Were Sorry Something Went Wrong

We are unable to fully display the content of this page.

The most likely cause of this is a content blocker on your computer or network. Please make sure your computer, VPN, or network allows javascript and allows content to be delivered from c950.chronicle.com and chronicle.blueconic.net.

Once javascript and access to those URLs are allowed, please refresh this page. You may then be asked to log in, create an account if you don’t already have one, or .

If you continue to experience issues, contact us at 202-466-1032 or

Over the past decade and a half, Ive given talks on dozens of college campuses about the need to increase socioeconomic diversity, but never before had I witnessed what I observed during a recent speech at Middlebury College.

Before introducing me, students from the sponsoring organization, Money at Midd, began the forum by publicly announcing their names and how much they and their families paid each year in tuition and fees. The first student, Samuel Koplinka-Loehr, said that his family paid about $18,000, and that he added $3,000 from his job. He passed the microphone to the next student, who said his family paid the full $56,000 comprehensive fee. A young woman said that her family could not afford to pay anything, but that she worked to pay $1,200 toward college costs.

I was dumbstruck, then elated, by the frank nature of the exchange. At Middleburyand on campuses throughout the countryclass is coming out of the closet.

Is Advancing Your Education The Right Decision

The salary figures and unemployment rates above demonstrate that, for many individuals, earning a bachelors degree leads to a positive return on investment. But according to Hughes, that isnt enough to conclude that earning a college degree is necessarily the right path for everyone.

I dont think everyone needs a bachelors degree, Hughes says. For example, a lot of individuals who go to vocational schools probably have the background they need to be successful in their trade. Of course, to progress in their career, they might have to go back to school, but that should be an individual decision that you make for yourself.

Read More: Do I Really Need a Bachelors Degree?

That being said, if you do decide that earning a degree will help you reach your personal and professional goals, its important that you find a program that aligns with those goals.

Hughes specifically recommends that students evaluating potential programs should examine the schools price point and the type of academics being offered. The program that you choose needs to fall within your budget, offer you the flexibility and support youll need to complete your degree while juggling other responsibilities, and arm you with the experience that will help you land a job after graduating.

Look For Grants And Scholarships

Grants differ from loans in that they do not have to be paid back. That’s why you’ll often hear them called “free money.”

The federal government runs the Pell Grant program, which gives money to undergraduates from low-income families. The specific amount you’ll receive depends on your expected family contribution and your cost of attendance. For the 2022-2023 year, the maximum is $6,895.

In addition to this federal assistance, each state provides additional financial aid.

Florida, for example, has the Bright Futures Scholarship Program that awards as much as $211 per credit hour to eligible applicants. Washington has the Washington College Grant, which can cover full tuition costs at approved, in-state public institutions or “a comparable amount toward tuition and other education-related costs at an approved private college or career training program.”

Schools also often offer what’s called merit aid to students with certain standardized test scores or other academic achievements. At private colleges especially, this is a significant form of financial aid, totaling billions of dollars a year.

Finally, you may want to take advantage of outside scholarships. Companies, nonprofits, foundations and other groups are constantly coming out with private scholarship opportunities that may offer free money with fewer strings attached than federal, state or institutional programs.

Heres a quick breakdown of common sources of funding:

You May Like: Is College And University The Same

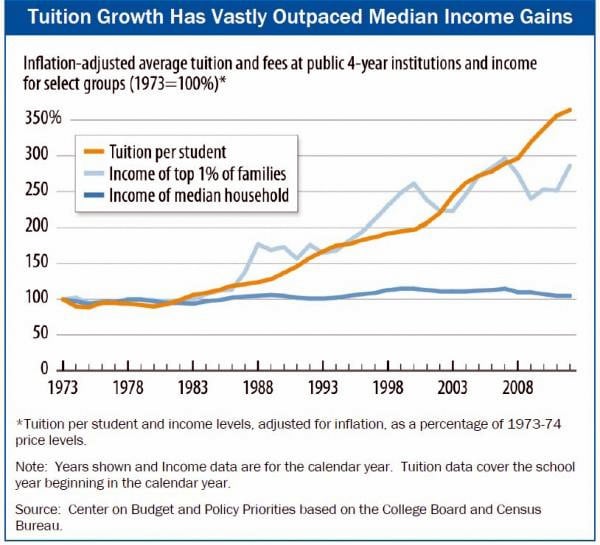

Historical Average Cost Of Tuition

The cost of tuition has increased significantly over the last 40 years even after adjusting for inflation. See our report on College Tuition Inflation to learn more.

- In 1963, the annual cost of tuition at a 4-year public college was $243, which had the same buying power as $2,349.33 in September 2022 currency values.

- From 1963 to 2020, the cost of tuition increased 355.1% after adjusting for inflation.

- Between 2010-11 and 2020-21, before adjusting for inflation, the average tuition increased 11.4% at 2-year colleges.

- During the same period, the average tuition increased 30.9% at public 4-year institutions and 41.3% at private, nonprofit 4-year institutions.

- From 2000 to 2020, average postsecondary tuition inflation outpaced wage inflation 111.4%.

- In 1963, the cost of a 4-year-degree from a public university was $972.

- In 1989, the same degree cost $7,120.

- As of the 2020-21 academic year, $102,828 is the price of a bachelors degree.

Cost of tuition and required fees assuming an in-state public institution attendee completes their bachelors degree program in 4 years.

Average Salary With An Associate Degree

Median Weekly Earnings: $963

Median Annual Earnings: $50,093

Average Unemployment Rate: 4.6%

Those who have completed an associate degree earn an average pay of $963 per week or $50,093 per year. In keeping with the economic trend, their risk of unemployment also decreases compared to those with less education, to 4.6 percent.

Associate degree holders earn more than $8,000 more per year than their peers whose education stopped after high schoola substantial increase, which translates into more than $320,000 over a typical 40-year career. And by advancing from an associate degree to a bachelors degree, average annual pay increases by an additional $19,288.

For this reason, it is not uncommon for an individual who has earned an associate degree to go back to school in order to convert their associate degree into a bachelors degree and obtain the higher earning potential that typically comes with a four-year degree. Wages aside, because a bachelors degree is a prerequisite for most graduate-level courses, associate degree holders with a desire to pursue more advanced degrees understand that doing so is the next logical step for them to take.

Also Check: Does Gpa Transfer From Community College To University

Making Sure You Can Repay

One guide to how much to borrow is to look at how much the student will be earning right after college. The benchmark we use: you shouldnt borrow more than your estimated starting salary during your first year out of college. This is a good rule of thumb to ensure that you have enough income to comfortably make your student loan payments over a typical ten-year repayment term. So, if your student anticipates that theyll earn $40,000 in their first entry- level job after graduation, they shouldnt take out more than $40,000 in total student loans.

You can research potential salaries on sites like College Scorecard, Edmit, Federal Student Aids Career Search tool, Payscale, or through the college career office. You can also look at monthly payments and income numbers and aim for 10% of your students monthly income to go towards loan repayment .

We encourage parents to look at your own goals and life plans and assess how contributing to the education of all of your children will affect your lifestyle and future retirement. When you apply for student loans youll be approved based on family income, not on what you can safely afford. Use a loan calculator to see how much youll need to pay monthly for different loan amounts. If you cant afford to make the payment now, you more than likely wont be able to afford it when your student finishes college.

Dont Forget About Scholarships And Grants

For a lot of Americans, thinking about the cost of college is stressful. And if youre in that boat, you might be forgetting about a little ray of sunshine called scholarship and grantsalso known as free money.

But heres the catch: You have to complete the FAFSA every yearand every state has its own deadline for completion.

The FAFSA is used to figure out how much you can get in federal grants and state grants. Even if you think you make too much money, do it anyway. Many colleges, foundations and corporations use it to award scholarships.

Filling out the FAFSA probably isnt how youd like to spend a rainy afternoon, but if you dont, you might be leaving cash on the table. A third of undergrad students dont file the FAFSA, and of those, 2 million would have qualified for a grant!7 Spending a day filling out these forms sounds worth it now, doesnt it?

In addition to grants, you need to go after all the scholarships you can. We repeat: all the scholarships. And in todays digital age, apps like Scholly and websites like CareerOneStop make finding and applying for those scholarships much easier. So, theres really no excuse for not going after every penny you can find.

Don’t Miss: What College Major Is Best For Me

The Majority Of Jobs Require College Education

In past generations, a college education wasnât necessary to earn a middle-class income. According to the Georgetown University Center on Education and the Workforce, two-thirds of jobs required a high school diploma or less before the 1980s.

Thatâs no longer the case. Georgetown University predicts that 70% of all jobs will require some college education by 2027.

Without higher education on your resume, it may be more difficult to find a high-paying job, and competition for available opportunities will be fierce.

Live Off Campus Or Enroll In Community College

If commuting to school and living at home is an option, it can save a lot of money. The average cost for room and board is $10,440 at public colleges and $11,890 a year a private institutions. That can be just as much as the cost of tuition at some schools.

If your finances are really stretched thin, it might be worth exploring enrolling in a community college before transferring to a four-year school later. Tuition and fees at the average community college cost $3,520 last year.

Don’t Miss: Should My College Student File His Own Taxes

How Do College Payment Plans Work

Many schools also offer flexible payment plans to make it easier to afford the cost of tuition. In fact, there are several different creative financing plans at most academic institutions.

These financing plans could include prepaying all four years of tuition at the beginning of your education to lock in a lower rate, or making monthly payments so you can spread out your tuition cost and not have to pay the entire amount all at once.

Making monthly payments for college can make it much easier if you are trying to work your way through school since you can pay a smaller amount at a time. Although you are not typically attending school for the full 12 months of the year, the repayment plan could still allow you to stretch your payment out over 12 months.

However, some schools charge for monthly payment plans or other extended payment arrangements. If your school charges fees, youll need to factor in this added cost when deciding if you should make monthly payments for college.

Explore College 529 Savings Plans

Another great way to save for college is a 529 Savings Plan, also called a 529 Plan. State-sponsored and offered by nearly all U.S. States, 529 Plans are specialized savings and investment accounts that do not tax the interest accrued. In almost all cases, you keep everything you earn to put towards a college education.

There are two primary types of 529 Savings Plans: College Savings Plans and Prepaid Tuition Plans. College Savings Plans work like retirement funds in that they invest deposited money into mutual funds or other options . Prepaid Tuition Plans allow plan owners to pre-pay all or some of the cost of an in-state public college education.

Interested in learning more about 529 Savings Plans? Check out this page for more information.

Also Check: Is Arizona College Regionally Accredited

What Percent Of Parents Pay For Their Childrens College Education

85% of parents pay for a portion of their childs college tuition, according to Sallie Maes How America Pays for College 2021. The reality is, even a percentage of the total college bill can be tough for most families to pay.

How much exactly should parents be saving? Average yearly tuition and fees have risen to an average of $38,070 for private four year institutions and $10,740 for in-state residents at public four year colleges.

Add on living costs, and some students can expect to shell over $50,000 for one year of higher education. That means that even parents who only plan to pay for part of the costs of college still must save tens of thousands of dollars to help their kiddos with college.

Average College Tuition And Fees

Although college tuition and fees are separate costs, colleges usually report a combined tuition and fees figure. For the 2022-2023 academic year, the average price of tuition and fees came to:

- $39,400 at private colleges

- $10,940 at public colleges

- $28,240 at public colleges

What is college tuition? College tuition is what colleges charge for the instruction they provide. Colleges charge tuition by the units that make up an academic year, such as a semester or quarter. Tuition at public colleges is usually lower for in-state residents. Out-of-state students often pay double the tuition as in-state students.

Tuition can vary by major. Students in the sciences, engineering, computing, pre-med programs, and the fine arts often pay higher tuition than students in other majors. For example, at the University of Illinois Urbana-Champaign, students enrolled in the College of Engineering pay up to $5,000 more in tuition per year than students pursuing majors in the liberal arts.

What college fees cover. Fees may support services such as the library, campus transportation, student government, and athletic facilities. Fees charged can vary widely from college to college. For example, the University of California, Irvine charges students a campus spirit fee to help support the athletics and school spirit programs and a fee for student health insurance.

Source: College Board, Trends in College Pricing and Student Aid, 2022.

Don’t Miss: What Colleges Offer Criminal Psychology

What Types Of Federal Student Aid Are Available

While there are no overall FAFSA income limits, the type of aid youre eligible for and whether you qualify for need-based financial aid will depend on your familys finances.

Even if you dont think you qualify for need-based aid, though, it makes sense to fill out the FAFSA to see if you can get non-need-based aid. You have to complete a FAFSA each year to keep receiving federal student aid.

Below are the types of federal financial aid you can obtain as a result of filling out the FAFSA:

Student Loans Can Be Confusing

Nearly 55% of parents surveyed said they had a âgood understanding of how the federal student loan process worksâ while 45% did not. The numbers broke down about the same when parents were asked about private student loans.

Federal student loans are from the government. The terms and conditions of these loans are set by law with benefits such as fixed interest rates and various repayment plans, including some based on a studentâs income after graduation.

Private loans, in contrast, are made by private firms and lenders like banks, credit unions and state-based or state-affiliated organizations

Lenders, like College Ave Student Loans put a lot of effort into helping students and parents sort out the confusion of the student loan process. In addition, College Ave helps borrowers create a loan that fits their budget and goals with low rates and flexible repayment options to choose from.

You May Like: What To Study In College Test

The Horned Frogs And Bulldogs Will Meet In What Some Consider A David Vs Goliath Battle On Monday Night

No. 1 Georgia will meet No. 3 TCU at SoFi Stadium for the 2023 College Football Playoff National Championship on Monday night. The Bulldogs are coming off of a 42-41 win over No. 4 Ohio State in the Peach Bowl semifinal, while the Horned Frogs are still surging after stunning No. 2 Michigan 51-45 in the Fiesta Bowl semifinal.

Georgia is looking to become the first repeat national champions of the CFP era and the first since Alabama accomplished the feat in 2011-12. Led by Heisman Trophy finalist Stetson Bennett IV at quarterback, the Dawgs have evolved into one of the most balanced and efficient offenses in the country. The Frogs sent a player to New York as a Heisman finalist as well. Max Duggan, who didn’t even start the season as TCU’s No. 1 signal-caller, has emerged into one of the most dynamic players in the country.

What should you expect in Los Angeles on Monday night? Let’s break down the game and make picks straight up and against the spread.

CBS Sports will be with you Monday night with live coverage of Georgia vs. TCU in the College Football Playoff National Championship. Follow along for score updates, analysis and highlights from the national championship game.

How Can You Calculate Your Own Costs Of Studying In The Us

In recent years, its become easier for individual students to calculate how much they could expect studying in the US to cost. All US universities are now legally required to include a fees and financial aid calculator on their websites, allowing students to get a rough idea of how much their intended course of study would cost and what aid they may be eligible for. These net price calculators can be accessed via the governments College Affordability and Transparency Center, which also provides details of the US universities with the highest and lowest tuition fees and net costs.

This article was originally published in February 2012. It was most recently updated in May 2019.

Want more content like this? Register for free site membership to get regular updates and your own personal content feed.

Recommended Reading: What Colleges Offer Mining Engineering