theres no penalty for prepaying your student loans, and the sooner you pay them off, the less youll pay in interest. Setting up an automatic payment program will help you avoid missing a payment and could also lower your interest rate by up to 0.25 percentage point.

Joe and Lauren Quigley of San Antonio have resolved to pay off their $32,000 in student loans by 2018. Theyre making extra payments on their highest-rate loan: a Direct subsidized loan with an interest rate of 4.5%. Theyve already paid off another federal loan with a rate of 4.5%.

It Impacts Your Debt To Income Ratio

This is the ratio that shows the amount of your monthly income that goes to debt payments. It is a very significant ratio that lenders use to determine your eligibility for car loans and mortgages. Most financial experts suggest that you maintain your debt to income ratio at a maximum of 36%. If your ration is beyond this figure, you are less likely to be approved for other loans. Still, there are chances of qualifying for loans but at very high interest rates.

Read Also: What Is The Best Thing To Go To College For

How Much Should You Borrow

The low borrowing limits and interest rates on the most affordable federal loans for undergrads mean that most borrowers who finish their degrees can repay them.

But if you go on to grad school, its easier to take on the level of student loan debt thats more difficult to repay. The higher limits on PLUS loans can saddle you with six-figure loan debt.

You can use the Department of Educations College Scorecard to get an idea of how much debt its reasonable to take on with the degree you are pursuing.

Tip:

Shop Around For Private Student Loans

When students are up against federal student loan limits, they have another option: private student loans. These loans arent subject to the federal loan limits outlined above.

That doesnt mean there are no limits on student loans from a private lender. CommonBond, for example, sets its loan limits according to cost of attendance . Others have a lower aggregate limit on student loans, such as Citizens Bank, which allows undergraduate students to borrow up to $150,000.

Borrowers will often need good credit and credit history to be eligible for a private student loan. Most undergraduate students qualify by applying with a cosigner, such as a parent.

Todays private student loan rates often are competitive with federal student loan rates and start around 3.34% for well-qualified borrowers. To know for sure, request a few student loan rates from our favorite lenders.

However, keep in mind that you wont have the same borrower protections and benefits federal student loans offer if you choose to take out a private student loan.

For example, deferment, forbearance and repayment options are a given with federal student loans but not necessarily with private student loans. So taking on this form of student debt carries a higher risk.

Don’t Miss: How To Find What To Major In College

How Does Interest On A Student Loan Work

Because youre not just paying back the amount you borrow, youre paying back interest as well, its important to understand how much that will add to the total amount you pay.

How much you pay in interest depends on a number of factors: whether your loan is subsidized or unsubsidized, the interest rate on your loan, the amount you borrow, and the loan term.

For example, you graduate with a $10,000 loan with a 5% interest rate and plan to pay it off over 10 years. You will pay $2,728 in interest over the 10 years that you repay the loan. Your monthly loan payment will include both payments to reduce the principal balance and interest payments. The total amount repaid will be $12,728 including both principal and interest.;

Interest generally continues to accrue during forbearances and other periods of non-payment. So, if you take a break on repaying your loans or skip a loan payment, the total cost of the loan will increase, and not just because of late fees.

Loan payments are applied to the loan balance in a particular order. First, the payment is applied to late fees and collection charges. Second, the payment is applied to the interest that has accrued since the last payment. Finally, any remaining money is applied to the principal balance. So, if you pay more each month, you will make quicker progress in paying down the debt.

You can use a loan calculator to help you calculate exactly how much youll pay in interest.

Use A Student Loan Calculator To Help Decide If You Should Borrow To Pay For College

A student loan calculator can be an invaluable tool in deciding if you should borrow to pay for college. Our student loan calculator considers the number of years you are in school, loan amount, loan term if you make monthly payments in school, and interest rates.

You can explore what your monthly payments might be and how much the loan could cost over its lifetime. Having an idea of what your monthly payments could be can help you understand what you can afford and if you should borrow to pay for school.

Visit our student loan calculator.

You May Like: Where To Find Internships For College Students

Visit Your Colleges Financial Aid Office

For students or parents who are facing educational costs they cant cover or are nearing either annual or aggregate student loan limits, there is help.

If they suspect the loan amount will not cover all costs, they should reach out to the colleges office of financial aid to discuss this, Moon said. If the loan amount does not cover the cost of attending the university, then there are options the university can offer.

For instance, Moon said, a university might be able to offer institutional need- or merit-based aid. Students or families might also be able to get on a payment plan for tuition or college costs and avoid a loan.

Even if you dont think you qualify for more aid, you should make the effort. Make an appointment, meet in person and be prepared to describe your situation and any extenuating circumstances.

Explain why you need and should receive additional aid. The human element can make all the difference.

How Realistic Is That

Rules of thumb are a good starting point. But you can do better than just ballparking a borrowing number.;

One big factor in loan affordability is your future earning potential. According to PayScales 2019 College Salary Report, the highest-paying jobs in the first five years after earning a bachelors degree are in the fields of engineering, computer sciences, and economics. Examples of the lowest paying right out of college are education, the arts, community services, and mental health fields. ;;

Choosing a major based solely on salary potential is a recipe for future misery. However, salary data can go a long way in informing your borrowing decisions.; For example, if youre aiming to go into early childhood education, youd want to borrow less than a future electrical engineer. Similarly, if you plan to train for a high-paying gig that requires more education, borrowing more may be a reasonable decision. ;

Recommended Reading: Is Taylor College In Belleview Fl Accredited

What Was The Impact Of Borrowing On Borrowers

Even small amounts of debt are a problem if the borrower has little income after leaving school, but different levels of debt appear appropriate to different borrowers. One borrower may find payments of eight percent of income to be too much of a sacrifice. Another may find payments of 15 percent of income to be worthwhile depending on income post-graduation.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Is Grammarly Free For College Students

What Is The Library Doing To Stop The Spread Of Covid

The safety of our community is our highest priority. Library employees will follow all directives from the BC Provincial Government and WorkSafeBC, sanitizing and disinfecting workspaces and equipment, and frequent handwashing.

Can I disinfect library materials when I pick them up?;No. We ask that you please don’t do that. Disinfectants will damage library materials.;;

Federal Direct Unsubsidized Loan Limits

Federal direct unsubsidized loans are available to undergraduate and graduate students and are not based on financial need. Interest accrues on these loans at all times, including while you are in school and during periods of deferment. The current administrative forbearance period granted by the federal government because of the coronavirus pandemic is an exception.

The amount of direct unsubsidized loans you may be eligible to receive is determined by your year in school and your status as either a dependent or independent student. The maximum amount you may be able to borrow in unsubsidized loans per year increases each year you are in school, though dependent students are eligible to borrow less than independent students. The federal StudentAid.gov website has a chart that shows how this works.

It’s important to note that there are exceptions to limits on unsubsidized loans for dependent students whose parents are determined ineligible for Parent PLUS loans. Such students may be able to borrow up to the unsubsidized loan limits for independent students.

Read Also: What Colleges Offer Rn Programs

How To Pay For College When Youve Hit Your Federal Student Loan Limit

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

*; ; ; ; ; *; ; ; ; ; *

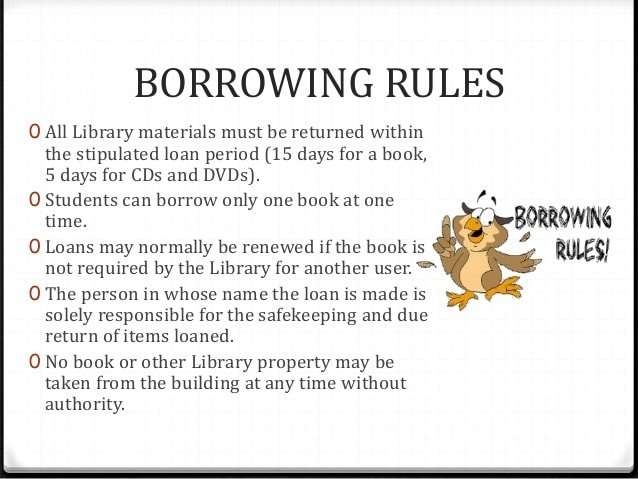

Where Can I Borrow

Brescia faculty, students and staff may borrow items from any of the Western Libraries and the Affiliated University College Libraries.

Brescia faculty, students and staff may also borrow general-loan print materials from all participating Omni Libraries. Users may request items via the search tool for pick up at Brescia, Western or Affiliate University College library location, or borrow in-person at any participating library.

1285 Western Road London, Ontario, Canada N6G 1H2 519.432.8353

Recommended Reading: How To Get Recruited For College Basketball

Types Of Student Loans

Understand the different ways you can borrow money to help pay for college

After you’ve explored free money for college , you may want to look into , which are provided by the government, and then , which are provided by banks and other financial institutions, to help you pay for college.

Don’t forget, with both federal and private student loans, you’ll have to pay back the money you borrow plus interest.

Paying for college tip

With our private student loans, you can apply only once and get the money you need for the entire school year.

To submit the FAFSA for federal student loans , there are a few things to keep in mind:

- Remember that theres no cost for submitting it.

- Complete the FAFSA every year you need money for college.

- Get it in as soon after October 1 as possible. The earlier, the better, since some grant money is awarded on a first-come, first-served basis.

Youll find out about how much youre eligible for in federal student loans when you receive your .

Items Available For Check

The library’s circulating collection consists of books and media, which are usually loaned for a 21-day period. Reserve materials consist of devices, textbooks, books, solution manuals, magazine articles, sample tests and other materials. The reserve materials loan period varies from 1 hour to 7 days. Specific items available may vary by campus. Valencia students may have a maximum of 25 items checked out on their account.

Recommended Reading: What Size Are College Dorm Beds

Write A Detailed Letter Explaining The Reason For Your Appeal

This is what initiates the Professional Judgment Review.

Your appeal may be needs-based, meaning your initial financial aid offer is not enough to cover your costs. Or it could be merit-based, meaning you have a higher offer from another school or some significant achievement since you first submitted the FAFSA.

A needs-based appeal might be right for you if your family experienced a job loss or reduction in salary. It might also apply if your family has extra expenses for a special needs child or elderly parent care, or even if your parents themselves enrolled in college. Finally, you might need to ask for more financial aid if your family survived a natural disaster.

| Examples of special circumstances |

|---|

| Lost income or change in employment Change in marital status or family size Death of a spouse or parent Parent enrolls in college, full-time No longer receiving child support New healthcare costs not covered by insurance Experienced a total loss due to a natural disaster |

A merit-based appeal, on the other hand, is all about your academic achievements. If your grades significantly improved since you submitted the FAFSA, for instance, you might notify the school to see if it will grant you more merit-based aid. Evidence of academic awards or additional letters of recommendation could help your case.

Whether youre filing a needs-based or merit-based appeal, youll need the documentation to back up your case. Make sure you can prove your point with supporting paperwork.