Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Important Application Forms: Fafsa And The Css Profile

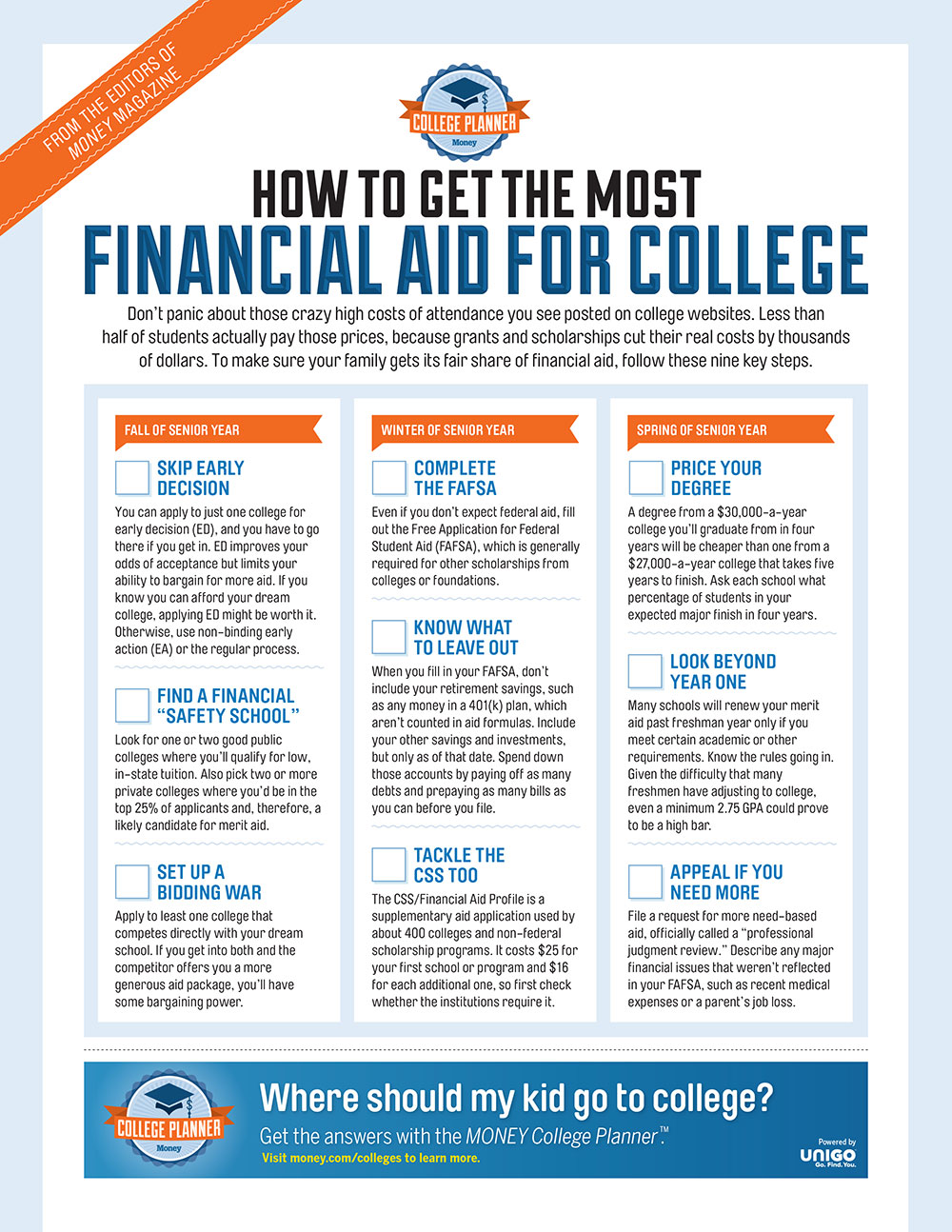

There are two primary pathways to financial aid as you enter college. One is the Free Application for Federal Student Aid sponsored by the U.S. Department of Education and required for you to be considered for federal aid as well as for most college and state assistance.

The second, known as the CSS Profile, is sponsored by the College Board and used by roughly 400 mostly private colleges and universities to allocate non-government financial aid from those institutions.

Each form has its deadlines and procedures You should submit the FAFSA even if you don’t believe you will qualify for federal financial aid. That’s because you may be wrong, and even if you’re right, the FAFSA is also required for most local, state, and individual school financial aid, including merit scholarships. Whether you should submit the CSS Profile probably depends on whether the financial aid you are interested in or the school you plan to attend requires it.

Second Best: 100% Of Need Met With No Loans For Some Incomes

These schools will meet 100% of your financial need no matter what your family’s income is, but if your income is below a certain level, they’ll also make sure you don’t have to take out loans.

Let’s consider Student A and Student B again to illustrate this.

Student A’s parents can contribute $30,000 per year toward the $50,000 cost of tuition and living. To meet the $20,000 of need, Student A is offered $3,500 in Subsidized Stafford Loans and $2,000 in Unsubsidized Loans, while the parents are offered a PLUS Loan of $2,500. Student A is then offered the final $12,000 through a combination of scholarships, grants, and work study.

Student B’s parents make less than $50,000. Almost all the schools listed below require no financial contribution from Student B’s parents. Student B is offered the full $50,000 yearly cost through scholarships, grants, and work study.

Below are the schools that offer this kind of aid.

Dartmouth is one of the schools that offers loan-free aid to some students.

| Aid is loan-free if parents earn less than $75,000 with “typical assets.” For everyone else, loans are capped at $4,000 per academic year. |

You May Like: Study.com Credit Transfer

What Funding Can I Get For College Scotland

It is important to note that every month Scottish universities provide scholarships, bursaries and grants to students studying undergraduate courses. Student loans are covered by this rule, along with the Young and Independent Students Bursary, and all other grants, apart from Disabled Students Allowance and Care-Adapted Housing Grant, except for these.

Confirm Your Dependency Status

Your eligibility for financial aid is closely linked to whether youre considered a dependent or an independent student. If youre an independent student, you dont have to include parent information, such as parent income or assets, when you apply for financial aid. Independent students may qualify for more need-based financial aid they also have higher loan limits when borrowing federal unsubsidized loans as undergraduates.

The federal government determines dependency status based on certain specific factors. Youre automatically an independent student if youre:

- 24 years old or over

- Pursuing a masters or doctoral degree

- A parent who provides more than half of your childrens financial support

- Living with non-child or -spouse dependents and you provide more than half of their financial support

- An active-duty or veteran member of the U.S. armed forces

- An emancipated minor, or youre in a legal guardianship

- An unaccompanied young person either homeless or at risk of homelessness

- In foster care, a ward of the court or both of your parents have died

If none of these situations apply to you, then youre a dependent student and you must add your parents information to the FAFSA, meaning their income and assets will affect your financial aid. For some students, this feels inappropriate because they do not have contact with their parents, or their parents refuse to provide their information.

You May Like: Where Can I Sell My School Books Online

With Exceptional Institutional Support

CCA is ranked as the top art school in the nation for best return on investment. But what can you expect when it comes time to actually make that investment? A college committed to helping you succeed.

We have a dedicated Financial Aid office that helps students discover and learn how to apply for financial aid we provide internship connections, career development, and student employment and we invest in student futures by awarding more than $24 million in college-funded scholarships each year.

The financial aid process varies based on your circumstances. Nearly 75% of our students receive some form of financial aid, and the average amount of combined scholarships and grants a CCA undergraduate student receives is $22,465. Here are the major types of aid and who is eligible for each:

- Scholarships: First-year freshmen, transfer, international, continuing, and graduate students

- Grants: First-year freshmen, transfer, continuing, and graduate students

- Work-Study: First-year freshmen, transfer, continuing, and graduate students

- Loans: First-year freshmen, transfer, international , continuing, and graduate students

Upcoming FAFSA priority deadlines

To apply for grants and loans, youll need to submit a Free Application for Federal Student Aid, known as FAFSA, by the deadlines listed below.

- For new students entering fall 2022: February 1, 2022

- For new students entering spring 2023: October 1, 2022

- For continuing students entering fall 2022: May 1, 2022

Federal Sources Of Financial Aid Per Year

Federal financial aid programs are provided through the U.S. Department of Education . Congress votes on how much money each program receives every year, and what the minimum and maximum amounts of financial support can be.

This grant has specific rules about working in certain fields and following certain classwork paths to become a certified teacher upon graduation. If you do not meet these standards, your grant will be revoked, and you may have to pay some or all of it back.

- Student loans: There are several loan programs provided by the federal government, including:

- Direct subsidized loans

- Direct PLUS loans, both for graduate students and parents with dependent undergraduates

- Direct consolidation loans

Loan amounts vary based on several factors, like:

- Whether you are a dependent or independent undergraduate student

- Whether you are a graduate or professional student

- Whether you have defaulted on student loan payments in the past

- Whether you have a significant financial need, qualifying you for subsidized loans

How much you can take out also depends on your academic year in school. Here are the current amounts set by the federal government:

You may also qualify for the federal work-study program, which helps you find a job, either on or off-campus, and pays you upfront so you can apply the income to your education costs. The amount you receive through this program varies by school.

Read Also: Penn Foster Vs Ashworth

How Do You Qualify For Free Education In Scotland

Staying in Scotland to complete their studies allows students who live there to receive free university tuition. Applicants must be eligible after living in Scotland for at least three years and applying to university. Scotland charges fees to international students studying there from other parts of the United Kingdom.

Will Financial Aid Cover My Tuition

Federal student aid from ED covers such expenses as tuition and fees, room and board, books and supplies, and transportation. Aid can also help pay for other related expenses, such as a computer and dependent care. And remember, the first F in FAFSA stands for freeyou shouldnt pay to fill out the FAFSA form!

You May Like: Free Grammarly For Students

What Types Of Federal Student Aid Are Available

While there are no overall FAFSA income limits, the type of aid youre eligible for and whether you qualify for need-based financial aid will depend on your familys finances.

Even if you dont think you qualify for need-based aid, though, it makes sense to fill out the FAFSA to see if you can get non-need-based aid. You have to complete a FAFSA each year to keep receiving federal student aid.

Below are the types of federal financial aid you can obtain as a result of filling out the FAFSA:

Can You Get Financial Aid For Community College

Enrollment at community colleges is growingand for good reason. Many community colleges offer a quality education for a much smaller price tag.

You might think that because community college typically costs less, you can’t receive financial aid to attend. But fortunately, that’s not the case. You’re eligible for the same types of financial aid at a community college that you would be at a four-year institution.

Even better, attending community college can provide an opportunity to save not just on tuition but also on the associated costs of higher educationbooks, housing, meals, and transportation.

Read Also: Getting Accepted Into College

Turns Out There Are A Few Differences Between A Federal Student Loan And A Private Loan:

-

Most federal loans dont require a credit check.

-

Federal loans often have low, fixed interest rates,which vary based on the first disbursement date of the loan. The interest rate for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans for undergraduate borrowers first disbursed on or after July 1, 2020, and before July 1, 2021, is 2.75%

-

Federal loans are tax-deductible.

-

Federal loans can also be deferredmost commonly, students will defer their loans for up to 6 months after they graduate .

-

Lastly, federal loans are eligible for loan forgiveness in some special cases.

While this list may make federal student loans look nicer than what Mr. Local Banker Man would has to offer, it should be noted that student loans are still debt. Taking out a student loan means spending money you dont have and that you will have to pay back… with interest.

Taking out a multi-thousand dollar loan at 18, with no career or even the guarantee of a good job once you graduate? Thats a financial gamble. For better or worse, it will impact your life long after college.

Given that, lets talk about the different kinds of federal student loans you could apply for and the impact they can have on your financial future.

How Assets Are Applied In Financial Aid Determinations

As mentioned above, assets in the childs name impact the financial aid award. So do parental assets. Here is a breakdown of how these assets are included in the financial aid calculation:

20% of a childs assets may be counted towards aid calculations, meaning how much that child can apply towards one year of their college costs5.64% of a parents assets may be counted towards aid calculations, meaning how much a parent can apply towards one year of their childs college costsMoney put into a 529 account is counted as a parental asset at 5.64% vs. a childs asset at 20%

For example, if you have $50,000 put into your childs name, the government says $10,000 of it can be applied to pay for 1 year of college. If it is in the parents name, only $2,820 will be applied.

How much financial aid you will receive for college is based on many factors. Being aware of how you can best manage your funds to gain the best possible outcome can make the difference in not only how much money you can receive but what kind of aid as well.

Read Also: How Much Is Berkeley College Tuition

What Determines Your Expected Family Contribution

Your Expected Family Contribution is based on your familyâs total income , assets and dependency status . Untaxed income can include retirement plan contributions and tax-free benefits such as Social Security disability and retirement benefit payments and unemployment benefits. Other factors include your family size and the number of children attending college or a career school during the academic year.

How To Estimate Your Financial Aid Package

Every students financial aid offer will look a little different. Tools like the Federal Student Aid Estimator help you figure out how much youre on the hook for when it comes to paying for college, as well as estimate your financial aid package. You can also use the Get2College Expected Family Contribution Calculator if you want to get an idea of your familys responsibility before submitting the FAFSA.

Read Also: University Of Phoenix Degree Worthless

What Types Of Aid Can You Get After Submitting The Fafsa

Your financial aid package will be broken up into several parts: Grants, scholarships, work-study, and loans.

- Grants: Often given based on exceptional financial need or if you belong to a designated group. Pell Grants, which are offered to students with significant financial need, have a maximum award of $6,495 for the 202122 award year . The maximum award for the 2022-23 school year has yet to be announced. Learn more about types of federal grants.

- Scholarships: Aren’t usually given based on your EFC, but rather on factors such as academic merit, athletic achievement, or volunteer experience. You might even net a full ride, where your entire cost of school is covered.

- Work-study: Your total package is based on when you apply, your level of financial need, and the amount of money your school has available. Work-study is a type of financial aid that provides part-time positions for students with financial need to earn money for academic expenses.

- Loans:Direct Subsidized Loans are made to students with financial need, and the government will cover the interest on the loans while you’re in school and during a six-month grace period after you graduate. Direct Unsubsidized Loans aren’t made based on financial need, and interest will accrue once loan funds are dispersed. Here are the maximum loan amounts you can receive from the government:

What Are The Different Types Of Financial Aid

When looking at financial aid, its important to get a better understanding of the different types. There are two main kinds of financial aid: need-based and merit-based.

Need-based Aid:Need-based aid is exactly what it sounds likeits based on your financial need and is calculated using the FAFSA. There are a couple of types of need-based aid: federal grants, institutional grants, loans, and work-study.

Merit-based Aid: Merit-based aid depends on your academic and extracurricular achievements with no regard for financial need. By building a strong academic and extracurricular profile, you can increase your chances of receiving this type of aid.

Also Check: Colleges That Accept 2.5

Will I Receive Full Aid For The Difference Between My Coa And Efc

Although your EFC might be small or even zero, this does not mean you will automatically be eligible to receive aid for the remaining tuition costs. For instance, if you are a first-year undergraduate, and your COA is $75,000 per year, and your EFC is $5,000, youll have a $70,000 financial aid need.

Assuming you receive both federal grants, your maximum grant amount would be $10,345. Lets assume youre eligible for work-study and receive another $10,000 in aid. Lastly, you can borrow up to $3,500 in subsidized loans. This would bring your need-based aid to $23,845, which would not cover your $70,000 in expenses.

While non-need-based federal aid may cover a portion of the rest, youll likely need to look for scholarships or private loans to cover your remaining balance. Or, you can apply to a school with a lower COA.

Do You Know How To Improve Your Profile For College Applications

See how your profile ranks among thousands of other students using CollegeVine. Calculate your chances at your dream schools and learn what areas you need to improve right now it only takes 3 minutes and it’s 100% free.

As you look at colleges and begin to think about applying for financial aid, you may be wondering: what is the maximum income to qualify for financial aid? The good news is that theres usually no cutoff, but how much aid you receive does depend on income. In this post, we break down what the different types of financial aid are, the qualifications, and how you can apply.

Recommended Reading: How Much Do College Application Fees Cost

How To Get Grants For College

Follow these steps when looking for college grants

Free money tip

Want to pay less for college? File the FAFSA® to see how much financial aid you can get. Sallie Mae and our partner Frank make applying easy with a faster, simplified process and step-by-step guidanceand it’s free.