Discount Tuition Model Fails To Serve First

Colleges use a discount model to price tuition, meaning the sticker price has little relation to what most students and families pay. For this reason, some argue that the college affordability crisis is not as bad as it appears.

Colleges intimidating sticker prices can deter prospective applicants.

Financial aid packages and scholarships help bring the actual cost of college down and can even make it free. For example, some students with great financial need are eligible for full-ride Pell Grants.

While the discount model is intended to flex to meet students’ needs, it’s often not helpful to first-generation college families. For individuals unfamiliar with the complexities of the higher education pricing system, intimidating sticker prices can deter prospective applicants.

As colleges become more serious in their efforts to diversify their student bodies, it will be incumbent on schools to make their pricing models more understandable and affordable for students from lower economic backgrounds.

It’s Simply Not Worth It

With the debt the students are left in along with the struggle of managing a house/apartment, keeping a car, and finding a better job. To make up the money lost and piling on is stressful, and for some, nearly imposable. A college degree doesn’t get you as far as you use to. To work without any degree use to get you by comfortably, now, if you don’t have any college experience, you will barely make it day to day. If you are even able to obtain a good college that gives you a chance to get a good job, you then have to work instead of study to keep up on the pile of looming debt they throw at you.

Student Debt Is Tough And Federal Loan

to be addressed. As Robert Applebaum states in his short essay mentioned in the article Student Loans: Should Some Indebtedness Be Forgiven? tuition rates are increasing at ridiculous rates because colleges somehow feel that because the government makes it easy to get a loan it justifies their rising tuition costs . Instead of arguing for student loan forgiveness, perhaps protesters should refocus their attention at the paramount reason for needing student loans in the first place.The article

Don’t Miss: Who Buys Back Used College Textbooks

Is College Tuition Really Too High

- Read in app

To understand the feeling of crisis that many see in higher education right now, its useful to start with some figures from 40 years ago. In 1974, the median American family earned just under $13,000 a year. A new home could be had for $36,000, an average new car for $4,400. Attending a four-year private college cost around $2,000 a year: affordable, with some scrimping, to even median earners. As for public university, it was a bargain at $510 a year. To put these figures in current dollars, were talking about median family income of $62,000, a house for $174,000 and a sticker price of $21,300 for the car, $10,300 for the private university and $2,500 for the public one.

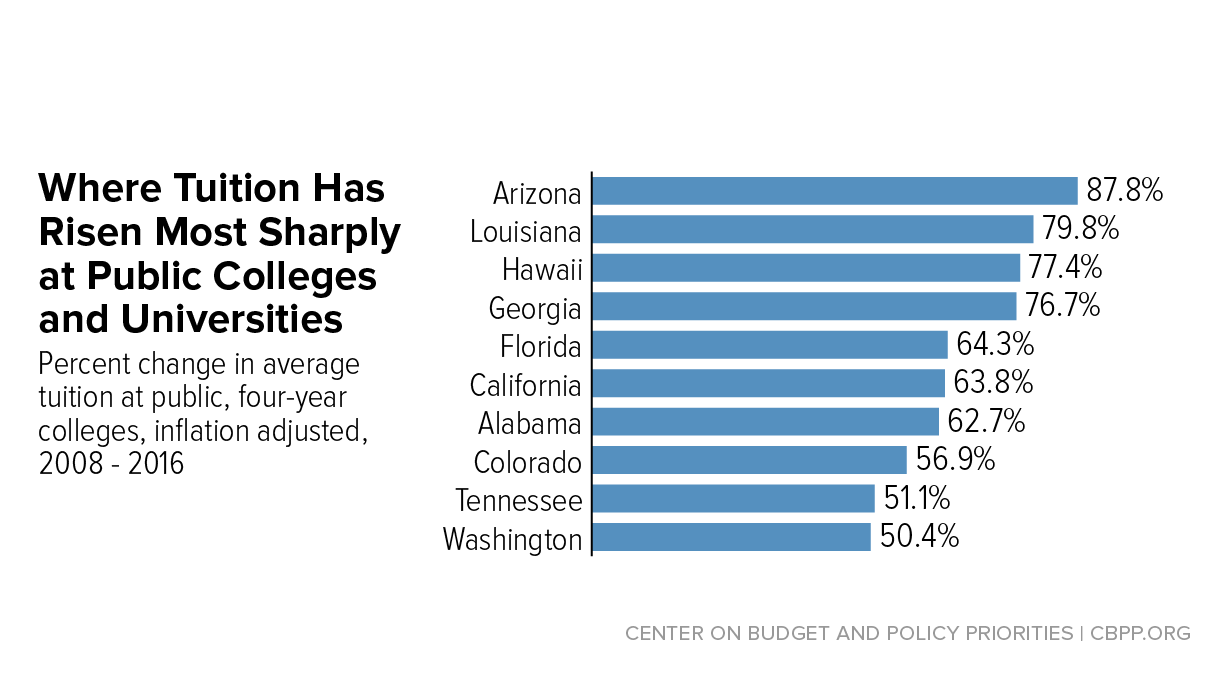

A lot has changed since then. Median family income has risen slightly, to about $64,000, while median home prices have increased by about two-thirds. But the real outlier is higher education. Tuition at a private university is now roughly three times as expensive as it was in 1974, costing an average of $31,000 a year public tuition, at $9,000, has risen by nearly four times. This is a painful bill for all but the very richest. For the average American household that doesnt receive a lot of financial aid, higher education is simply out of reach.

The Importance Of Lowering College Tuition

College tuition needs to be lowered for people who have the strong drive for success but not always the money.

Dear Future President,

College tuition should be lowered so that more hard working kids who deserve it can go to college and colleges can become more populated. If we lower the cost of colleges we will have several more kids from eighteen to twenty-four to be able to go to college and broaden their education. A college education gives you many great opportunities and helps pave a great future for you too. If there are more kids going to college then the college is getting more money which can make the campus better, they can offer more scholarships, and teacher pay can increase but increases tuition will only make colleges less populated. If colleges made tuition less money more people will be able to go so therefore they would be making about the same amount of money as if they made their tuition higher and less people.

Sincerely,

Read Also: What Size Are College Dorm Beds

Students Might Have More Freedom To Choose A Major They Enjoy

Whether it is the influence of parents or knowing you need to pay loans back as quickly as possible, current students are often guided toward practical majors that have a more lucrative post-graduation income. If shelling out thousands upon thousands of dollars is no longer a factor, parents and students might feel more relaxed about studying for majors that dont necessarily have a large paycheck associated with them. Interest and enjoyment from a field of study goes a long way in helping students stick with it and avoid burning out.

Did You Find This Article Helpful

At certain places on this site, you may find links to web sites operated by or under the control of third parties. Fulton Bank, N.A., Fulton Financial Corporation or any of its subsidiaries, Fulton Financial Advisors, and Fulton Private Bank do not endorse, approve, certify, or control those external sites and do not guarantee the accuracy or completeness of the information contained on those web sites. The bank may not be affiliated with organizations or third parties mentioned on the page.

You May Like: College Scouts For Football

The Colleges’ Argument: Their Costs Haven’t Dropped

Joni Finney, professor of practice at the University of Pennsylvania and director of the Institute for Research on Higher Education, says students’ concerns are valid. But institutions have to pay their own bills. Think: staff salaries, building maintenance and utilities.

Regardless of instruction format, Michigan State “is delivering courses taught by highly qualified and world-class faculty, tutoring services, faculty office hours and access, academic advising and access to our libraries,” President Samuel Stanley said in a recent statement explaining why it’s not offering a tuition discount. At the same time, the university has to cover costs for course design, professional development and technology needs.

This adds up. Data from the National Center for Education Statistics shows that public four-year colleges spend an average of $45,000 per student.

“In higher education, we are not good at looking at our fundamental costs and figuring out how to be more cost-effective,” Finney says.

To safeguard themselves against fluctuations in funding and the economy, universities often rely on tuition as a revenue source. In 2016-2017, net tuition per student made up 43% of total revenue at public baccalaureate colleges, according to the most recent Trends in College Pricing report from the College Board.

The pandemic is a threat to colleges’ bottom line and students’ wallets.

Targeted Relief May Do More Good Than Blanket Discounts

Some college leaders say that rather than offer broad tuition discounts, colleges should target relief to needy students. Not all students and families have felt the economic impacts of COVID-19 equally. Reducing the bills of those who can afford to pay, including well-off international students, could reduce the pot of money colleges have to put toward high-demand services, such as mental health resources.

Many schools continue to invest heavily in technology for online learning.

Additionally, while online education seems less expensive to produce, the upfront cost of getting these programs established can be significant. Many colleges reported increased operating expenses as they quickly ramped up online offerings following the onset of the pandemic.

Since online learning is here to stay, many schools continue to invest heavily in technology to prepare for future terms. And colleges must continue to pay a variety of constant costs like faculty salaries that don’t change significantly whether classes are offered online or in person.

Targeted relief may allow colleges to help the students who need it the most, while still expanding academic offerings and essential student support services.

You May Like: Which Meningitis Vaccine For College

The Money Has To Come From Somewhere

If America were to move to a tuition-free college policy, where would the money come from? The short and simple answer is taxes. Who gets taxed seems to vary based on who is talking, but it seems certain that the upper echelons of American society will see increased taxes if this passes. There is a likelihood that it will increase the upper-middle-class as well. Or maybe it will all come from Wall Street speculation taxes. The point is, all we know is that someone will pay these dues through taxes. The uncertainty of who will carry the burden is not making many Americans comfortable.

What Is The Difference Between School And College

College: In college, you get the ownership of your time and for the first time you can do just about anything you want. This is where the responsibility comes in as you have to make your schedule to fit in all the academic and personal needs. School: In school, half of the class falls in this category.

Recommended Reading: College Terre Haute Indiana

What Do Other Students Think About Online Classes And College Costs

The second most popular option among college students is that tuition should be customizable during COVID-19. If students aren’t able to access facilities like the campus gym, library or equipment labs, they shouldn’t be paying for them.

This option would change the college cost model to an à la carte solution, rather than an all-you-can-eat buffet of campus life.

There could be significant implications for accounting, financial aid and student loans. However, the lack of facilities is the reason that pre-pandemic online degree programs typically cost less than in-person ones.

A small number of students said that tuition should not change if college classes are online. In this perspective, full-tuition rates are based on the school, its education and the field of study. A transition to online school is simply a change in how classes are delivered, and it shouldn’t affect the cost.

A few students also responded that tuition could increase. These students say that the lack of people on campus could have the net effect of increased tuition. For example, if a percentage of students take a gap year during COVID-19, a school may need to raise the rates for the remaining students to prevent a budget shortfall. Students attending small private colleges are most likely to face this outcome if other income sources cannot replace tuition revenue.

Find out how the online study resources available on OneClass can help you get a great GPA, even during a pandemic.

Why Private Colleges Reset Tuition

Colleges reset tuition for myriad reasons, but administrators cite cost transparency as a top goal. Families often dont understand that many high-cost private colleges offer significant tuition discounts to eligible students, Gilbert says.

That was the case in Sides’ family. Her husband suffered sticker shock with Seattle Pacifics prices, but Sides had researched its merit scholarships and suggested her daughter apply anyway. The scholarship Seattle Pacific awarded put the colleges price close to that of an Oregon public university.

Tuition discounts reached a record high in 2019. Yet, more often than not, a conversation to explain available financial aid and scholarships never happens because many lower and middle-income families walk away before understanding their specific cost, says Stephen Thorsett, president of Willamette University in Oregon.

Willamette is reducing tuition by 20% starting next fall, part of the universitys new vision as it shifts its identity to a national liberal arts university. The reset should make costs easier to compare with public universities, Thorsett says.

In 2018, Birmingham-Southern made the decision to cut tuition and mandatory fees , to $17,650, to be transparent about costs and to put it closer to neighboring Alabama public university prices in hopes of attracting new applicants. Boosting enrollment is often a key goal of a reset, particularly for private colleges competing with nearby public universities, Gilbert says.

Don’t Miss: How To Build Credit In College

Government Loans & Grants Incentivize High Prices

Grants and low-interest loans are supposed to make college more affordable, right?

Well, think again. Colleges know that the majority of students will have an easy way to come up with money . Thus they can easily raise prices knowing students will just apply for more loans to pay for them. Without the easy access to college loans, students would be forced to choose lower-priced alternatives or simply demand lower prices, and colleges would have to follow suit.

The theory that more federal aid drives up college tuition prices is known as the Bennett Hypothesis. In an interview with the NY Times, Bennett says

If the federal government gives money, tuition goes up. If the federal government doesnt give money, it goes up. Now, I think the availability of federal funding drives it up more quickly and more surely. Federal student aid makes it easier for colleges to do what theyre going to do anyway, which is raise tuition. Theres more money available.

Federal loans were meant to help poor students achieve an education that would lift them out of poverty. Too often today they serve as a way to hold college graduates back from economic milestones such as getting married, starting a family or buying a house. Sometimes the fear of debt can keep students out of college altogether. One study found that debt above a certain level was associated with higher dropout rates .

Doing More To Focus On Student Outcomes

Cost and debt are only part of the storywe need increased focus on student success.

Addressing growing college costs and debt is absolutely critical. Many more students need access to vastly more affordable and quality higher education opportunitiesincluding tuition- free degree options. For too long, though, America’s higher education system has focused almost exclusively on inputsenrolling students in collegeand too little on outcomesgraduating from college with high-quality degrees. We must reset the incentives that underpin the system so the focus is on the outcome that matters: completing a quality degree at a reasonable cost. Otherwise, we will merely be finding better ways of paying for an unsustainable status quo.

The most expensive education is one that doesn’t lead to a degree.

While graduating with high levels of debt is holding too many borrowers back from reaching their full potential, the even more damaging outcome is for students who take on debt but never complete their degree. In fact, students’ ability to repay their loans depends more strongly on whether they graduate than on how much total debt they take on.

Also Check: Cape Fear Community College Tuition

Why Colleges Should Not Cut Tuition Prices

FILE- In this March 14, 2019, file photo students walk on the Stanford University campus in Santa… Clara, Calif. Before student loans, people who couldnt afford to go to college usually didnt. Even though tuition was cheaper, it was still cost-prohibitive for many, who turned to solutions such as working through school, getting help from their parents or finding scholarships.

ASSOCIATED PRESS

Most private colleges could lower their tuition prices. But they should not.

First, lower tuition prices would not help students as much as you may think. And second, it wont help schools at all. On the contrary, it may really hurt.

Lowering tuition wont help students because students already pay pretty low, pretty steady tuition rates. Despite what youve heard, the cost of college is not skyrocketing or whatever hyperbole headline misinformed writers want to use. As I wrote about a year ago, as a whole, college is not much more expensive than it was a decade ago. While it is true that sticker prices are going up, so are aid packages and discounts, keeping the overall net cost the amount students actually pay pretty flat and reasonable for the deal of a lifetime.

But the increased discounting at college that has kept real costs flat also means that if colleges cut their ticket prices, theyre certain to cut their aid offerings in kind, leaving little or no net change in what students pay.

Level The Playing Field:

Right now, if you cant afford to pay for college out of your pockets, you cant always go to your school of choice. You may feel forced to take loans or apply for scholarships. Therefore, the playing field is not equal. The only way to really make college education fair for everyone is to make it affordable for everyone. A lot of countries, especially in Europe, have already made this a reality. The University of the People has done the same by being a high-quality, 100% online, and tuition-free institution.

You May Like: Is College Ave Student Loans Legit

Why College Tuition In America Should Be Lowered

Why CollegeTuitionShould be Lowered By Sarah Claymiller What could you do with $14000? Well you could buy 4000 Whoppers with that money. You could also buy 35 IPads and 4 80 inch flat screen TVs. Or instead of those things you could buy yourself one years worth of collegetuition. Does it seem a little unusual that only one year of tuition costs that much? It might be if you live outside of America the United States is one of the biggest spenders on secondary education compared to other

PremiumCollege tuition, Higher education, Education finance 1496 Words | 4 Pages