Average Cost Of Books & Supplies

Some programs require more expensive materials than others, so the cost of books and supplies varies widely.

- At public 4-year institutions, students pay an average of $1,334 annually on books and supplies.

- Books and supplies at private, non-profit institutions average $1,308 at private, for-profit institutions, the average cost is $1,194.

- At public 2-year institutions, students pay an average of $1,585 each year for books and supplies.

- At private, nonprofit institutions, books and supplies average $1,061 at private, for-profit 2-year colleges, the average cost is $1,393.

Example Loan Payments And Costs

How much are student loan payments for College of DuPage? Obviously this varies based on a number of factors – offsetting financial aid you receive, percentage of fee you pay upfront while enrolled and the interest rate on your loans. We’ve modeled a sample student loan based on current Stafford loan rates to give you an approximate idea.

The following are the costs for a loan if you borrowed $11,070, 100% of the estimated average net price for a two year program and paid nothing while enrolled. The total of all payments including interest would sum $12,674.40. This could be your effective total out of pocket cost of an education at College of DuPage. Note that this calculation assumes you don’t pay full list price tuition, are part of the reported 46% of students at this school who receive financial aid and you are paying an average annual net price of $5,535. If you do not financially qualify for a reduced net price, your student loan payments could be significantly higher than this example. Use our College of DuPage student loan calculator below to change loan assumptions and recalculate.

Student loans are not free money and must be repaid. You cannot dismiss student loans by via bankruptcy.

| Example Payments | |

|---|---|

| Sum of All Payments over 10 years | $12,674.40 |

Career And Salary Outlook

According to the Bureau of Labor Statistics , individuals with an advanced degree earn significantly more than workers with just a bachelors or an associate degree. For example, doctoral degree-holders earn a median weekly salary of $1,883, while bachelors degree-holders earn $1,248. Furthermore, professionals with postgraduate degrees enjoy a much lower unemployment rate than other workers.

Some high-paying professions require only an associate or the completion of a postsecondary non-degree program. For example, air traffic controllers need only an associate degree. According to the BLS, these professionals earn an annual median salary of $122,990. Postsecondary non-degree programs in electrical repair and fire prevention qualify graduates for positions that pay twice as much as the average median wage .

Recommended Reading: Is Ashworth College Recognized By Employers

How Can You Calculate Your Own Costs Of Studying In The Us

In recent years, its become easier for individual students to calculate how much they could expect studying in the US to cost. All US universities are now legally required to include a fees and financial aid calculator on their websites, allowing students to get a rough idea of how much their intended course of study would cost and what aid they may be eligible for. These net price calculators can be accessed via the governments College Affordability and Transparency Center, which also provides details of the US universities with the highest and lowest tuition fees and net costs.

This article was originally published in February 2012. It was most recently updated in May 2019.

Want more content like this? Register for free site membership to get regular updates and your own personal content feed.

This article was originally published in May 2019.It was last updated in May 2021

Want more content like this Register for free site membership to get regular updates and your own personal content feed.

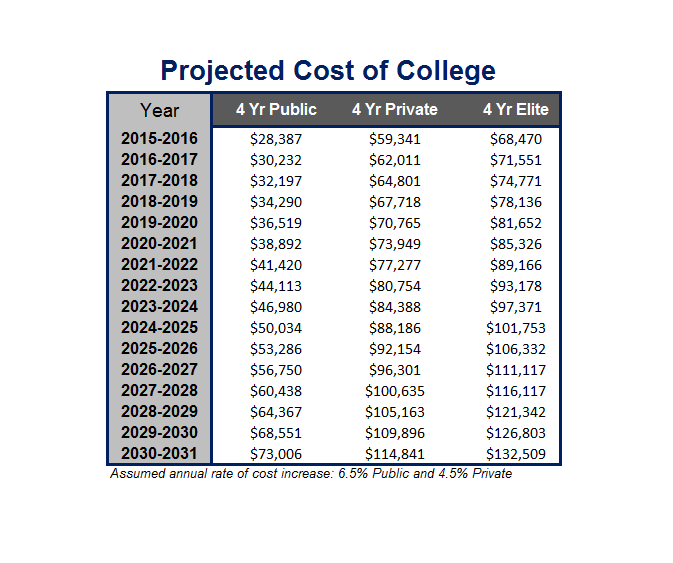

Estimated Future Cost And Expected Tuition Increase

What will it cost to send your child to College of DuPage in the future? Nationally, university tuition prices are rising around 5% per year. Looking out five, ten, fifteen or eighteen years, these are CollegeCalc’s estimates how much you could expect to pay for a 2 year degree assuming tuition increases at the national average rate. Estimated future prices are based on the current in-state 2 year cost of $49,202.00. Use the college savings plan calculator below to perform a more comprehensive analysis on future costs and how much you will need to save for College of DuPage.

| Annual |

|---|

College Cost Analysis.

- CollegeCalc is a source for students and parents seeking college pricing data and higher education cost calculation. Learn more.

- Terms of Service

- All school data is sourced from the U.S. Department of Education IPEDS Surveys for school years 2019-2020 and 2018-2019 and is in the public domain. Site data was last updated in January 2021 This site is not affiliated with or endorsed by the U.S. Department of Education. We believe the content represented on this website to be correct yet make no guarantee to its accuracy. CollegeCalc.org has no direct affiliation with the schools presented on this website and the school names are the property of their respective trademark owners.

-

If you represent a school and believe that data presented on this website is incorrect, please contact us.

2021-12-05 05:28:09 – desktop – s:ms

You May Like: What College Is In Terre Haute Indiana

Average Cost Of College Tuition

Tuition covers the academic side of your college experience. You either pay a per-credit rate or a per semester rate. Students who pay per-semester get the better deal. For the 2017-2018 school year, tuition at a four-year private college costs an average of $34,740. Public universities charge in-state students $9,970 and out-of-state students $25,620. During your time in school, expect the yearly price to increase by an average of 2.4% at private colleges and 3.2% at public colleges.

Affording Student Loan Payments And Post Graduation Salary

Can I afford to attend COD? In the end, the answer comes down a determination if you will earn enough to comfortably pay back a student loan with your post graduation salary. This is an extremely important point to consider. In order to afford student loan payments and still meet all your other costs of living, it is recommended not to borrow more than you can pay back using 10% of your monthly income earned after graduation. If you’re considering attending College of DuPage, you need to carefully consider if it will be realistic to make the post graduation loan payments based on your expected salary.

Using the 10% of salary threshold, an annual income of $12,674.40 would be needed to afforda $105.62 monthly payment in the example $11,070.00 loan modeled above. You will need to determine if it is at all realistic that you will be earning this type of salary after graduation. This assumes a loan payback over 10 years. You can change the terms of this example loan using the student loan calculator below.

Recommended Reading: How Can I Sell My College Books

Distribution Of Students By Tuition

The majority of four-year undergraduate students are paying between $6,000 and $15,000 for tuition and fees with a median of $12,090. However, as we look deeper into the data, mostly public college students pay these costs, while private nonprofit students are more spread out near the higher costs.

Public four-year institutions have a median tuition cost of $10,270, while private nonprofit four-year schools have a median that is over three times that amount at $35,260. The majority of students at private nonprofit four-year schools are paying roughly between $33,000 and $51,000.

Student Loans And Debt

The second consideration after understanding the cost of college is determining how to finance it. Some students are fortunate enough to have some form of family financial assistance, but student loans end up financing a significant portion of higher education in the U.S. 19% of College of DuPage students receive U.S. Federal Student Loans with an average annual Federal Loan aid amount of $4,216.

Recommended Reading: What College Has The Best Dorms

Cost Of Books And School Supplies

The average price of books and school supplies for students at both public and private colleges in 2020-2021 is $1,240.

Textbook prices have risen 812 percent since 1978, according to a 2019 report by Follet, an educational products company. Borrowing books from the library or purchasing digital or used textbooks can reduce your costs, but students still find budgeting for textbooks to be a major source of stress, according to a survey of current and former college students by textbook publisher Cengage. Thirty-one percent of the students surveyed said they took fewer classes to save on textbook costs, and 43 percent said they skipped meals or took out loans to pay for course materials.

Best Online Community Colleges

Pursuing a degree from an affordable online college benefits cost-conscious students in many ways. For example, online learners do not incur commuting and living expenses like their on-campus counterparts. Online enrollees often save a substantial amount of money, even if on-campus and online tuition costs the same. Most online programs offer multiple start dates and rolling admissions, which means students can enroll almost as soon as they are accepted.

Prospective learners should look for the same indicators of quality in an online program or college as an on-campus one. Factors such as accreditation, faculty credentials, available specialization courses, and scholarship opportunities matter just as much for online schools as they do for brick-and-mortar institutions.

Community college benefits students uninterested in a four-year university as well. When applying for jobs that do not require a college diploma, associate degree-holders may experience a competitive edge. Keep reading to learn more about the benefits of attending community college and helpful resources. Discover the best online community college for you by checking out the rankings below:

Read Also: What Clubs Look Good For College

Masters Degree Debt Load

Bachelors degree seekers borrow a lot of money, but graduate students borrow three times as much. In 2015-2016, masters students borrowed an average of $18,210 as compared to an undergrads $5,460. After their two to five years in graduate school, a Masters degree recipient leaves with an average of $51,000 in student debt. With debt that high, masters degree holders shoulder roughly 38% of the nations $1.4 trillion student debt load. M.S, MBA, education, M.A., medicine, and law degrees make up around 61.8% of graduate student loan debt.

Questions To Ask Yourself About Community College

akzamkowy.org” alt=”How much do college textbooks cost on average > akzamkowy.org”>

akzamkowy.org” alt=”How much do college textbooks cost on average > akzamkowy.org”> Wondering if community college is right for you? Ask yourself some of these questions:

- Do you prefer smaller class sizes?

- Do you want to stay close to home?

- Is saving money worth the effort of transferring?

- Will your credits transfer between your community college and intended transfer college?

- Does your intended major have stringent class requirements you may not be able to complete in two years at your transfer college?

- Have you toured the community colleges near you? Did you like them?

- Have you spoken with your high school counselor about community college options?

Read Also: Ashworth College Graduation Rate

Its More Than Just Tuition

Students who attend community college save much more than just the cost of tuition. Most students live at home with their parents, saving hundreds of dollars every month on rent and utilities. This can add up to a few thousands over a period of two years. Especially if students are working part-time.

Average College Tuition And Fees

Although college tuition and fees are separate costs, colleges usually report a combined tuition and fees figure. For the 2020-2021 academic year, the average price of tuition and fees came to:

- $37,650 at private colleges

- $10,560 at public colleges

- $27,020 at public colleges

What is college tuition? College tuition is what colleges charge for the instruction they provide. Colleges charge tuition by the units that make up an academic year, such as a semester or quarter. Tuition at public colleges is usually lower for in-state residents. Out-of-state students often pay double the tuition as in-state students.

Tuition can vary by major. Students in the sciences, engineering, computing, pre-med programs, and the fine arts often pay higher tuition than students in other majors. For example, at the University of Illinois Urbana-Champaign, students enrolled in the College of Engineering pay up to $5,000 more in tuition per year than students pursuing majors in the liberal arts.

What college fees cover. Fees may support services such as the library, campus transportation, student government, and athletic facilities. Fees charged can vary widely from college to college. For example, the University of California, Irvine charges students a campus spirit fee to help support the athletics and school spirit programs and a fee for student health insurance.

Source: College Board, Trends in College Pricing and Student Aid, 2020.

You May Like: Can American Students Go To College In Europe

The Cost Of A Canadian University Education In Six Charts

Tuition is only part of the cost of going to university. There’s also the cost of books, food, travel and the occasional beer. Here’s how students finance their education.

By April 1, 2018

Students living at home spend $9,300 per year on average. For those who move away, its closer to $20,000. We asked 23,384 students how they pay for school and where they spend their money. Heres what they told us.

1. The total average cost of a post-secondary education

2. Where does the money come from to pay for school?

First, the good news: only half of students are in debt. Now the bad: parents are picking up the slackand not in a very efficient way. Nearly two-thirds of students say they dont have an RESP.

3. The cost of books by program

Course materials account for a fraction of the total cost of university, but they still add up. Heres how the least and most expensive programs compare on the cost of books.

4. Debt by year of study

The average level of debt by each year of study, based on responses from more than 11,000 indebted students.

5. Spending on food on campus in a typical week

6. How much do you spend on groceries in a typical week?

This is an update of a story originally published on October 19, 2017.

Average Cost Of College & Tuition

Report Highlights. The average cost of college* in the United States is $35,720 per student per year. The cost has tripled in 20 years, with an annual growth rate of 6.8%.

- The average in-state student attending a public 4-year institution spends $25,615 for one academic year.

- The average cost of in-state tuition alone is $9,580 out-of-state tuition averages $27,437.

- The average traditional private university student spends a total of $53,949 per academic year, $37,200 of it on tuition and fees.

- Considering student loan interest and loss of income, the ultimate cost of a bachelors degree may exceed $400,000.

*In this report, college refers to any postsecondary educational institution that offers an undergraduate degree program.

| $29,958 |

*Additional expenses do not account for potential lost income nor student loan interest.

Related reports include Student Loan Debt Statistics | Average Cost of Community College | How Do People Pay for College? | Student Loan Refinancing

Don’t Miss: Rhema Bible College Tuition

Estimated 2 Year Cost At Published Tuition

At the current published rates, an estimated total tuition, fees and living expense price for a 2 year associate degree at COD is $49,202 for students graduating in normal time. This methodology for estimating the 2 year cost is a straight multiple of the most recent reported annual total cost and does not factor in tuition increases during the time you’re in school. It also assumes you receive no grant or scholarship aid and pay the full list price.

A potentially more accurate but less conservative estimate of a degree cost can be made by using the school’s annual $5,535 in-state net price as the basis. Applying this cost over 2 would estimate the cost of a degree at $11,070**

**Based on a 2 year multiple of Average Annual Net Price for in state students receiving grant or scholarship aid reported to the U.S. Department of Education’s 2018/2019 IPEDS Survey. Financial aid is only available to those who qualify. Consult this school’s net price calculator for further understanding of your potential net price.

Trade School Vs Community College

When looking at costs, it’s important to think about the kind of training experience you want. Comparing trade schools and community colleges is a bit like comparing apples and orangesboth can get you where you want to go, but they do it in slightly different ways.

Trade school programs are focused on the skills needed for a specific occupation. They are short and streamlined and designed to get you into the workforce quickly. Many can be completed in a year or less, and some only take up to two years. These types of schools tend to offer hands-on training many even provide pathways to apprenticeships. They also frequently offer flexible schedules , which can make it easier to fit your training around work or family commitments.

Many community colleges offer vocational programs with a broader scope of training that includes more general education classes. They aim to provide a more well-rounded education. They tend to be more affordable than trade schools, but they often require a greater investment of time. Community college programs generally take two years to complete. However, keep in mind that many students end up taking longer. In fact, fewer than 40 percent of students who began their education at two-year colleges in 2012 had graduated with a credential by 2018.

Recommended Reading: What College Accepts The Lowest Gpa