How Much You Should Save For College

Kahler also said the earlier you can get started in a 529 college savings plan, the better off you’ll be. Not only can you get a tax deduction or credit for contributions earnings grow on a tax-advantaged basis and, when you withdraw the money, it is tax-free if the funds are used for qualified education expenses such as tuition, fees, books and room and board.

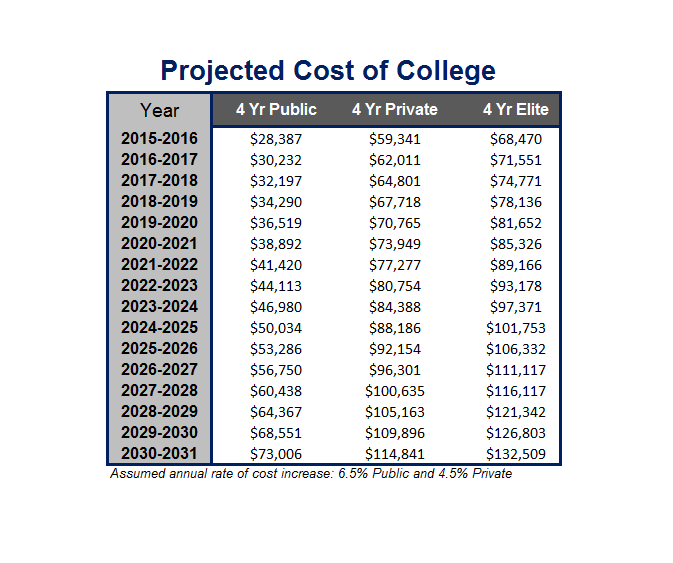

Projected Cost Of College For 1 Year

In this hypothetical example the average cost of one year of college includes tuition, fees, and room and board. The example also assumes an average college-cost inflation rate of 6%.

Projected cost of college for 1 year

This chart shows that in 18 years the average cost for one year of college could increase by more than $35,000 for public college and close to $80,000 for private college. In 2014-2015 the cost for one year was $18,943 for public college and $42,420 for private college. At 5 years, the estimated costs are $25,426 for public college and $56,767 for private college. At 10 years, the estimated costs are $34,026 for public college and $74,968 for private college. At 15 years, the estimated costs are $45,535 for public college and $101,710 for private college. At 18 years, the estimated costs are $54,232 for public college and $121,138 for private college.

Fees Associated With College Education

The amounts charged by private colleges vary from one institution to another and are governed by the rules in the Regulation respecting private educational institutions at the college level . The amounts charged by CEGEPs for programs leading to a Diploma of College Studies or an Attestation of College Studies are comprised of the regular student fees that all students must pay, plus fees that certain categories of students must pay for specific services.

Application fees

CEGEPs may charge students seeking admission to a program an application fee toward defraying the cost of opening, analyzing and processing their file. There is a $30 cap on these fees.

In the case of CEGEPS whose application process is managed by a regional service , application fees are charged by the regional service organization in question. These organizations may also charge students for certain additional services.

Registration fees

CEGEPs may charge fees for certain administrative procedures related to the recording of information concerning a student and his or her education path. These fees are for services that are ongoing from the time a student requests to take one or more courses until a final assessment or an official transcript are produced for the term concerned.

These fees are capped at $20 per term, per student.

Other associated fees

CEGEPs may charge instructional services fees that are not related to admission or registration, for example:

- student guide

Don’t Miss: Arielle Charnas Apartment

How To Calculate The Cost Of Attending College

How much college is going to cost you really depends on your personal situation. But there are a couple of tools you can use to figure out how much youll have to pay:

- Net price calculator.Most schools have a net price calculator on their financial aid website that gives prospective students an estimate of how much your family is expected to contribute toward your educationmore info button and how much financial aid you might receive.

- FAFSA4caster. The FAFSA4caster gives you an estimate of how much federal aid you might qualify for at a particular school including grants, loans and work-study as well as the potential net price.

You might want to use both to get a more accurate estimate. A schools net price calculator might have a more accurate reading of institutional scholarships and grants you might qualify for. But the FAFSA4caster can give you a better idea of how much federal aid you might receive.

How Can You Calculate Your Own Costs Of Studying In The Us

In recent years, its become easier for individual students to calculate how much they could expect studying in the US to cost. All US universities are now legally required to include a fees and financial aid calculator on their websites, allowing students to get a rough idea of how much their intended course of study would cost and what aid they may be eligible for. These net price calculators can be accessed via the governments College Affordability and Transparency Center, which also provides details of the US universities with the highest and lowest tuition fees and net costs.

This article was originally published in February 2012. It was most recently updated in May 2019.

Want more content like this? Register for free site membership to get regular updates and your own personal content feed.

This article was originally published in May 2019.It was last updated in May 2021

Want more content like this Register for free site membership to get regular updates and your own personal content feed.

You May Like: College Beds Size

Average Private College Tuition

- The average private 4-year college tuition, including required fees, in the 2019-2020 school year was $32,769.

- This was $886 more than the average private 4-year college tuition and required fees from the 2018-2019 school year, which was $31,883.

- Adding in room and board for the 2019-2020 school year, the total cost per year for private 4-year college was $45,932 per year.

- This was an increase of $1,261 over the total tuition, required fees, plus room and board for private 4-year colleges for the 2018-2019 school year.

Why Is College So Expensive

As with everything else, several factors are contributing to the increased prices of colleges.

First of all, it is the increasing demand: more than 5.1 million students attended college in 2017 compared to 2000. This number continues to grow, and with higher demand, come higher prices.

Second, colleges include many branches such as administrative branches, instructional, construction, maintenance, supplies, and with prices for living, in general, going higher, so do these expenses. Additionally, the dark side of colleges is that they are increasing their administrative branches and fees Education data reports explain that just between 1975 and 2005 the number of administrators in colleges has increased by 85% and of administrative staffers by over 240%. This means that while the prices are going up, you are not necessarily paying more to get a better education and teachers, a contrary, studies have shown that in 2018 almost 73% of all faculty positions were not held by college professors but by non-tenure-track who get paid lesser and have lesser experience and education so these higher costs are going in the pockets of the administrators and administrative staffers who are rather working as college promoters and marketers. This is one of the biggest issues that college education in the states is facing, and as such, I feel we are obliged to mention it, considering that it is one of the biggest, main reasons for increased college expenses and tuition.

Don’t Miss: Ways To Raise Money For College

Indirect Costs While Attending Valencia

These are the costs that don’t show up on the college bill. They include books, supplies, and travel, as well as personal expenses such as laundry, telephone, and pizza. Since you will be living off-campus, room and board costs will also be indirect costs. You can control indirect costs to some degree, by making smart spending choices.

The Cost Of A Canadian University Education In Six Charts

Tuition is only part of the cost of going to university. There’s also the cost of books, food, travel and the occasional beer. Here’s how students finance their education.

By April 1, 2018

Students living at home spend $9,300 per year on average. For those who move away, its closer to $20,000. We asked 23,384 students how they pay for school and where they spend their money. Heres what they told us.

1. The total average cost of a post-secondary education

2. Where does the money come from to pay for school?

First, the good news: only half of students are in debt. Now the bad: parents are picking up the slackand not in a very efficient way. Nearly two-thirds of students say they dont have an RESP.

3. The cost of books by program

Course materials account for a fraction of the total cost of university, but they still add up. Heres how the least and most expensive programs compare on the cost of books.

4. Debt by year of study

The average level of debt by each year of study, based on responses from more than 11,000 indebted students.

5. Spending on food on campus in a typical week

6. How much do you spend on groceries in a typical week?

This is an update of a story originally published on October 19, 2017.

Looking for more?

Get the best of Maclean’s sent straight to your inbox. Sign up for news, commentary and analysis.

Don’t Miss: Take One Class At Community College

How Much Does Sfa Cost

The cost of attendance at SFA includes both direct costs and additional costs.

Direct costs are things like tuition, fees, housing, meals and books. Additional costs include things like travel and other miscellaneous expenses. Simply add these projected costs together, and you can determine your estimated cost of attendance.

Keep in mind that your total cost also depends on factors such as how many credit hours youre taking, your choice of residence hall, the meal plan you select and the textbooks and materials required for each of your classes. Cost also varies depending on whether youre an undergraduate or a graduate student, or participating in the Fixed Rate Tuition Plan.

Another factor that affects your total cost is your residency status. Texas residents pay less than students coming to SFA from out of state.

How Much Do I Need To Save

If you already have an idea where your student is headed, you can use the college savings calculator to get a personalized projection for a particular college or state.

CONNECT WITH US

Investment returns are not guaranteed, and you could lose money by investing in the Direct Plan.

For more information about New York’s 529 College Savings Program Direct Plan, download a Disclosure Booklet and Tuition Savings Agreement or request one by calling . This document includes investment objectives, risks, charges, expenses, and other information. You should read and consider them carefully before investing.

Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other benefits that are only available for investments in that state’s 529 plan. Other state benefits may include financial aid, scholarship funds, and protection from creditors.

The Comptroller of the State of New York and the New York State Higher Education Services Corporation are the Program Administrators and are responsible for implementing and administering the Direct Plan.

Ascensus Broker Dealer Services, LLC, serves as Program Manager and, in connection with its affiliates, provides recordkeeping and administrative support services and is responsible for day-to-day operations of the Direct Plan. The Vanguard Group, Inc., serves as the Investment Manager. Vanguard Marketing Corporation provides marketing and distribution services to the Direct Plan.

You May Like: How Much Is Berkeley Tuition Per Year

How Can I Cover Expenses

If you dont qualify for enough federal and institutional aid to cover the cost, you might want to consider these options to help pick up the slack:

- Private grants. If you attend a school that cant meet 100% of your financial need, you might qualify for a grant from an institution outside of your school.

- Private scholarships. Students with good grades or special talents might qualify for merit-based scholarships from outside organizations.

- Interest-free loans. Some private organizations offer loans that dont come with interest though usually in smaller amounts than traditional student loans.

- Private student loans. After exhausting all of your federal and free financial aid options, consider applying for a loan from a private lender to cover the rest of your expenses.

You might want to start your search for extra funds with your schools financial aid office. They can likely tell you the scholarships and grants for which you might be a good candidate.

How Much Does Community College Cost

One thing that we surely confirmed throughout this paper is the variation of prices for colleges depending on the state, type, region, degree, etc. Generally speaking, the community college cost for 2020, according to Community College Review, is approximately $4,816 yearly for in-state colleges and $8,581 yearly for out-of-state colleges.

The state is offering the most inexpensive community college in New Mexico, where a student will pay on average $3,846 per year.

Opposite to this, the state which has the most expensive community college tuition is Pennsylvania where a student has to pay on average $14,212 per year.

Because 23% of dependent and 47% of independent community college students come from families with income less than 20 000 dollars, it is no surprise that almost 80% of community college students have part-time and 39% full-time jobs to help them get through college.

When it comes to receiving Federal Work-Study aids, the NCES reports that community college students receive 7 times less than the undergraduates at private nonprofit 4-year colleges with only 2% of the community college undergraduates receiving any of the Federal Work-Study aids.

| Ranking |

| n/a |

Also Check: Is Central Texas College Regionally Accredited

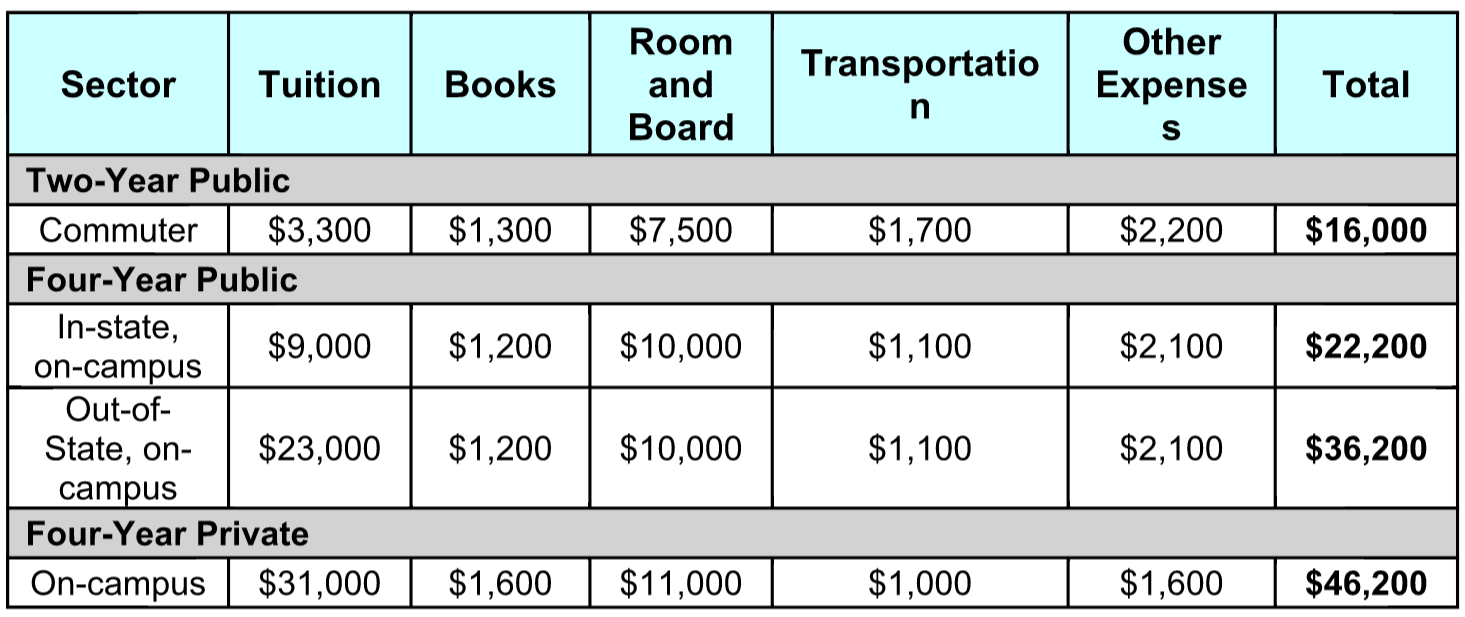

A Breakdown Of The Average Costs Of College

To give you a quick overview of the costs for a full year of college at a four-year public and private nonprofit college, we’ve included a breakdown of all costs associated with going to college. This includes the average college tuition cost, room and board, books and supplies, transportation and other expenses.

| Public two-year | |

|---|---|

| $40,940 | $50,900 |

Community colleges are primarily two-year public institutions but some schools also award four-year degrees and there are private community colleges. According to Community College Review, the average cost of community college is $4,864 and $8,622 per year for public community colleges. For private community colleges, the average tuition is around $15,460 per year.

Average Cost Of College By Degree Type

One will expect the prices of degrees to go up as degrees go up. When it comes to public 4-years degrees, the costs go up slightly and not that drastically, as one may expect: with Bachelors costing $8,230 on average, Masters costing $8,670, and Doctoral costing $10,830 on average. But when it comes to the private nonprofit schools, the prices drastically change, with Masters actually having the lowest average costs of the degrees with $29,960, then Bachelors having the average cost of $33,450, and finally doctoral with an incredible $42,920 average cost. These are just the average costs of the degree types, of course, they can vary slightly or significantly from this for different colleges.

You May Like: Dorm Bed Size

Private College Tuition Vs Public College Tuition

Private vs. public college timeless war that even Hollywood movies seem to get tangled in nonetheless, whatever your position may be, one thing that is common for both is the increase in the colleges fees and tuition.

The prices of colleges, be they private or public continue to increase. Statistics provided by Education Data, show that on average the private college tuitions are over three times more expensive than public college tuitions: in 2018/2019, on average private college students had to pay around $35,830 in tuition compared to public college students who paid $10,230.

Average College Tuition For Graduate And Professional Degrees

The first year for which information is available for the cost of graduate school tuition and required fees at degree-granting postsecondary schools was 1989. Beginning in the 1999-2000 school year, percentiles started to be recorded, as well as a breakdown between non-profit and for-profit private schools.

Read Also: Berkeley College 41st

Cost Of Living In Canada

Although Canadian student visa requirements say you must have at least CA$10,000 on top of your tuition fees, youll likely need to budget much more than this for your living expenses. Your living costs will vary considerably depending on your location and spending habits, with large cities generally more expensive to live in. According to the 2019 Mercer Cost of Living Survey, Toronto was the most expensive Canadian city to live in, closely followed by Vancouver, with rent particularly high in both cities.

The three main types of student accommodation vary considerably in costs, with students paying around CA$3,000-7,500 for on-campus accommodation each year. Private shared accommodation can cost around CA$8,400 per year plus bills. University accommodation is often cheaper, with some universities offering meal plans to allow you to purchase food from the universitys food outlets.

Here are some examples of average living costs in Canada, taken from Numbeo in October 2019:

- Eating out at a restaurant: CA$16 per person

- One-way ticket on local public transport: CA$3

- Loaf of bread: CA$2.86

- Cinema ticket: CA$13.50

- Monthly gym fee: CA$48.25

You will need to purchase compulsory health insurance while studying in Canada. This will cost approximately CA$600-800 per year. You should also budget for extra costs, such as warm winter clothing if you dont already have any.

Fees For Canadian Citizens And Permanent Residents

| Faculty or program | Approximate tuition | |

|---|---|---|

| Faculties of Arts, Environment, Health, Mathematics, and Science | $8,000 | |

| Accounting and Financial Management*, Sustainability and Financial Management* | $8,000 | |

| Business Administration and Mathematics Double Degree | $12,000 | |

| Computer Science, Business Administration and Computer Science Double Degree | $15,000 | |

| Global Business and Digital Arts | $14,000 | |

| Mathematics/Financial Analysis and Risk Management | $12,000 | $2,100 |

|

Fees are for two terms/eight months of school, based on September 2021 and a full course load . Fees for September 2022 will be available in August 2022 and will likely be higher. You pay fees one school term at a time . Co-op students pay a fee of $739 per term to cover some costs of the co-op program. If you’re in a co-op program, you don’t pay tuition during your co-op work terms. *For accounting and finance programs, tuition is significantly higher in your upper years. For the two aviation programs, professional pilot training is estimated to be an additional $77,000 over three calendar years. Your exact fees will be posted to your Quest student account approximately a month before the start of each term. |

Read Also: Uei Transcripts