Fill Out The Fafsa Electronically

Now that you have the information you need, its time to fill out the FAFSA. Unless youre unable to, I highly recommend filling it out electronically. It will be faster to submit than a paper copy, and you can save your progress along the way.

To start filling out the FAFSA online, visit this page.

If youd prefer to use your phone, you can also fill out the FAFSA with the myStudentAid app .

If youve created an FSA ID , then you can enter it to pre-fill some of your FAFSA info, including your name, SSN, and DOB. Youll also need an FSA ID if youre filling out the FAFSA in the myStudentAid app.

If you get stuck during the process, consult the official FAFSA Help page. You can also contact the financial aid office at the college you plan to attend for further assistance.

What Questions Can I Ask Financial Aid Officers At Schools I’m Planning To Apply To

- Whats the average total costincluding tuition and fees, books and supplies, room and board, travel, and other personal expensesfor the first year?

- Will applying for financial aid impact my admission application? Whats the priority deadline to apply for financial aid, and when will I be notified about financial aid award decisions?

- How is financial aid affected if I apply under an early decision or early action program?

- Does the college offer need-based and merit-based financial aid?

- Do I need to complete a separate application for merit scholarships if available? Does the college require me to fill out the CSS Profile?

- If my familys financial circumstances change after filing the FAFSA, should I contact the financial aid office? Will my financial aid award be adjusted? Do I need to apply for financial aid every year?

Maximize Federal Student Loans

Borrow federal before private. Federal loans come with more generous repayment and forgiveness options compared with private loans.

» MORE:How to apply for student loans: Federal and private

Determine how much to borrow. The amount you should borrow will depend on what kind of monthly payments you can expect and your income in your first year after graduation. A good rule of thumb is to borrow no more than 10% of your forecasted monthly take-home pay. Use a student loan repayment calculator to estimate payments.

Read Also: Is Ashworth College Legitimate

What Is The Difference Between Scholarships And Grants

The federal government gives grants like the Federal Pell Grant and the Federal Supplemental Education Opportunity Grant based on financial need. There are also grants specifically available for African-Americans, single mothers, and women. Other grants are offered through your specific state. Students can find out if they are eligible for various grants after filling out a FAFSA.

Scholarships are given mostly on a merit basis, but award money is also dispersed to students in financial need. Scholarship money goes directly to the student or school to offset tuition costs and other college expenses. There are thousands of scholarships available for everything from left-handed students to online students. Reward money is sometimes given to students who demonstrate the financial need or to minority groups.

Nonprofits, individuals, and associations also give out scholarship money throughout the year. On average students attending public, four-year colleges, at all income levels, received $9,740 for the 2011-2012 school year in grant and scholarship aid, according to the Department of Education.

College For All Texans

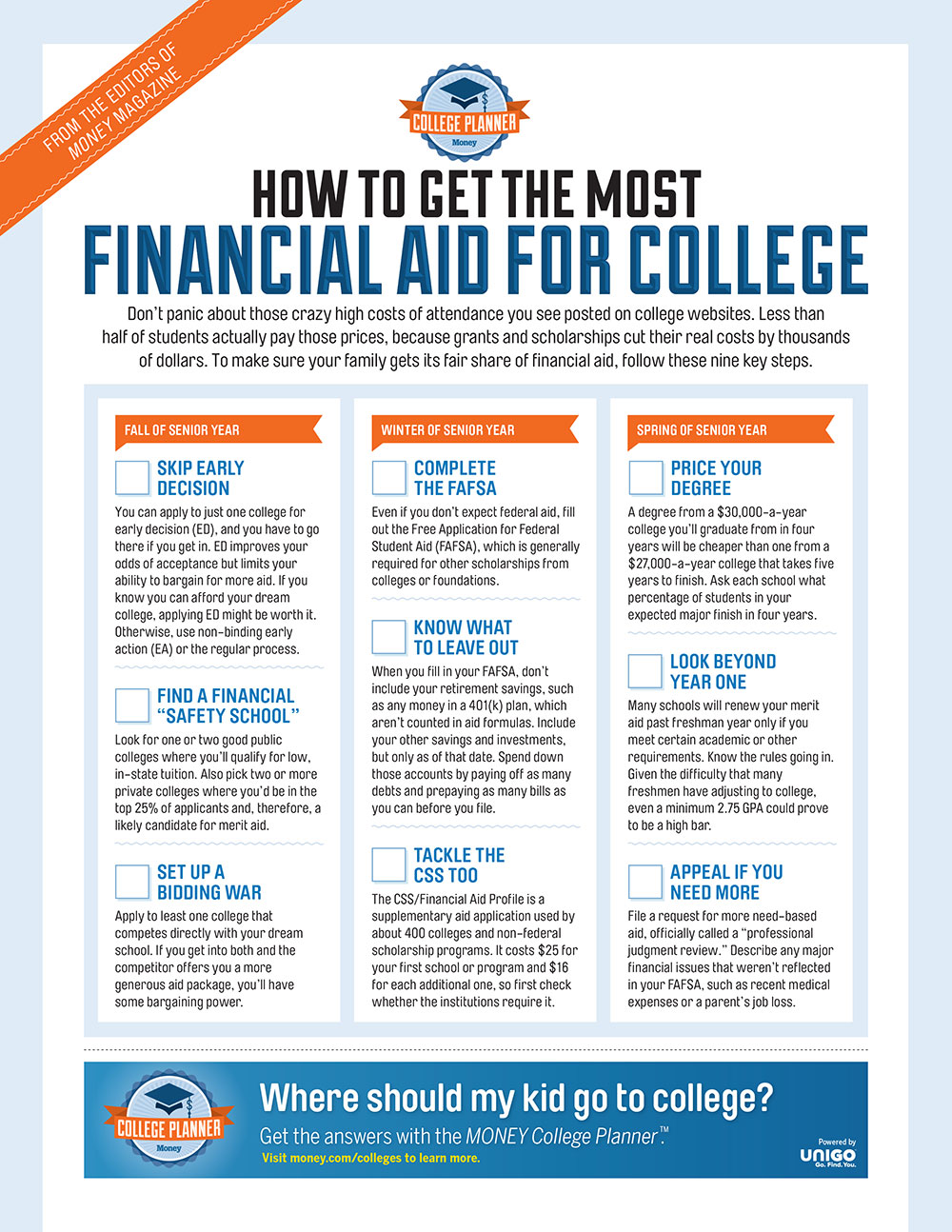

Applying for financial aid requires a little work on your part. But the fact is, you won’t receive assistance unless you ask for it. And asking for it means completing a few forms.

There are three very important things to remember about applying for aid:

- You only have to complete one financial aid application to start the process.

- The financial aid office at the college you plan to attend will be in charge of awarding you financial aid.

- Deadlines matter! The earlier you submit your forms, the more likely you are to get a good financial aid package.

You and your family can choose from many different types of financial aid. Some are based on financial need, and some on academic performance. Others are tied to a student’s or family’s ability to borrow. Not all colleges and universities participate in all programs, but the more you know about financial aid, the better prepared youll be. Here youll find links to the many kinds of financial aid available to students attending Texas colleges and universities. You can also search for a particular program using the search box above.

Don’t Miss: Where Can I Sell My College Books

Tips For Completing The College Board Profile

The PROFILE application can be completed online as well, for faster and easier processing. Not all institutions require that this form be completed, so make sure to check with your institution. Apply as early as possible if your institution does use the PROFILE, as the application is for fund sources that may eventually run out.

Here are a couple of useful resources:

You will need to first register and then complete the PROFILE application.

Fees are required for registration and sending the application to institutions. Make sure you have all of your financial records handy . A pre-application worksheet, which is available for you after you have registered, can be used to save you time when completing the PROFILE.

Once the PROFILE is completed, retain a copy of the Acknowledgement page, which may include additional guidance for you on the next steps to take. Your chosen institution will receive their need analysis report from PROFILE in approximately a week from the time the application is completed, and will then be able to determine eligibility within the institutions variable processing time.

Inaccurate information will cause delays, so please make sure you are referring to your records carefully when completing your application.

You can follow up with your institutions financial aid office to ensure your information has been received and is being processed.

Return Of Unearned Financial Aid

Refunds & Repayments for Title IV Financial Aid Recipient

A Return to Title IV calculation is required when a student does not attend all of the days the student was scheduled to complete within a payment period or period of enrollment. A student who does not complete his/her payment period is considered to have withdrawn whether or not any credits were earned. The R2T4 calculation is done to determine the amount of aid earned by the student.

Detailed information on repayments is available in the Office of Financial Aid. These policies are subject to change by action of the United States Department of Education.

Read Also: Arielle Charnas Age

Financial Aid From Your Employer

Many employers provide college financial aid for their employees and their dependents. Check with your employers HR office to see whats available.

Employers can provide up to $5,250 in tax-free employer-paid educational assistance each year. This can include payments of tuition and student loan repayment assistance programs .

The U.S. Armed Forces may provide money for college through ROTC scholarships, GI Bill benefits and student loan repayment programs.

You can earn an education award for volunteering through the AmeriCorps program.

Consider State Grants To Pay For College

After you have gone through all of your federal grant options, consider state grants by contacting one of the state grant agencies provided by the Department of Education.

We also have put together this ultimate guide of Financial Aid and Student Loans By State, which includes any grants offered by your state. Just click your state and see what’s available.

Also Check: What Size Are The Beds In Dorm Rooms

How Do I Apply For Federal Student Aid

Create an FSA ID account if youre going to submit your FAFSA online or track its status online. If youre going to submit a paper FAFSA by mail and wont be tracking its status, you wont need an FSA ID.

Complete and submit the FAFSA.

Know what happens after you submit the FAFSA. This includes:

Learning how to correct or update information on it.

Finding out how and when youll get your aid.

Know the Deadlines for Submitting the FAFSA

-

The federal deadline for submitting the FAFSA for the 2021-22 school year is June 30, 2022.

-

The federal deadline for submitting the FAFSA for the 202021 school year is June 30, 2021.

-

Many states and colleges use the FAFSA for their financial aid programs. See the state deadlines. Check with your college for its deadline.

How To Calculate The Cost Of College: A Guide To Financial Aid Terms

This story was produced with support from the Education Writers Association Reporting Fellowship program.

And that isn’t just an inconvenience for students and parents it has lasting consequences. “This is a really critical moment. This is the moment you decide,” says Laura Keane, uAspire’s chief policy officer. “Students rely on these financial aid offers to make their decisions.”

It’s also when students first weigh their options with student loans, which can follow them well into adulthood.

3 big problems with financial aid award letters

Because financial aid offers are sent to individuals, researchers have found it difficult to study them en masse. But uAspire, an organization that works with students during the admissions process, has been collecting them for years. The uAspire-New America report yielded the following takeaways:

1. There is a lot of jargon and terminology. Take something like the Federal Direct Unsubsidized Loan, which often appears on award letters. To be eligible, students simply have to fill out the Free Application for Federal Student Aid, or FAFSA. Researchers found that colleges referred to this loan 136 different ways in their financial aid letters. Some colleges didn’t even use the word “loan” they called it “Fed Dir Unsub” or just plain “Unsubsidized.”

Loading…

toggle caption

Policy is catching up

Also Check: Army Pay For College

Making The Cost Comparison

We know the cost of tuition and paying for college is important to you. Check out the chart below to see how Sinclair’s tuition compares.

Based on 30 Credit Hours Per Year:

Average Published Tuition Costs for Full-Time Undergraduates, 2020-2021

NOTE: These amounts do NOT include room and board fees incurred at typical four-year schools.*SOURCE: The College Board. 2020-2021 Annual Survey of Colleges** Sinclair Community College Pricing, 2020-2021

What do I do after I fill out the FAFSA?

Once youve filled out the FAFSA, it is vital that you monitor your sinclair.edu email account, because important messagesincluding notification alerts and award acceptancewill be sent there. If you miss important notifications, you may risk losing your financial aid funds.

How do I apply for scholarships?

Scholarships are awarded by groups apart from the federal aid process, so you must apply for them separately. The best way to learn about scholarships is to research them using a schools online resources, like Sinclairs scholarships page, where you can apply for scholarships using the Sinclair Online Scholarship Application System.

- Learn about scholarships or log in to the Sinclair Online Scholarship Application system.

- Learn about getting help with the scholarships at a Sinclair Scholarship Workshop.

Is there anything else I should know about paying for college at Sinclair?

- Learn more about the Tuition Payment Plan.

What Could I Do When My Financial Aid Award Isn’t Enough

If a financial aid award doesnt cover all your college expenses or your familys finances change after youve completed the FAFSA:

When youre not sure about your next step, contact the colleges financial aid office. Financial aid officers are there to answer your questions.

Our Financial Aid Checklist helps you navigate the financial aid process and get as much funding as you can for college. Visit BigFuture for free, comprehensive college planning resources.

Read Also: Charis Bible College Dc

What Parent Information Is Reported On The Fafsa Form And Is It Kept Private

Parents must include tax, income, and some asset information on the FAFSA form. They must also obtain an FSA ID to serve as their electronic signature for the financial aid application process.

Assets not included in the financial aid calculation include personal property, annuities, cash value of life insurance, retirement accounts, and 529 plans owned by people other than the student or parents.

The information reported by students and parents on fafsa.gov is encrypted so it is unreadable by anyone who might intercept it. Additionally, the U.S. Department of Education does not sell student or parent information and does not share that information with any entities beyond those specified on the FAFSA form: the schools the student lists on the FAFSA form, the state agencies of the states in which those schools are located, and the state agency in the student’s state of residence.

Talking points:

- The income and assets of the student are weighed more heavily than those of the parents in the assessment of the student’s eligibility for federal student aid.

- The parents’ home equity is not considered in the FAFSA form. Parents shouldn’t allow lenders to persuade them to draw equity out of their home in order to qualify for more aid.

Financial Aid Related Academic Information

- Academic Amnesty : The federal aid programs make no provision for the concept of academic amnesty. A school must always include all courses taken when evaluating SAP, regardless of when they were taken.

- Completed program, no degree: A student who completes the academic requirements for a program is no longer eligible for federal aid for that program.

- Developmental Courses: Students may attempt a maximum of 30 credit hours of developmental courses. Developmental coursework is not counted toward Pace or GPA.

- Incomplete Grades : Incomplete grades in any class will always be counted as attempted credits however, they will not be counted toward completed credit hours. When the incomplete is changed to a letter grade, it will be counted toward completed hours. The student must notify the Office of Financial Aid of the incomplete grade change and to request a re-evaluation of Title IV eligibility.

- Pre-Requisite Courses: Federal aid does not cover pre-requisite courses.

- Repeat Courses: Students may retake of any previously passed course once. Failed courses may be retaken until passed.

You May Like: Cfcc Transcript

Help For Students Enrolled In A Private Not

- Access to Better Learning and Education Grants provide assistance to Florida students who are pursuing an undergraduate degree at a private, not-for-profit college or university in the state. Annual scholarships are $1,500.

- Florida Resident Access Grants provide assistance to Florida students who are pursuing an undergraduate degree at a private, not-for-profit college or university in the state. The amount of the award is based on the amounts established in the General Appropriations Act.

Financial Aid Programs Available

General Eligibility Requirements

All types of financial aid have some kind of eligibility requirements. Financial aid from the State usually requires the student to be a resident of the state for tuition purposes. Some scholarships have specific criteria designated by the donor.

In general, to be considered for student financial aid a student must:

- be a citizen or an eligible non-citizen of the United States

- Have a valid Social Security Number

- Have a high school diploma or GED

- register with Selective Service, if required

- be accepted to the college as a degree or certificate seeking student in an aid eligible program at CF

- be making satisfactory progress toward the completion of a program of study according to the Standards of Satisfactory Academic Progress for Financial Aid Recipients at College of Central Florida

- not owe a refund on any grant or loan, not be in default on any loan, have made satisfactory arrangements to repay any defaulted loan, and have not borrowed in excess of the loan limits under Title IV Programs at any institution

- re-apply each academic year

Please note a drug conviction may affect aid eligibility.

Financial Aid Programs Available

- Federal Supplemental Educational Opportunity Grant

- Federal Iraq Afghanistan Service Grant

- Florida Student Assistance Grant

- College of Central Florida/Foundation Scholarships and Talent Grants

- Institutional Need Grant

Federal Work Study

Recommended Reading: College With Lowest Sat Scores

Financial Aid : Earlier Fafsa Provides More Time To Line Up Tuition

But across the country, institutions have begun to re-evaluate how they present their financial aid offers. Colorado State University has undergone two revamps under Tom Biedscheid, assistant vice president of enrollment and access.

“We thought we had an amazing letter before,” Biedscheid says, but 2 1/2 years ago, he got a call from a frustrated high school guidance counselor: More than a dozen of her students had been accepted to the school, but based on their reading of the financial aid offer, not one was ready to enroll.

“That was the moment we realized we needed to put some effort into making our offer easier to understand because it was the single most important document a student’s going to receive,” Biedscheid says.

For the first remodel, Colorado State sent out letters that clearly defined direct and indirect expenses. It separated loans from the money that didn’t need to be paid back, like scholarships and grants. And they eliminated loans that parents take out, called Parent Plus loans. This current admissions cycle, it added a glossary of terms at the end. Biedscheid says the number of questions from prospective students has gone down.

He says it’s important that there is consistency in the information that schools provide students, but he’s worried that a standard federal form is the wrong answer. “Institutions vary greatly, and trying to communicate cost and aid in a one-size-fits-all fashion could cause more harm than good.”