The Best Ways To Pay For Your Child’s College Education

by Dan Caplinger | Updated July 17, 2021 – First published on Feb. 18, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

College has gotten so expensive that you can’t afford to leave any stones unturned in finding good ways to help your kids pay for their education. Ideally, parents should try to save money and invest it in a brokerage account so it can grow as much as possible. There are also some special college savings accounts that allow you to take advantage of special federal tax benefits that the government offers.

As important as it is to help finance your child’s college education if you can, there are other ways to pay for college that can be even better. By using as many of these tools as possible, you’ll be in the best position to pay for college without burying yourself — or your child — under amountain of debt that’ll take years to repay. In particular, the following can go a long way toward reducing the cost of college for you and your child:

Apply For Private Scholarships

There are thousands of private scholarships out there from companies, nonprofits and community groups. Ask your high school guidance counselor or use a free online service like Scholly that suggests scholarships you might be eligible for. A company called NextGenVest offers a free mentor who can also suggest scholarships, as well as help you understand your aid award.

Invest In A 529 Savings Plan

Harriet Sukaskas, a middle-school teacher in Johnston, R.I., says her three grown children had to borrow to cover their years in college. To avoid that burden for her two granddaughters, Avery, 4, and Abby, 2, Sukaskas invested in Rhode Islands 529 plan, CollegeBoundfund, shortly after they were born.

Sukaskas contributes through payroll deduction and adds extra payments to the accounts on holidays and other special occasions. If they get a toy, they play with it an hour or so, and thats about it, she says. Id rather have something waiting for them when the time comes for them to attend college.

Sponsored by 48 states and the District of Columbia, 529 savings plans provide a tax-efficient way for grandparents to help with college costs. Earnings on investments grow tax-free, and withdrawals arent taxed as long as the money is used for qualified expenses, including tuition, fees, and room and board. If you withdraw money for nonqualified expenses, such as a medical emergency, youll owe income taxes and a 10% penalty on the earnings.

Unlike other education savings vehicles, 529 plans have high contribution limits: Most plans allow you to invest $300,000 or more per beneficiary. And you can contribute to the plans no matter how high your income. But youre limited to the investments offered by the plan, and you can only change investments once a year.

Also Check: What College Accepts The Lowest Gpa

Get Paid For Your Opinion Or To Surf The Internet

Youre a college student, so chances are pretty good youve got strong opinions and like to spend time online. Turn both of those things into money-making endeavors! Websites like Survey Junkie offer multiple opportunities per day to fill out surveys in exchange for instant money, while companies like Swagbucks pay people to search the internet. Both companies are reputable, and while you may not get rich, theyre a great resource for extra money.

Buy Your Grandchild Us Savings Bonds

Pros:

- U.S. Savings Bonds are easy to purchase at your local bank or from Treasurydirect.gov.

- Savings bonds are a relatively safe investment that offer guaranteed interest if held to maturity.

- Series EE and I bonds purchased after 1989 by someone age 24 or older may be redeemed tax-free when the proceeds are used to pay for higher education expenses.

Cons:

- The tax exclusion on Series EE and I savings bonds doesnt apply unless the grandchild is your dependent that means youll have to pay income tax when the bonds are redeemed.

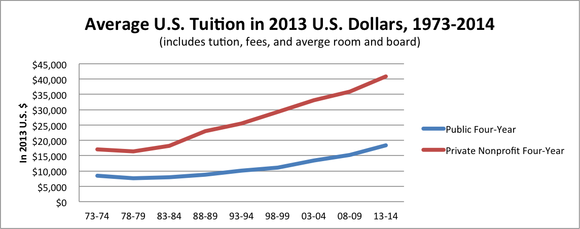

- Interest rates have been at historic lows and are not keeping up with tuition inflation.

- Individuals may only purchase $10,000 worth of each Series EE and Series I savings bonds per calendar year.

Read Also: How To Get Recruited To Play College Baseball

Be Flexible With Your Schedule

Some college programs, such as engineering, are more intense than others, making it quite challenging to work while in school. For these programs, consider attending school part-time so you can still work part-time. Even if your program is not overly demanding, attending school part-time can help you spread out tuition costs and free up more time to work. However, part-time students may not have the option of living on campus, which can make it more difficult to be involved in the social aspects of college. Also, if you have student loans that requires you to be in school at least half time, be careful to meet these requirements so you don’t trigger early repayment of your loans.

Another option is to take a year or two off after high school to work full time so you can save up enough money to make school affordable. If you don’t want to postpone college, you could take your classes during evenings and weekends and work full-time during the week. This strategy will mean that your degree will take more than four years to complete, but it can be easier to budget, and you will gain valuable work experience as you go.

Think About The Cost Of Living

Keep in mind that housing and other living costs will vary by location. If you choose to live off-campus, your living expenses are typically much less. Geographically, an apartment in New York City will be much pricier than an apartment in the Midwest, and the college where you obtain your undergraduate degree can sometimes influence where you will end up working and living after school.

Therefore, consider where you want to live after graduating and the cost of living in that location. If possible, it should be a place where you would want to live, where the cost of living is affordable, and where your school will be a recognizable name that will allow you to get more mileage from your diploma. Various branches of the University of California may be considered terrific schools in the West, but may not be held in the same high regard in New York.

You May Like: Where Can I Watch College Hill Season 1

Students Can Work Part

Studies show that students who work while in college are more confident and more organized than students who dont have a part-time job. Your child can work to make spending money or help pay for their books each semester. They dont even need to find a job with regular hours. There are lots of ways to make money in college on a flexible schedule.

If your child qualifies for a work-study program on campus, make sure they take advantage of this job opportunity. Its a great way to make money to support their education. Students are encouraged to find positions that support the community or are related to their major. How much money they can earn will depend on their total Federal Work-Study award.

Work While You Attend School

You might wish you could pay for college without working, but a job should be something you consider. There are several approaches to working and attending school at the same time.

You can work in the summer and save all you earn to pay for your expenses during the school year. But if you can work full time and attend school part-time, you might qualify for tuition reimbursement through your job. Another option is to attend college full time and work part-time.

The key to making this work is finding a great college job. Work-study jobs, for example, are a great way to make money while gaining valuable work experience. Alternatively, you might want to consider some side hustles to help you raise extra money. You’ll have to plan on working at least during the summers if you don’t qualify for a Pell Grant.

Don’t Miss: Why College Should Be Free Articles

Apply For A Scholarship

Scholarships are typically merit-based. They consider your grades, talent or service. Best of all, you don’t have to pay them back.

- University scholarships: Universities earmark scholarship dollars every year for undergraduates. At Saint Louis University, the most coveted award is the Presidential Scholarship tuition paid in full for four years.

- Private Scholarships: How else can you get a scholarship for college? Some trusted resources include Fastweb, College Board, Sallie Mae or the Scholarship Foundation of St. Louis. A private scholarship might affect the rest of your financial aid package, so notify your university’s office of financial services if you’re awarded one.

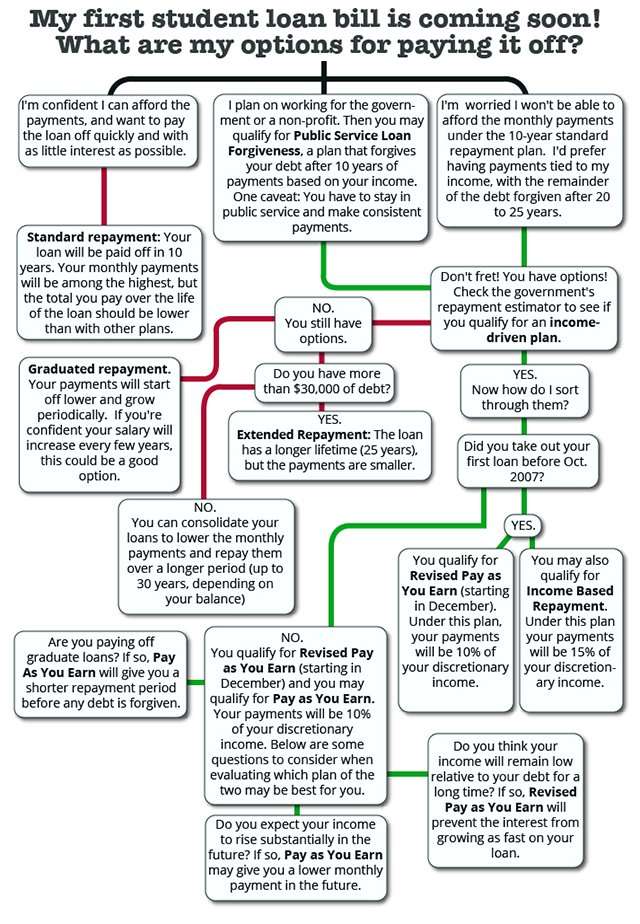

Pay As You Earn Repayment Plan

- Who’s eligible: Borrowers who received a disbursement of a Direct Loan on or after October 1, 2011.

- How it works:PAYE takes monthly payments at 10% of discretionary income, but never exceeds what you would pay on a Standard Repayment Plan.

- Who it’s good for: People who need a low monthly payment and/or are interested in Public Service Loan Forgiveness.

- Who it’s not good for: Borrowers whose income fluctuates significantly from one year to the next.

Recommended Reading: What College Accepts The Lowest Gpa

Pay Off Student Loans

Cosigning a private student loan will help your grandchild get a lower interest rate, but youre responsible for the debt if your grandchild defaults or falls behind. Debt collectors could sue you to collect the amount due, jeopardizing your retirement savings.

A better option is to encourage your grandchild to stick with federal loans, which are easy to get and have more-flexible repayment terms than private loans, then help repay the loans after graduation. This strategy wont affect the familys eligibility for financial aid. Loan payments on behalf of someone else are considered taxable gifts, so limit your repayments to $14,000 a year .

Wanjiaone Multifunctions 7 In 1 Study Led Desk Lamp With Usb Charging And Pencil Holder

A college student dorm space should always hold a study lamp for late-night studies. This LED desk lamp is multifunctional, comes with proper lighting, and is attached with USB charging. You can have your laptop, phone, tab while doing assignments. This study lamp will cost you around $49.99. The product also has a separate space for keeping pen, pencils, and minimal essential study table items. The touch of the spectrum band is to arrange the 256 color-changing bases that create any environment at night. The product measures around 5.3 x 5.1 x 23.6 inches in size and weighs 2.2 pounds.

Recommended Reading: Should College Tuition Be Lowered

First Aid Only 312 Pieces All

An emergency can knock on your door at any moment. Especially staying away from home, college students need a pack of first aid essential in the dorm room. This pack of first aid essentials includes 299 Pieces of items that are necessary for primary emergency purposes. This product measures around 9.25 x 2.88 x 7 inches in size and weighs 1 pound. There are clear pockets inside the pouch of this first aid box, which will quickly help you find your required item.

Become A Personal Grocery Shopper

If youre one of the few college students to own a car, your friends might constantly ask you if you can go to the store to buy food for them and theyll pay you back.

Buying groceries, snacks, and beverages with the ibotta app lets you get cash back on many items that college students want without having to go to the cafeteria.

Activate your first ibotta offer and get a $10 cash bonus. You can request payment via PayPal or gift card once your balance reaches $20.

Related:How to Make Money as a Personal Grocery Shopper

Recommended Reading: Is Ashworth College Recognized By Employers

Paying For College With Merit

Colleges may offer merit aid as an incentive to enroll. This aid is based on academic performance or other talents, and not on financial need. Other sources of merit-based aid include outside scholarship providers, employers, and service organizations. Merit aid and scholarships can be great ways to pay for college.

Tip: Ask colleges about their “outside scholarship” policies. Some colleges reduce the aid they award by the amount of scholarship aid received from outside sources.

Cut Down On Secondary But Significant College Expenses

Whether you elect to attend a lower-cost school or not, choosing one closer to home could decrease living costs. Living off campus could yield savings, and staying at your family home could reduce costs to near zero.

Aside from your living situation, look to trim college expenses like food, transportation and supplies. You could ditch the car in favor of public transportation, for example, or rent textbooks instead of buying them.

Budgeting less money for these college costs could help direct more of your financial aid toward tuition and fees.

Don’t Miss: Is Grammarly Free For College Students

Reduce Your Tuition Costs

Consider choosing a college with lower tuition rates. In-state schools are generally cheaper than out-of-state or private schools. Some schools offer discounts based on how close you live to the campus.

You might qualify for discounts if you’re a “legacy” because one or both of your parents went to school there.

Of course, school costs include more than just tuition, but you can save in other areas as well. Buy used rather than new textbooks. Check your college bookstore to find out what’s available. A lot of students sell their used books back to these stores when they graduate. Some will even rent textbooks, and online booksellers often offer used copies as well.

Refinance If You Have Good Credit And A Steady Job

Refinancing student loans can help you pay off student loans fast without making extra payments.

Refinancing replaces multiple student loans with a single private loan, ideally at a lower interest rate. To speed up repayment, choose a new loan term thats less than what’s left on your current loans.

Opting for a shorter term may increase your monthly payment. But it will help you pay the debt faster and save money on interest.

For example, refinancing $50,000 from 8.5% interest to 4.5% could let you pay off your student loan debt nearly two years faster. It would also save you about $13,000 in interest, even with payments that stay about the same.

Youre a good candidate for refinancing if you have a credit score in at least the high 600s, a solid income and a debt-to-income ratio below 50%. You shouldn’t refinance federal student loans if you want or need programs like income-driven repayment and Public Service Loan Forgiveness.

Recommended Reading: Ashworth College Financial Aid

Paying For College With Need

Families who prove they cannot afford to fully cover college expenses are eligible for financial aid. For many families, financial aid is the major source of college financing and is usually at the top of the list when they consider ways to pay for college.

Tip: Only two types of aid actually cut college cost: grants and scholarships. The other forms of aid, loans and work-study , must be repaid or earned. Be careful when evaluating aid packages and make sure you understand how much youre being offered in grants and scholarships vs. loans.

Icipate In Clinical Studies

If you attend college near a facility which runs sleep and/or medical trials, consider signing up to participate in their studies. Trials can usually be found on places like Craigslist or ClinicalTrials.gov, and sometimes pay as much as $750 per session. If your college includes a medical school or psychology department, they may also have opportunities.

Read Also: Cape Fear Community College Housing

Consider An Online School

Don’t overlook the possibility of attending an online school. Tuition can be much less, sometimes as much as 50% cheaper, and in most cases, classes are identical to those you’d undertake in a brick-and-mortar classroom. You can also study and “attend” when it fits your schedule, allowing you to more easily hold down a job as well.

Apply For Financial Aid

Of all the college-funding methods discussed is this guide, the first one were discussing is perhaps the most sure-fire. Its federally mandated financial aid. The reason that it’s perhaps the best way to pay for college is that its virtually guaranteed if you qualify, and many families do. Plus, applying isnt difficult and those who qualify often go on to achieve their collegiate dreams. There is a strong connection between applying for financial aid, enrolling and ultimately earning a bachelors degree. But millions of families who would qualify for financial aid never file the documents.

There are two main types of financial aid from federal institutions. The first is the Free Application for Federal Student Aid : a form that determines whether students qualify for a wide range of financial aid. Based on a students individual or family income, FAFSA can automatically qualify college applicants for a host of loans and grants, including Stafford Loans, PLUS Loans, Federal Pell Grants and other need-based grants. FAFSA is also the benchmark used by most colleges to distribute their own need-based scholarship packages.

Parents can file the FAFSA starting October 1 of each year. Its important to file early to capture any money that students qualify for, especially for low-income students. If you dont start early, you might miss the ability to get the Federal Supplemental Education Opportunity Grant , which can run out on some campuses.

You May Like: Community College Without High School Diploma Or Ged