Private Charity And Foundation Grants

Many grants are also available from private nonprofit charities and foundations. They can range from large, heavily endowed organizations like the Ford Foundation or the Bill and Melinda Gates Foundation to smaller or more local organizations.

Some nonprofits have a broad focus and will give grants to organizations and people doing a wide range of beneficial work. Others have a narrower focus, and may give grants for very specific purposes or to a narrow set of individuals. For example, some may only give grants to support research on a particular disease or to support college students in particular majors or from particular backgrounds.

Search online or print databases of grants to find grants that may apply to you or your organization. Many public libraries provide in-person help and online databases you can use to find and apply for grants that may be right for you.

Federal Direct Subsidized Loan

Eligibility for a subsidized loan is based on financial need as determined by yourCost of Attendanceand estimated family contribution . With this loan, the government will pay the interest while you are enrolled at least half time, during your grace period and during any periods of deferment.

Federal Direct Unsubsidized Loan

A FAFSA is required to receive an unsubsidized loan, but eligibility is not based on financial need. The amount will be determined based on your cost of attendance, any other aid received, and the federal annual loan limits. With this loan, interest will start accruing as soon as it is disbursed.

Before Disbursement

What Are The Different Types Of College Loans

Many students require financial assistance to attend college, but not everyone qualifies for scholarships and grants. Luckily, there are many types of college loans available, with options for every student. Some college loans are based on financial need, some are government loans available to all, some require a good credit history and can be acquired through private lending sources, and some are available specifically for parents of college students. The most common types of loans are:

Stafford Loans

Stafford Loans are either Federal Family Education Loans or William D. Ford Federal Direct Loans . College loans in the Stafford family are for students. Direct Loans are funded by the government and FFELs are funded by banks and other private lenders. The choice of FFEL or Direct is up to the school, not the student. However, both programs are virtually identical as far as eligibility and amounts available, but the repayment terms may differ.

PLUS Loans

Federal Perkins Loans

Private Lender Loans

Also Check: What Colleges Accept A 2.0 Gpa

Research Dependents Education Assistance Program

Along with the GI Bill, the Dependents Education Assistance Program offers 45 months of educational benefits for the children of certain veterans. This might come in the form of a technical school, certification, or apprenticeship. There are more limits to this type of funding, and it might not be approved for traditional two-year and four-year colleges.

The DEA Program also limits funding for the types of veterans whose children can apply. The grant is made to support children of permanently disabled veterans, deceased veterans, or soldiers who are currently MIA. These soldiers are unable to support their families through their military income or through civilian work, so the military provides education credits to help children further their job prospects.

Before your child applies for any of these grants, make sure they understand the limits of each option. If they accept a smaller grant from one organization, they may be disqualified from receiving a larger grant that could make paying for college easier. However, fully knowing their options can help them get the most grant funding possible to cover their education and help them graduate debt-free.

How Much Can I Get

The maximum award amount for the 2020-2021 academic year is $6,345. The amount awarded will depend on the student’s:

- financial need

- status as a full-time or part-time student

- plans to attend school for a full academic year or less

You may use the 2021-2022 Pell Grant Calculator in order to calculate an estimate of your Federal Pell Grant eligibility.

You May Like: Can I Join The Airforce And Go To College

Types Of College Grants Available To You

College grants are a form of financial aid that is awarded to students, to help pay for college. Typically, college grants are offered to students based on their financial need, and do not need to be paid back.

If you are in or applying to college, and researching your financial aid options, it is important to know the types of college grants available to you. Today, you can earn college grants from the government , from your college , or even from outside institutions . Here, we break down the different types of college grants available to undergraduate students.

Get Your Financial Documents In Order

Once you having found some government grants for college that you want to apply for, it is time to dig in and really gather together all of your financial documents. You will need to prove that you are in fact in need of assistance. This may mean that you also need to gather your parents or legal guardians tax returns and financial documents. Having this information on hand will ensure that your application is complete.

Read Also: Where Can I Sell My Old College Books

Childrens Health Insurance Program #

CHIP provides health insurance to uninsured children in families with incomes too high to qualify for the states Medicaid, but cant afford private coverage on their own.

According to the latest data, over 37.5 million children were enrolled in Medicaid the primary source of coverage for low-income children and another 9.6 million were enrolled in CHIP. 5

It covers children for everything they need doctor visits, vaccination, dental, and vision. For most families, its free. Others will pay low monthly premiums, enrollment fees and co-pay for some services.

Like Medicaid, CHIP is administered independently by each state, with rules of its own and is operated either as a Medicaid expansion, a separate program, or a combination of the two.

Iraq Or Afghanistan Service Grant

The Iraq or Afghanistan Service Grant is awarded to a student whose parent or guardian died as a result of U.S. military service in Iraq or Afghanistan after September 11, 2001. Identified students may receive increased federal financial aid if at the time of the parent or guardians deaththey wereeither less than 24 years old or were enrolled in college.

Eligibility is based on the following:

For students who are eligible, the Financial Aid Office will automatically offer this grant based on information provided by the Department of Education.

Read Also: Cheap Colleges In Maryland

Grants By Degree Level

To determine your financial eligibility, fill out a . Although most grants are awarded to undergraduates, graduate grants are available and very generous. Graduate grants will often fund your education and pay for career advancement opportunities such as internships and research positions. If you are employed and plan to return to school, check with your employer about scholarship and grant opportunities. Private companies often fund employees who are looking to get a masters, and may offer an increase in pay after the degree is attained. If you plan to utilize your employers financial aid, anticipate working for that company post-graduation.

Applying For Federal College Grants

In order to be considered for any type of Federal or State financial aid you must complete and submit the Free Application for Federal Student Aid . The FAFSA can be completed online or in hard copy and is available in a Spanish language version. There are both Federal and State deadline to consider so make a note and be sure to get your application in on time.

Once you have submitted your application it will be reviewed and you will then receive a Student Aid Report in the mail. This report will outline how much of your education costs you are expected to contribute to as well as how much and what types of Federal aid you have qualified for. A copy of your SAR is also sent to each of the schools you included on your FAFSA. Based on the information in your SAR each college prepares a financial aid package they are willing to extend to you in exchange for your attendance.

Also Check: How To Get College Discount On Apple Music

Grants In Your Community

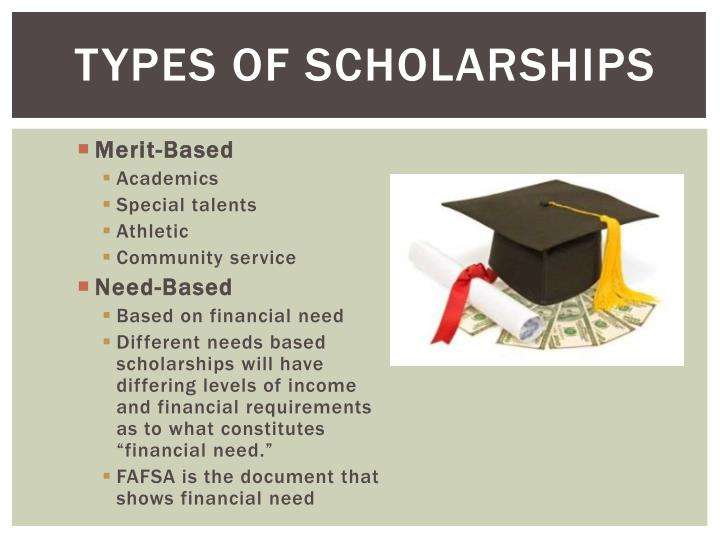

Many community organizations offer grants and scholarships to adult students going back to college. The difference between a grant and a scholarship is that a grant is based on financial need and a scholarship is awarded based on judged criteria, though financial need may be one of the criteria.

So, when you apply for a scholarship, you are competing with other applicants for a finite amount of money.

There are scholarships that are open for anyone to apply, but the majority of scholarships are specific. Scholarships can be found based on a variety of qualities, including:

- Athletic ability

- Military status

- Religion

Many colleges have scholarship programs, which are usually discussed in the colleges course catalogue. If the course catalogue does not mention a scholarship program, ask the financial aid officer during your meeting. The college may simply have chosen not to publish the information for the scholarship.

Some employers also have scholarship programs. Though, restrictions may apply, such as a minimum length of employment requirement before receiving scholarship monies. The Human Resources Department would usually have information pertaining to employer scholarship programs.

Elks Lodge

Child Care Access Means Parents In School Program #

The Child Care Access Means Parents in School Program, known as CCAMPIS, is the only federal grant program dedicated to providing campus-based child care for low-income parents in postsecondary education.

CCAMPIS is intended to support lower-income student parents who need child care assistance in order to remain in school and graduate with a college degree but most will have to get on a waitlist.

Applications are considered for child care assistance through CCAMPIS funding on the basis of eligibility status, financial income, need, resources, and family contribution levels.

You May Like: Bachelor Degree In Mortuary Science

Find Free Money For College With Federal Grants

What is a grant? A federal grant is a form of federal financial assistance where the U.S government redistributes its resources to eligible recipients who demonstrate financial need.

Below, weve got you covered for Federal grants, State Grants, College Grants, and other grants in special situations. Just follow these steps, and youll have a higher chance of uncovering grants that are the perfect fit for you.

Find this infographic useful? You can download the full version here.

How To Find The Right Sources

Few college-bound students have the financial resources to pay for their post-secondary education entirely out of pocket. Even students with substantial college savings plans typically find that they are left with sizable amounts of unmet need. The average total cost of attending a public four-year college is more than $20,000 per academic year. Students planning to attend a private college or university can expect to spend more than $30,000 per academic year. A college education is a costly proposition, and all indications are that those costs are only going to increase.

With the cost of a college education continuing to rise, most students will need to consider various types of financial assistance. It is not unusual for a students college fund to be comprised of some combination of personal savings, family contributions, scholarships, grants and student loans.

When preparing a college fund, no financial resource should be ignored. Education grants are one of the most popular, and most valuable, sources of financial assistance for college students. With the right grants, students can make their dreams of a higher education a reality.

Recommended Reading: How Do I Know If I Graduated College

What Are The Different Types Of Government College Grants

There are three main forms of government college grants, the Federal Pell Grant, the Federal Supplemental Education Opportunity Grant , and work-study programs. While there are many different types of financial aid available to pay for college, government college grants are considered an excellent choice because they do not have to be repaid. Qualifications differ for each type of federal grant, but are based, at least somewhat, on one’s ability to pay.

The Federal Pell Grant is probably the most widely known government college grant. To qualify for this grant, the applicant must prove financial need. Need is not based strictly on income, it includes the number of people currently living in the household, the number of people in the home currently attending college, and family assets other than income.

Students with the greatest need will qualify for the FSEOG. Students receive this grant when they have a very low expected family contribution for their education. This form of college grant is a supplement to other forms of financial aid.

Diversion Cash Assistance #

Diversion Cash Assistance , often known as Emergency Cash Assistance, provides alternative assistance for single mothers in times of emergency. It is generally offered as a one-time payment in lieu of extended cash benefits.

Families who qualify may receive a one-time grant of up to $1,000 to deal with an emergency or minor crisis, but may vary depending on the severity of the financial crisis.

You May Like: Volunteer Work For College Applications

Federal Grants That Pay For College

The U.S. Department of Education offers a range of federal grants. These need based grant programs provide free college money. They are usually for students attending four year colleges or universities, community colleges, and career schools. The amount of money each person receives may depend on:

- Your financial need

- Cost of attending the college of your choice

- Enrollment status

- Length of Enrollment

The EFC is your Expected Family Contribution. In other words, what you can afford to pay for college. State grants may boost your college fund too. This can help if your EFC is low, and your federal financial aid doesnt cover your tuition.

To come to a number, an EFC asks for several things. Your familys taxed and untaxed income, assets, and benefits. Benefits include unemployment or Social Security. It might also factor in in the size of your family and if more than one person will be attending college in the same year.

The four main types of federal grants that provide funds for college are:

Types Of Federal Grant Programs

There are several different types of Federal grants designed to benefit college students from all walks of life. The focus of the Federal grant program is to help students of all different backgrounds and skill levels attain their dream of going to college. Even if you’re not an ‘A’ student you may still qualify for a government grant.

There are three major forms of Federal grants:

Recommended Reading: College Ave Servicing

Learn About The Grants Available To You

In the Fall of 2019, over 90 percent of our students received financial aid. In addition, Goodwin University offers one of the lowest tuition costs for private, non-profit colleges in Connecticut.

If you are a current Goodwin student or a prospective student researching your options, do not hesitate to reach out to our team of financial aid advisors. We are here to help you achieve your goals, and help put college within your reach. From filling out your FAFSA, to designing a personalized financial aid plan, we are here for you. Learn more by visiting us online, or calling us at 800-889-3282.

Weatherization Assistance Program #

The Weatherization Assistance Program enables low-income families to reduce their energy bills. In most states, priority is given to the elderly and families with children.

One of the primary factors affecting eligibility is income. Depending on what state you live in, you are eligible for weatherization if your income falls below the 200% poverty level.

If you’re planning to apply for weatherization assistance, find your state on the map and contact the local WAP agency serving your area.

Don’t Miss: How Much Is Berkeley College Tuition