You Can Transfer To Another College Or University In A Few Easy Steps:

- Identify why you want to transfer

- Discuss your plans with your colleges academic advisor

- Determine if all your credits are transferable

- Start the college search

- Figure out the financial implications of going to another school

- Gather all required information for your new college application

- Apply

- Confirm your spot

How To Pay For College: 8 Expert

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Asking How do I pay for college? is like asking, How do I get healthy? or, How do I learn another language? There are lots of answers, but theres not always one clear path.

If youre like most students and families, youll cobble together funds from multiple sources. Some types of financial aid are better than others, so use the following advice in this order:

Paying Off Different Types Of Loans

There are many different types of loans available when you’re planning how to pay for college. Believe it or not, the way you pay them back may depend on what type of loan you have.

Whether you’re the student or the parent, you may have taken out a home equity loan or home equity line of credit to cover college expenses. During repayment, most home equity loans work like mortgages. Your key concerns should be whether you can make your payments on time, stay ahead of the market value on your property and prevent foreclosure. If you have a HELOC, the mortgage lender may have other options when the borrowing period ends, such as moving the debt to a traditional loan.

You might have unsecured loans instead of, or in addition to, equity loans. If you have a private student loan, check your loan paperwork for limits, interest rates and repayment terms. If you have a federal student loan, your interest rates and repayment terms depend on the type of loan, the date the loan was made and your selected repayment plan.

Federal Perkins Loans give you up to 10 years to pay, and you’ll owe your school directly for that amount. Also with the Perkins, you don’t have to pay while you’re enrolled at least half-time, and you’ll have a nine-month grace period before repayment when your enrollment ends.

You can choose one of the following repayment plans for your federal student loans:

Read Also: Can You Go To College For Free If Your Native American

Ask Your School For Additional Funding

Once youve settled on your school of choice, dont necessarily settle on the initial financial aid award package.

It may behoove your family to contact your campus financial aid office and ask for more support. According to experts, there are three occasions when you could successfully negotiate your aid package:

If you receive aid packages from multiple schools, compare them side by side to confirm which offer is the most generous.

Walmart And Sams Club

Walmart is the largest employer in the country, with an estimated 1.6 million U.S. workers and it will pay for college. Through its Live Better U program, all of them are eligible for specific degrees at partner universities.

Under the program, Walmart offers tuition coverage for the cost of higher education. For many years the retailer required that employees pay $1 a day for their education, but it just announced it is now paying the full tuition. Degrees are offered through the University of Florida, Brandman University and Bellevue University. These schools were selected for their focus on serving working adult learners.

Employees who live near a partner university may attend in-person, but the vast majority choose to attend online, a Walmart spokesperson said.

And this isnt only for a bachelors degree. Additional perks through Live Better U include discounted masters degrees and free foreign language classes. Eligible employees can also pass on these benefits to family members.

Don’t Miss: Can You Apply To Multiple Colleges

How To Apply For A Loan

Federal student loans may only go to students that enroll at accredited institutions that participate in the federal student loan program. Students must complete school applications for financial assistance in addition to the FAFSA. Most school forms include the FAFSA and require students to file it before the annual deadline.

Students can apply for federal loans and most state loans through the FAFSA. Most states use the FAFSA as a basis for making determinations of need after establishing the amount of federal grant, scholarship, and loan aid is available. The federal student loan program has overall limits and limitations based on need. The participating college or university must use the FAFSA filing to determine the allocation of loan funds to the student. Students must fill out the school financial aid forms which may ask slightly different questions that the federal form.

Academic Requirements And Documentation

International students must meet academic standards and provide specific documentation to enroll at a U.S. college.

For example, most universities require transcripts during the application process. For transcripts in a language other than English, schools typically require applicants to provide a translation from the institution or a certified translation agency with the original document.

International applicants often provide SAT or ACT scores as part of their application. Students complete the international registration process to take one of these standardized exams.

In addition to academic documentation, schools generally require proof of English language proficiency. Many schools waive the proficiency requirement for students who meet certain requirements, such as meeting a minimum GPA in a college-level English course.

Finally, many schools require international applicants to provide financial documents or immigration records to their school. Each school maintains independent academic and documentation requirements. Research the application process for each potential school.

You May Like: How To Get Noticed By College Football Scouts

How Much Will I Get In Pell Grant Money Whats The Maximum Pell Grant Award

Your Estimated Financial Need helps determine how much Federal Pell Grant aid youre eligible to receive.

However, there is a maximum cap of $6,195 for the 2019-2020 award year.

In some situations, a student may receive up to as much as 150 percent of the students Pell Grant award for the award year, often referred to as year-round Pell. This could happen in a situation where a student is enrolled in both the fall and spring semesters, but receives an award for the summer semester as well. For example, the student receives the Pell Grant award for $2,000. The student would most likely receive $1,000 for the fall semester, and $1,000 in the spring semester. Some circumstances might allow the student to receive $1,000 for the summer semester as well, resulting in 150 percent of the students Pell Grant award. However, even the year-round pell is subject to that $6,195 maximum.

Remote Social Media Manager

You will create, manage, and grow brands through content creation and advertising campaigns on various social media platforms or sites like Facebook, Twitter, Instagram, and more.

Look for social media manager jobs, employment sites like FlexJobs, and or apply directly to companies like on 99 Dollar Socialthat advertise jobs for social media managers.

You can earn $12-$15 an hour working part-time as a virtual social media manager.

Read Also: College Book Price

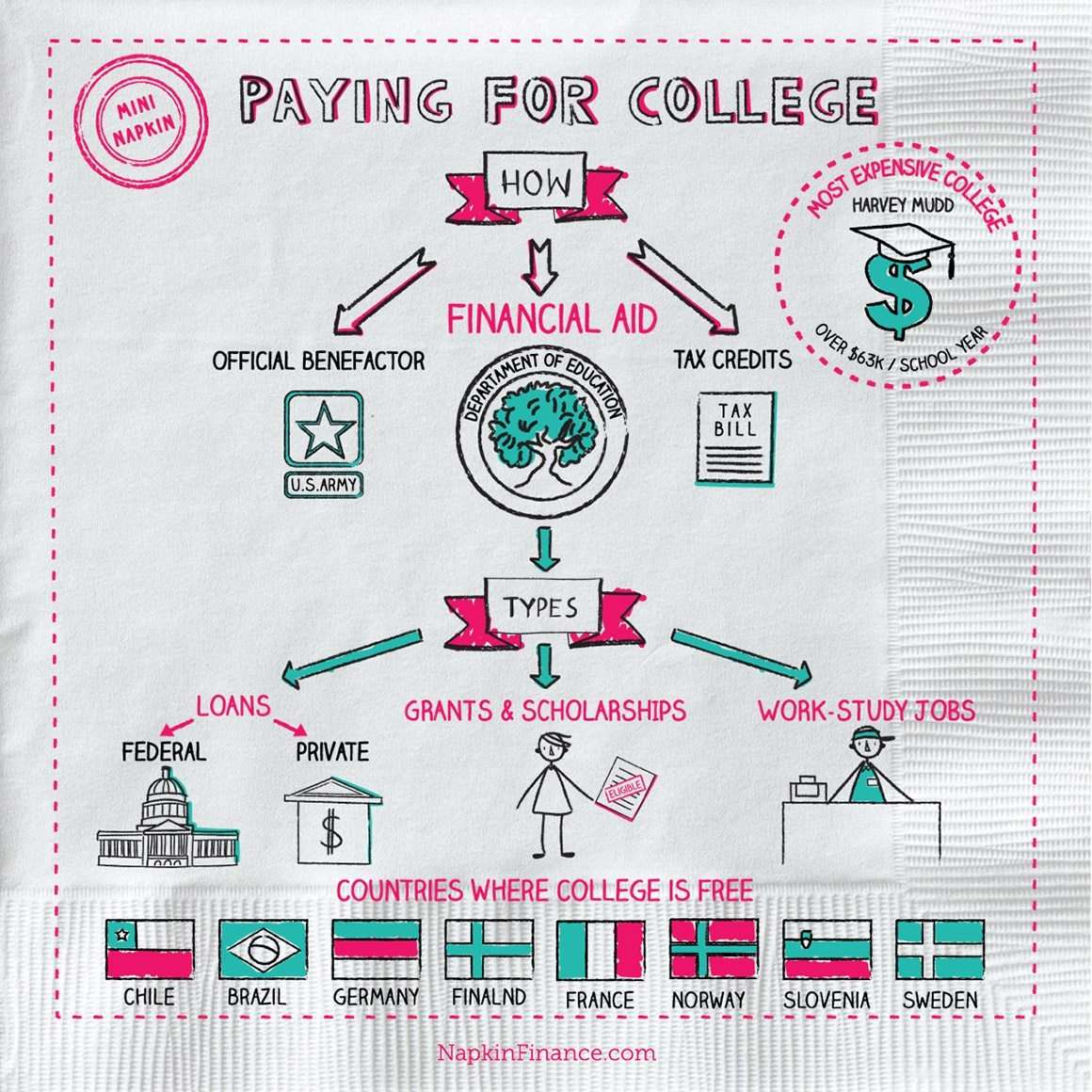

Paying For College With Financial Aid

Paying for college with financial aid is a necessity for most students, and comprises scholarships, grants, student loans and work-study programs. Scholarships and grants can be need-based or awarded based on academic merit theyre ideal because they don’t need to be repaid. Student loans are funds for school that must be repaid, and federal work-study programs provide need-based part-time employment to help students pay for college.

Depending on the type of financial aid, the funds can be used to pay housing expenses, renters insurance, transportation, textbooks, supplies and more. The cost of living during college can vary widely depending on where you attend school and could be much higher or lower than your hometown. The FAFSA can help you determine how to access specific types of financial aid and if you qualify for grants and other support.

Does Walmart Really Pay For Its Associates College Education

Yes! You heard that right. Our U.S. associates can pursue a degree at no cost through our partnership with Guild Education. No strings attached.

Our Live Better U program is about making education accessible, providing the tools to help people be successful, and creating a path for our people to go as far in their educational journey as their hard work and talents will take them.

Walmart associates can earn a college degree or certificate or even finish a high school diploma or learn a language for free. Through our partnership with Guild Education, we offer degrees in business, supply chain, technology, and health. Additionally, high school students have access to free ACT and SAT prep and up to seven hours of free college credit through Live Better Us College Start program.

Visit the Live Better U website or check out our first-year report card to learn more about how Walmart is investing in its associates personal and professional success.

Read Also: Can You Apply To Multiple Colleges

Where Would You Work

Students can work on-campus or off-campus depending on the school and the students choice of assignments. Typical off-campus assignments include private for-profit employers, local community-based organizations, and non-profit organizations. Undergraduate students typically get hourly pay while graduate students sometimes get salaried positions. The hourly pay must exceed the minimum wage, and the typical pay for work-study students is above the minimum wage. Students get paid at least once per month and they usually have a choice of getting funds directly or sent to their school to pay costs and required fees.

The federal work-study program policy encourages participating schools to assign students to work in fields or types of work that have some relevance to the students field of study. This policy may be more evident for graduate school when students can take professional level positions. It is an ideal situation for the program to place students in work that is consistent with their studies or career paths where possible.

You Got In Now How Do You Pay For It

Once you have selected the schools, evaluated their net prices, and sent in your application, it becomes time to wait for those acceptance letters . While you are waiting you can still continue your search for financial aid and how to pay for college. Oftentimes even college savings arent enough to cover the full college cost.

Luckily, there are quite a few places to find additional financial aid. Ideally, you should maximize free gift aid first before turning to student loans while youre figuring out how to pay for college.

Also Check: Universities That Accept Low Gpa

Dollar General’s Business Is Booming It’s Also Vulnerable To Crime Police Say

New York Walmart will pay for full college tuition and book costs at some schools for its US workers, the latest effort by the largest private employer in the country to sweeten its benefits as it seeks to attract and retain talent in a tight job market.

Good Debt Or Bad Debt

Financial experts vary in their assessment of student loans when compared to other debt.

Bob Schumann, a financial planner, says student loan debt is good. Schumann’s reasoning is that you can deduct the loan interest, the loan rates stay low and the debt “paves the way for you to make more money throughout your lifetime” .

Whether or not the debt is good or bad, student loan debt does affect your credit. A high credit rating allows you to borrow more at lower interest rates. To keep your high, make your scheduled payments on your student loans and look for deferment or forbearance options if you have trouble making payments.

School loan debt is also a risky business for the university itself. Students who default on their loans to for-profit institutions put those schools at risk of being shut out of the federal loan and grant programs. In 2007, 21 percent of students who started repayment to for-profit schools defaulted on their loans, while only 10 percent of students in four-year public schools defaulted on their loans. With 70 percent of their revenue coming from grants and loans, for-profit schools could suffer a financial blow if their enrolled students are denied financial aid because of their graduates’ defaults .

Also Check: What College Has The Best Doctor Program

Apply For Private Scholarships

There are thousands of private scholarships out there from companies, nonprofits and community groups. Ask your high school guidance counselor or use a free online service like Scholly that suggests scholarships you might be eligible for. A company called NextGenVest offers a free mentor who can also suggest scholarships, as well as help you understand your aid award.

Pay For College With Cappex

With 7 of the best ways to pay for college now covered, we hope this article has put you in a better position to fund the next step of your education. Want to take your research further? Ready to start securing funding? Take some time to read other financial aid articles here on our site, and sign up to search and apply for scholarships in seconds.

Also Check: College Terre Haute Indiana

Work While You Attend School

You might wish you could pay for college without working, but a job should be something you consider. There are several approaches to working and attending school at the same time.

You can work in the summer and save all you earn to pay for your expenses during the school year. But if you can work full time and attend school part-time, you might qualify for tuition reimbursement through your job. Another option is to attend college full time and work part-time.

The key to making this work is finding a great college job. Work-study jobs, for example, are a great way to make money while gaining valuable work experience. Alternatively, you might want to consider some side hustles to help you raise extra money. You’ll have to plan on working at least during the summers if you don’t qualify for a Pell Grant.

Boost Your Leadership Skills And Extracurriculars

Scholarship committees consider multiple factors in awarding funds. While good academic performance helps applicants stand out, strong leadership skills and extracurricular activities boost your chances of receiving a scholarship.

Students often provide evidence of volunteer service, work experience, or leadership skills in their scholarship application. Completing a community project, taking on a leadership role in a school organization, or volunteering as a tutor increases a student’s chances of receiving a scholarship.

Read Also: Do Colleges Offer Health Insurance

How Does Paying For College Actually Work

May 15, 2019 by Libby Donovan

college students talking about paying for collegeAs your child approaches college, you may be overwhelmed by a mountain of information on colleges you didnt know existed and loan offers from banks youve never heard of. Fortunately, its not all that complicated, and all colleges generally follow the same guidelines.

Aside from looking at schools that are good choices for your childs chosen area of study, there are other questions to ask your child before picking a college.

That last question is the big one. In an ideal world, you began saving for your childs college education when he or she was just a glimmer in your eye. Unfortunately, this isnt an ideal world, and many students and parents struggle to pay for college.

How To Pay For College: Private Student Loans

If a loan does not come directly from the federal government, it is considered a private loan.

Private student loans stem from multiple sources, including community organizations, nonprofits, corporations, banks, and even universities themselves. The interest accrued on private loans can be deducted from taxes, which can make them attractive to some students depending on their situation.

When youre deciding on how to pay for college, private loans should be considered a last resort for funding your degree, as the interest rates tend to be higher and the repayment plans are less flexible. If you find yourself needing one, its paramount to find a loan option that best fits your situation. With College Raptors free Student Loan Finder, you can look at interest rates and terms from leading lenders side by side.

Interest Rates

As a loan borrower, you will not only pay back the original amount that you borrowed, but also an interest that accrues every month based on the outstanding balance. For most borrowers, the interest rates are somewhere between 210%. Generally speaking, federal interest rates tend to be lower than private loan rates.

Factors that affect your interest rate may include:

- Savings habits

Variable Rate vs. Fixed Rate

All federal loans have a fixed interest rate, but private loans have an option called a variable rate. With a variable rate, the interest rate can go either up or down .

Co-Signers

Flickr user Dominican University

Recommended Reading: How To Get College Discount On Apple Music