Why Your Aid Might Be Different When You Transfer Fafsa

Your financial aid could differ for several reasons after your FAFSA® transfer:

- Cost of Attendance: The amount of federal aid you can receive depends not only on your financial situation but also on the actual cost of attendance. If your new school is less expensive than your previous school, the lower cost of attendance will affect your financial aid.

- Fund Availability: Some types of aid are distributed on a first-come, first-served basis because funds are limited. Your new school may not have as much grant money to distribute as your previous school did, and transferring can put you at the back of the line especially if you transfer mid-year.

- School-Specific Aid: In addition to federal aid, many schools and states have their own scholarships and grant programs. When you transfer schools, these types of awards do not go with you.

- Academic Eligibility: Each school has its own Satisfactory Academic Progress policy under federal guidelines. If your grades have made you ineligible for funds at your current school, switching to a new school may reset your SAP status to an extent and make you eligible for federal aid again.

To avoid any unpleasant surprises, its wise to compare the financial aid packages at different schools before finalizing your decision to transfer. Talk to your counselor or financial aid office about your FAFSA® transfer.

Resources:

How Will My Credits Transfer

Not all schools accept courses and credits in the same way, so it’s important to consider how your prospective school addresses the following factors.

Colleges may accept transfer credits if they are direct equivalents. For instance, one school may accept an English 101 class from another school in lieu of its own English 101 class.

Conversely, another school might accept your composition class, but only as a general elective that counts toward the total credits you need to graduate. It’s often simpler to transfer credits from general, lower-level classes than it is for more specialized, upper-level courses.

It is usually much easier to transfer credits for basic courses, such as 100- and 200-level courses, than it is to transfer upper-level courses. For basic courses, direct course equivalency is more common.

Your new school might accept the credits for your upper-level courses but not count them toward your major, so you may have to retake them. If you have already completed several upper-level courses, check with prospective schools to see if they will accept them.

Another factor to consider is whether a school runs on a semester system or a quarter system. While it’s best to speak with a transfer counselor at the receiving school, you can estimate the value of transfer credits with the following formulas:

Impact Of Assets On The Fafsa

Reportable assets increase the expected family contribution on the FAFSA and CSS Profile forms , thereby reducing eligibility for need-based financial aid. Need-based financial aid includes Federal Pell Grants, subsidized federal student loans, and the opportunity to enroll in a work-study program. Unsubsidized student loans are available to all students, regardless of financial need.

The impact of an asset depends on whether it is a student asset or a parent asset.

- Student assets increase the EFC by 20% of the asset value on the FAFSA and 25% on the CSS Profile

- Parent assets are assessed on a bracketed scale, increasing the EFC by up to 5.64% on the FAFSA and up to 5% on the CSS Profile

The FAFSA has a simplified needs test that causes assets to be disregarded if the parent income is less than $50,000 and certain other criteria apply. The CSS Profile does not have a simplified needs test .

The FAFSA also has an asset protection allowance that shelters a portion of parent assets based on the age of the older parent. The maximum asset protection allowance , however, has decreased from $84,000 in 2009-2010 to $9,400 in 2020-2021 and will eventually disappear entirely.

There is a similar asset protection allowance for independent student assets, but none for dependent student assets.

The CSS Profile has several specific asset protection allowances, such as allowances for emergency reserves and education savings, but not a general asset protection allowance.

You May Like: Nacac Colleges Still Accepting Applications

How To Get Financial Aid At Your New College

To make sure your new school gets the necessary paperwork for your financial aid, take the time to cover all your bases, including:

How Your Financial Aid Will Be Calculated

Its important to understand that the financial aid office at your new school will have to recalculate your financial aid from scratch.

In addition to FAFSA®, your new school will have its own financial aid application for you to fill out. Once it receives both applications, the financial aid department will calculate your financial aid. Your financial need, cost of attendance, and academic progress can all affect your aid eligibility.

Keep in mind that not all schools have access to the same types and amounts of aid. Therefore, your financial aid package may not be identical to what you received at your previous school.

Recommended Reading: Is Central Texas College Regionally Accredited

Pa State Grant Recipients

Notify the financial aid office at your current institution so they can cancel any pending semester Pennsylvania State grants on your behalf. Recipients of Pennsylvania State Grant must also contact the state grant agency to have their grant transferred to Temple University. See the PHEAA website for more information.

Convert Reportable Assets Into Non

Increasing contributions to qualified retirement plans can transform reportable assets into non-reportable assets. Contributions during the base year will not reduce reportable income, since the contributions will still count as part of total income , but it will reduce reportable assets.

Contributions to a qualified annuity may be one of the most flexible ways of sheltering an asset.

Read Also: Do I Need Ged To Go To Community College

Whats Next After Filing For Your Children

Colleges will begin to contact your children with financial aid offers during the spring. Be sure to read all of the correspondence, so you understand the different offers that are available to you. Once you and your children have made your decisions, be sure to meet the deadlines for filing the paperwork with the college.

Your Loans Could Enter Repayment

You can defer payments on federal loans and on many private loans while youre attending school. Your loans might also qualify for a grace period that lasts for up to six months after graduation. In fact, if youre enrolled in an eligible academic program at least half time, your federal loans are typically placed into deferment automatically.

If you have a private loan, you might be able to defer payments until after graduation or make interest-only payments while in school.

When you leave your old school, however, your withdrawal from your academic program will be reported to your lender. Make sure your lenders are aware that youre enrolled at a new school. If your lenders think youve left school for an extended period of time, your loans might enter repayment, sticking you with a hefty student loan bill.

While your new school should automatically report your enrollment, youre responsible for following up. If you fail to do so, you could end up owing loan payments because your lenders think youre no longer in school.

Also Check: Is Ashworth College Recognized By Employers

Sign And Submit Your Renewal Fafsa

One of the last steps is to provide the FAFSA code for your college, so your application information will be shared with your school. If youre thinking about transferring, make sure to include the codes for both your current college and other colleges youre considering. You can find these FAFSA codes on the colleges website or through the FAFSA Federal School Code Search tool.

The final step is to electronically sign and date your FAFSA. You can then submit your Renewal FAFSA and celebrateyou did it!

Financial Considerations For Transfers

A school transfer may increase your need for alternate forms of financial aid based on your housing requirements and tuition costs at the new college, particularly if you will be considered an out-of-state student. When you fill out a FAFSA, you can apply for and receive loans in addition to your Pell Grant. If you don’t need the loans immediately, you may refund them for terms at your current school and then accept the loans offered at your new school to cover any increase in costs.

Also Check: What Colleges Are Still Accepting Applications For Fall 2021

Can You Transfer Scholarships & Financial Aid In The Middle Of A

They say that money makes the world go round and college funding is no exception. The federal government remains the largest distributor of student loans in the United States. As of 2016, the average for student loan debt accrual is $37, 172. To qualify for a federal loan, all undergraduate or graduate students need to fill out the Free Application for Federal Student Aid to find out what sort of aid package they qualify for. Your FAFSA record is linked to your current institution, so if you want to transfer to another school, you will need to transfer financial aid too.

How Do I Apply For Federal Financial Aid At My New School

Regardless of the reason that youve decided to transfer, be it monetary, academic, or personal, you need to stay on top of financial aid. Filling out the FAFSA as soon as it is available each year ensures that you have access to federal sources of financial aid: grants, work-study, and loans. You may not have received an acceptance from the school to which you hope to transfer yet, and thats okay. You can specify that you would like your FAFSA results sent to both the school that you are currently attending and the school into which you hope to switch. This way, youve been proactive about your need for financial aid and you dont miss out on awards because youve waited too long to apply.

You will also want to ask an admissions representative how to apply for institutional financial aid. Your new institution may require the CSS Profile in addition to the FAFSA or have its own forms that are necessary to qualify for aid. If you are hoping to switch to a public school in your home state, you may be eligible for state-based financial aid as well.

Remember, to maintain eligibility for most financial aid, you need to be enrolled at least half-time.

Also Check: Can You Apply To Multiple Colleges

Follow These 9 Steps For A Smooth Transfer Between Schools

No essay required. Students and parents are eligible to win.

Ultimately, the decision is up to you, but it doesnt hurt to get a second opinion. After all, transferring colleges can be a long, detail-oriented process. If this is the move you really want to make, it will be worth the extra work and effort.How To Fill Out The Fafsa When You Have More Than One Child In College

Having one child who is heading to college can be stressful, but having to help multiple children at the same time can feel like too much to manage. While I cant save you from a forgotten application deadline or the how to do your own laundry lessons, hopefully, I can help make the financial aid part of the process run more smoothly with these tips:

Also Check: Berkeley College Tuition Cost

What Happens To My Financial Aid If I Decide To Transfer

A lot of students transfer schools at least one time within their collegiate career. In fact, 33% of students do, according to NACAC. Transferring schools is no easy task, and shouldnt be done lightly, but one burning question that transfer students have: what will happen to my financial aid?

For college expenses not covered by scholarships and federal loans, College Raptor has partnered with Sallie Mae to bring you loans with great repayment options and competitive rates.

Correct A Mistake Or Add New Information

If you made a mistake on the form for example, leaving a question blank you can correct it. There are also a few instances where you need to update your information:

-

If you used the wrong Social Security number. The federal student aid office recommends you submit a new online FAFSA, which will change the date your FAFSA was processed. If youve passed your schools priority deadline, ask the financial aid office at a school that received your FAFSA information to change your number for you.

-

Any changes to your dependency status except a change in your marital status. Contact your school about what to do if your marital status changes.

If you are selected for FAFSA verification, you must update your form if there is a change in the number of family members in your or your parents household or if there is a change in the number of people from your household in college.

Its also a good idea to update the FAFSA if you have a new mailing address, email address or other change in contact information.

To update tax information, see the how to section below.

Read Also: How To Transfer Colleges Cuny

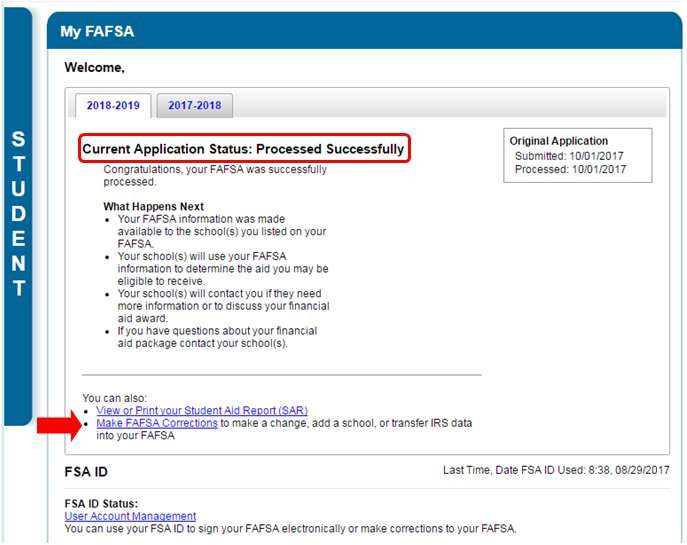

How To Change Your Fafsa Online

If you want to transfer colleges, be aware that your aid will not automatically follow you. If the college you plan to transfer to is not on your original FAFSA, then you will need to make changes to your FAFSA to reflect this change. To make changes online, you will need your Department of Education Personal Identification Number to make any changes. You created a PIN to submit your FAFSA electronically in the first place, and you can use this same PIN to edit your FAFSA year after year as needed. After you’ve logged into the FAFSA website, click on the link “Make FAFSA Corrections” to make changes to the colleges that receive your request for a loan. After you’ve made your corrections, you can use your PIN to electronically sign your document and submit it. Any new college on the list will now process your aid request and send you their offered aid package.

Can I Transfer My Information From One Childs Fafsa To Another So I Dont Have To Re

Yes! Once your first childs FAFSA is complete, youll get to a confirmation page. On the confirmation page, youll see a hyperlink that says, transfer your parents information into a new FAFSA. Make sure you have your pop-up blocker turned off and click that link.

TIP: If you want the process to go as smoothly as possible, your second child should have his/her FSA ID handy so youre ready for the next step.

Youll then see the alert below confirming that you want to transfer your information to another FAFSA.

Once you click OK, a new window will open allowing your other child to start his or her FAFSA. We recommend that your child starts the FAFSA by entering his or her FSA ID using the option on the left in the image below. However, if you are starting your childs FAFSA, choose the option on the right and enter your childs information.

IMPORTANT: Regardless of who starts the application from this screen, the FAFSA remains the students application so when the FAFSA says you it means the student. If the FAFSA is asking for parent information, it will specify that. When in doubt, refer to the left side of the screen. It will indicate whether youre on a student page or a parent page .

After you select the FAFSA youd like to complete and create a save key, youll be brought to the introduction page, which will indicate that parental data was copied into your second childs FAFSA.

Don’t Miss: How To Sell My College Books