Will You Get More Financial Aid As An Independent Student

- Will You Get More Financial Aid as an Independent Student?

As a college-bound high school graduate or the parent of a student applying to colleges, you may wonder if independent students get more financial aid, like student loans, than dependent students.

Overall, the answer is no, although some Department of Education programs provide more money to independent students than dependent ones.

Types Of Financial Aid

Pell Grants, a type of federal aid for low-income students, are the most well-known type of assistance for higher education expenses. While this type of aid is granted based solely on a familys income and financial resources, numerous other types of aid exist, including grants, scholarships, loans, work-study programs, 529 plan grants, and assistantships .

Percentage Of Students Receiving Financial Aid

Students often assume they arent eligible to receive financial aid. However, even if you think you dont meet the criteria, you can always apply. You might be surprised at the percentage of students who receive full or partial student financial aid even though they initially thought they wouldnt qualify.

Recommended Reading: Is Rhema Bible College Accredited

Dont Assume You Wont Qualify

Having a substantial family income doesnt always mean that financial aid is beyond your reach. Its important to remember that the needs-analysis formula is complex. According to the U.S. Department of Education, factors such as the number of students attending college and the parents’ age can affect your award. Its always a good idea to fill out the FAFSA just in case.

Keep in mind, too, that some universities wont offer their own financial aid, including academic scholarships, if you dont fill out the FAFSA first. The assumption that the form is only for low- and middle-income families often closes the door to such opportunities.

History Of Federal Financial Aid

Until the mid-20th century, students not from wealthy families generally had to lay their hopes for college on the kindness of generous philanthropists. The U.S. Congress enacted the GI Bill in 1944 to reward veterans who served during wartime, giving them the opportunity to pursue higher education and catch up to their peers. The next step in financial aid opportunities came in 1958 when Congress passed the National Defense Education Act. This law provided college students with low-interest loans with debt cancellation for students who became teachers. But although graduate fellowships for students pursuing science, math, engineering, and other fields falling under strategy were also approved, the general population could not yet access benefits offered by the federal government.

The biggest change came in 1965 when Congress passed the Higher Education Act . This law solidified the federal governments commitment to equalizing college opportunities for students in financial need. Over the years, this law has evolved to be more inclusive and, with the acts reauthorization in 1972, the basic charter of todays federal student aid system was formed.

The biggest change came in 1965 when Congress passed the Higher Education Act .

Don’t Miss: Can I Sell My College Books

Look For Mistakes And Correct Them

Review FAFSA and CSS Profile. You may have made a mistake on either the Free Application for Federal Student Aid, known as the FAFSA, or the College Boards CSS profile. Both are used by colleges to determine how much you and your family can contribute to college costs.

Consult a counselor. Ask a college counselor to look over your forms to make sure you didnt misinterpret any questions.

Make corrections. You can make corrections to the FAFSA online, but be sure to contact your schools financial aid office to confirm updates to both the FAFSA and the CSS Profile.

What Happens If Your Appeal Is Approved

The process is largely formulaic and data-driven.

If your financial aid appeal is approved, it will be implemented by making a change in the data elements on the FAFSA. For example, if a parent has lost their job, the financial aid administrator will change the income and income tax figures on the FAFSA.

This will generate a new expected family contribution using the FAFSAs standard financial aid formula. The EFC will yield a new figure for demonstrated financial need, based on the difference between the cost of attendance and the new EFC. This, in turn, will yield a new financial aid package.

The college financial aid administrator can also implement some adjustments through a change to the cost of attendance. Changing the cost of attendance is more common when the students EFC is already zero, since the EFC cannot be reduced below zero.

You May Like: What Colleges Are Still Accepting Applications For Fall 2021

Reason : Colleges Use The Css Profile With The Fafsa To Understand Your Full Financial Picture

The CSS Profile helps schools award non-federal institutional aid, and not every college requires it. However, filling out the CSS Profile does not take the place of the FAFSA. Rather, it is an additional application for non-federal financial aid.

Schools that require the CSS typically meet 90% to 100% of a family’s financial need and package their financial aid with institutional grant money.

Reason : You Rely On Yourself To Pay For Everything

If you don’t file the FAFSA, you don’t give yourself the option to allow your child to take on federal student loans, grants and more. If you don’t have the money to cover college expenses, you may pull from your regular budget, reach into your savings account or investments to cover college costs. What happens if you say bye-bye to all your liquid assets? It could wreak havoc on your finances and maybe even stymie your savings for retirement.

Don’t Miss: How To Test Out Of College Courses

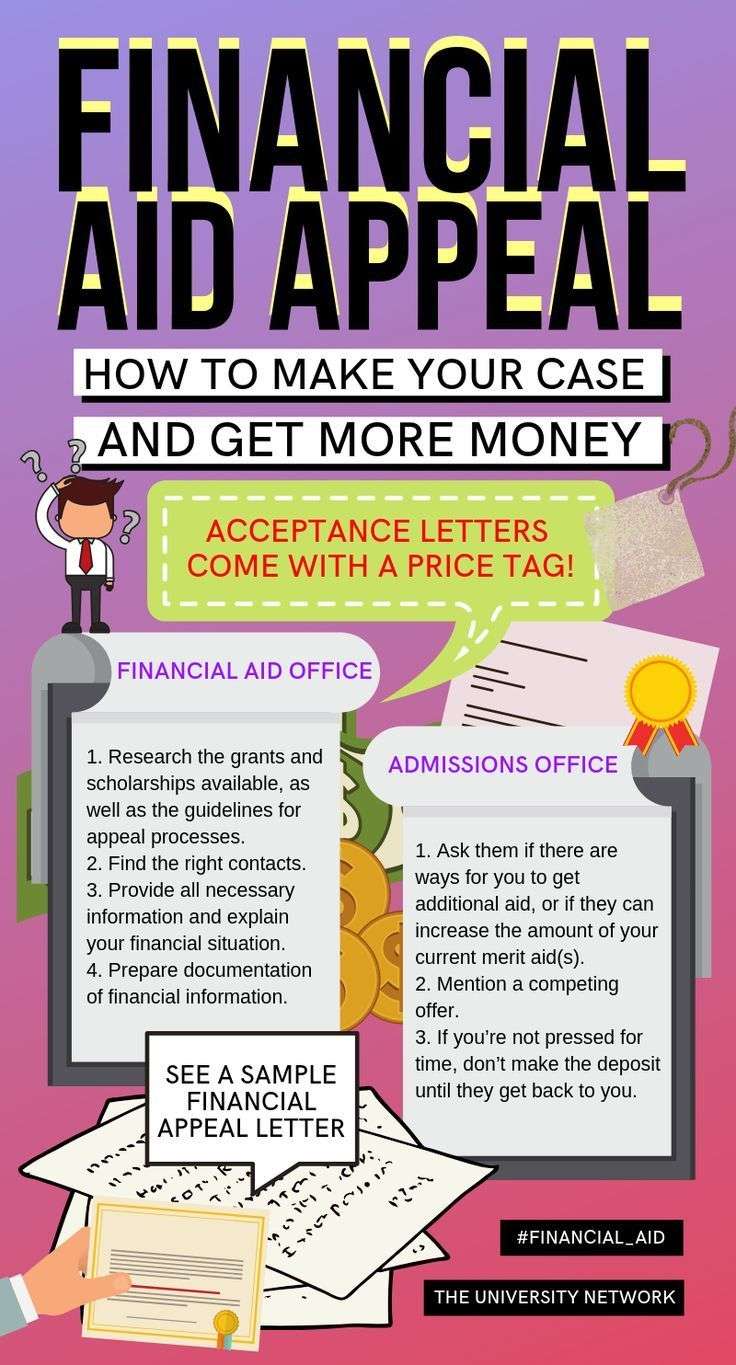

Appealing Your Financial Aid Might Raise Your Award Amounts

You may assume that the financial aid award you receive is final. The school, the federal government, and your state government are providing as much money as possible to help you attend college, but in reality, you can appeal the amount given if you need more financial assistance. To appeal your financial aid award amount, follow these steps:

There is a clear appeals process to ask for more financial aid. Inquire with your school about how the institution expects your appeal to proceed.

When you learn how to get more financial aid, know that it is not a bargaining process, like asking for a reduced price on something you buy. Instead, there is a formal appeal to the decision-making committee.

Cost Of College Degrees

The cost of a college degree can vary widely. Aside from some colleges being more expensive than others, other factors also impact the cost of a degree. This includes specific degree programs, attendance levels, college fees, opportunity cost, room and board, books, and more. That being said, for the 2018-19 academic year, the average cost of college, including factors such as tuition, fees, and housing was estimated to be about $18,400 for public institutions, $47,400 for private, non-profit institutions, and $27,000 for private, for-profit institutions.

Compared to costs from 10 years prior, 2018-2019 costs of attending a public institution increased by 28%. After adjustment for inflation, the cost of attending private, nonprofit colleges rose 19% and decreased by 6% at private, for-profit institutions for the same time frame between 2008-09 and 2018-19.

Don’t Miss: Is Ashworth College Recognized By Employers

Strategies Based On Appealing For More Financial Aid

If a students ability to pay for college is affected by special circumstances, they should appeal for more financial aid. College financial aid administrators can make adjustments to the data elements on the FAFSA on a case-by-case basis, when the decision is supported by adequate documentation of the special circumstances.

Special circumstances include anything that has changed or anything that distinguishes the family from the typical family. It can include unemployment, death or disability of a wage-earner, high unreimbursed medical or dental expenses, homelessness, disability-related expenses, private K-12 tuition, parents genuinely enrolled in college, unusually high child care or dependent care costs and the end of child support or Social Security benefit payments. Special circumstances can also include one-time events that are not reflective of ability to pay during the award year, such as an unusual bonus.

Dependent Vs Independent Students

Many college-bound students fit the requirements of dependent students. These are young adults between the ages of 18 and 24 who are recent high school graduates, still rely on their parents financial support, and are not married. When most people think about a student pursuing an associate or bachelors degree, that is the profile they think of. However, more independent students are enrolling in college. The job market increasingly requires education beyond a high school diploma or GED, and older adults who may have dropped out of college or completed an associate degree rather than a four-year degree are returning to school after working for a few years. Independent students are those who do not rely on their parents for financial support.

Recommended Reading: College Hill Episodes

Financial Aid Helps Offset College

Financial aid is a broad term that includes all types of funding you can use to help pay for college. This includes grants, scholarships, loans, and work-study programs. Although many students pursue financial aid through federal programs, there are also state-sponsored, college-sponsored, and privately-funded financial aid opportunities.

Statistics show that, while 86% of college students benefit from some form of student financial aid, more than $2 billion in student grants go unclaimed.

Statistics show that, while 86% of college students benefit from some form of student financial aid, more than $2 billion in student grants go unclaimed. Numerous other financial aid opportunities, such as scholarships offered by businesses, nonprofit organizations, and other entities, are also underutilized. This means a lot of money is left on the proverbial table. Most students dont realize there are many opportunities to find money to help them achieve their educational goals if theyre willing to invest the time and effort.

Other Options For Paying For College

If your appeal for financial aid is unsuccessful, you do have other options for paying for college. First, make sure to apply far and wide to scholarships.

You could win a scholarship for various reasons, including grades, athletics or community service. Since you dont have to pay back a scholarship, its the best type of aid to help you pay for college.

After youve exhausted the search for scholarships, other gift aid and work-study programs, another option to cover a gap in funding is private student loans. Look for reputable lenders with competitive rates, like College Ave or LendKey.

Keep in mind that youll likely need a cosigner to qualify for a private student loan. Before you sign any paperwork, make sure to read over the terms and conditions.

If you arent able to secure more federal financial aid, dont lose hope. You do have other options to cover tuition bills, as long as youre careful about how much student debt you take on.

Rebecca Safier and Andrew Pentis contributed to this report.

Don’t Miss: College Hill Virginia State University Cast

The Basic Financial Aid Application Process

The process of getting financial aid includes reapplying every year that you attend school. The basic process goes like this:

- Go online and fill out a FAFSA with your current financial information and school costs.

- Enter up to 10 schools at the end of the FAFSA, if you are not already enrolled in a school.

- Manage your finances and investments, pay your bills, and pay down any debts before completing your FAFSA financial information, as this represents your baseline financial status.

- Carefully look at the financial aid awards package sent to you by your school or the schools you listed.

- If you are not yet enrolled in a school, you can use the financial aid award as one of the ways you choose the college to attend.

- If you are already enrolled in a specific postsecondary school but have questions about your financial aid package, speak with the financial aid counselor on campus.

- Appeal for more need-based aid if you feel your award is not enough.

To get the most possible financial aid in the first round:

Financial aid is an important method of paying for college. If you do not receive enough money to cover your first year of school, or your award is less than the previous year, you can appeal the amount and see how much your college can help you.

Strategies Based On Assets

Some strategies can shelter assets from the need analysis formulas. Other strategies shift assets from the students name to the parents name to reduce the impact of assets on the EFC.

Assets can be sheltered on the FAFSA by paying down debt. Money in a bank account counts against the EFC on the FAFSA, while many forms of consumer of consumer debt are ignored. So, paying down credit cards and auto loans reduces reportable assets on the FAFSA. It can also save money, if the interest rate paid on the debt is higher than the interest rate earned on savings.

Assets can also be sheltered by accelerating necessary expenses. If you were going to install a new roof on your home or replace the furnace, you might as well do it before you file the FAFSA instead of afterward. Like paying down debt, this reduces reportable assets on the FAFSA.

Increase contributions to qualified retirement plans in the years leading up to college. At the very least, maximize the employer match on contributions to your retirement plan. Even though voluntary contributions to a retirement plan will count as untaxed income on the FAFSA, the money already in a retirement plan is not reported as an asset on the FAFSA.

It is also important to avoid pitfalls involving assets.

Read Also: Pell Grant Single Mom

Learn More About How To Pay For College

My conversation with Rebecca was more helpful than I could have hoped for, but it left me perturbed. When grant money is so difficult to come by and loans are so easy, it can be tempting to assume student loans are the best way to pay for college.

But thats just not true.

At Accelerated Pathways, we believe college shouldnt be a debt sentence. We help students avoid the need for student loans altogether by lowering their college costs through the use of affordable online courses. Id encourage you to make a smart financial decision and avoid federal student loans. Learn more about how Accelerated Pathways can help you save money on your education and graduate debt free.

Special thanks to Rebecca Decker, one of our amazing admissions counselors, for taking the time to chat with me about this topic.

Maximize The Number Of Children In College At The Same Time

The federal financial aid formula divides the parent contribution portion of the expected family contribution by the number of children in college. Increasing the number of children in college from one to two is almost like dividing the parents income in half. So, something as simple as having more children in college at the same time can have a very big impact on the amount of financial aid available to each child. It may be too late to space the children closer together, but the impact on aid eligibility can be a consideration when deciding whether to allow a child to skip a grade. This is another reason why it is important to file the FAFSA every year, even if you got no grants last year since small changes can have a big impact.

Don’t Miss: How To Get Free College Merch

Should You Become An Independent Student To Get More Financial Aid Help

Research shows that about half of students attending undergraduate programs are independent, and many have dependents of their own, such as children and spouses. Among independent students, most are the first in their families to attend this level of higher education. Many took years off from school after getting their high school diploma so they could work and support a larger family unit, including parents and younger siblings.

More independent students are people of color, recent immigrants or from immigrant families, or from abusive family situations who emancipated themselves.

While emancipation from your parents is one route to becoming an independent student, it is not inherently worthwhile for your financial aid application. There are several complicating factors in the FAFSA.

If your parents give you any financial support at all, but you are an independent student, your EFC number could be much higher than if you remained a dependent student. Most students qualify for several forms of financial aid, from need-based grants to merit-based scholarships to student loans.

You may not qualify for the same amount of financial aid every year, but taking on a little more in student loans one year, or finding outside scholarships or work opportunities, can help you make up the difference. Private student loans are a great way for many college students, both dependent and independent, to make up small gaps in their education costs.

Where To Find Scholarships

Students can access a wealth of scholarship databases through a simple internet search. While large, aggregated scholarship websites can be helpful, a more targeted approach can help funnel down to more fruitful results. Students may find the process of searching for scholarships less overwhelming if they begin with their school and local community. Below are some suggestions of where to start.

Also Check: Does Trade School Count As College

Scholarships For Online Students

- Eligibility: Applicants must be enrolled in an accredited online degree or certificate program, possess a minimum 3.0 GPA, and demonstrate financial need.

- Award Amount: $1,000

This website provides an online forum for first-generation college students to share ideas about applying for, enrolling in, and funding their college experience.