Thanks To A Program Called Michigan Reconnect Adults Over 25 Now Have The Opportunity To Attend A Community College For Free

Adults over age 25 get free college tuition in mi. News sports autos entertainment usa today. Residents 25 and older without a degree are eligible. If you live in michigan and are over the age of 25 and wishing you had a way to attend college for free, youre in luck. Free tuition for students with expected family contributions on the fafsa of under $8,000.

Gretchen whitmer and a bipartisan group of lawmakers announced the $30 million michigan reconnect program which is expected to help 4.1 million people get free community college or a skills. Residents 25 and older without a degree are eligible. Michigan residents 25 and older who dont have a college degree can now apply for funding to. Adults over age 25 get free college tuition in mi. Free tuition for students with expected family contributions on the fafsa of under $8,000.

But figuring out where you can pay nothing for college tuition and where youd still have to write hefty checks is not always simple. February 13, 2021 chaunie brusie 167 views. Gretchen whitmer and a bipartisan group of lawmakers announced the $30 million michigan reconnect program which is expected to help 4.1 million people get free community college or a skills. If you live in michigan and are over the age of 25 and wishing you had a way to attend college for free, youre in luck. News sports autos entertainment usa today.

Average Cost Of College In America

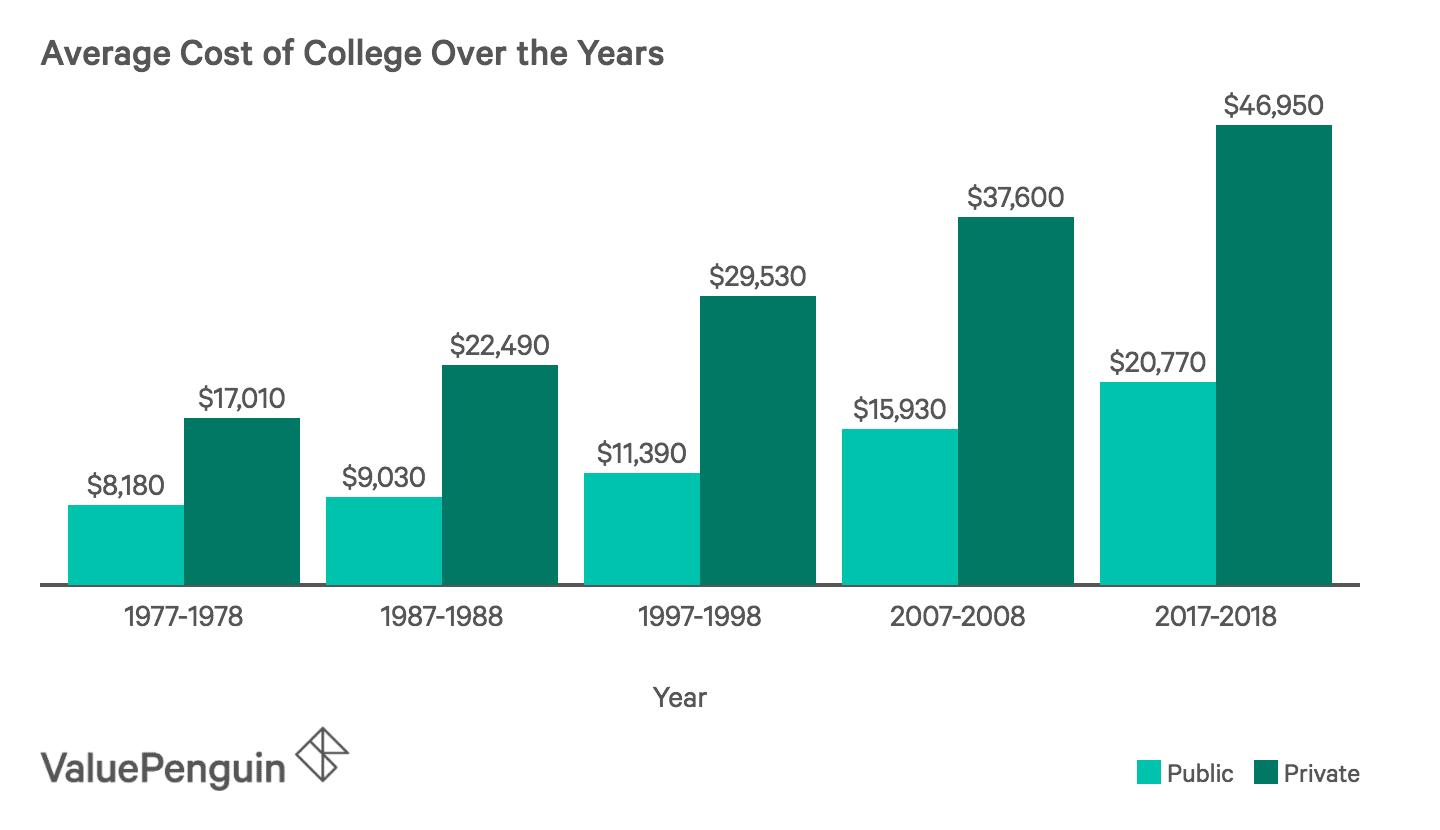

Our researchers found that the average cost of college for the 20172018 school year was $20,770 for public schools and $46,950 for nonprofit private schools, only including tuition, fees, and room and board. Each year, school costs have continued to increase, even accounting for inflation. We took a look at higher education data from the College Board to provide a deeper understanding of the costs and the differences between states, school types and degrees.

Average Cost Of College In Pennsylvania

College in Pennsylvania costs 30.27% more than the national average cost of attendance at a public 4-year institution. The average private university costs 23.57% more, and local community colleges are 65.89% more expensive than they are nationwide.

| Charge |

|---|

| -4.47% |

Recommended Reading: Transferring To Cuny

How To Calculate The Cost Of Attending College

How much college is going to cost you really depends on your personal situation. But there are a couple of tools you can use to figure out how much youll have to pay:

- Net price calculator.Most schools have a net price calculator on their financial aid website that gives prospective students an estimate of how much your family is expected to contribute toward your educationmore info button and how much financial aid you might receive.

- FAFSA4caster. The FAFSA4caster gives you an estimate of how much federal aid you might qualify for at a particular school including grants, loans and work-study as well as the potential net price.

You might want to use both to get a more accurate estimate. A schools net price calculator might have a more accurate reading of institutional scholarships and grants you might qualify for. But the FAFSA4caster can give you a better idea of how much federal aid you might receive.

Apply For Financial Aid

Financial aid can bring down your costs no matter where you end up – if you submit the right application, that is. Anyone can apply for federal student aid with the FAFSA, the application for the biggest source of student financial aid in the US.

Many colleges and universities use the FAFSA to award their own financial aid funds. For more information, check out our step-by-step guide to applying for financial aid.

Read Also: Raising Money For College

How Should You Approach Rising College Costs

Its frustrating to see never-ending tuition inflation and feel powerless against it. But as an informed consumer, you can make smart choices to ensure that you dont pay more than you can afford. You may choose to attend an in-state public college, for example, or to attend an affordable community college for two years and then transfer to a university to complete your degree.

No matter what type of school you plan to attend, use a net price calculator to determine how much you might actually pay at a certain school. You may find that you qualify for more financial aid than you expected. Also, make sure to fill out the Free Application for Federal Student Aid to be eligible for grants, scholarships and low-cost federal student loans. That can make a significant difference in the amount you pay out of pocket.

Tuition And Fees: Real

Here, I’ll go through a couple of examples of tuition and fee breakdowns at real schools. This way, you’ll be able to see exactly where students’ money is going.

Example #1: Arizona State University College of Liberal Arts & Sciences, Full-Time In-State Student

An in-state college student at ASU would be responsible for the following tuition and fees before any financial aid funds were applied:

|

Description |

A lot more expensive than ASU, right? The major difference here is that ASU is a public school whereas BU is private. To learn more about why these sticker prices are so high, read our guide explaining why college has gotten so expensive.

Although BU might come with a pretty high sticker price, that doesn’t mean the average student pays $48,436 every year for tuition and fees. At schools like BU, students’ average Net Price tends to be much lower. For more info on sticker price versus Net Price, check out our guide to college costs.

Don’t Miss: Ashworth College Masters

Secchia Institute For Culinary Education At Grand Rapids Community College

Grand Rapids

Secchia Institute for Culinary Education at Grand Rapids Community College offers programs accredited by the American Culinary Federation, several with exemplary status. SICE culinary programs graduates are prepared to set into a variety of culinary positions in just about any type of venue. Associate degree students in their final year of study can gain professional experience in the workforce or can take additional coursework to prepare to transfer to a bachelors degree program. Certificate students take specialized courses to focus on their individual area of interest. Student operated facilities such as Heritage Restaurant and Fountain Hill Brewery give advanced students the opportunity to demonstrate their skills and gain experience. Art and Bevs Bistro features a variety of baked goods prepared by baking and pastry students. Secchia has received many awards and honors including the National Award of Excellence in Post-Secondary Food Service Education from the National Restaurant Association.

Related Rankings:

Read Also: Colleges That Take Low Gpa

Average Cost Of College By Flagship University

University of Wyoming had the lowest in-state tuition while University of South Dakota had the lowest out-of-state tuition, which lines up with the state rankings. Unlike the state rankings, Pennsylvania State University had the highest in-state tuition at $18,436, with the University of New Hampshire ranking as a close second. And the University of Michigan had the most expensive out-of-state tuition out of all the flagship universities.

| Flagship university |

|---|

Recommended Reading: How To Tell If Someone Graduated From College

Sorting Out Grants And Loans

One of the key things for students and their families to determine is the breakdown of scholarships and grants vs. student loans in the aid offer.

Grants don’t have to be repaid. They come from colleges themselves in the form of merit- or need-based scholarship aid. Some are for one academic year only, while others cover as many as four.

Grants also come from private sources such as local organizations and foundations. The federal government awards grants as well, primarily in the form of Pell Grants.

One of the key things for students and their families to determine is the breakdown of grants vs. loans in the aid offer.

Loans are a different matter. They do, of course, have to be repaid, and all have varying terms.

Federal loans are either subsidized or unsubsidized. If you have financial need, you can get subsidized loans, which come with low interest rates and the option to defer payments interest-free until after you graduate.

You don’t have to demonstrate financial need to get unsubsidized loans, which have a slightly higher interest rate. And while you can defer payments with unsubsidized loans, too, you must pay interest along the way.

In addition, your parents can take out a federal Direct Plus Loan.

Finally, you can get a private loan from a bank or other financial institution. Rates vary considerably and tend to be higher than federal loans. Your college also might offer loans as part of its aid package. Some private loans allow deferment.

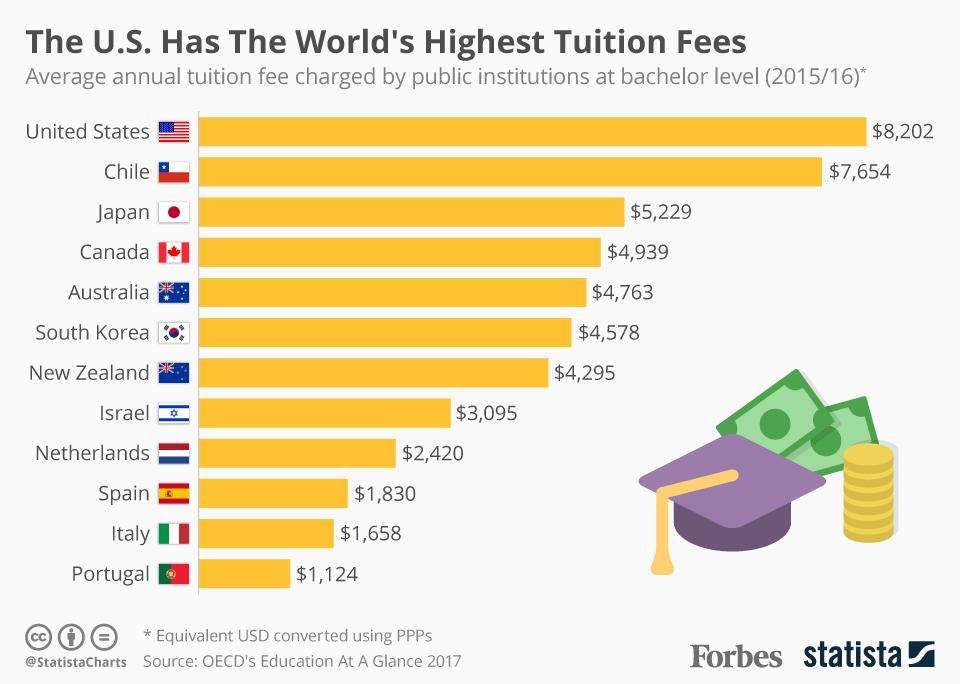

Why Is College So Expensive In America

Although some of the top-ranked colleges in the world are in the United States, this isnt the only reason why higher education in America is so expensive. When looking at the total overall price of college the U.S. almost always costs more in comparison to other parts of the world. This is because American college students tend to live away from home during college more often than students in other countries. Living expenses during college can easily cost much more than just tuition and books.

The cost of a college education in America is also high due to the competition for students. Look at many colleges and their campus living arrangements in the U.S. today. They are much more extravagant than they were a few decades ago. Luxury dorm living with amenities costs money and this is passed onto the people that attend the college of their choice. Universities in the U.S and parents are telling young adults they deserve the college experience. People are willing to pay for this with decades of student loan debt. Colleges in America are more than willing to accommodate this.

Also Check: College Beds Size

Oakland Community College Tuition & Cost

Bloomfield Hills, Michigan

How much does it cost to attend?

In District Michigan Resident Sticker Price

| Fee |

|---|

| Other Expenses Budget | $2,630 |

In district Michigan residents should budget an annual total cost of $14,558 to attend Oakland Community College on a full time basis.This fee is comprised of $2,328 for tuition, $7,800 off-campus housing, $1,600 for books and supplies and $200 for other fees.

Net Price

Net price is indicative of what it actually costs to attend Oakland Community College when typical grants and scholarships are considered. The net price varies by family income and financial need.

Average Net Price 2019/2020

| Family Income | |

|---|---|

| $110,000+ | $8,478 |

The average reported annual net price for Oakland Community College for students receiving grants or scholarship aid was $3,598 in 2019/2020. Net price includes tuition and required fees, books and supplies, and average cost for room and board and other expenses

Explore Oakland Community College

Dont Miss: Ed2go College Credit

Frequently Asked Questions About College Costs

What is the average cost of college in 2020?

The average published cost for tuition and fees at a private, non-profit four-year college in the US was $37,650 in 2020-2021. If youre considering going to college in your home state, you can expect to pay around $10,560 in tuition and fees at a public four-year college. If you want to go to college in a different state, you can expect to pay an average of $27,020. International students should expect to pay at least as much as out-of-state students at state schools, though there may be exceptions. Private colleges generally charge the same for all students, regardless of where they come from.

How much does four years of college cost?

]The average total budget including tuition, fees, room, board, and other related expenses for a private college at $54,880 per year in 2021-2021, according to College Board. Assuming that expenses remain constant throughout your four-year academic career, this comes out to a total of $219,520 for your degree. An out-of-state student at a four-year public college will spend approximately $43,280 for 2020-2021, making their total expenses for four years an estimated $173,120. An in-state student averages total expenses of $26,820 for the 2020-2021 academic year, coming out to a total of $107,280.

What are some of the costs of college?

How much does community college cost?

Is community college free?

How much do college textbooks cost?

How much will college cost in 18 years?

Recommended Reading: How To Get 15 College Credits Fast

Average Cost Of College Tuition: How Much Do You Have To Save

Theres no denying the cost of getting a college degree.

As a parent, maybe you want to shield your child from the burden of student debt.

It can take graduates 10, 20, or 30 years to pay off what they owe. Student debt also makes it harder for grads to buy a house or save for retirement.

For this reason, some parents begin saving for their childs education early. But even if you know the importance of saving early, you might not know how much to save.

Let’s face it:

The cost of college will dramatically increase over the next five, 10, or 20 years.

Knowing the average cost of college tuition today can help you plan for the future.

Stats On The Average College Costs Abroad

28. Canadians pay about $5,100 a year on college education.

As a multicultural and diverse country like the US, Canada is highly attractive for students from all around the globe and fetches lower tuition fees than the average cost of college in America. The cost of college in Canada is an average of C$6,463 for undergraduate degrees per year. International students should expect a yearly bill of C$29,714 .

29. Th cost of college in Germany is zero for locals and in most cases, for international students.

It might be shocking for someone from the US, but the average cost of a college education for most of the Universities in Germany is actually zero. You read that right. Since 2016, the majority of German universities have abolished fees for higher learning. Besides some small administrative spending and living expenses, the cost of free college stands.

Since 2016, however, some establishments reintroduced fees for internationals. For example, non-EU attendees of Baden-Württemberg must now pay 3,000 per year in tuition fees, which is still a bargain compared to the average cost of college in the States.

30. The cost of college in France is also zero in most cases.

31. The cost of college in Japan is also lower than the average cost of college in the US.

Japan is known to offer some of the highest standards of education in the world. Compared to their American counterparts, Japanese students have it easy, having to pay ¥535,800 per year.

Don’t Miss: Berkeley College Nj Tuition

Stats On How To Lower The Average Cost Of A Four Year College

9. Around 66% of students apply to the federal financial aid program.

Undergraduates eligible for federal work-study earn about $1,794 per year, on average. Moreover, 18% of students gain income through work-study. Financial aid consists of grants and scholarship programs designed to help students with good results in school and sports. Students with disadvantaged personal situations who show extraordinarily academic results may also be favored. As such, the average cost of college tuition can be reduced drastically.

10. About 60% of students receive scholarships, with an average award of $7,923.

Those who score a GPA of 4.0 or higher get the chance of getting a scholarship and sidestep some college costs, but other students may also benefit from them in special circumstances. Each school may have different rules on them. But how much does it really help? Besides covering the tuition costs, the aid may also be spent on other necessities, within reason. Students that have the opportunity for one should, as the average cost of college after scholarships are significantly lower, if not even zero.

11. Approximately 10% of high school students participate in dual enrollment courses.

12. In 2018-2019, over eight million students enrolled in community college.

13. The average cost of online college tuition ranges from $38,496 to $60,593.

Cost Of Living In Canada

Although Canadian student visa requirements say you must have at least CA$10,000 on top of your tuition fees, youll likely need to budget much more than this for your living expenses. Your living costs will vary considerably depending on your location and spending habits, with large cities generally more expensive to live in. According to the 2019 Mercer Cost of Living Survey, Toronto was the most expensive Canadian city to live in, closely followed by Vancouver, with rent particularly high in both cities.

The three main types of student accommodation vary considerably in costs, with students paying around CA$3,000-7,500 for on-campus accommodation each year. Private shared accommodation can cost around CA$8,400 per year plus bills. University accommodation is often cheaper, with some universities offering meal plans to allow you to purchase food from the universitys food outlets.

Here are some examples of average living costs in Canada, taken from Numbeo in October 2019:

- Eating out at a restaurant: CA$16 per person

- One-way ticket on local public transport: CA$3

- Loaf of bread: CA$2.86

- Cinema ticket: CA$13.50

- Monthly gym fee: CA$48.25

You will need to purchase compulsory health insurance while studying in Canada. This will cost approximately CA$600-800 per year. You should also budget for extra costs, such as warm winter clothing if you dont already have any.

Don’t Miss: Fastwebs Scholarships

Other Factors Affecting Average Tuition Over Time

Of course, a number of factors could slow the rise of college costs over time. After the move to distance learning in the wake of COVID-19, there is the possibility that many colleges may offer a combination of on-campus and online classes in the future, which could have a lasting impact on tuition and room and board costs.