Colleges Want To Help

If you find yourself struggling with covering the high cost of college tuition, you are not alone! With the state of the economy, financial aid officials are working hard to accommodate students in all financial situations.

To have the highest chance of receiving the money you need, it is best to start early! Contact your prospective colleges to find out their policy on financial aid, and make time to visit their websites where helpful information may be posted.

In addition, a number of colleges offer payment plans to help students manage the cost of their education without going into debt. Heres a list of almost 250 online colleges offering monthly payment plans to their students.

Can I Get Financial Aid If Im Not A Us Citizen

In many cases, yes.

To start, many private and institutional scholarships are available regardless of your citizenship.

Beyond that, you may be able to qualify for federal student aid if youre a U.S. national or a U.S. permanent resident. And there are many other cases as well, including if you have a certain immigrant status or are a citizen of one of the Freely Associated States.

For a full list of ways you can get federal student aid without being a U.S. citizen, visit this page. If youre unsure if you meet these requirements, consult with your colleges financial aid office.

Get The Student Aid You Deserve

I hope this guide has helped you understand how financial aid works. If you take nothing else away from this article, remember to apply for financial aid. If you dont, then you could miss out on major college savings.

Besides financial aid, there are plenty of other ways to make college cheaper. Check out these 39 ways to cut the cost of college to learn more.

Read Also: Can Single Moms Get Paid To Go To College

Determine Your Financial Situation

The first step in figuring out what you need in terms of financial aid is having an honest look at your familys financial situation. Are you able and willing to cover the cost of tuition?

Having a clear understanding of your financial situation and establishing realistic expectations is essential to moving forward in pursuing other forms of financial aid.

The #1 Reason To Apply For Financial Aid: Colleges Want You

Colleges want to see your ability to pay for college and will use tuition discounts to get well-off clients. Wealthy parents are the ones that contribute to endowment funds and booster programs. Plus, colleges want to be attractive and offering tuition discounts helps increase enrollment for these highly desirable students.

Recommended Reading: What Colleges Are Still Accepting Applications For Fall 2021

Where And How To Apply For The Fafsasteps For Beginners

Once youre ready to begin the FAFSA, keep these tips in mind:

Understanding Expected Family Contribution: Federal Method

After the FAFSA is completed, the government will determine your Expected Family Contribution , using the “Federal Method,” which is determined by your financial information. Your EFC is NOT what you will have to pay for tuition! Rather, your EFC is a government formula that provides colleges with an indication of what you might be able to afford.

Within five days of filling out the FAFSA, you should receive your Student Aid Report . On this report, you’ll find your EFC and your Data Release Number , which is required for any changes to your FAFSA. If the information on your SAR is correct, your FAFSA is complete. Keep a copy of the SAR for your records

Read Also: What To Do In College

When It Makes Sense To Not Apply For Financial Aid

If you have made it this far, you know that we are big proponents of applying for financial aid. For almost all students, applying for financial aid is the right move.

However, in cases where a family is able to comfortably pay for the full cost of attendance without any concerns, you may not have to apply for financial aid. So, if your family is donating a building or making a major donation to the school, you probably dont have to worry about financial aid. For everyone else, apply!

Reasons Why Everyone Should Apply For Financial Aid

One of the most common questions I hear is, Dont I make too much to apply for financial aid? This is an excellent question. If you earn a high income, own a nice home or two and have money saved for college and retirement, why would you bother completing those cumbersome and intrusive financial aid applications?

While most of my clients looking for help with a college funding plan do not qualify for need-based financial aid, I still advise them, plus every colleague, friend, and relative I know, to apply for financial aid. Here are the top five reasons why, and some may surprise you!

You May Like: How Much Does It Cost To Go To Berkeley College

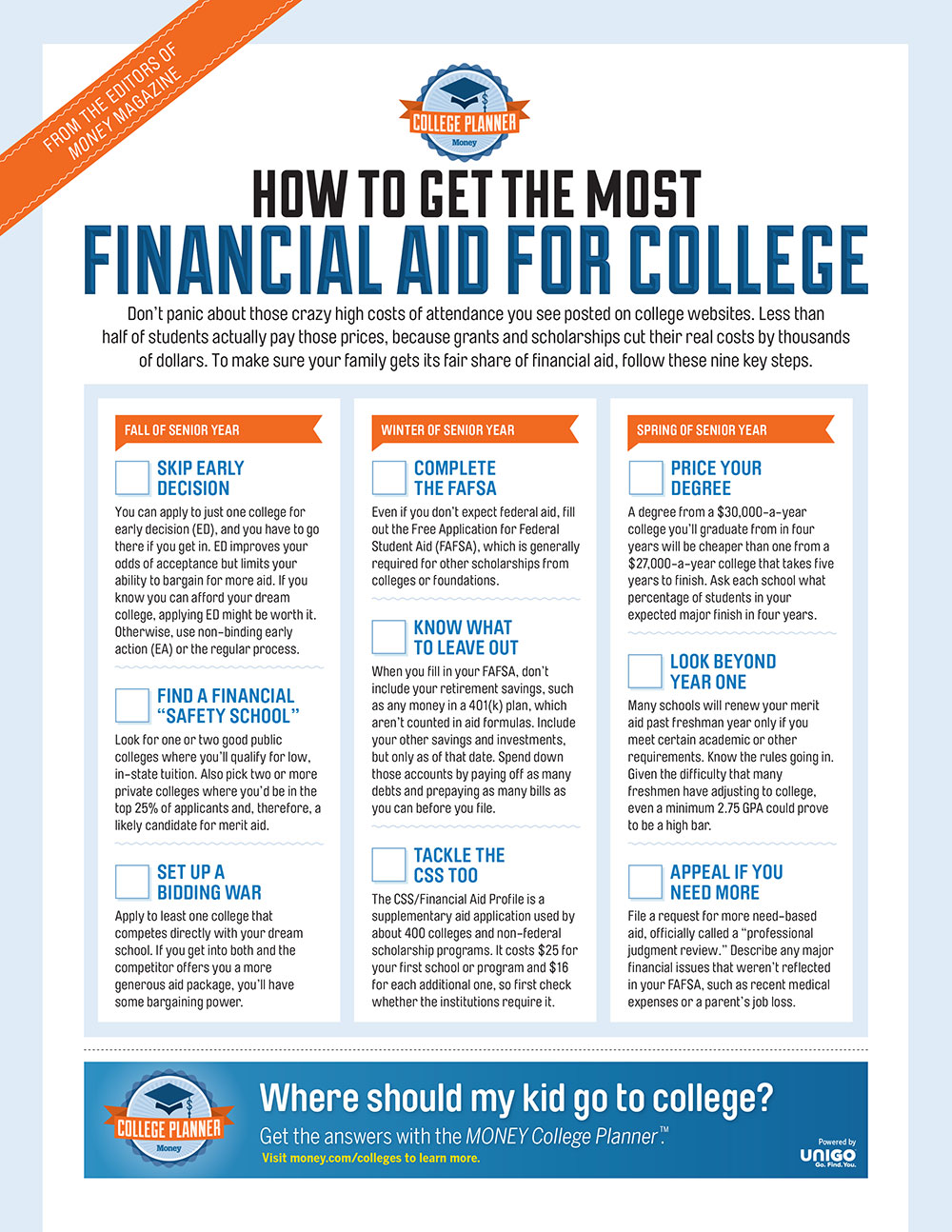

Two Important Application Forms: Fafsa And The Css Profile

There are two primary pathways to financial aid as you enter college. One is the Free Application for Federal Student Aid sponsored by the U.S. Department of Education and required for you to be considered for federal aid as well as for most college and state assistance.

The second, known as the CSS Profile, is sponsored by the College Board and used by roughly 400 mostly private colleges and universities to allocate non-government financial aid from those institutions.

Each form has its deadlines and procedures You should submit the FAFSA even if you don’t believe you will qualify for federal financial aid. That’s because you may be wrong, and even if you’re right, the FAFSA is also required for most local, state, and individual school financial aid, including merit scholarships. Whether you should submit the CSS Profile probably depends on whether the financial aid you are interested in or the school you plan to attend requires it.

What Kinds Of Schools Meet 100% Of Need

As you are looking over the lists below, you might start to notice a pattern. Most of these schools are well known for being excellent in their fields. It’s usually the top schools that are committed to and able to meet 100% of their students’ financial needs.

There are a few reasons for this.

The first is that, traditionally, these schools are attended by wealthier students. When many students are paying full price, and some even have family members making financial donations to the school, these schools will have more money to spread around to students who are not as well off financially.

Many of these schools also have larger endowments than the average university, which means there is more money to give to students who need it.

Finally, meeting 100% of students’ financial needs has become a selling point for top schools that are competing for top students. Once one school started having this policy, others had to match it to stay competitive and continue being attractive to the best students.

The bottom line is that you can attend a top school and have it be affordable.

Higher education costs in the United States have been skyrocketing for the last 20 years, but it’s still possible to get a great education without breaking the bank. Learn how you can maximize the quality of your college education while minimizing costs with our six-hour online course.

You May Like: Is Carrington College Nationally Accredited

What Do I Need To File The Fafsa

To fill out the FAFSA, you need your driver’s license and Social Security number. The Office of Federal Student Aid asks for financial documents like your most recent W-2s and federal income tax return. You must also provide current bank statements investment records for stocks, bonds, and real estate and farm and business assets.

Additionally, you must submit untaxed income records, which cover things like child support, veterans noneducation benefits, and interest income. If you are a dependent, your parent or guardian must submit these materials, as well. Eligible noncitizens undergo a similar process but use their Alien Registration number in lieu of a Social Security number.

What Is The Expected Family Contribution

The EFC is a number that financial aid offices use to determine how much financial aid you will receive.

The formula to calculate EFC is complicated, but it takes into account factors such as your familys income, assets, benefits, family size, and number of family members attending college during the year.

It is not the amount your family will have to pay for college or the amount of aid you receive. Rather, it factors into financial aid calculations.

Also Check: Is Ashworth College Recognized By Employers

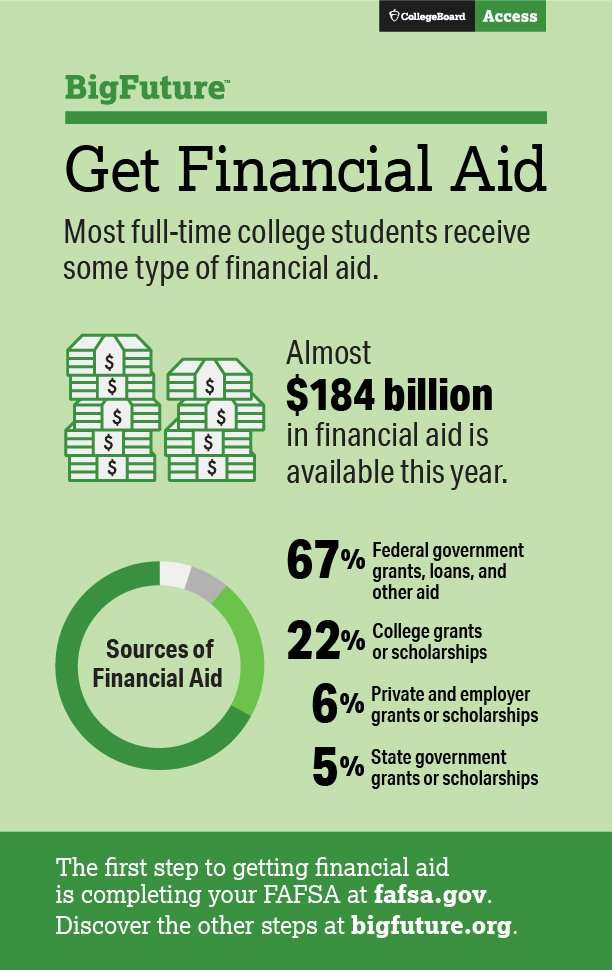

What Is Financial Aid How To Pay Less For College

As college costs continue to rise, financial aid has become a necessity for most college students. Ideally, the listed cost of attendance wont deter you from applying to or attending the college of your dreams. Knowing about the process will enable you to maximize the amount of financial aid for college you receive and prevent finances from becoming an impediment to reaching your college goals.

In this article, I will define and explain the different types of financial aid that are available for college. Furthermore, I will explain how colleges determine your eligibility for financial aid, and Ill offer you guidance and resources to make sure you know all the different types of aid available to you.

Why Is The Fafsa Important

Higher education costs continue to rise. CollegeBoard reports that in-state students who attended public, four-year institutions in 2020 paid on average $21,950 in tuition and room and board, while out-of-state learners paid an average of $38,330. Private colleges and universities may charge in excess of $50,000 per year.

To offset these costs and avoid hefty amounts of debt after graduation, you need to prioritize financial aid. The FAFSA allows you to apply for multiple loans, grants, and scholarships simultaneously through an accessible online platform. By completing this form in a timely manner, you can tap into the $120 billion in annual funding offered by the Office of Federal Student Aid.

Additionally, the FAFSA comes with zero risk. You do not need to pay a fee or accept any loans or other forms of aid that come your way. For additional information on FAFSA myths, check out the Department of Education’s blog.

You May Like: What Schools Are Still Accepting Applications

Your Guide To The Fafsa

- The FAFSA is a form that allows U.S. citizens and eligible noncitizens to apply for federal loans, grants, and work-study programs.

- The FAFSA calculates your eligibility based on financial need with respect to your estimated cost of attendance and family contribution.

- You can submit the FAFSA online or by mail, designating up to 10 colleges and universities as recipients.

- The FAFSA is risk-free, since you do not need to accept any of the awards presented in your financial aid package.

A Note from BestColleges on Coronavirus and Financial Planning in College

The COVID-19 outbreak has caused rapid and significant changes in students’ lives. Campus closures have pushed students to online learning, and life after graduation is uncertain for many.

Saving money and budgeting in college is top of mind for many students, even in the best of times. Our Financial Aid Guide can help you understand and plan your finances in college.

We are also working to provide information and resources to students about the impact of coronavirus on college life. Read our latest Coronavirus Resources for Students.

We encourage students to contact their college’s financial aid office for any financial questions related to coronavirus. Many services have moved online as schools work to support students through this challenging time.

Reason #: Be Prepared To Appeal

When you apply for financial aid by completing the FAFSA and CSS Profile, you are letting colleges know you care about the cost. This also means that parents need to be prepared to appeal financial aid awards. Yes, you can appeal your financial aid and merit aid package! Another tip many parents dont realize is that if their student is accepted from two or more colleges with different net prices, some colleges will increase the merit aid offered in order to be competitive.

To find out how to appeal a financial aid award, contact the financial aid office and ask about the appeal protocols. Many colleges require crafting an appeal letter, which is a powerful tool for parents to state their case and provide supporting documentation. Colleges will respond to your appeal letter and it may provide your student with the opportunity to attend their first choice college for less money!

Read Also: Single Mom Going Back To School Grant

Is There A Limit On Financial Aid

Financial aid is always a highly sought after and hot topic for most families when it comes to figuring out how to pay for their childs college education. Will we qualify for financial aid? How much money will we get, if any? And, is there a limit on the amount of financial aid that we can receive? Well, the answer is, of course there is a limit! Very few things in life are infinite and certainly when it comes to financial aid and paying for college I would say there is DEFINITELY a limit!

Our blog How Much Financial Aid Should I Expect walks you through how financial aid awards are determined, how to calculate your Expected Family Contribution and when you will know how much money you are receiving.

As far as the limit on financial aid, that is dependent on what your familys defined financial need is , how generous a specific school is as it relates to financial aid, and where your child falls in their applicant pool.

How To Maximize Your Financial Aid

After youve completed your FAFSA as early as youre able to and received your award letter that details how much aid youre on track to get, theres a chance you might not get enough money to cover your college costs. Or theres a possibility that you want to limit what you borrow in loans so you dont have as much to repay later. Regardless of your circumstance, there are other ways to get financial aid.

If you dont qualify for need-based financial aid awarded through the federal government, you can apply for merit-based scholarships or other types of grants that are given out at the federal, state, local and school level. Many businesses and organizations award grants and scholarships in specific industries and fields. Search online for scholarships based on your desired major to see what you qualify for.

Along with that, theres a lot of free money on the table based on race, religion, sex, ethnicity, sexual orientation and more. You arent obligated to accept all the aid youre rewarded, especially if youre liable for repaying it later on. Exhaust all your free money options through grants and scholarships before accepting loans. Use scholarship and regular search engines to find free money from the federal level all the way down to school-specific aid.

Don’t Miss: Is Ashworth College Worth It

Reasons For A Financial Aid Appeal

Written by Shannon Vasconceloson January 12th, 2021

by Shannon Vasconcelos, former financial aid officer at Tufts University

Fill Out The Fafsa And Write Down All Login Information

- Prior to filling out the FAFSA, take thirty minutes to watch Karen Cooper, Director of Financial Aid at Stanford University, work through the entire FAFSA on Khan Academy.

- Gather and organize the documents that you will need to make the process go smoothly.

- Use the IRS Data Retrieval Tool to transfer your tax information into your FAFSA form. According to the Federal Student Aid website, “The IRS DRT remains the fastest, most accurate way to input your tax return information into the FAFSA form.”

Recommended Reading: Are Summer Classes Easier