Have Questions About Financial Aid

Learn about financial aid through these short videos.

A college education is exciting and life changing, and no one should miss the opportunity because they don’t think they can afford it.

Prince Georges Community College makes affordability part of its mission. It offers its students a variety of financial aid options.

Scholarships, grants and work-study programs provide funds that do not have to be repaid. Loans that do have to be repaid are available with competitive interest rates and easy payback terms.

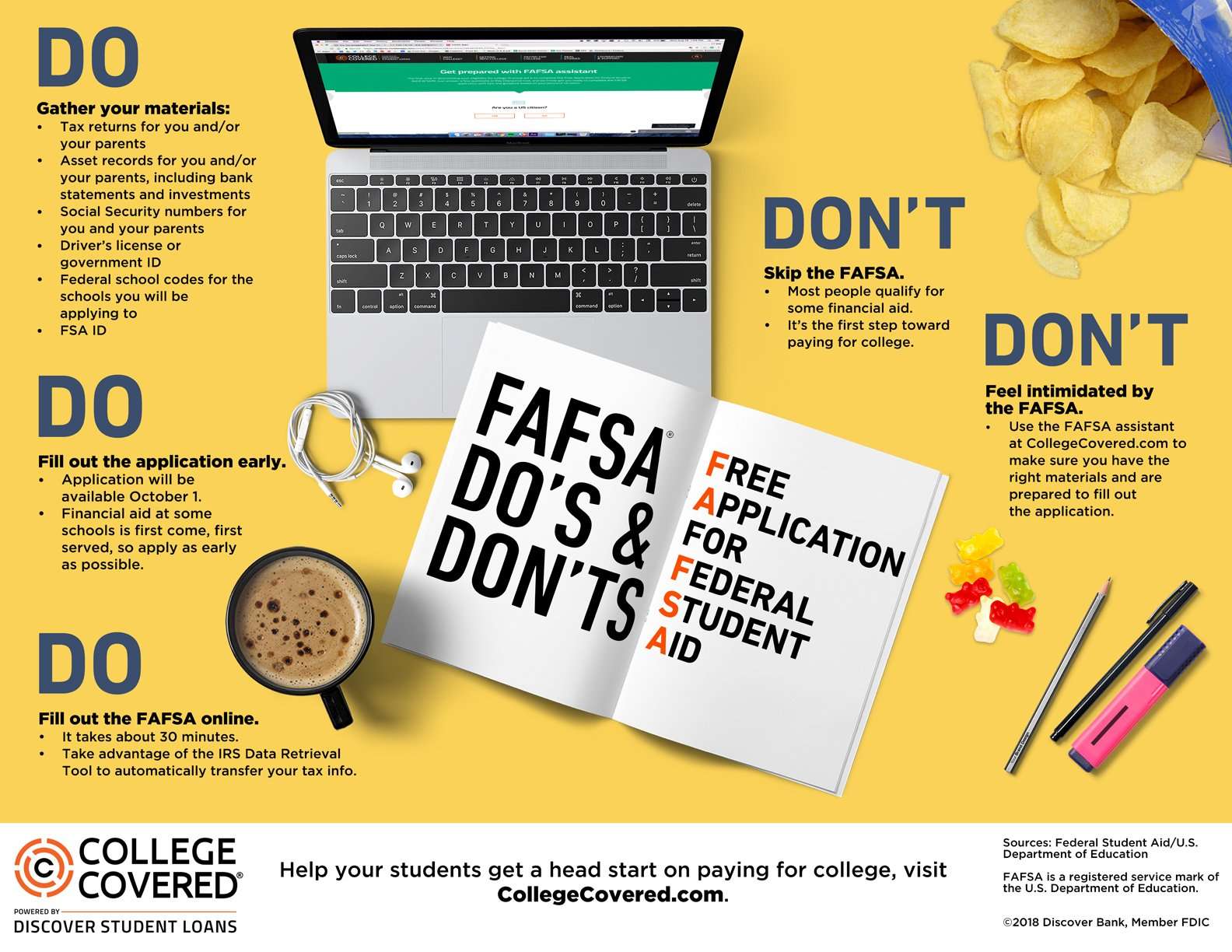

The first step in applying for financial aid is filling out a Free Application for Federal Student Aid online.

Determine Your Financial Situation

The first step in figuring out what you need in terms of financial aid is having an honest look at your familys financial situation. Are you able and willing to cover the cost of tuition?

Having a clear understanding of your financial situation and establishing realistic expectations is essential to moving forward in pursuing other forms of financial aid.

Applying For Financial Aid

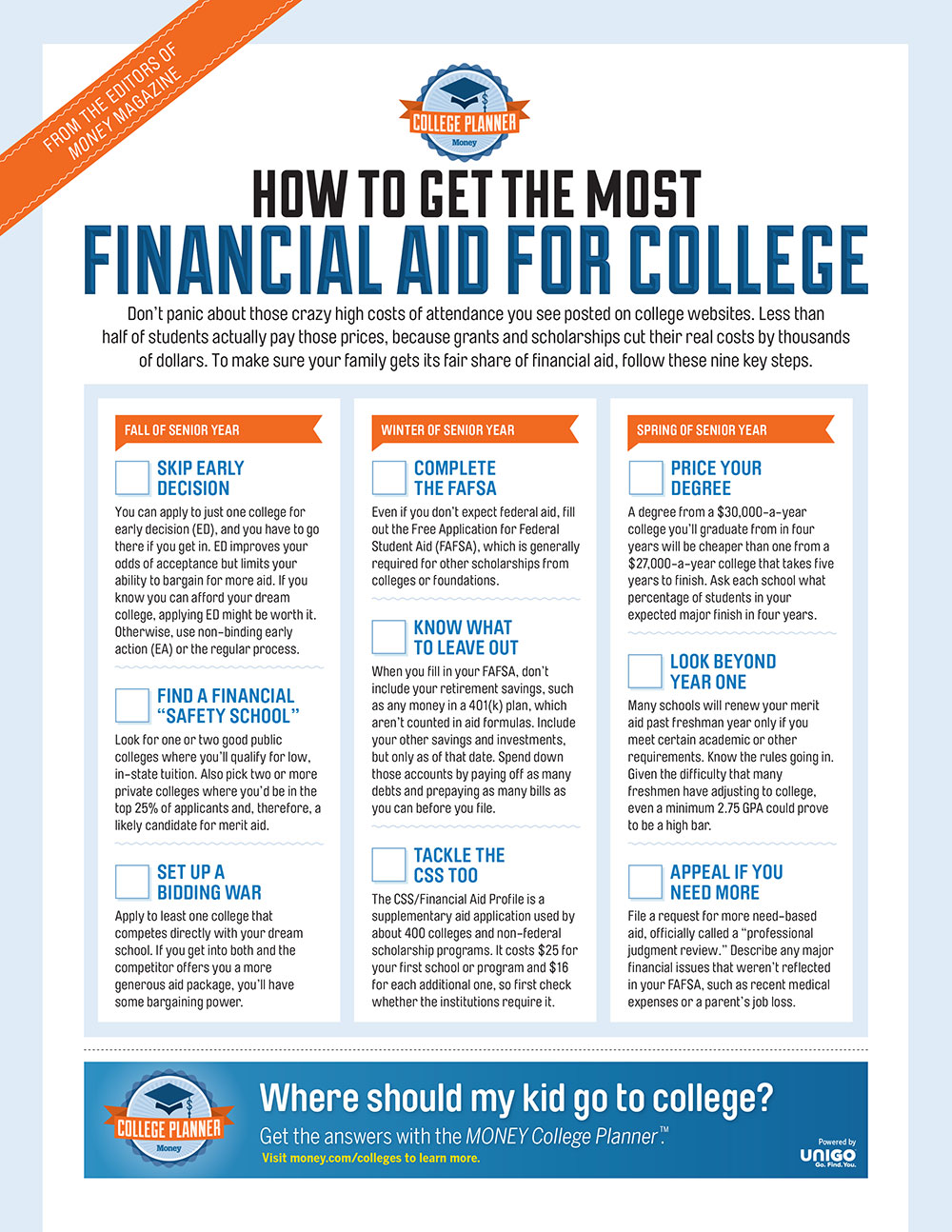

- Research financial aid programs early. There are many different types of , and available, totaling billions of dollars. Start researching during your sophomore and junior years of high school, or one to two years before you plan to start college. You can find information at this website; at your high schools counseling office; at your college’s financial aid office; at public libraries; or at various lending institutions.

- Early in your high school senior year, or one year before you start college, contact the financial aid offices at the colleges of your choice for deadlines and additional documents that may be required.

- Complete a , which is available to complete online and offers mobile-friendly options or in paper format, as soon after October 1 as possible. You must submit this form in order to be considered for all federal financial aid programs, most institutional programs, and most , including the .

- Students report their 2019 income information on the 2021-22 FAFSA.

- Further details regarding how to obtain the tax information needed to complete the FAFSA are provided on the page.

- If you are an Illinois student who is not eligible for federal financial aid , you may apply for a MAP grant using the online Alternative Application for Illinois Financial Aid, which is patterned after the FAFSA. For more information, visit the page of this website, and talk with your high school counselor or the financial aid office at your college or university.

You May Like: How To Get Recruited To Play College Baseball

Review The Financial Aid Award Letter

The financial aid award letter lists the types and amounts of financial aid available to you. Be careful to distinguish grants from loans. Calculate the net price by subtracting just the gift aid from the full cost of attendance. Gift aid includes grants, scholarships and other money that does not need to be earned or repaid. The total cost of attendance includes tuition and fees, room and board, books, supplies, transportation and miscellaneous expenses. Compare the net price with the resources available to your family, such as savings, income and loans to evaluate whether you can afford the costs.

Should I Apply For The Fafsa Early

Some federal financial aid is awarded on a first-come-first-served basis so its a good idea to file as early as possible. Completing the FAFSA early has many benefits such as allowing you to spend more time on searching for free money like scholarships and grants and focusing on other college planning and preparation.

Don’t Miss: How Do College Coaches Make Offers

Beat Financial Aid Deadlines

FAFSA submission periods open on Oct. 1 every year, and they remain open until the end of June a year and a half later but you shouldnt wait to file. File before the deadline, and if you can, file as soon after October 1 as possible, Randolph said.

But if you have a whole 21 months to submit a FAFSA, whats the rush? Well, filing early can have a few benefits:

- Your FAFSA will be received and processed well before the school year when you will need it.

- Find out earlier what aid you qualify for. This can help you plan ahead, budget for college costs and even compare colleges to choose the most affordable option.

- If there are any errors in your FAFSA, youll have time to correct or amend the application so you can receive the correct amount of aid.

- You could get more non-federal aid: If you apply early, youll have a better chance to qualify for non-federal financial aid programs, such as for school-based funding or state grants.

After You Complete Fafsa

Once CCC receives a copy of your FAFSA from the U.S. Department of Education, an email will be sent to your CCC student email address , requesting documents needed to complete your file. Once all documents are received, we will continue processing your application for financial aid. If awarded, we will notify you of your award via your CCC student email. All students should read CCCs Things You Must Know; document, which includes detailed information regarding financial aid policies.

Also Check: How Much Does One College Class Cost

Quick Note On Verification:

Verification, which is a federal process, requires Northwest University to check the accuracy of the information you and/or your parents, and/or your spouse, reported when completing the FAFSA. The documents needed to verify the information you reported will be listed on the Financial Aid Offer Letter with a link to the forms on the web site. If any of the information submitted requires corrections to your FAFSA,;it will be submitted to the United States Department of Education. If the updated information results in any changes to your financial aid offer, a revised Financial Aid Offer Letter will be sent to you by either mail or email.;Financial aid will not be disbursed and federal loans will not be originated until verification is complete.

Turns Out There Are A Few Differences Between A Federal Student Loan And A Private Loan:

-

Most federal loans dont require a credit check.

-

Federal loans often have low, fixed interest rates,which vary based on the first disbursement date of the loan. The interest rate for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans for undergraduate borrowers first disbursed on or after July 1, 2020, and before July 1, 2021, is 2.75%

-

Federal loans are tax-deductible.

-

Federal loans can also be deferredmost commonly, students will defer their loans for up to 6 months after they graduate .

-

Lastly, federal loans are eligible for loan forgiveness in some special cases.

While this list may make federal student loans look nicer than what Mr. Local Banker Man would has to offer, it should be noted that student loans are still debt. Taking out a student loan means spending money you dont have and that you will have to pay back… with interest.

Taking out a multi-thousand dollar loan at 18, with no career or even the guarantee of a good job once you graduate? Thats a financial gamble. For better or worse, it will impact your life long after college.

Given that, lets talk about the different kinds of federal student loans you could apply for and the impact they can have on your financial future.

Read Also: What Colleges Offer Rn Programs

Where And How To Apply For The Fafsasteps For Beginners

Once youre ready to begin the FAFSA, keep these tips in mind:

Where To Find Help In Completing The Fafsa

Most errors on the FAFSA are made because students and/or parents fail to read the instructions or don’t fully understand the instructions. Please read ALL of the FAFSA instructions carefully.

If you need help:

- Attend a workshop where a presenter helps families complete the FAFSA and learn about how to pay for college. Check for locations here: www.mafaa.org or at www.minnesotacollegegoal.org.

Also Check: How To Be Debt Free In College

Types Of Student Loans

Student loans are from the federal government or from private sources, such as a bank, credit union, state agency, or school. Learn the differences between federal and private loans before considering a loan.

Federal Student Loans

If you need to borrow money to pay for college or career school, start with federal student loans. Theyre more affordable than private loans.

Types of Federal Student Loan Programs – The William D. Ford Federal Direct Loan Program offers four types of Direct Loans:;;;;

- Direct Subsidized Loans are made to eligible undergraduate students based on financial need.

- Direct Unsubsidized Loans are made to eligible undergraduate, graduate, and professional students, and are not based on financial need.

- Direct PLUS Loans are made to graduate or professional students and parents of dependent undergraduate students.

- Direct Consolidation Loans allow you to combine all of your eligible federal student loans into a single loan with a single loan servicer.

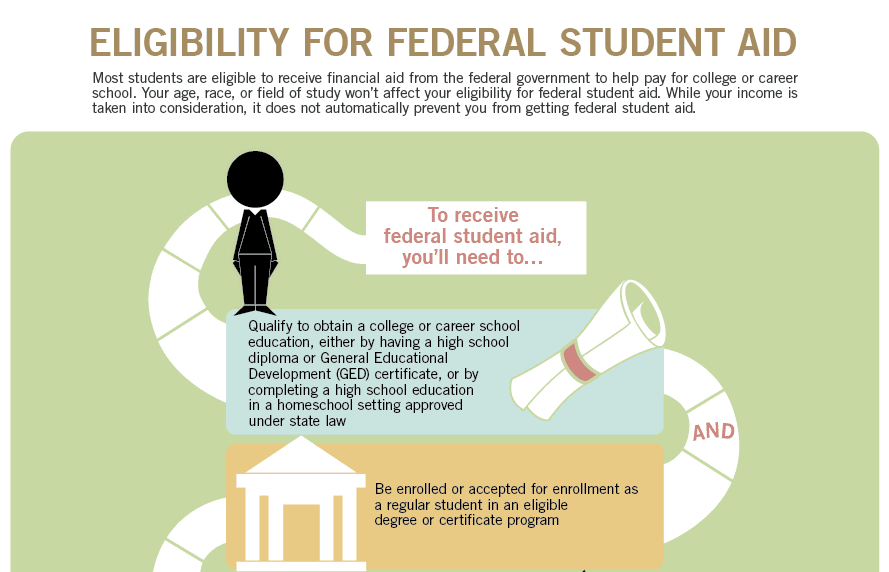

Eligibility – You must be enrolled at a school that participates in the school loan program, and meet the general eligibility requirements.

How to apply – Complete the Free Application for Federal Student Aid or FAFSA. Watch this video to learn more about what happens after submitting your FAFSA.

Private Student Loans

How To Apply For Merit Scholarships

Start searching for scholarships as soon as possible. The sooner you start searching for scholarships, the fewer deadlines you will miss.

- There are scholarships you can win in younger grades, not just during your senior year in high school.

- Some scholarships have deadlines in the fall, not just during the spring.

- Continue searching for scholarships even after you enroll in college, as there are some scholarships that are open only to current college students.

Search for scholarships on free scholarship matching sites. The best scholarship databases are free.

- Dont pay a fee to search for scholarships or to apply for scholarships.

- If you have to pay money to get money, its probably a scam.

To increase your chances of winning a scholarship, apply to every scholarship for which you are eligible.

You May Like: How To Grants For College

Information For New Students

Once you’ve made your decision to attend Fleming College, you have to plan for all the necessary financial resources you will need to be successful. You are making a valuable investment in your future. The Financial Aid Office can assist you by providing you with financial options.

Enter Your Personal And School Information

The first two sections in the meat of the application focus on the student’s personal information and school selection. In the student demographics section, you’ll need to enter your name, address, email address, phone number, driver’s license number, marital status, citizenship status, Selective Service status, and education history.

On the School Selection tab, you will enter information about your high school and college. If you have your college’s Federal School Code, you can enter it here. Or you can look it up with a search system. Once you pick your school and enter your planned housing status, you can move on to information about the household and parents.

You May Like: Do Illegal Immigrants Get Free College

There Are Resources And Support To Help You Apply For Financial Aid

There are affordable college and career training opportunities for everyone. The first, best step is to apply for financial aid.;Not sure where to start? Talk to someone you can trust:

- The 12th Year Campaign is hosting virtual financial aid info and filing events to help students and families apply for college and;financial aid.

- Are you a high school student? Your counselor can answer questions and direct you to resources.

- Talk to the financial aid office at any colleges you’re interested in attending. Whether you’re an adult thinking about going back to school or a high school student considering your options, financial aid staff can help you navigate the process based on your circumstances.

When Should I Fill Out The Fafsa

As soon as possible after it becomes available on Oct. 1, financial aid experts say. Many states and colleges use the form to determine scholarship aid, and some programs award the money on a first-come, first-served basis until available funds are depleted. A list of deadlines for both federal and state aid programs is available on the federal student aid website.

And note: While the federal deadline for filing a FAFSA extends into the summer after a given academic year, waiting until then means you will probably be eligible only for loans. The FAFSA for the current academic year, for instance, has a federal filing deadline of June 30, 2022.

Also Check: Is College Ave Student Loans Legit

Financial Aid Isn’t A One

Published in:How to Pay for College

About the Author

Julissa Treviño is a writer and journalist based in Texas. Her work has appeared in BBC Future, CityLab, Columbia Journalism Review, The Dallas Morning News, Racked, Teen Vogue and other publications. She enjoys traveling, playing with makeup, biking and trying new food. Follow her @JulissaTrevino. Read more by Julissa Treviño

More Articles in How to Pay for College

There Are Some Shortcuts

The FAFSA is notorious for being confusing, especially when it comes to filling out financial info.

“For example, students applying for financial aid for the beginning of the 2020-2021 academic year, the tax year with which the FAFSA will assess their need is 2018,” they said. So that means that if you’re getting ready to apply for the next school year, the info you need to supply is for the last tax year.;

If you want to save time and effort, FAFSA offers an option to use what’s called the IRS Data Retrieval Tool. This tool collects parents and/or students tax figures and pre-fills them into the FAFSA. “This helps to mitigate errors.”

Also? It can save you a ton of time.

Don’t Miss: What Is The Average Cost Of College Tuition

How To Apply For Need

To apply for need-based financial aid, file the Free Application for Federal Student Aid, otherwise known as the FAFSA. The FAFSA is used to apply for financial aid from the federal and state governments, as well as most colleges and universities. The information entered on your FAFSA determines your financial aid eligibility.;

- You will need an FSA ID, which you can get at fsaid.ed.gov, to electronically sign the FAFSA.

- Then, file the FAFSA online at fafsa.ed.gov.

- The FAFSA is a free form. You do not need to pay anybody to file the FAFSA.

About 200 mostly private colleges use a supplemental form called the CSS Profile for awarding their own financial aid funds. These colleges must still use the FAFSA for federal and state aid.

- File the CSS Profile online at cssprofile.collegeboard.org.

- The CSS Profile costs $25 for the form and first college, plus $16 for each additional college. Automatic fee waivers may be available to low-income students.

It is best to file the FAFSA and CSS Profile as soon as possible on or after October 1. Students who apply for financial aid sooner tend to get more grants than students who apply later. More than a dozen states award state grants on a first-come, first-served basis, until the money runs out. Some colleges also have very early deadlines.

Gather the documentation youll need to file the FAFSA in advance. Read a few tips on how to get more financial aid by tweaking your income, assets and demographics.

How To Apply For Financial Aid

Tweet This

Today is the earliest date you can file the Free Application for Federal Student Aid for the 2019-20 academic year. The FAFSA is required for families that want to apply for federal aid, grants, loans, and work study awards for higher education. Everyone with a student attending or going to attend college next year should complete the FAFSA as soon as possible; ideally now.

Thats because many states and colleges that use the FAFSA as part of their financial aid process have a limited pool of funds, making aid for recipients first come, first served.

529 Expert, LLC

Why Everyone Should Complete The FAFSA

I make too much money so filing is a waste of my time, is usually wrong. There is no income limit for filing the FAFSA. In fact, among families earning $100,000 or more a year, 78.6% qualified for some form of financial aid, and over 60% qualified for grants according to the National Center for Education Statistics.

The FAFSA is free, so the only real cost is the time it takes to complete. You can get a quick estimate using the FAFSA4Caster to see for how much you might qualify.

Who Can Apply

In order to apply for financial aid you need to meet certain eligibility requirements including, at a basic level:

There are more detailed eligibility requirements available from the U.S. Department of Education if you are concerned you might not qualify.

What You Need

Before;filing the FAFSA you will need a lot of documentation:

How To File

What Happens After Filing

Also Check: How Do College Credit Hours Work

Choosing Your Financial Aid Package

Compare the financial aid packages.Does one school give you better financial aid than another? Is that the school of your choice? What does each package cover?

Pick the college you would like to attend.Choose the school that meets your financial and academic needs as well as any other criteria you consider a priority.

Fill out the financial-aid verification forms of the school you’d like to attend.Complete the form in its entirety. Accept all or part of the financial aid offered. Verification forms often come with specified deadlines, so pay close attention to when they are due.

Submit the completed financial-aid verification forms to the school of your choice.Return the financial-aid form to its corresponding school as soon as possible and make sure to include any additional documents noted.