Look For An Affordable School

As much as obvious it sounds, picking a more affordable school holds true when being unable to afford high tuition or loans. That said, its important to start research early on and pick the most affordable school. The most affordable schools include community colleges and technical schools.

If you want to go to a university over a college, keep in mind that finding the one that offers generous aid is of paramount importance. Most school websites are equipped with the net price calculator which helps students make calculations over the amount theyll have to pay and borrow.

However, just because some schools have a lower price, doesnt mean studying there is more affordable. Sometimes, the school will cost less but also offer no financial aid whatsoever. On the other hand, sometimes a school will cost more and offer at least one-half or three-quarters of scholarship.

Another thing to keep in mind that the colleges usually just cover tuition and that youll still need to pay for accommodation, campus, textbooks and equipment, food and life in general. That said, choose wisely when applying for a more affordable school.

Focus On Grants And Scholarships First

Grants differ from loans in that they do not have to be paid back. That’s why you’ll often hear them called “free money.” The federal government runs the Pell Grant program, which gives money to undergraduates from low-income families. The specific amount you’ll receive depends on your expected family contribution, your cost of attendance and your college plans. For the 2020-2021 year, the maximum is $6,345.

Check out state financial aid programs here. Florida, for example, has the Bright Futures Scholarship Program that awards as much as $211 per credit hour to eligible applicants. Washington has the Washington College Grant, which can cover full tuition costs at approved, in-state public institutions or put “a comparable amount toward tuition and other education-related costs at an approved private college or career training program.”

Schools also often offer what’s called merit aid to students with certain standardized test scores or other academic achievements. At private colleges especially, this is a significant form of financial aid, totaling billions of dollars a year.

Finally, you may want to take advantage of outside scholarships. Companies, nonprofits, foundations and other groups are constantly coming out with private scholarship opportunities that may offer free money with fewer strings attached than federal, state or institutional programs.

How To Pay For College: 16 Strategies

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Also Check: Grammarly For Free Students

Grants From The Government

Many states offer grants that you can take advantage of today. These grants can go a long way towards helping you with your college costs. If you DON’T complete an application for a grant, you’re likely to leave behind thousands of dollars on the table .

The first step to applying for a grant is filling out a FAFSA form. As soon as you do this, various state and institutional scholarships and the federal Pell Grant will become available to you.

Then, if you’re still struggling with costs, consider applying to state-level grants. Each state is different, but there are usually many programs benefitting many groups of people. You can learn about the grants in your region by heading over to the Department of Education website and taking a look.

How To Pay For College: 7 Of The Best Money Saving Tips

How to pay for college is a question on many parents’ and students’ minds. With costs rising at well above the national rate of inflation, many are looking for solutions.

Suppose you’re a student about to enter college . In that case, you already know that post-secondary education is pricey and have likely asked yourself this question many times. A study by Education Data found that the average cost of college in the United States in 2021 was $35,720 per student per year. That’s a lot of money!

Sometimes it can be overwhelming thinking about college just because the costs are so high. How in the world am I ever going to afford this? Will I need to go into debt? Is there any way for me to pay for college? This post will try to answer some of these questions for you and alleviate some of your worries.

We’ll run through 7 different tips that could help make college costs easier for you to handle. Ready to learn how to pay for college? Let’s dive right in.

Read Also: How To Transfer From One Cuny To Another

Explore Grants Scholarships & Other Free Money

New York State offers a variety of grants and scholarships for residents who plan to attend in-state colleges:

- Tuition Assistance Program the states largest source of financial aid provides up to $5,665 per school year per eligible student

- Excelsior Scholarship covers the entire tuition for eligible CUNY and SUNY students

- Enhanced Tuition Awards offer up to $3,000 to eligible students attending private colleges

- STEM Incentive Program awards annual SUNY tuition to the top 10% of high school students who pursue a degree in science, technology, engineering or math

- See the complete list of free money options available

Your Choice Of School

Put simply top-rated schools tend to have more money, which means they can offer more generous financial aid packages. Some schools even claim to cover all unmet financial need.

Whether you attend a public or private college will also affect your net costs. Private schools tend to cost more than public in terms of sticker price, but they tend to have better financial aid programs. Public schools are relatively inexpensive for state residents, but can be very pricey for out-of-state applicants.

Also Check: Is Fsaid.ed.gov Legit

How Much Will You Pay Navigating The True Cost Of Higher Education

High school and college graduation ceremonies across the country have wrapped up, and a new generation of students is preparing to begin their higher education. Or perhaps not. A recent report from the National Student Clearinghouse Research Center shows 662,000 fewer students enrolled in undergraduate programs in spring 2022 than a year earlier, a decline of 4.7 percent.

Many of these enrollment shifts demonstrate the impact of the COVID-19 pandemic on students who likely chose to delay enrollment. Cost also is often a large contributing factor. Just getting into college can be expensive, and unexpected costs can create a barrier. For students pursuing a four-year degree, many schools charge application fees to even determine admission.

According to a recent study by U.S. News & World Report, the average cost to submit a college admissions application is $50. Some schools charge more than $75 per application. If a student applies to five to seven schools, as recommended by the College Board, that can quickly add up to over $250. Admissions application costs do not include the cost of taking the SAT exam or ACT exam . And these exams often carry additional fees, such as change of date and/or cancellation fees. Additionally, some colleges require an enrollment deposit that comes due after admission. Waivers of fees are sometimes available, either through high schools or college admissions offices, but this option may not be advertised to prospective students.

Save Money Ahead Of Time With A 529 Plan

Saving up is one of the best ways to pay for college. While you can save money using a regular savings account or taxable investment account, a 529 plan can help you gain a tax benefit as you set money aside for school: The funds can eventually be used tax-free for qualified education expenses.

The longer you have to save up, the better off youll be. Generally speaking, parents who started contributing to a 529 plan 10 years ago should have almost enough money in the account to pay for two years of college.

Not everyone starts saving when their children are at a young age, so its important to look for multiple savings strategies. Keep in mind that 529s rely heavily on stock market returns, so its wise to have backup savings in case of a downturn before college.

There are times when withdrawals from a 529 count as part of a students income when filling out the annual Free Application for Federal Student Aid . That said, it can make sense to put off using money from a 529 account until later in the students college career.

Withdrawals during freshman and sophomore years can affect financial aid awards. Run the numbers to see if it makes sense to use funding from other sources during the first two years of college.

Read Also: Central Texas College Diploma

Student Loan Rates Are Rising

Apply for a private student loan and lock in your rate before rates get any higher.

College must be paid for before you attend school or when you are attending. Paying college tuition on time is essential, as many colleges will not allow you to register for classes until your tuition has been paid and many colleges will drop you from courses if your tuition is late.

Apply For State Grants

While scholarships are usually merit-based, grants are typically awarded based on your financial need. If your family income isnt especially high, consider state grants for college.

In Indiana, for example, there are grant programs available for:

- Undergraduates with financial need

- Adults returning to school

- For attending trade schools

Like scholarships, grants are a form of gift aid that almost always doesnt need to be repaid. You should always prioritize this type of cash for college over other options, especially student loans.

You can learn about grants available in your state by contacting its higher education authority via the Department of Education. Here are some opportunities organized by situation:

| Read up on grants for |

|---|

| Paying off student loans |

Don’t Miss: Brandon Charnas Real Estate

Saving Money Through A 529 Plan

Family contributions is a fancy phrase for money that you and your family have saved and one of the primary ways people pay for college.

One of the best ways to save for college is through a 529 Education Plan. A 529 plan allows families to use money tax-free for education expenses, including college. It is never too late to start a 529 plan, but a longer period of time will allow you to invest more money and allow your investment to grow.

Learn more: How much money can you put in a 529 Plan?

Use Grants If You Qualify

A 2018 NerdWallet study found high school graduates who don’t complete the FAFSA leave behind billions of dollars in unclaimed federal Pell Grant money.

Dont make that mistake. As long as you submit the FAFSA and renew it each year youre enrolled in school, youll receive Pell money if youre eligible for it.

In addition to the Pell program, the federal government offers several other types of grants, which dont need to be paid back. Many states have grant programs, too. Use this map on the Education Department website to find the agencies in your state that administer college grants. Then look up and apply to state grant programs you may qualify for.

» MORE:Guide to grants for college

Read Also: Uei Trade School

Rent Out Your Possessions

Thanks to the latest shared economy trend, theres good money in renting out your own things. If you live off-campus, consider renting out a spare bedroom on AirBnB, or make the whole place available when you head home on weekends or breaks. If you have a car, you can make that available for people to rent through apps like Getaround and Turo. If you live in a city and rent a parking space, you can even rent that out on JustPark.

Consider An Online School

Don’t overlook the possibility of attending an online school. Tuition can be much less, sometimes as much as 50% cheaper, and in most cases, classes are identical to those you’d undertake in a brick-and-mortar classroom. You can also study and “attend” when it fits your schedule, allowing you to more easily hold down a job as well.

Don’t Miss: Cheapest Colleges In Maryland Out Of State

Explore College 529 Savings Plans

Another great way to save for college is a 529 Savings Plan, also called a 529 Plan. State-sponsored and offered by nearly all U.S. States, 529 Plans are specialized savings and investment accounts that do not tax on interest accrued. In almost all cases, you keep everything you earn to put towards a college education.

There are two primary types of 529 Savings Plans: College Savings Plans and Prepaid Tuition Plans. College Savings Plans work like retirement funds in that they invest deposited money into mutual funds or other options . Prepaid Tuition Plans allow plan owners to pre-pay all or some of the cost of an in-state public college education.

Interested in learning more about 529 Savings Plans and comparing them state-by-state? Check out this USNews article for more information.

Making Your College List

I suggest for those of you chasing merit aid, make sure to apply to a good amount of safety schools.

For those with high stats this also makes sense but also try for some of the elite schools that might actually work out to be close-to-free for you.

And for those in the middle be sure to include a good mix of safeties and target schools to make sure you wind up with choices you can actually afford.

The best advice is to keep your list financially balanced.

Recommended Reading: Does The National Guard Pay For College

External Awards & Scholarships

There are a lot of people who want to help you succeed. Every year organizations, including companies, clubs and associations, distribute student awards. These groups provide funding based on their own sets of criteria that can include financial need, academic standing and others. Awards also exist for students with disabilities or exceptionalities.

Watch the video for details.

Paying For College With Federal Student Loans

There are three types of federal student loans you are likely to encounter: Direct Stafford Subsidized, Direct Stafford Unsubsidized, and Direct PLUS Loans. Federal student loans come with generous periods of deferment and forbearance, as well as potential eligibility for income-driven repayment plans and Public Service Loan Forgiveness. Private student loans do not offer the same benefits. That is why we recommend at least reviewing your federal student loan options before considering private student loans.

> > > More: Student Loans for College

Don’t Miss: Mortician Salary Nj

Review Your Financial Aid Award Letters

What is a financial aid award letter?

- Financial aid award letters arrive around the same time as admission offer letters. Assuming that you remembered to list them on your FAFSA, every college that offers to admit you should send you a financial aid award letter.

- The letter should provide all the information you need to compare the net price of attendance at all the schools youre considering.

How to compare financial aid award letters

- Financial aid award letters can be difficult to compare because some schools dont provide a total cost of attendance or make clear that loans are aid you have to repay. Here are some examples of how the letters might look and how you can compare financial aid award letters.

- RaiseMe makes it easy to determine your net cost of attendance for college with their Interactive Financial Aid Award Letter tool.

How To Pay For College Using Multiple Strategies

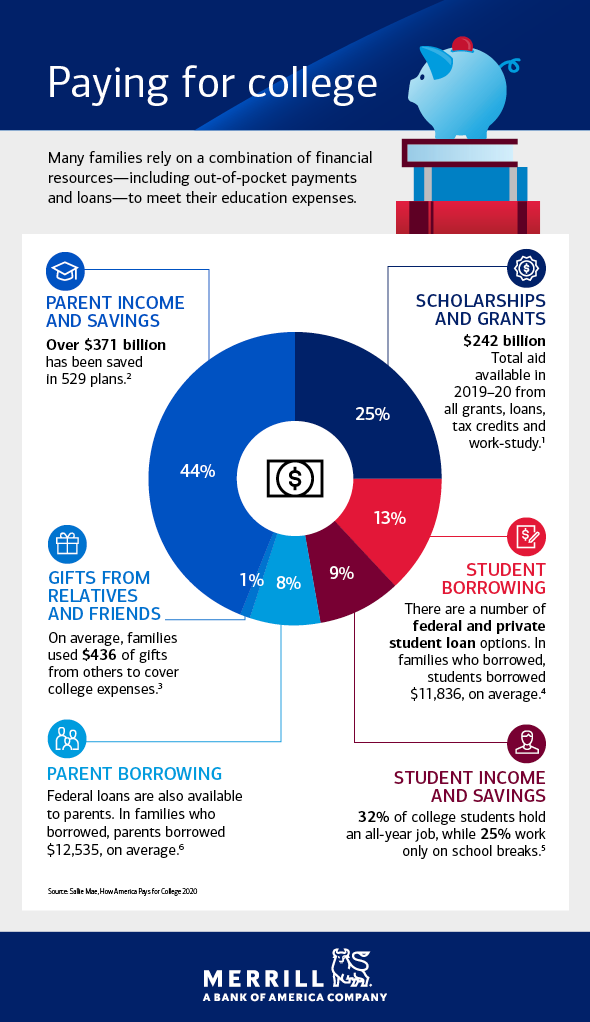

![How Families Pay for College in 2019 [Infographic] How Families Pay for College in 2019 [Infographic]](https://www.everythingcollege.info/wp-content/uploads/how-families-pay-for-college-in-2019-infographic.jpeg)

You might have asked teachers, counselors and admissions officers about how to pay for college only to get a different answer each time. Thats partly because there are a lot of different answers.

And chances are, with the rising cost of college, youll need to use more than one tactic to pay for school. Many students fund their undergraduate education by attending low-cost schools and finding scholarships, federal and private student loans and part-time work.

Ensure you make the right school choice, tap savings and seek out gift aid before all else. Then try to cut expenses and ramp up income before you resort to borrowing. Work your way down our list of 16 strategies, ensuring that you combine the best of each of them before taking on debt.

Andrew Pentis and Christina Majaski contributed to this report.

Read Also: Schools That Offer Mortuary Science

Paying For College With Borrowed Money

Loans are part of many families’ college financial strategy. Loans offered by the college as part of the aid package usually have the lowest interest rates. Families can also take out federal PLUS Loans or loans from private loan providers.

Tip: Some families use credit cards or borrow against assets, such as home equity and life insurance. These are two of the riskier ways to pay for college. Be sure to evaluate the expense and risk of these options before making a commitment.