What Types Of Loans Are There

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Read on to learn about the different types of loans and which one would suit your financial needs:

How Can A Student Get A Small Loan

If you need only a small amount to help you pay for your educational or living expenses, there are options available.

- Personal loans are available for as little as $600, depending on the lender. When you apply for a loan, you can ask for only the amount you need.

- Student loans typically come in higher loan amounts. However, youre welcome to take only as much as you need. If you still end up with more money than you want, you might be able to return it, depending on the type of loan you have. Or you can simply pay it back as a payment to reduce your loan amount.

How To Apply For A Federal Student Loan

To apply for a federal student loan, you first need to file the FAFSA.

The simplest way to file the FAFSA is online at studentaid.gov or through the MyFAFSA mobile app. To file the FAFSA electronically, you will need your FSA ID. If you dont have one, you can register at studentaid.gov.

*html,bodyimg,spanspan& lt A href=”https://www.youtube.com/embed/S0h2KTvUlLs?autoplay=1″& gt & lt /A& gt & amp quot frameborder=& amp quot 0& amp quot allow=& amp quot accelerometer autoplay encrypted-media gyroscope picture-in-picture& amp quot allowfullscreen=& amp quot & amp quot title=& amp quot & amp quot & amp gt

You may also choose to file a paper FAFSA, but this will take longer to process.

To apply for a parent PLUS loan, your child will first need to complete and submit the FAFSA. Once this is done, the parent can log into studentaid.gov with their own FAFSA ID and complete the PLUS loan application. Here you will indicate how much you would like to borrow and agree to a credit check to see if you have adverse credit as determined by the program.

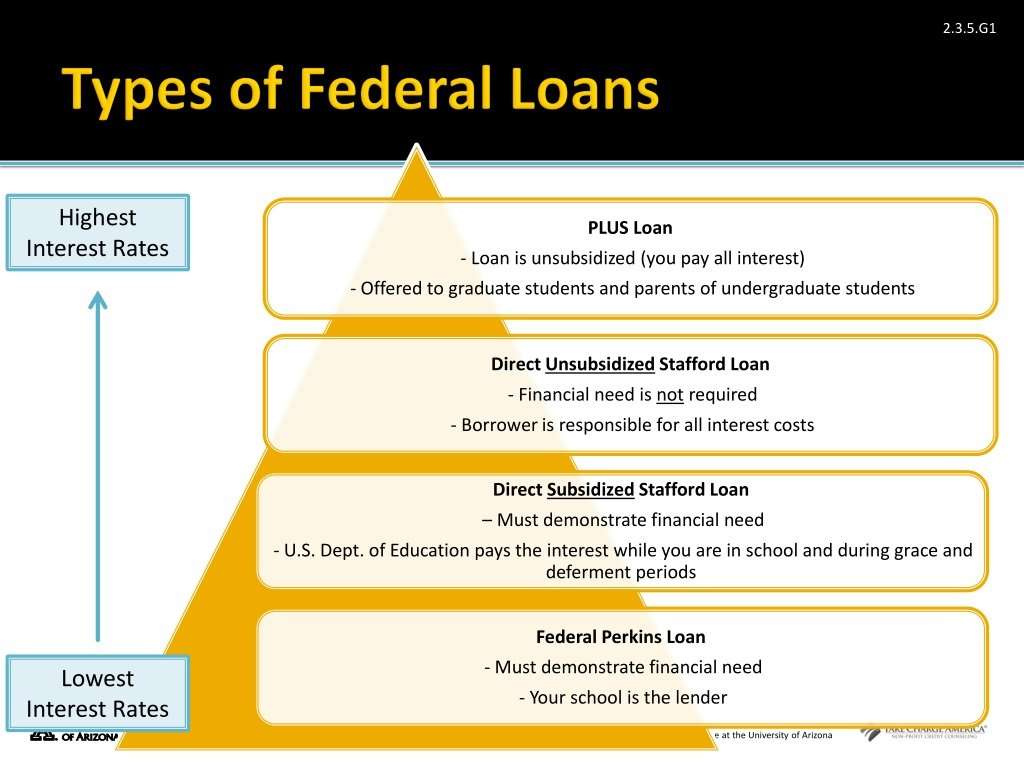

Note: Before you borrow from the parent PLUS loan program, make sure to exhaust Direct subsidized and unsubsidized loan options first as these loans have lower interest rates and fees.

Once you have accepted your federal student loans, you may still have funding gaps. Or you may want to forgo PLUS loans for a more competitive interest rate and loan with no origination fees. This is where private student loans come in.

Don’t Miss: Army Pay For College

Direct Parent Plus Loan

This loan type is for biological, adoptive and stepparents to support their dependent undergraduates.

A key difference between Parent PLUS loans and other types of loans is that parents are expected to make payments while their children are in school, though they may request deferment during the loan application process.

The government does not offer a way for parents to transfer a PLUS loan to their children, but some private lenders do allow you to refinance a Parent PLUS Loan in a childs name.

Interest rate: 7.08% Aggregate loan limit: The cost of attendance minus any other financial aidLoan fee: 4.236% Terms: 10 to 25 years

Why You Should Seek Help With Student Loan Debt Relief

Getting a student loan is like asking for support to help you get the education you need. So, there is no shame in asking for help when it is time to repay that loan. Again, it is important to know that you arent alone.

Tuition costs are higher than ever, and the relatively high-interest rates only add fuel to this fire. The unstable job market doesnt help either, and the six-month grace period does little to help students with their loan repayments in a meaningful way.

Many graduates cant secure well-paying jobs right out of school, which forces them into minimum wage employment and even unpaid internships. This makes it impossible for them to pay the minimums on time. If you are stuck in this cycle, its okay to ask for help.

The Canadian government recognizes the struggle students face and has developed several programs to help the situation. For example, you can find tuition-free education programs in your province. Besides that, Ontario slashed tuition fees by 10% to give students a chance to catch up.

People find it embarrassing to ask for financial aid when repaying student loans. Some people may be oblivious to forgiveness programs altogether. It is essential to understand there is no shame in asking for help. Several institutions can help students with financial assistance with their debt. You can opt for government programs, non-profit organizations, and even from your friends and family.

Also Check: How To Get College Discount On Apple Music

What Should I Consider When Shopping For A Private Loan

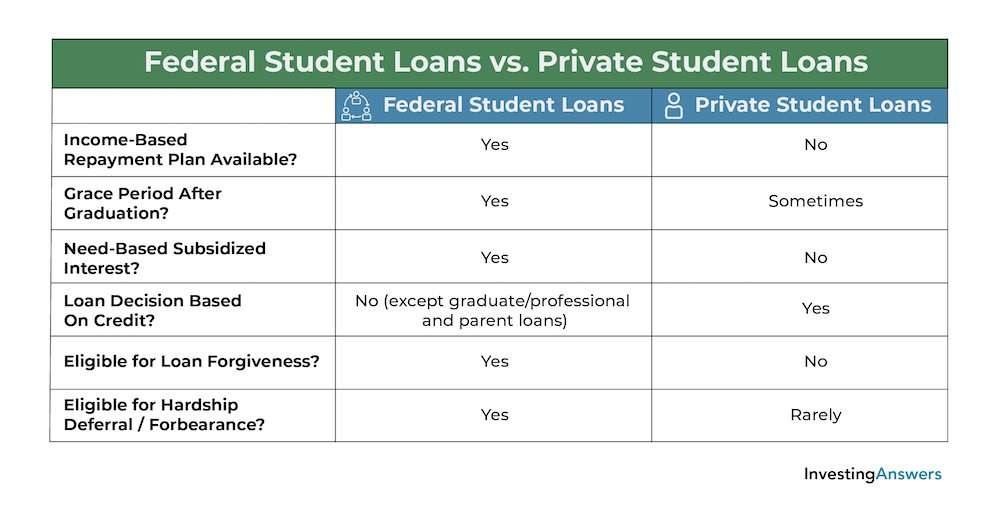

First, make sure you need a private student loan. These loans generally are not as affordable as federal student loans and offer little repayment flexibility.

Here are some factors to consider:

- Talk to your school’s financial aid office to get a form certifying that you need additional aid to cover the cost of attendance – most lenders require it.

- Shop for lower interest rates and loans that offer flexibility if you have trouble making payments.

- Some private lenders may advertise very low interest rates – remember that only borrowers with the best credit will qualify for these rates. Your rate could be much higher.

- In 2011, over 90% of private student loans required a co-signer, so make sure you have someone like a parent or another relative lined up. Your co-signer will be legally obligated to repay the loan if you can’t or don’t. You may want to consider loans that offer “201cco-signer release” after a number of on-time payments.

Consider All The Different Types Of Student Loans

Part of why private loan companies have enjoyed success in lending to students, graduates and parents alike is that theyre able to offer customized loans to creditworthy borrowers. Federal loans, on the other hand, were established to help cash-poor or credit-risky borrowers afford the rising costs of college.

Review all of these student loan types before deciding whats best for you and only you.

Want more help comparing your options? Check out some more key differences between federal and private student loans.

Don’t Miss: How Much Does It Cost To Go To Berkeley College

Direct Grad Plus Loan

PLUS loans, whether theyre for graduate students or parents are unique in that they require the applicant to undergo a credit check. The Direct Grad PLUS loan, specifically, was built for graduate and professional students who have had more time to improve their credit score .

If youre trying to qualify for PLUS loans but have an adverse credit history, enlisting a creditworthy endorser can help your case.

Grad PLUS loans also give their borrowers until six months after they finish or leave school to begin making payments.

Interest rate: 7.08% Aggregate loan limit: The cost of attendance minus any other financial aidLoan fee: 4.236% Terms: 10 to 25 years

The Impact Of Student Loan Debt In Canada

University education is one way to gain the required skills to secure a well-paying job. That being said, the impact of student loans is still considerable when we talk specifically about Canada. Currently, the student debt in Canada is averaging $15,300 for college and $28,000 for university students.

Additionally, student loan repayment starts right after graduation. The loan restricts them from becoming genuinely financially independent and achieving their personal goals. Graduates get so caught up in making loan payments that their dreams of buying a new house or starting a business venture go on the back burner.

A study showed that student loans in Canada have gone from 15 billion to 18.7 billion in the span of 7 years. Due to this rise in debt, the government has started working on forgiveness of student loans in Canada. Moreover, certain Canadian activists and decision-makers want to cancel loans of up to $20,000 for every Canadian.

Recently, the government announced a freeze on the accrual of interest on student loans until March 31, 2023. They made the decision in an attempt to help ease the pressure on students. However, students are still required to make their monthly payments and pay the principal amount as quickly as possible.

Read Also: Can I Sell My College Books

How To Accept Your Federal Or Private Student Loan

You accept your federal student loans by signing and returning your . You may be asked to take part in entrance counseling at your school to make sure that you understand your loan obligations. Plus, youll sign a Master Promissory Note to agree to the loans terms.

You accept your private student loans after youve been approved. Heres our process:

Both federal and private student loans are legal agreements. When you agree to a loan and sign or e-sign for it, youre committed to paying it back, along with interest.

Repaying Your Canada Student Loan

Government-funded loans are easier to repay. Moreover, the government gives students a grace period of six months after their graduation before requiring payments. Additionally, government loans usually have a fixed interest rate, which can be changed to a variable interest rate per the students need.

Once you have graduated, you will receive a letter from the government outlining your loan, interest accrued, and repayment schedule. Paying off student loans is not an easy task and can take years to pay off. Debt can weigh on the person, but there are ways to speed up the repayment process.

The government offers forgiveness programs to students to remove some of their debts. Depending on where you live, specific eligibility criteria allow you to have some of your loan written off. That can help you pay down your student loan faster, and become debt free sooner.

If you apply for a Canada Student Loan, you can take advantage of the grace period provided by the government. This six-month period is interest-free, which means that you get to pay off your principal amount right off the bat. Making early payments helps lower the overall amount of debt load and makes the repayment process quicker. Thats because the payments you make within that 6 month period all go to your principal instead of being split between principal and interest.

Read Also: Selling My College Books

Know What You Want To Study And How Much Itll Cost

Studying medicine is relatively more expensive than getting an MBA. The degree or specialization you choose can be the deciding factor in choosing the size of your loan repayments thatll be due a few years later.

If you can find a course or field with relatively low tuition cost but a higher chance of employment, go for it. That being said, never compromise on your interests. Look for cheaper alternatives in your relevant field and build up from there. Dont just research the rate of hire. Make sure you understand the starting salary for new grads, the top end earning potential, and the different job roles you can fulfill with your degree.

How To Borrow Responsibly For College

When youre borrowing money for college, its important to . We recommend these three steps:

Other tips for borrowing responsibly: Consider what your salary will be after you leave school, remember that youll have to pay back your loans with interest, and dont borrow more than youll need for school costs.

No purchase necessary. Void where prohibited.Odds of winning depend on the number of entries received. See official rules at .

This completion service is not affiliated with or endorsed by the US Department of Education. The FAFSA® form is available for free at studentaid.gov.

FAFSA is a registered service mark of U.S. Department of Education, Federal Student Aid

Don’t Miss: How To Get Recruited For College Cross Country

Compare Your Student Loan Rates To Make The Right Choice For You

Most students end up using a mix of federal and private loans to pay for college, as well as scholarships and grants.

Do your best to avoid taking out more loans than you need. While it might feel good to have extra cash on hand today, larger loans can be a serious financial challenge after graduation.

If youre looking for private student loans, be sure to consider as many lenders as possible. Credible makes this a breeze you can compare multiple lenders to find the right loan for you, all without affecting your credit score.

Compare student loan rates from top lenders

- Multiple lenders compete to get you the best rate

- Get actual rates, not estimated ones

- Finance almost any degree

Different Types Of Loans You Should Know

Topwww.creditkarma.com

363 People Used

Top Dentistry Scholarships For 2021

Top 9 Most Expensive Countries To Study And Work You Can Think Of

Top Scholarships For Studying Abroad In Europe To Apply For ASAP

Pros And Cons Of Paying For Scholarship Help

You May Like: Can Single Moms Get Paid To Go To College

My Financial Aid Doesnt Cover Everything Now What

There are two loan options for covering the remaining costs after all aid has been determined. These have different requirements to determine eligibility such as a credit check by the lender.

Please Note: Many families combine paying out of pocket or using payment plans along with the loan options below. Borrowing a combination of the two loan types listed below is also possible.

Option 1: Federal Parent PLUS Loan

A credit-based, fixed-rate loan that parents of dependent, undergraduate students can borrow to pay for the students education costs not covered by other aid. Parents may borrow up to the schools cost of attendance less all other financial aid the student is receiving. Note: This loan can never be transferred into the students name. The parent is solely responsible for repayment.

Option 2: Alternative Loans

Alternative/private loans are student loans through banks or credit unions and are available to help students meet education costs not covered by other aid. Students/parents may borrow up to the schools cost of attendance less all other financial aid the student is receiving.

The Ultimate Guide To Student Loans In Canada

Every year people search for student loans in Canada to make their dream of higher education a reality. Despite the rising costs of education, many people still head to college because they believe its an investment in their future. They cut down on expenses, tap into unique resources, and even take on freelance jobs, doing whatever it takes to pay for their education.

But not everyone has multiple options to pay for college, and it can be utterly confusing to look for scholarships and financial aid. There isnt enough for everyone. That explains why student loans are rapidly rising in Canada, with the average debtor owing over $28,000.

That is a monumental amount of money, and it will only get bigger with continual increases in fees. On top of that, student loans can be very confusing since its difficult to find correct and concrete information. Thats why we bring you this guide to answer your questions about student loans in Canada.

You May Like: How To Get Recruited To Play College Baseball

Iraq And Afghanistan Service Grants

These grants are awarded to students whose parents or guardians were members of the Armed Forces and died as a result of performing military service in Iraq or Afghanistan after September 11, 2001. To qualify, a student must be under 24 years old or enrolled in college at the time of the parent or guardians death.