What Is Financial Aid

In short, financial aid is money to help you pay for college. It can come in a variety of forms, such as grants, scholarships, work-study, and federal and private loans. All these types of aid can also come from a range of sources, including the federal government, state government, nonprofits, your college, and private companies or organizations.

A great tool to help you figure out how much financial aid youll need in order to attend school is the Financial Aid Calculator. It calculates the difference between the cost of the school and your expected contribution, which comes from the FAFSA .

Ask For A Professional Judgment

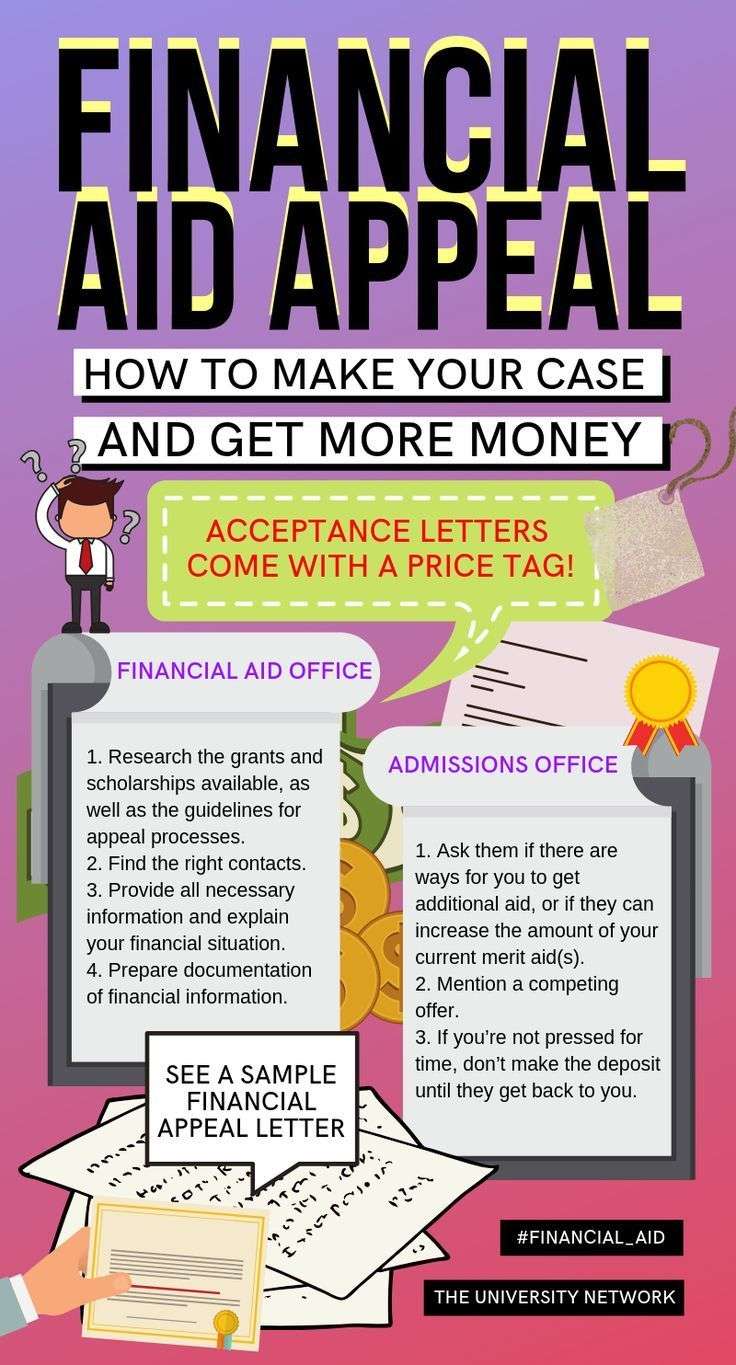

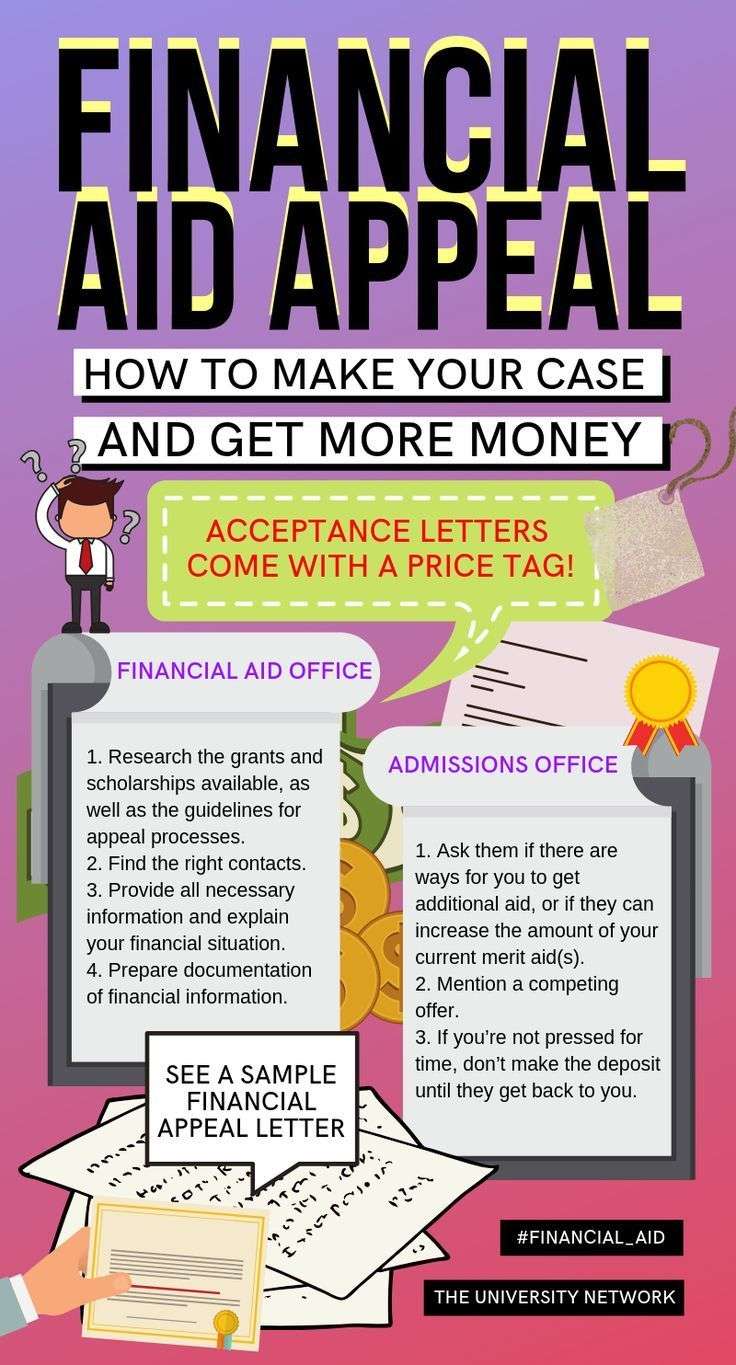

Many families dont realize they can negotiate additional financial aid. Once you receive a financial aid award letter, you can request a professional judgment directly from the colleges financial aid office.

This is as simple as writing an appeal letter or submitting an online form that details why additional financial aid is needed.

Each school has different policies and procedures. But in general, this is a great option for families that experienced an income drop or had a significant financial hardship that isnt reflected in their submitted FAFSA information.

How To Submit A Financial Aid Appeal

To file a financial aid appeal, write a short letter to the college financial aid office that summarizes the special circumstances and their financial impact on the family. Be specific as to dates and amounts.

Some colleges have a form they would like you to submit with the appeal.

Keep the letter short and to the point, a maximum of 1-2 pages. Colleges do not want to hear your entire life story.

Include copies of documentation of the special circumstances with the appeal letter.

Do not ask for a specific sum of money, as this can reduce the amount of financial aid you receive. Once a college decides that the special circumstances justify an adjustment to the financial aid package, the process is formulaic. If you ask for less money, thats all youll get.

Recommended Reading: Can You Apply To Multiple Colleges

Start With Your High School

If your high school offers a college access program, thats a great place to begin, says MorraLee Keller, director of technical assistance at National College Attainment Network. Many high schools have access programs such as Gear Up or Upward Bound, and they usually have a staffer whos an expert on the FAFSA . Even if your high school doesnt have a formal college access program, the guidance department may be offering FAFSA completion events this month with financial aid experts on hand to answer families questions.

Ways To Get More Financial Aid From Other Sources

Besides the federal student aid program, there are other ways to apply for additional financial support. These are listed in the table below:

| Method | Explanation |

| State student aid programs | At times, applicants not eligible for federal college aid may apply for state financial aid. The best way to check this is to contact a grant agency in the state you live in and inquire about the qualifications and conditions |

| School aid programs | Some colleges and schools provide financial support for their students from their own funds. Get in touch with your college financial aid department and ask what options you have |

| Aid offered by various private and non-profit organizations | Many of these institutions also have ways to finance the selected group of students. They usually require you to file specific applications, but they can sometimes use the info you provided in FAFSA. This is another great opportunity for students who dont qualify for federal aid |

| Programs for veterans, military service members, and their families | If you or any of your family members are a past or present military service member, there may be certain education-related financial benefits for you |

Another option is to consider some other colleges that may be offering a higher financial aid amount. You can pick another university from the table below and learn everything about its financial support programs:

| Yale University Financial Aid |

Read Also: What Size Are College Dorm Beds

Reduce Your Taxable Income During The Base Year

Colleges and universities primarily use the Free Application for Federal Student Aid to estimate a students ability to pay for college. Currently, the students Expected Family Contribution is used to determine need-based financial aid eligibility. However, the EFC will be replaced by the Student Aid Index beginning in the 2023-2024 academic award year.

That said, the biggest factor influencing need-based aid is their familys income level and assets.

But this financial data isnt based on a familys current financial situation. Instead, income and tax information is used from the prior-prior year. This is referred to as the base year.

For example, an incoming freshmans first FAFSA base year is from January 1 of their sophomore year of high school through December 31 of their junior year. Therefore, families need to start planning and adjusting their finances years in advance to get more money through the FAFSA.

In general, you can increase financial aid eligibility by reducing your taxable income. Families can achieve this by following these financial guidelines during the appropriate FAFSA base year:

- Avoid selling stocks and bonds that result in a capital gain.

- Dont take retirement plan distributions that increase your income.

- If possible, defer any work bonuses until they wont affect your childs financial aid eligibility.

Learn How To Appeal Your Award

If you have your heart set on a school that didnt give you enough aid, you can appeal the award. But enter the process with realistic expectations: A strong appeal could get you an extra few thousand dollars, but a $20,000 gap will be harder to bridge.

Your appeal is most likely to be successful if:

-

There was an error on your aid application.

-

Your familys circumstances have changed since you first applied. For example, your parent may have lost a job, gotten divorced or given birth.

-

You have a competing offer from another school that you can ask your dream school to match.

Contact the schools financial aid office to find out how its appeals process works. Typically, youll email the office with your request, which should include supporting documents proving your claim and a request for a specific additional sum.

If you’re already enrolled in school and need funds more immediately, ask about emergency financial aid. Your school’s financial aid office will also have guidance on how you can apply. You’ll usually need to specify an amount and provide documentation to back up the ask.

Read Also: Central Texas College Accreditation

How To Request More Financial Aid From A College

If the college you want to attend offered an aid amount that cant cover the costs of your education, you can appeal their decision and make them reconsider it. This process requires composing an appeal letter by:

The problem arises when you want to appeal decisions of multiple institutions, which automatically means you must submit a personalized letter to each of them. This can be quite a burdensome and time-consuming task. You may also easily forget to include some significant details.

Reason : Colleges Use The Css Profile With The Fafsa To Understand Your Full Financial Picture

The CSS Profile helps schools award non-federal institutional aid, and not every college requires it. However, filling out the CSS Profile does not take the place of the FAFSA. Rather, it is an additional application for non-federal financial aid.

Schools that require the CSS typically meet 90% to 100% of a family’s financial need and package their financial aid with institutional grant money.

You May Like: How Much Is Apple Music For College Students

Tips To Improve The Chances Of Success With Either Type Financial Aid

Some tips are always applicable, no matter what kind of aid youd like to increase.

- Use the correct terms. Yes, youre negotiating but appeal is the word to use in your conversations with colleges.

- Letters are good. In-person appointments are better, if you can get one. The student and parents should all attend.

- Be honest, enthusiastic and very polite. Your student would love to attend the school in question. Youre just asking the college to make that more possible. Dont make demands or say that the college would be lucky to have your student attend.

- Ask for a specific amount.The more specific you can be, the better, says Matthew Smartt, a financial planner in Belmont, Michigan. Theres a fine line between being specific and being greedy, and where that line is depends on the situation. Use other offers as reference. For instance, if you have aid offers of $25,000, $29,000, and $33,000, you might get all three offers up to $33,000 but you probably wont parlay any of them into an offer of $60,000 in aid.

- Follow up. If you dont get an answer within about a week, check in with the college. But if the answer is no, dont make a pest of yourself. The chance of them coming through with something after theyve said no is close to zero, Haas says. The only way I can even imagine it is if there is some significant new information.

File Early And Accurately

The opening date for turning in the FAFSA has been moved up, and it’s important to get that thing in within about a month of opening day. If you plan to start college in the fall of 2018, that means turning in the FAFSA starting Oct. 1, 2017.

Financial aid is first come, first served, Sipos explains. If you wait until spring, financial aid officers may be running low on funds to distribute. “They might give you half the award they would have given you if you had applied a few months earlier,” he says.

In addition, if your FAFSA has errors, it can get kicked back to you for corrections and then you have to go to the back of the line.

Don’t Miss: Can I Sell My College Books

Maximize Federal Student Loans

Borrow federal before private. Federal loans come with more generous repayment and forgiveness options compared with private loans.

» MORE:How to apply for student loans: Federal and private

Determine how much to borrow. The amount you should borrow will depend on what kind of monthly payments you can expect and your income in your first year after graduation. A good rule of thumb is to borrow no more than 10% of your forecasted monthly take-home pay. Use a student loan repayment calculator to estimate payments.

Seek Out Generous And Low

There are about six dozen generous colleges, including the Ivy League, that have adopted no loans financial aid policies. These colleges

with grants in the students need-based financial aid package. Also, in-state public colleges may be your least expensive option, even after subtracting gift aid like grants and scholarships.

Now that you know how to file the FAFSA to get more money in college, make sure you avoid these .

Recommended Reading: If Your Native American Is College Free

How To Increase Eligibility For Need

There are several ways of increasing eligibility for financial aid on the Free Application for Federal Student Aid .

Tips About Income on the FAFSA

The expected family contribution is heavily weighted toward income, much more so than assets. As much as 47% of parent available income and 50% of student income are counted on the FAFSA, as compared with up to 5.64% of parent available assets and 20% of student assets. Accordingly, it is important to avoid artificially increasing income during the base year, two tax years prior to the FAFSA award year. This is especially important if the parents are close to the $50,000 income threshold for the Simplified Needs Test.

- Avoid realizing capital gains during the base year, or offset them with capital losses. It is best to realize capital gains prior to January 1 of the sophomore year in high school

- Do not exercise stock options

- Defer bonuses to a subsequent year

- Avoid taking distributions from retirement plans, even a tax-free return of contributions from a Roth IRA

- Gifts to the student are treated as income on the FAFSA, but gifts to the parent are not

Tips About Assets on the FAFSA

Assets are less important in the federal financial aid formula, but still can affect eligibility for need-based aid. In particular, assets in the students name have a bigger impact on aid eligibility than assets in the parents name. So, it is important to save and spend assets strategically.

Save assets strategically:

Spend assets strategically:

Adding Private Student Loans

If you werent able to get enough in federal aid, and your parents arent able to take out a loan on your behalf or cover the balance of your tuition, you may be able to borrow additional loans from a private lender.

You can start learning what private student loans are available by inquiring with a variety of lenders. You may want to compare their interest rates and loan terms to make sure youre finding the best loan fit for you. As youre shopping around, keep in mind that a fixed interest rate will stay the same for the life of a loan, while a variable rate can change over time as market interest rates change.

It is important to read the terms carefully to understand what you will owe and when payments will be due. If you dont qualify on your own, possibly due to your credit score, income, or employment status, you can ask a parent or family friend with a good credit history to serve as a co-signer.

Don’t Miss: Do Native Americans Get Free College

Consider Private Student Loans

Finally, if you do not qualify for federal financial aid because either you or your parents have high income or substantial assets, private student loans may be an option.

Private student loans are available from banks and lenders, and they usually require a strong credit history or a co-signer with one .

Its important to compare private student loan options because interest rates, repayment terms, and benefits vary widely.

To get started, you could check out our guide to the best private student loans or see if you qualify for one of our top-rated partner lenders, College Ave or Ascent.

| Best for |

| View Rates |

Clarify Who Owns Your Assets

If youve been putting money away for your childrens college education over the years, youll be in much better shape when they graduate from high school. But all that saving does have a small catchsome of that money will be included in your EFC. One important aspect to realize about the FAFSA is that schools anticipate students will contribute more of their assets toward higher education than parents will.

Consequently, your application will fare much better in most cases if any college savings accounts are in a parents name. So if you set up a Uniform Gift to Minors Act account for your child to avoid gift taxes, you could be hurting your chances of need-based aid. Youre often better off emptying these accounts and putting the money into a 529 College Savings Plan or a Coverdell Education Savings Account. Under current rules, these are both treated as a parents asset, as long as the student is classified as a dependent for tax purposes.

You May Like: Meningitis Vaccine Required For College

Maximizing Your Aid Eligibility

Believe it or not, there are strategies for maximizing your eligibility for need-based student financial aid. These strategies are based on loopholes in the need analysis methodology and are completely legal. We developed these strategies by analyzing the flaws in the Federal Need Analysis Methodology. It is quite possible that Congress will eventually eliminate many of these loopholes. Until this happens, we believe that revealing these flaws yields a more level playing field and hence a fairer need analysis process.

In the strategies that follow, the term base year refers to the tax year prior to the award year, where the award year is the academic year for which aid is requested. The need analysis process uses financial information from the base year to estimate the expected family contribution. Many of these strategies are simply methods of minimizing income during the base year. Likewise, the value of assets are determined at the time of application and may have no relation to their value during the award year.

A Word About Honesty

We have not included any strategies that we consider unethical, dishonest, or illegal. For example, although we may describe some strategies for sheltering assets, we do not provide techniques for hiding assets. Likewise, we strongly discourage any family from providing false information on a financial aid

Check out top strategies for maximizing aid eligibility. For more detailed strategies on maximizing your need, click on the topics below.

How To Get More Financial Aid For College

- To get any college aid, students must file a Free Application for Federal Student Aid.

- For the 2022-23 school year, the FAFSA filing season opens Oct. 1 and the sooner you file, the better.

- “Just about everyone is going to qualify for something,” said Sallie Mae spokesman Rick Castellano.

The Covid-19 pandemic and economic downturn that followed made it even more difficult for many students and their parents to afford college just as costs went up.

Tuition and fees plus room and board for a four-year private college averaged $50,770 in the 2020-21 school year at four-year, in-state public colleges, it was $22,180, according to the College Board, which tracks trends in college pricing and student aid.

Now, in order to obtain a four-year degree, nearly all students rely on some sort of financial aid.

More from Personal Finance:Fewer students are going to college because of the cost

“Financial aid is becoming a larger piece of the college admissions puzzle, as tuition costs continue to rise,” said Marnix Broer, co-founder and CEO of EdTech platform StuDocu.

“Many students are choosing a college based on where they can afford, so it’s more important than ever for students to understand their options when it comes to where the best financial aid may be available for them.”

That’s where the Free Application for Federal Student Aid comes in. Students must fill out the FAFSA to access any kind of assistance, including scholarships and grants, work-study and loans.

You May Like: Where Can I Sell College Books