Wondering How To Save For College

A 529 plan is an excellent way to save for the future, but only if youâve done your homework. As a student loan attorney, Iâm well-versed in the ins and outs of saving for college and would love to help you select the best plan. Just schedule a free 10-minute consultation.

Subscribe to receive the best student loan information and suggestions delivered directly to your inbox. to stay up to date on all you need to know about student loans.

Stop Stressing.

Hey, Iâm Tate.

I’m a student loan lawyer that helps people like you with their federal and private student loans wherever they live.

Other Benefits Of Nc 529

Fees are very low and vary depending on which investment option you choose. Investors can select from several investment options to match their investing strategies and risk tolerance:

- Age-Based Options are based on the childs age. As they get closer to heading off to college, investments gradually move from stocks to bonds and short-term reserves. Investors also can choose between aggressive, moderate, or conservative investment strategies.

- Individual Options include nine different Vanguard portfolios and the Federally-Insured Deposit Account provided by State Employees Credit Union.

Discuss the options with a financial advisor to make the best choice for your familys savings goals.

Another bonus family members can contribute to your childs account for birthdays and special occasions. There are no enrollment fees or sales charges to open an NC 529 Account when done through College Foundation, Inc., who administers it for the state. Start saving today with a minimum contribution of $25 and watch your childs college dreams grow over the years.

Are 529 Contributions Tax Deductible

Never are 529 contributions tax deductible on the federal level. However, some states may consider 529 contributions tax deductible. Check with your 529 plan or your state to find out if youre eligible.

A 529 plan allows you to save for college or higher education while receiving some type of tax benefit. Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition, fees, books, as well as room and board. The contributions made to the 529 plan, however, are not deductible.

For more information about 529 Contributions, visit:

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Also Check: What Percentage Of High School Graduates Go To College

Recent Legislation Allows Rollovers From 529 Plans To Able Plans

Recent legislation allows rollovers from 529 plans to ABLE plans without federal tax consequences. For Iowa state income tax purposes, a rollover from College Savings Iowa but will also not entitle the taxpayer to a deduction to the extent that the rollover was previously deducted as a contribution to College Savings Iowa. College Savings Iowa 529 participants who are residents of other states should consult with a tax advisor about their state laws. Rollover amounts from a 529 account apply towards the overall limitation on amounts that can be contributed to an ABLE account within a taxable year. Any amount rolled over that is in excess of this limitation shall be includable in the gross income of the distributee. This provision applies only to distributions made no later than December 31, 2025.

For more information about the tax benefits offered by College Savings Iowa, refer to our Program Description.

*The earnings portion of nonqualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.

**If withdrawals are not qualified, the deductions must be added back to Iowa taxable income. Adjusted annually for inflation.

- What are the basics of 529s?

Report 529 Plan Contributions Above $15000 On Your Tax Return

In 2021, 529 contributions up to $15,000 for individuals or $30,000 for married couples filing jointly will qualify for the annual federal gift tax exclusion. This limit will increase to $16,000 in 2022. Sometimes, for estate planning purposes or other reasons, families will make contributions that exceed this amount. When that happens, you are able to take an election on your gift tax return to spread your contribution over five years. This will allow you to make contributions up to $75,000 without generating a taxable gift. You will have to file IRS Form 709, United States Gift Tax Return, if your contributions exceed the $15,000 annual gift tax exclusion.

Keep in mind that the annual gift tax exclusion will remain at $15,000 in 2021.

Also Check: What Are All The Majors In College

Exceptions To Section 529 Tax Deductions

Each 529 plan defines qualified educational expenses for which you can make tax-free withdrawals from your account. Commonly approved costs include tuition, books and room and board at eligible schools. You can also make non-qualified withdrawals, but youll have to pay taxes when you withdraw these funds, and youll also pay a 10 percent federal tax penalty.

There are three exceptions to this penalty rule:

Report 529 Plan Contributions On Your State Income Tax Return

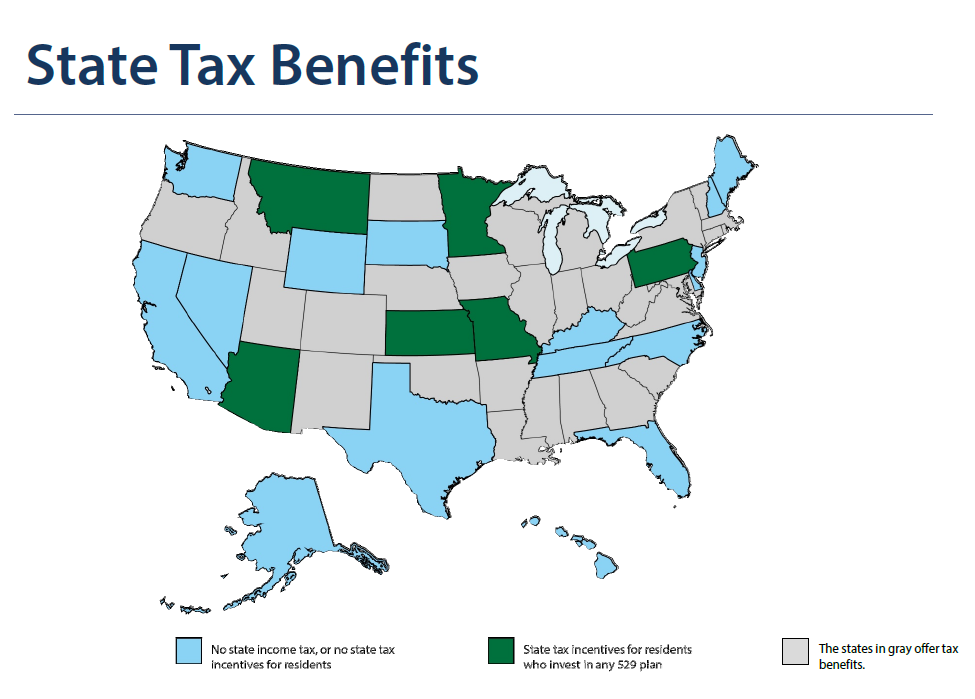

If you use a 529 plan and pay state income tax, you may be eligible for an additional benefit. Currently, over 30 states including the District of Columbia offer a full or partial tax credit or deduction on 529 plan contributions. Most states only offer this benefit to residents who use their home states plan, but residents of Arizona, Arkansas, Kansas, Minnesota, Missouri, Montana and Pennsylvania offer taxpayers a state income tax deduction when they contribute to any states 529 plan.

Read Also: Did President Trump Go To College

Federal Income Tax Treatment Of Qualified Withdrawals

There are two types of 529 plans savings plans and prepaid tuition plans. The federal income tax treatment of these plans is identical. Your contributions accumulate tax deferred, which means that you don’t pay income taxes on the earnings each year. Then, if you withdraw funds to pay the beneficiary’s qualified education expenses, the earnings portion of your withdrawal is free from federal income tax. This feature presents a significant opportunity to help you accumulate funds for college.

Qualified education expenses for 529 savings plans include the full cost of tuition, fees, room and board, books, equipment, and computers for college and graduate school, plus K-12 tuition expenses for enrollment at an elementary or secondary public, private, or religious school up to $10,000 per year.

Qualified education expenses for 529 prepaid tuition plans generally include tuition and fees for college only at the colleges that participate in the plan.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: What Classes Do You Take In College For Business

Should You Have A 529 Plan

529 plans are an obvious choice for college savings for many families. Most plans have age-based investing options that automatically rebalance, taking more risk when your child is younger and less risk as they get older. You can open a 529 plan immediately on the website of your stateâs plan.

Whatever option you choose for saving for a college education, getting started today is one of the most critical decisions you can make. Youâll allow your money time to compound if you start early, and thatâs where a large portion of the value in your account will come from over time.

Qualified Elementary And Secondary Education Expenses

These are expenses for no more than $10,000 of tuition, incurred by a designated beneficiary, in connection with enrollment or attendance at an eligible elementary or secondary school.

*CAUTION Illinois Qualified Expenses do not include expenses for:

- tuition in connection with the Beneficiarys enrollment or attendance at an elementary or secondary public, private, or religious school. The amount of cash distributions for such expenses from all 529 qualified tuition programs with respect to a Beneficiary shall, in the aggregate, not exceed $10,000 during the taxable year.

- If a withdrawal is made for such purposes it may be a Federal Qualified Withdrawal and not be included in income for federal and Illinois purposes, but if an Illinois income tax deduction was previously claimed for Contributions to the Account all or part of that deduction may be added back to income for Illinois income tax purposes.

Please consult with your tax advisor.

Recommended Reading: How To Find Financial Aid For College

Report Any Taxable 529 Plan Withdrawals

Qualified education expenses include tuition, fees, books, computers and related technology and some room and board costs for students attending an eligible college or university. Families can also take a tax-free distribution to pay for tuition expenses at private, public and parochial elementary and high schools. This amount is limited to $10,000 per year, per beneficiary. The SECURE Act of 2019 expanded the definition of qualified 529 plan expenses to include costs of apprenticeship programs and student loan repayments. Qualified distributions for student loan repayments have a lifetime limit of $10,000 per beneficiary and each of their siblings.

529 withdrawals spent on other purchases, such as transportation costs or health insurance coverage are generally considered non-qualified. In rare cases, these expenses are considered qualified only if the college charges them as part of a comprehensive tuition fee, or the fee is identified as a fee that is required for enrollment or attendance at the college .

If you made non-qualified purchases last year, you will need to review your 1099-Q, which breaks out the basis portion and the earning portion. The earnings portion of a non-qualified withdrawal will be subject to income tax and a 10% penalty. The basis portion will never be taxed or subject to penalty because it is made up with the amount you originally contributed with after-tax dollars.

Next Steps To Consider

529 Participants may take up to $10,000 in distributions tax free per beneficiary for tuition expenses incurred with the enrollment or attendance of the designated beneficiary at a public, private, or religious elementary or secondary school per taxable year. The money may come from multiple 529 accounts however, the $10,000 amount will be aggregated on a per beneficiary basis. Any distributions in excess of $10,000 per beneficiary may be subject to income taxes and a federal penalty tax.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: What Can I Go To College For

Qualifying For The Tuition And Textbook Credit

Taxpayers who have one or more dependents attending grades K-12 in an Iowa school may take a credit for each dependent for amounts paid for tuition and textbooks. The credit is 25% of the first $1,000 paid for each dependent for tuition and textbooks. Dependents must have attended a school in Iowa that is accredited under section 256.11, not operated for a profit, and adheres to the provisions of the U.S. Civil Rights Act of 1964. If expenses qualify for both the tuition and textbook credit and 529 Plan, taxpayers may claim both.

Get A State Income Tax Deduction

If you’re a New York State taxpayer and an account owner, you may be able to deduct up to $5,000 of your Direct Plan contributions when you file your state income taxes. Please consult your tax advisor. **

You must make a contribution before the end of a given calendar year for it to be deductible for that calendar year. If you send your contribution by U.S. mail and it’s postmarked on or before December 31, we’ll treat your contribution as having been made in the year in which it was sent.

To learn more about depositing your tax refund directly to your NY529 Direct Plan account, see here.

Note: There are no federal tax deductions for contributions to 529 plans.

You May Like: Can You Attend Two Colleges At Once

Who Can Get A Tax Deduction For 529 Plan Contributions

Although some facets of 529 plans are set by the federal government through Section 529 of the Internal Revenue Code, many of the specifics are left up to the states to decide. Each state offers at least one 529 plan, some of which carry benefits that others lack â perhaps the best example of which is a state income tax deduction or credit. Whether or not you can get a tax deduction for contributing to a 529 plan will depend on two main points: where you live and whether you own the account.

Different states have different policies in this regard â in some, you can enjoy a state income tax break for contributing to any account, whereas others only grant this benefit to those making donations to an in-state plan in a few states, only the account owner can use the deduction. In seven states â California, Kentucky, Delaware, New Jersey, North Carolina, Maine, and Hawaii â no deductions are available, while another nine have no state income tax from which to deduct contributions. Below, weâve sorted the states that do offer some kind of tax break to clarify whether you might be eligible for a tax deduction for your contributions to a 529 plan:

The Cost Of 529 Plans Is Set To Rise

As 529 plans mature and more families use them to fund college costs, the price tag to the U.S. Treasury will also rise, unless some reforms are undertaken. Over the next decade, the federal government is set to spend almost $30 billion on 529 tax expenditures, according to Treasurys Office of Tax Analysis. Annual costs are projects to be just under $4 billion by 2026.

Read Also: How Do You Graduate From Online College

Who Is Eligible For A 529 Plan State Income Tax Benefit

States typically offer state income tax benefits to any taxpayer who contributes to a 529 plan, including grandparents or other loved ones who give the gift of college. However, in 10 states only the 529 plan account owner may claim a state income tax benefit.

Eligible taxpayers may continue to claim a 529 plan state income tax benefit each year they contribute to a 529 plan, regardless of the beneficiarys age. There are no time limits imposed on 529 plan accounts, so families may continue to make contributions throughout the childs elementary school, middle school, high school, college years, and beyond.

State income tax benefits should not be the only consideration when choosing a 529 plan. Attributes such as fees and performance must always be taken into account before you enroll in a 529 plan. In some cases, better investment performance of another states 529 plan can outweigh the benefits of a state income tax deduction.

Prioritize Which 529 Accounts To Spend From First

If your child has more than one 529 savings account, such as an additional account through a grandparent, knowing which account to use first or how to take advantage of them concurrently could help. Don’t leave decisions to the last minuteinstead, sit down with all plan owners and decide on a withdrawal strategy ahead of time to make sure the qualifying college costs are divvied up in the most beneficial way.

Also, if financial aid is in the picture, a distribution from a grandparent-owned 529 account may be considered income to the child on the next financial aid application, which could significantly affect aid. To avoid any problems, grandparents can take distributions from 529s as early as the spring of the student’s sophomore yearright after the last tax year on the student’s last undergraduate Free Application for Federal Student Aid , assuming the student finishes college within 4 years. Wait until the following spring to employ this strategy if it looks like your child will take 5 years to graduate.

Read Also: What Colleges Does The Gi Bill Cover