What Funding Is Available To Study In The Us

When assessing the costs of studying in the US, its usual to distinguish between the sticker price the published rates and the amount students actually pay once various sources of funding and financial aid are considered. Unlike in other countries, its rare for US students to pay the full tuition amount. In 2015/16, 85 percent of full-time undergraduate students at four-year universities in the US received some form of financial aid, including 83 percent of those at public colleges and 89 percent at private non-profit colleges.

Often, the most prestigious US universities with the highest sticker prices offer the most generous funding opportunities. At MIT, the highest-ranked university in the US , 58 percent of undergraduates receive financial aid. At Caltech, almost 60 percent of undergraduates receive aid, while 98 percent of graduate students and 99% of doctoral candidates receive full financial support. Similar figures are cited by most other leading US universities, with forms of support including scholarships, grants, assistantships and work-study schemes.

Cost Of Attendance 2022

| ITEM | |

|---|---|

| Total Cost of Attendance: | $63,936 |

| *out of state transportation increases to an estimated $1,900, bringing the total estimated cost of attendance to $64,736. |

The cost of attendance is an estimate of the costs of being enrolled for one year at Cornell. Scholarships, grants, and other assistance have not yet been applied to reduce this total cost. When you apply to Cornell and are admitted, we will provide you with a financial aid summary that details all of your financial assistance options based on your estimated cost of attendance plus your personal financial situation. Filing your FAFSA, and sharing it with Cornell using code 001856 ensures we can calculate the best possible aid summary for you.

Lets Take A Closer Look At Some Of The Types Of Support Offered By Harvard:

- Scholarships and Grants These can be at the institutional, state, or federal level. According to their website, Scholarship funds come from a variety of sources, including Harvard endowment funds, gifts from alumni, general tuition revenues, and federal and state grants. This type of funding includes Federal Pell Grants and Supplemental Educational Opportunity Grants. You can determine your eligibility for these by filling out the FAFSA.

- Outside Awards These scholarship funds come from sources outside of Harvard. They include funding from secondary schools, civic organizations, parental employers, corporations, the National Merit Scholarship Programs, VA Benefits, and the ROTC. These outside awards are factored into your aid package, and they must be reported here.

- Student Employment Students may hold jobs during their time at Harvard. In your aid package, you could be expected to work during term-timeoften around 10 to 12 hours per week. This includes the Federal Work-Study Program , which subsidizes the wages of eligible students. View the Harvard Student Employment Office website for more information.

- Loans Students are not expected to take out loans as part of their financial aid package. In fact, most Harvard students graduate debt-free. However, you are able to borrow in order to help cover your student or family contribution. You can fill out the Harvard Student Loan Request Form or pursue federal or private parent loans as well.

Read Also: Cape Fear Community College Financial Aid

What About Student Visa Fees

After you are accepted at the university you plan to attend, you need to apply for a student visa. During the application process for your visa, there are two costs you need to pay:

Student and Exchange Visitor Program fee â $350 USD

DS-160 visa application fee â $160 USD

With so many fees to keep in mind, it can be challenging to remember everything you need to pay. This is where budgeting for your college fees allows you to financially prepare for studying in the US and make sure no payment is missed.

College Tuition Based On Program

Choosing a college major also plays an important role not just in terms of post-graduation careers but also on the total amount of college tuition. Differential tuition, a growing trend in US institutes, refers to the diverse cost of tuition and fees based on a major. Schools that rely on a differential tuition model charge students based on the chosen field of study, the market value of the degree, demand for the major, and instruction fee .

Engineering is the most popular program in the US, with over 20% of its enrollees being international students. Its annual tuition averages $32,000. As a practical degree, engineering jobs include electrical engineering, civil engineering, and mechanical engineering. According to the National Association of Colleges and Employers , engineering graduates earn an average salary of $63,000 .

Business administration and management is another popular major in the US. Its average annual tuition is $56,000 or $75,000 if additional fees, food, and living allowances are to be included. This program covers advertising, public administration, entrepreneurship, international business, and more. The average annual salary of a sales manager is $126,640, a financial manager is $129,890, a human resource manager is $116,720, a food service manager is $55,320, and a marketing manager is $135,900 .

Read Also: Colleges Terre Haute Indiana

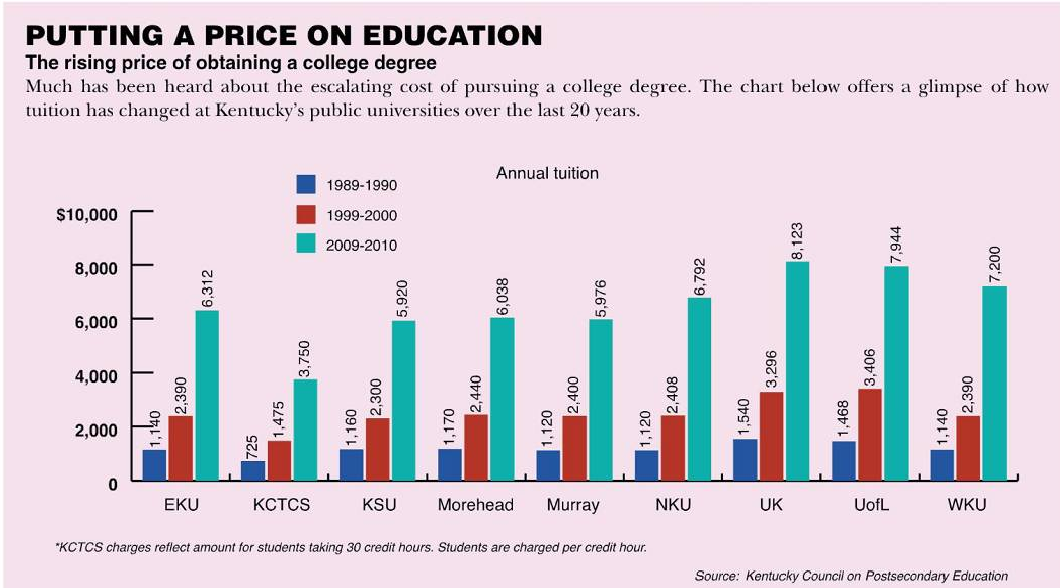

Average College Tuition Over Time

- In 1963, the total cost of a 4-year college education was $5,144.

- Accounting for inflation, this would be equivalent to approximately $42,220 in todayâs dollars.

- The tuition and required fees for a year of college were only $508, on average, in 1963.

- Adjusted for inflation, this would still only be about $4,239.

- In 2020, the cost was $101,584 for the total of all four years of a 4-year college degree.

- In the 10 years between the 2008-2009 school year and the 2018-2019 school year, the cost of an undergraduate education increased by 28 percent at public colleges and by 29 percent at private non-profit colleges, adjusting for inflation.

- On the other hand, during this same time period, the cost of at private for-profit colleges actually decreased by 6 percent when accounting for inflation.

- The average cost of a year of school in 1985 was $4,885.

- When adjusted for inflation, this would be approximately $11,369.

- In 1985, a year at a public 2-year college would have cost $2,981, which would be $6,938 when adjusted for inflation.

- That same year, the cost for a year at a public 4-year college, all in, would have cost $3,859, or $8981 accounting for inflation.

- Also in 1985, a year at a private 4-year college would have cost $9,228, or $21,478 adjusting for inflation, and including tuition, fees, room, and board.

Is College Tuition A Tax Deduction

Many of you asking how much does college cost? will also want to know whether college tuition costs are tax-deductible.

In short yes, college tuition costs are tax-deductible. That means if you covered any of the costs of a degree program for yourself last year, you could be eligible to reduce your taxable income.

Read Also: What Is The Easiest University To Get Into

Cost Of Living In Canada

Although Canadian student visa requirements say you must have at least CA$10,000 on top of your tuition fees, youll likely need to budget much more than this for your living expenses. Your living costs will vary considerably depending on your location and spending habits, with large cities generally more expensive to live in. According to the 2019 Mercer Cost of Living Survey, Toronto was the most expensive Canadian city to live in, closely followed by Vancouver, with rent particularly high in both cities.

The three main types of student accommodation vary considerably in costs, with students paying around CA$3,000-7,500 for on-campus accommodation each year. Private shared accommodation can cost around CA$8,400 per year plus bills. University accommodation is often cheaper, with some universities offering meal plans to allow you to purchase food from the universitys food outlets.

Here are some examples of average living costs in Canada, taken from Numbeo in October 2019:

- Eating out at a restaurant: CA$16 per person

- One-way ticket on local public transport: CA$3

- Loaf of bread: CA$2.86

- Cinema ticket: CA$13.50

- Monthly gym fee: CA$48.25

You will need to purchase compulsory health insurance while studying in Canada. This will cost approximately CA$600-800 per year. You should also budget for extra costs, such as warm winter clothing if you dont already have any.

Series Ee Savings Bond

Purchasing a savings bond in a large denomination can also help pay for future college expenses. Savings bonds are a safe, guaranteed investment that earn a fixed-rate of interest.

One option is a Series EE savings bond purchased through the Department of Treasury.

These bonds are sold at face value, and you can buy up to $10,000 in savings bond during a calendar year.

These make excellent birthday and graduation presents. And while some people use savings bonds to supplement their retirement income, theyre also used to finance education.

Series EE savings bonds earn interest for a period of 30 years.

These bonds are also guaranteed to double in value within 20 years. Interest earnings are subject to federal income tax, but may qualify for the education tax exclusion.

Read Also: Charter Oak State College Fema Credits

Open A 529 Saving Plan

A 529 is a state-sponsored educational savings plan. Funds in the account can be used to pay for tuition, books, fees, and other educational expenses.

You can open an account for your own child, a grandchild, a relative, and even a friend. Depending on the plan, youre allowed to contribute a maximum of $300,000 to $400,000 per beneficiary.

As a bonus, deposits up to $15,000 per year per beneficiary qualify for the annual gift tax exclusion. For a couple, this limit is $30,000.

The best part:

A 529 savings plan grows tax-free.

Youll also benefit from tax-free withdrawals when you use the money for qualified educational expenses.

Abiding by the rules set by the IRS, qualified education expenses include:

- Tuition

- Computer software for education purposes

Sticker Prices And Discount Rates

A shrewd car shopper knows not to pay sticker price . Likewise, not everyone pays sticker price for college, either.

Some do. If a family is wealthy enough not to qualify for aid or doesn’t request it then the bill they receive can reflect that price. Yet for many families, the bill falls far shy of the total cost.

How far? At private, nonprofit colleges, less than half, on average. During the 2020-21 academic year, the average discount rate for first-time, full-time, first-year undergraduates at these schools reached a record high of 53.9%. For all undergrads at these schools, the rate was 48.1%.

During the 2020-21 academic year, the average discount rate for undergraduates at private, nonprofit colleges was 48.1%.

Colleges “discount” tuition by awarding incoming students scholarship aid and forgoing tuition revenue. Some of that scholarship money comes from full-pay students. Because education consumers equate price with quality, colleges maintain a high-cost, high-discount model instead of lowering tuition.

Discount rates have increased in the face of escalating tuition costs, a commitment to access and diversity, and heightened competition for students. Between the 2011-12 and 2019-20 academic years, the average discount rate rose almost seven percentage points.

Recommended Reading: College Hill Virginia State University Episodes

Tuition Fees For Different Types Of Universities

The university where you enroll will determine your final tuition fees. Public and private universities, two-year colleges, and four-year colleges will all have different tuition fee structures.

For example, public universities receive funding from the government, while private universities receive funding from donations, foundations, and other private sources. Tuition fees at private US universities tend to be higher than public universities, as tuition makes up a large part of their funding. Public universities may be required to accepted a certain percentage of local students, and students who live in that same state often have lower tuition fees compared to students from another state or country.

The duration of your preferred universityâs degree program also affects the tuition fee you will pay. Some public and private colleges offer a two-year associateâs degree with general education classes â these are known as two-year colleges, community colleges, or technical colleges. Because of their shorter duration, associateâs degree programs can be affordable options, enabling students to enter the workforce sooner or transfer to continue their studies for a bachelorâs degree .

Centre College Tuition And Fees

2022-2023 Annual Cost of Attendance

| Tuition | |

| Room & Board | $12,300 |

Included in tuition and room and board, is access to physical and mental health care at Centres Student Health & Counseling center. In addition, tuition provides access to:

Additional expenses: We estimate the average student will spend about $3,140 for related expenses, such as books, transportation, and personal expenses.

These costs constitute the sticker price of a Centre education more than 90% of students do not pay this much. Use our Net Price Calculator to obtain an estimate of what your family may expect to pay if you choose to attend Centre College.

Also Check: Study.com Partner Schools

Average College Tuition For Graduate And Professional Degrees

The first year for which information is available for the cost of graduate school tuition and required fees at degree-granting postsecondary schools was 1989. Beginning in the 1999-2000 school year, percentiles started to be recorded, as well as a breakdown between non-profit and for-profit private schools.

Why Is College So Expensive

So, the first question you may ask about college tuition is obvious: why is college tuition so expensive? What drives that 4 years of college average cost up so high? There are a few reasons why the price of college can appear so high. However, there is also plenty of variety in the college costs at different schools.

First, lets discuss the difference between college costs at state universities versus college costs at private universities. State universities receive state funding, while private colleges and universities do not. This creates a sizable difference between the average college tuition at a state school versus the average private college tuition.

Because state universities are funded by the state, they often have lower average college costs than private college costs. State colleges, otherwise known as public colleges, rely on federal, state, and local funding. Since these institutions are partially funded by taxpayers, residents who live in-state will have a lower college tuition cost at public universities than out-of-state students. The 4 years of college average cost at public universities is lower than the average private college tuition.

Also Check: Rhema Bible College Accreditation

A Breakdown Of The Average Costs Of College

To give you a quick overview of the costs for a full year of college at a four-year public and private nonprofit college, we’ve included a breakdown of all costs associated with going to college. This includes the average college tuition cost, room and board, books and supplies, transportation and other expenses.

| Public two-year | |

|---|---|

| $40,940 | $50,900 |

Community colleges are primarily two-year public institutions but some schools also award four-year degrees and there are private community colleges. According to Community College Review, the average cost of community college is $4,864 and $8,622 per year for public community colleges. For private community colleges, the average tuition is around $15,460 per year.

Is Attending College In The Us Worth The Cost

Many have started wondering whether attending college in the US is a good decision provided the increasing tuition cost and uncertainty in acquiring a relevant job afterward. Luckily, the listed cost of college is almost deceiving. The sticker price is the published rate, which is different from the amount students actually pay after considering other sources of funding and financial aid . Federal aid can also essentially decrease tuition costs based on a students financial situation. Moreover, private aid both from citizens and organizations can lessen the burden.

For some, life circumstances may get in their way of attending higher education. Others also do not pursue college to get a job right after high school and start earning money, but the delay in earning money is definitely worth it . For example, a typical four-year bachelors degree holder earns almost more than $1 million throughout their lifetime than a high school diploma holder. However, not all education aids are created equal as they vary from colleges or universities and choice of major.

Without a doubt, financial aid can make college affordable and graduates can earn more throughout their professional careers. If one proceeds carefully, the answer is yesattending college in the US can be one of the best decisions a student will make .

Don’t Miss: Mortuary Schools In Illinois

Take Advanced Classes In High School

Advanced Placement classes can be a challenging yet promising way to cut down on the cost of your college tuition. You can often transfer the AP credits you earn in high school toward your undergraduate degree. Not only does this fast-track your education, but it saves you thousands of dollars in the cost of college classes!

Canadian Workplace Orientation Fee

International students enrolled in a co-operative education program will be charged an additional, non-refundable, Canadian Workplace Orientation fee. Collection of the fees will commence with the semester in which the first Co-op Professional Practice subject is scheduled at the rate of $350.00 per work term. If a program contains more than one work-term, the co-op fee is billed in the semester prior to each subsequent work-term. The fee assist students to be more successful in their program prior to their first co-op semester so that more students can take advantage of this wonderful work and learn opportunity by meeting the eligibility requirements for the co-op semesters and continue to offer additional services through to graduation.

Also Check: How Tall Is Arielle Charnas