College Decisions Are Due May 1 We Can Help

Understanding student loan rates are important when evaluating student loans. Learn about differences between fixed interest rates and variable interest rates.

Learn the difference between subsidized and unsubsidized federal loans when you apply for a Federal Direct Loan, previously called a Direct Stafford Loan.

How To Apply For A Private Student Loan

Since private student loans are offered by banks and financial institutions , you apply directly to the lender.

Follow these instructions to apply for a private student loan:

It doesnt take long to fill out a private loan application online. If you , it only takes about 15 minutes to apply and get a credit decision.

College Isnt Getting Any Cheaper

The average cost, including tuition and fees, of attending a public 4-year university was $8,800 in the 2016-2017 school year, according to the National Center for Education Statistics. Students at private nonprofit 4-year universities had it even worse, shelling out $33,500 on average.

With a price tag like that, you might wonder how youll ever be able to pay for an undergraduate degree. Personal savings, scholarships and federal loans might go a long way toward footing the bill and indeed, its always best to use up these sources first.

But if those options dont cover all your college-related expenses, you might decide to take out a loan to cover the rest. Private student loans and personal loans for college are two possibilities to help you bridge that last gap, but which one is better?

Lets look at how each works.

Read Also: What School Do I Belong To

Loans Can Damage Your Credit Score

If you want to buy a house or finance a car at some point, youll need good credit. Strapping yourself to long-term, unavoidable payments on debt is probably not a good way to increase your credit score. This is especially true as youre just starting out in your career, when it can be far too easy to miss payments. A missed payment on your student loan can drop your credit score and hold your score down for up to seven years.

Important Update Regarding Recent Changes In Direct Subsidized Loan Eligibility

On July 6, 2012 the President signed into law the Moving Ahead for Progress in the 21st Century Act . This law places a limit on Direct Subsidized loan eligibility for new borrowers on or after July 1, 2013, and prior to June 30, 2021.

Loans first disbursed on or after July 1, 2021, are no longer subject to the Subsidized usage limit .

Borrowers were not eligible for Direct Subsidized loans once they received subsidized loans for a period of 150% of the length of the borrower’s educational program. The borrower also becomes responsible for accruing interest during all periods as of the date the borrower exceeds the 150 percent limit. For detail information on 150% Loan Limit visit Time Limitation on Direct Subsidized Loan Eligibility For First Time Borrowers.

A first-time borrower was a borrower who had no outstanding balance of principal or interest on a Direct Loan or FFEL loan on July 1, 2013. Borrowers who had a loan balance which has been paid in full prior to receiving loans after July 1, 2013 became a first-time borrower.

Recommended Reading: Rhema Bible College Online

Fafsa For Online Degrees

The application process isnt that different from the one that traditional students are going through. Even as an online program student, what you have to do is fill out the FAFSA, more specifically the Free Application for Federal Student Aid. This application is required for both federal and private loans.

You can either ask for a copy by mail or fill it out online, after which you print it and mail it to the rightful location. There is also more than one type of federal loan.

Borrow Subsidized Loans Before Unsubsidized

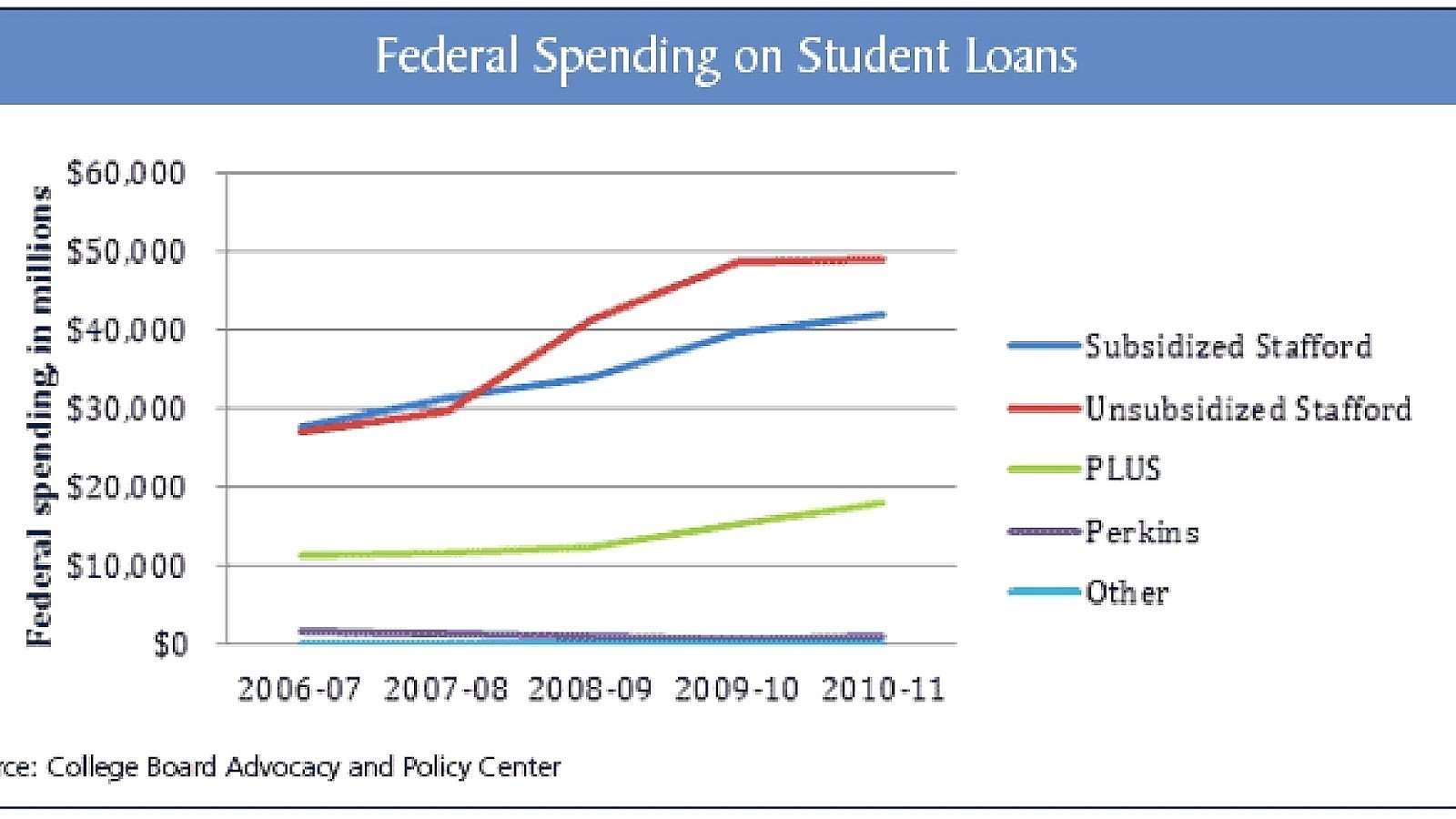

The FAFSA serves as your application for federal student loans as well. Youll be notified of what you can borrow in the financial aid award letter from any school that accepts you. There are two types of federal loans: subsidized and unsubsidized.

Subsidized federal loans go to undergraduate students with a financial need. The subsidy covers the interest on the loan while youre in school. Unsubsidized federal loans arent based on need, and interest starts to accrue immediately.

» MORE:How much can you get in student loans?

You May Like: Average Size Of Dorm Room

Understand Important Loan Features

When researching loan options, its important to understand the features of two types of loans: federal student loans and private student loans.

Federal student loans are provided through the government, and the amount granted to you is determined by the information on your FAFSA . Alternatively, private student loans are provided by banks or other private lenders and usually require applicants to undergo a credit check. Students with little to no credit history may use a cosigner to qualify.

Beyond the types of loans available, its helpful to look at the impact of the interest rate on student loans as these rates make a difference in the amount you pay during the loan term. Interest rates can be either fixed or variable in other words, a rate may stay the same over the life of the loan or fluctuate based on market conditions. Try using the Student Loan Interest Calculator to discover how you can potentially pay less interest on your student loan.

Finally, consider your student loan repayment options. The loan term is the allotted period of time you have to repay the borrowed amount. You can try using a loan repayment calculator to calculate your student loan payments.

You End Up Paying Much More By Way Of Interest

Your loan starts attracting interest the moment you take it. Lets say you need only $1,000 for your first year in college. If you limit your loan to that $1,000, your interest for that first year will accrue only on the principle amount of $1,000. During the second year, the interest will accrue on the initial $1,000 + the next $1,000 that you borrow and so on.

If you take a loan of $4,000 in the first year itself, your interest for the first year will accrue on the full $4,000 during the next four years. Even if the interest is set at a rate amount when you take the loan, this higher interest accrual over the next four years will far exceed any savings from the lower rate of interest.

You end up paying more no matter which option you choose. If you choose to make interest only payments while you are still in college, that interest will be calculated on the full amount youve borrowed. If you choose to defer your payments, the interest will be calculated on the original amount that you borrowed. Either ways, the interest will be much higher when you take a loan for four years as compared to taking the loan for one year at a time.

Read Also: How To Sell College Books

Student Loan Rates Are Rising

Apply for a private student loan and lock in your rate before rates get any higher.

Its important to understand student loan requirements and limits for all loan types. For example, there are limits on the amount you can borrow, as this chart shows:

| Dependent Undergraduate Student | Dependent Undergraduate Student with a Parent PLUS Loan Denial | Independent Undergraduate Student | Graduate or Professional Degree Student | |

|---|---|---|---|---|

| First Year | $5,500. A maximum of $3,500 may be subsidized. | $9,500. A maximum of $3,500 may be subsidized. | $9,500. A maximum of $3,500 may be subsidized. | $20,500 |

| $6,500. A maximum of $4,500 may be subsidized. | $10,500. A maximum of $4,500 may be subsidized. | $10,500. A maximum of $4,500 may be subsidized. | $20,500 | |

| Third, Fourth and Fifth Years | $7,500. A maximum of $5,500 may be subsidized. | $12,500. A maximum of $5,500 may be subsidized. | $12,500. A maximum of $5,500 may be subsidized. | $20,500 |

| $31,000. A maximum of $23,000 may be subsidized. | $57,500. A maximum of $23,000 may be subsidized. | $57,500. A maximum of $23,000 may be subsidized. | $138,500. The graduate debt limit includes direct loans received for undergraduate study. |

Before Applying For A Student Loan Exhaust All Other Financial Aid

Before even thinking about applying for a student loan, make sure you exhaust all your other options first. There are other forms of financial aid you can use to pay for college:

Scholarships: Unlike loans, which have to be repaid with interest, scholarships never have to be repaid and are merit-based . You can search for available scholarships at FastWeb, and you can apply for a wide variety of scholarship types from many different sources, including:

- Colleges

- Philanthropists, high profile figures, and celebrities

- Other individuals on a local, state, or federal level

Grants: Like scholarships, grants do not have to be repaid, but are typically based on need rather than merit. You can qualify for grants from the federal government or from your school, as well as some other places. You can get college grants through:

- Your college or university

- Federal grants

- State grants from your states grant agency

- Local grants from your area including nonprofits, professional organizations, private businesses, for-profit institutions, and private philanthropists

Work-study programs: With a work-study program, you work at a part-time job related to your area of study and use the money you earn to pay for a portion of your tuition and expenses.

Also Check: What Colleges Accept 2.5 Gpa

The Way To Get College Loans To Own On The Web College

The way to get college loans to own on the web college

On line schools are a nice-looking selection for we seeking to earn a diploma. Attending an online university could be cheaper than browsing to the-campus college or university.

Still, theyre a big expense the total cost for an online bachelors degree can top $60,000, predicated on You.S. Reports.

If youve exhausted your financial aid options, you may be wondering if you can get a student loan to pursue your online degree. The good news: Yes, its entirely possible. But its helpful to understand how different types of student loans work so that you can choose the best one for your situation.

Student Loans Are A Blind Risk

That being said, any time you take out a student loan, youre taking a blind risk on something that has potentially serious repercussions for your future. Even though the average amount of debt owed by college students is just shy of $30,000, its not unusual for debt to be much higher. Most students going to a traditional university dont know exactly how expensive their education will be in the end, and college is just getting more expensive every year. Taking into account that the average yearly income for recent grads is only around $47,000, the amount of debt you owe can easily eclipse your ability to pay it back, which can cripple progress in life for years to come.

Read Also: Does The Air Force Pay For Student Loans

How To Get More Financial Aid For College

- To get any college aid, students must file a Free Application for Federal Student Aid.

- For the 2022-23 school year, the FAFSA filing season opens Oct. 1 and the sooner you file, the better.

- “Just about everyone is going to qualify for something,” said Sallie Mae spokesman Rick Castellano.

The Covid-19 pandemic and economic downturn that followed made it even more difficult for many students and their parents to afford college just as costs went up.

Tuition and fees plus room and board for a four-year private college averaged $50,770 in the 2020-21 school year at four-year, in-state public colleges, it was $22,180, according to the College Board, which tracks trends in college pricing and student aid.

Now, in order to obtain a four-year degree, nearly all students rely on some sort of financial aid.

More from Personal Finance:Fewer students are going to college because of the cost

“Financial aid is becoming a larger piece of the college admissions puzzle, as tuition costs continue to rise,” said Marnix Broer, co-founder and CEO of EdTech platform StuDocu.

“Many students are choosing a college based on where they can afford, so it’s more important than ever for students to understand their options when it comes to where the best financial aid may be available for them.”

That’s where the Free Application for Federal Student Aid comes in. Students must fill out the FAFSA to access any kind of assistance, including scholarships and grants, work-study and loans.

The Average Bachelors Degree Is Expensive

Theres a reason student loans are such a big problem. The average cost of tuition for a year at a private university is $34,740, while the average out-of-state tuition for a public university is around $25,600. However, in-state students do get a significant break on tuition at public universities they only have to pay an average of around $10,000 a year. Of course, none of these numbers take any additional costs for things like room and board into account. According to the College Board, public universities charge an additional $10,800 on average for both in-state and out-of-state students to stay on campus. Private universities charge a little over $12,000.So yeah, college is expensive.

Naturally, most of us dont have the funds to pay for even a basic 4-year degree out of pocket, so the go-to solution for getting a college education is to take on debt. On average, students who take out student loans just for the bachelors degree, graduate with around $29,800 in debt.

Recommended Reading: Ashworth College Accreditation Reviews

What Are Some Advantages Of Federal Loans Over Private

Federal loans have relatively low, fixed interest rates and offer a variety of flexible repayment plans. Private loans, unlike those from the government, aren’t based on financial need. Borrowers may have to pass a credit check to prove their creditworthiness. Borrowers with little or no credit history, or a poor score, may need a cosigner on the loan. Private loans may also have higher borrowing limits than federal loans.

Ascent Student Loans Disclosures

Ascent loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding.com/Ts& Cs.

Rates are effective as of 01/01/2022 and reflect an automatic payment discount of either 0.25% OR 1.00% . Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates.

1% Cash Back Graduation Reward subject to terms and conditions, please visit AscentFunding.com/Cashback. Cosigned Credit-Based Loan student borrowers must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs are available for the most creditworthy applicants and may require a cosigner.

Don’t Miss: How Much Is Berkeley Tuition Per Year

Types Of Federal Student Loans

There are three types of federal student loans. Theyre all provided by the government through the Federal Direct Loan Program.

- Direct Subsidized Loans are based on financial need.

- Direct Unsubsidized Loans are not based on financial need. Theyre not credit-based, so you dont need a cosigner. Your school will determine how much you can borrow, based on the cost of attendance and how much other financial aid youre receiving.

- Direct PLUS Loans are credit-based, unsubsidized federal loans for parents and graduate/professional students. Direct PLUS Loans for parents are also known as .

Its important to consider federal student loans before you take out a private student loan, because there are differences in interest rates, repayment options, and other features.

How To Get Started

To get the best loans, follow these steps in order:

- Complete the FAFSA. It can qualify you for federal loans, which usually have the best terms.

- Contact your colleges financial aid office to ask about loans through your college.

- Check with the U.S. Department of Education to find out about state loans.

Don’t Miss: Whats The Student Discount At Apple

How To Get Private Student Loans For Parents With Bad Credit

Just as with a federal loan, you could get a cosigner for a private student loan. Again, you are the primary borrower, but your cosigner would be on the hook if you couldnt pay it back.

Whats different with private student loans is that your credit score is used to determine your interest rate. So you could have a low or bad score and still get a loan, but your interest rate might be higher.

Establish The Studies Program Is Certified

The brand new Council getting Higher education Accreditation makes it easy to search databases and directories of accredited institutions locally, nationwide, and worldwide. You can search its robust databases containing 8,200 schools and 44,000 programs to confirm whether your school and degree path are accredited.

Also Check: College For Mortician