Is The Card For You

Although the Apple card offers some unique features that can help motivate cardholders to stay on top of their debt, the rewards program can easily be bested by other cards. Theres a bushel of other no-annual-fee rewards cards that offer welcome bonuses, intro APR offers and other perks. Choose one of those options over this bad apple.

To view rates and fees of the Blue Cash Preferred® Card from American Express, please visit this page.

Using Apple Family Sharing

Apple Card Family can be a helpful financial tool for your whole family. If youre considering utilizing it, be sure to start by setting up Apple Family Sharing to add all of your family members to a group.

In addition to sharing an Apple Card Family account, you can also share apps, music, books, iCloud storage, subscriptions, and movies through Apple Family Sharing.

Is The Apple Card Worth It

The minimal fees make this a good, low-cost addition to your Apple Wallet, and thats the only place you should keep it. When making purchases outside of Apple or without Apple Pay, youre better off with one of the many no-annual-fee cards that pay 1.5% or 2% cash back on all purchases and have a variety of benefits.

You May Like: University With The Best Dorms

Apple Expands Wallet Student Id Support Just In Time For Back

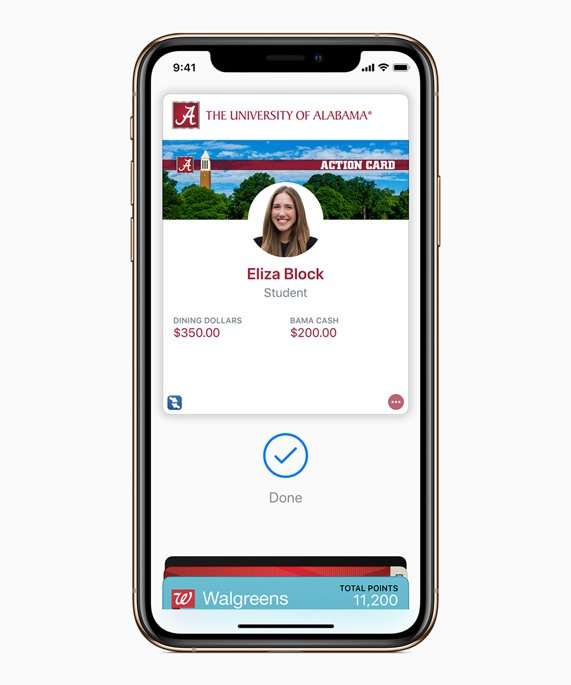

Some university students in the US and Canada can carry their iPhone or Apple Watch to class this year instead of their plastic ID card.

Apple Wallet opens up its Student ID card support to more schools.

It’s that time of year again! It’s time for students to get ready to go back to school. Some kids may be continuing onto the next grade level in elementary or middle school, but others may have graduated high school and are heading off to college. Thanks to Apple, some university students in the US and Canada may be able to ditch their plastic ID card and carry their iPhone to class instead.

In a blog post last week, Apple said that it’s expanding student ID support to more schools in the US and is launching support in Canada. Those schools include the University of New Brunswick, Sheridan College, Auburn University, Northern Arizona University, University of Maine and New Mexico State University. Apple’s mobile student ID cards can also be accessed from your Apple Watch.

Get the CNET Apple Report newsletter

Apple has been working on safe ways to ditch your physical wallet. The tech giant said at WWDC in June that its new operating system, iOS 15, will let you carry digital versions of government-issued ID cards, like your driver’s license, on your iPhone. The Wallet app feature, however, will only work in participating US states.

Deserve Edu Mastercard For Students

Our pick for: No credit history and international students

The Deserve® EDU Mastercard for Students doesnt require applicants to have a co-signer or security deposit, and international students don’t need a Social Security number. That makes it a little easier to get approved even for students with limited credit histories. Plus, it comes with a solid 1% back on all purchases. Read our review.

Also Check: Website That Buys Back College Textbooks

Customer Experience Even For Non

You don’t have to actually have the card to benefit from it. If you apply, and are not approved, you may be asked to enroll in Goldman Sachs’ “Path to Apple Card” program to improve your finances. The program tracks your progress through several “customized” steps such as making on-time bill payments, reducing overall debt levels, and resolving any past due accounts. After successful completion of the plan, you will be invited to reapply for the card.

Using Apple Card For Non

If you need to pay for purchases that can’t be made with Apple Pay, you can use the physical version of the Apple Card that Apple sends once you sign up. In addition to Goldman Sachs, Apple is partnering with Mastercard, so the physical Apple Card can be used wherever Mastercard is accepted.

When your physical card comes in the mail, setting it is simple. On the iPhone XS, XS Max, and XR, all you need to do is hold your iPhone near the envelope that it came in for an NFC scan and then tap the “Activate” button on your iPhone when it pops up.

On the iPhone X and earlier, you need to open up the Apple Card, open the Wallet app, tap the “Activate” button in the Wallet app and then hold your iPhone near the packaging that the Apple Card came in. Unlike traditional cards, you do not need to place a phone call for activation purposes.

Read Also: Do Native Americans Get Free College

Virtual Card Numbers For Online Non

There are no credit card numbers or other information on the physical titanium Apple Card. This data is instead available in the app, leaving some questions about online purchases where you often need a number and a CVV.

Apple Card is able to generate virtual card numbers for these kinds of purchases. The Wallet app provides a virtual card number and a virtual confirmation code, with the number being semi-permanent and able to be regenerated whenever you want. This info can be used for non-Apple Pay online purchases, over-the-phone purchases, and other similar situations.

There is not, however, support for single-use numbers or single-merchant numbers for having separate card numbers for different merchants. Purchases are also protected by a one-time use dynamic security code rather than a persistent CVV.

You Shop Primarily At Stores That Don’t Accept Apple Pay

Some major retailers, including Walmart, dont accept Apple Pay. And while Costco does, you can only use Visa cards there the Apple Card runs on the Mastercard payment network. This is to say nothing of the much smaller merchants where you may run into issues: Food trucks, mom and pop stores, bodegas and others simply may not be equipped to handle Apple Pay.

» MORE: How the Apple Card stacks up against the competition

Recommended Reading: Is Central Texas College Accredited

How We Picked These Cards

As we sorted through dozens of student cards, we looked for ones that accepted alternate forms of validating identity or determining risk for the lender. These two features will be critical for international students, especially those who dont have a Social Security number.

We also looked for cards that charge fewer fees, which can be helpful for students. And we looked for cards that offered some sort of rewards, like cash back or points that could be used toward free travel.

Earning Points & Rewards

The Apple Card offers what it calls Daily Cash, its own version of cash-back rewards. Cardholders earn 3% Daily Cash on Apple purchases, 2% on purchases made with Apple Pay, and 1% on purchases made at merchants that dont accept Apple Pay.

Apple also has a few partner merchants where cardholders can get 3% Daily Cash when using Apple Pay, including Uber, Uber Eats, Walgreens, Nike, Exxon Mobil, Panera, and T-Mobile .

Apple Card does not limit the amount of Daily Cash you can earn, and Daily Cash does not expire. If you have unredeemed Daily Cash if and when you close the account, Goldman Sachs will either credit it to your account, send it to you electronically, or mail you a check.

Recommended Reading: Is Central Texas College Accredited

Do You Rely On Budgeting Apps Like Mint Or Ynab

If so, I have bad news for you. Apples support page confirms that, Exporting data from Apple Card to a financial app like Mint is not currently supported.

As it says not currently supported, we have hope that youll be able to do this in the future, but theres no telling if or when that will happen.

Apple Card does have some great features to track spending built right into the Wallet app, but its just for Apple Cardyou cant tie all your spending and income sources together.

Apple

Apple Card has good tools for tracking spending, but all that data is locked in the Wallet app for now.

Oh, and also, you have to pay your Apple Card bill with your iPhone. Its kind of crazy, but you cant yet look at your transactions or pay your bill just by logging into a website.

Who Is Eligible For An Apple Student Discount

01. Further or higher education students

To qualify for an Apple student discount you need to be 16 or older and enrolled in a further or higher education establishment such as a university or college, and have a student ID to prove it. So you if you’re still as school you can still qualify post-high school students in the US or sixth-form and university students in the UK are eligible.

Also note that you can get the Apple student discount as soon as you’ve been accepted onto your course, even if you haven’t started it yet.

02. Parents of students

It’s not only students who can claim an Apple student discount. If you’re the parent of a student in further or higher education and buying the device on their behalf, you’ll qualify for the discount too. Remember, though, that you can’t claim the discount if you’re buying the product for yourself.

03. People working in education

If you work in education then you can also qualify for an Apple student discount. Staff members at further or higher education colleges and universities, both public and private, can apply you’ll need to provide documentation that proves where you work. You don’t have to be a teacher or lecturer non-teaching staff such as administrative workers are eligible too.

Also eligible for the Apple student discount are homeschool teachers, currently serving members of a school board, and currently service executives of a PTA or PTO .

Also Check: Can You Apply For More Than One College

Why Its Wise To Build Credit As A Student

Building credit might not seem like an urgent priority when you’re still in school, but the earlier you start the clock on your , the better. Having good credit will be important down the road when you want to buy a home or get a car loan, but there are even more immediate benefits. For example, good credit can improve your chances of landing a job or renting an apartment.

Your credit history, detailed in your credit report and summarized by credit scores, shows how well you’ve handled borrowed money and using a credit card responsibly is one of the quickest and easiest ways to build credit. Among the situations in which good credit comes in handy:

See and track your credit score

» MORE: 5 questions on applying for a student credit card

Things To Keep In Mind About The Apple Credit Card

Before we dive into Apple Cards details, three points bear mentioning.

First, although cardholders who dont pay their statement balances in full each month are subject to interest charges that vary with their creditworthiness and prevailing benchmark rates, Apple Card charges none of the fees typically levied by credit card companies: no annual fee, no late fee, and no over-limit fee.

Second, Apple Card is designed to work with Apple Pay, which runs on Apple hardware only. If youre one of the many millions of iPhone users in the United States, this card is for you. If youre an Android loyalist, youre out of luck.

Third, Apple Card has a slightly unorthodox application process that doesnt impact your credit score until youve accepted the offer . If you decide not to follow through with getting an Apple Card after applying, or your application isnt approved, your credit score wont decline as a result of your inquiry.

You May Like: Student Discount Apple Music

Concerts Performances And Arts Events

Want to take in some culture Then you should know that you can get discounts on classical concerts, jazz shows, ballet, and theater if youre a student.

In some cases, your student status can get you in free. When I was in college, I got to see banjo virtuoso Béla Fleck perform with the Akron Symphony Orchestra. These would have been $25 tickets normally, but I got in for free because I was a student.

How to get the discount: Just check the website of local arts organizations. Or, ask the arts faculty at your college, as they can sometimes get you exclusive discounts. Usually, all you need is a student ID.

Spend Tracking And Budgeting

All transactions made with the Apple Card are listed clearly in the Wallet app with color-coded categories like Food and Drinks, Shopping and Entertainment, and more. Apple Card also provides weekly, monthly, and yearly spending summaries, again using the same color coding so you can see what you’re spending at a glance.

Along with categorized spend tracking, the Wallet app provides a Total Balance summary that provides a look at your previous monthly balance, new spending (including pending transactions, and any payments or credits that have been made.

Interest charged and Daily Cash earned are also offered up, and users can see PDF statements from past months.

Read Also: What Size Are College Dorm Beds

How Do You Apply For The Apple Card

If you have an iPhone, applying for the Apple Card is easy. Simply open the Wallet app, tap the plus sign and select Apply for Apple Card. Confirm or update your personal information with Apple, then review and accept the terms and conditions.

If your application is accepted, the card is instantly added to your Apple Wallet meaning you can begin making purchases right away. You can then request a titanium Apple card that will arrive later in the mail.

If your application is denied, Apple may invite you to participate in its new Path to Apple Card program. This unique program gives denied applicants detailed information regarding the reasons their application was denied, as well as tasks they can complete to help them improve their credit. If you complete the Path to Apple Card program successfully, youll have the option to reapply for the Apple Card.

How Do You Earn Rewards With The Apple Card

When you make certain types of purchases with your Apple Card, you earn Daily Cash. These cash back rewards are applied to your account every day, and you can decide whether to use your Daily Cash to make purchases, send money to friends or family or make a one-time payment toward your Apple Card balance.

Heres how the reward structure works:

- Earn 3 percent cash back when you buy Apple products using Apple Pay.

- Earn 3 percent cash back when you make purchases with select retailers, including Duane Reade, Exxon, Mobil, Nike, T-Mobile, Uber, Uber Eats and Walgreens, using Apple Pay.

- Earn 2 percent cash back when you use Apple Pay to make purchases elsewhere.

- Earn 1 percent cash back on all other purchases.

Cardholders who apply through Jan. 31, 2021, can earn $50 bonus Daily Cash by opening an account and spending $50 or more in purchases within your first 30 days at Exxon or Mobil gas stations or convenience stores via your Apple Card in the Apple Pay app . Apple often gives new cardholders the opportunity to earn $50 bonus Daily Cash, so make sure you take advantage of it.

Also Check: How To Build Credit While In College

The Best Battery Packs

You never have to run out of power again if you carry an external battery pack with you. That’s whether you’re reliant on your phone and tablet or you take your laptop with you everywhere.

The Elecjet PowerPie packs enough power to juice all your devices. It’s capable of fast charging, and it’s affordable.

At less than half an inch and 251g, not to mention the 10,000 mAh capacity in its small frame, the Crave Plus is perfect for college students who prefer to travel light but need a lot of juice.

The Anker PowerCore III 10,000mAh may have all the necessary ports you need for charging, but it’s that wireless aspect you really want to use. Leave your phone cable at home.

Financial Education For College Students Is A Necessity & Parents Are Key

College students whove had financial education are far ahead of their peers.

Not only do they start with more knowledge, but theyre also likely to have more experience using money-management skills, setting them up for a better financial start after graduation.

Where do college students get their financial education? College students say they learn most of what they know about money management from their parents. Yet, most of them report wanting to learn more!

Get our free ebook, What Your Kids Need To Know About Money For Future Financial Independence.

According to a survey by US News, 40% of college students havent been taught about credit cards before they start using them.

So, when it comes to whether college students should have credit cards, parents play a huge part in their education and success.

Parents have to open up the lines of communication with their kids when it comes to money. Like it or not, it does impact a students future.

You May Like: How To Get Noticed By College Football Scouts

Best Laptop For Architecture Students Under $1000

Acers entry on this list includes an Intel Core i7-6700HQ processor of 2.6 GHz. It has 8GB of DDR4 RAM. The hard drive is 1TB in size and is 5400-RPM.

The screen of this computer is 15.6 inches, and a powerful NVIDIA GeForce GTX 960M graphics card is included. These features mean it will be able to run those graphic-intense architectural programs with solid proficiency.