Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

Current Interest Rates For Private Student Loans

Private student loans offer fixed interest rates and variable interest rates. Variable loans have a fluctuating rate which can go up or down based on market conditions.

Current interest rates on private student loans are at historic lows. Fixed rates are as low as 3.49%, and variable rates are as low as 1.05%.

Fixed rates on private student loan refinance have decreased to as low as 2.97%, and variable rates have dropped to 1.61%.

The government does not set the interest rate on private student loans. Instead, private lenders set their rates, which can vary depending on the loan you take out. Thats why its important to compare private lenders before you borrow a private student loan.

Interest rates on private student loans are all credit underwritten. That means borrowers will need to have a good credit score to qualify for the best interest rates. Unfortunately, many students have very little credit history, which means they could end up paying more in interest. Private student loans may also require a cosigner if you dont have steady income and solid credit.

Want to see how much you will pay for a student loan next year? Use our student loan calculator.

Can I Lower My Interest Rate

If youve borrowed a fixed-rate student loan, your interest rate generally cannot be lowered without refinancing. However, many student loan servicers offer a 25% interest rate reduction for borrowers who enroll in an auto debit scheme.

If you have a variable-rate private student loan, your lender may lower your rate due to market activity. But, variable rates work both ways, and changes in market activity could also cause your student loan interest rate to go up.

Read Also: Central Texas College Bachelor Degrees

Current Student Loan Interest Rates

Depending on the kind of student loan you have or are looking to get, interest rates vary. About 90 percent of student loan debt is comprised of federal loans, with interest rates ranging from 3.73 percent to 6.28 percent. Average private student loan interest rates, on the other hand, can range from 1.49 percent to 12.99 percent fixed and 0.99 percent to 11.98 percent variable. While federal student loan rates are the same for every borrower, private student loan rates vary widely based on the lender, the type of interest rate and the borrower’s credit score.

What Factors Affect My Personal Loan Rates

Personal loan interest rates in Canada typically range from 3.5% to 47%. The rate you get will depend on the following factors:

- You need near-perfect credit to qualify for the lowest advertised rate.

- Income. Lenders will usually check if you have enough regular cash flow to easily afford your monthly repayments.

- Debts. The lowest rates go to borrowers with a debt-to-income ratio below 20%.

- Collateral. Securing your loan makes it less risky to the lender and gets you lower rates.

- Loan amount and term. Some lenders may offer different rates depending on how much you want to borrow and how long you need to repay.

- Type of lender. The type of lender you choose will usually affect your personal loan interest rates in Canada .

- Type of interest rate. Credit unions and banks offer variable and fixed rates. Generally, variable rates have lower starting rates. Online lenders offer fixed rates.

Recommended Reading: Where Can I Watch College Hill Season 1

What Is The Average Personal Loan Interest Rate In Canada

According to the Bank of Canada, the average personal loan rates from January to September 2021 were between 4.37% and 6.44%. This combines fixed and variable rates and does not differentiate between loans with collateral and loans without .

As of September 2021, which is the most current information available, the average interest rate is 6.44%. You may end up paying more than that once your personal variables are factored in.

Key Terms In This Story

Fixed interest: An interest rate that does not change during the life of a loan. All federal student loans have fixed interest rates, but private loans can offer fixed or variable interest rates. Fixed interest is the safer option because you dont have to worry about your rate and payment increasing.

Variable interest:Variable interest rates can change monthly or quarterly depending on the loan contract and come with rates caps as high as 25%. Variable interest loans are riskier than fixed interest loans, but can save you money if the timing is right.

Private student loan: Education funding from banks, credit unions and online lenders instead of the federal government. Private loans are best used to fill funding gaps after maxing out federal loans.

About the author:Anna Helhoski is a writer and NerdWallet’s authority on student loans. Her work has appeared in The Associated Press, The New York Times, The Washington Post and USA Today. Read more

Read Also: Colleges Quarter System

The Difference Between Fixed And Variable Rates

Student loan interest rates can be either fixed or variable. Fixed interest rates dont change over your loan term, so youll know upfront how much your total cost to borrow will be and what your monthly payments will look like. Variable interest rates change based on market conditions, so your monthly payment may increase or decrease periodically.

What Are The Federal Loan Interest Rates

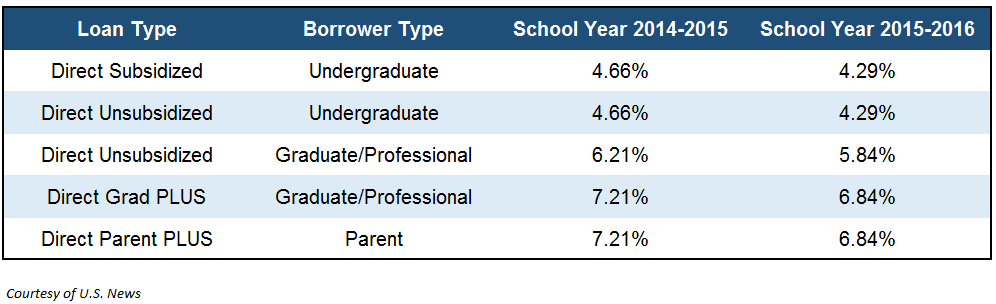

When you pay for college, youll find out that federal loans interest rates are almost always lower than private loans. Federal loans fix the interest rate for the lifetime of the loan, but the actual rate differs between loan types. Direct subsidized loans and direct unsubsidized loans both have the same rates for undergraduates: 3.76%. This rate will continue until July 1st, 2017. If someone alters the law after this date, the rate changes.

There are separate interest rates for direct subsidized loans for graduates and direct PLUS loans for parents, graduate students, and professional students .

Recommended Reading: Does The Army Pay For College

Are There Any Downsides To Refinancing Student Loans

Refinancing federal student loans means you turn them private. As a result, you lose access to federal programs, such as income-driven repayment and Public Service Loan Forgiveness. You would also lose out on any new relief programs offered in the future, such as student loan forgiveness awarded en masse.

Some private lenders offer help if you run into financial hardship, but this varies by lender. If youre relying on federal protections, then you should not refinance your federal student loans. But if youre comfortable sacrificing these programs, refinancing could be a smart strategy for paying off your loans.

Should You Take Out A Student Loan Now

With federal student loan rates at record lows, now might be the best time in history to take out a student loan. Always exhaust all your options for federal student loans first by using the Free Application for Federal Student Aid form, then research the best private student loans to fill in any gaps. Whether you choose federal or private loans, only take out what you need and can afford to repay.

Try to take out no more in student loans than what you expect to make in your first year out of school.

If you have private student loans, this may be a great time to refinance. All of the best student loan refinance companies are offering competitive rates and can cater to unique debt situations.

You May Like: Lowest Gpa Requirement For College

What Types Of Student Loans Can Be Refinanced

Both private and federal student loans that were used at a qualifying institution are eligible for refinancing. A qualifying institution typically means a Title IV-accredited school in the United States.

You must be the primary borrower on any loans you wish to refinance. A lender might also require that youve already earned your degree or are close to earning your degree. Some lenders also state a minimum loan amount for refinancing.

Who Services My Federal Student Loans

Borrowers dont make their federal student loan payments directly to the U.S. Department of Education. Instead, loan servicers act as go-betweens, handling a variety of important tasks including:

- Billing

- Processing and keeping track of payments

- Helping borrowers change payment plans

- Dealing with requests for deferment or forbearance

- Certifying borrowers for loan forgiveness

Four servicers handle the majority of federal direct loans and Federal Family Education Loans. The largest of these is FedLoan Servicing , which controls 31% of the total. The others are Great Lakes Higher Education Corporation with 23%, Navient with 21%, and Nelnet with 17%. Multiple nonprofit servicers handle the remaining loans.

Don’t Miss: Can Americans Go To College In Europe

Student Loan Interest Rates From 2006

Over the past 12 years, interest on federal student loans has ranged from 3.4% to 7.90%, depending on the type of loan. Although these student loan rates have fluctuated through the years, rates have been rising since 2016. To see a visual representation of how student loan interest rates have changed over time, we’ve provided a chart that illustrates the rate pattern for three types of student loans since 2006.

*Note that in the above chart we didn’t include the historical rates for Stafford Loans or Federal PLUS Loans. Both loans were part of the Federal Family Education Loan Program , which was terminated in 2010. However, we have included their historical rates from 2006 and on in our breakdown below.

Current Student Loan Refinancing Interest Rates

Refinancing student loans is a smart option if you can receive a lower interest rate than the rate on your existing loans. By receiving a lower rate, you reduce the total interest youll pay over the life of your loan.

Remember, refinancing is done by private lenders, not the federal government. This means that federal borrowers should only refinance their loans if they receive a lower interest rate and dont need the added benefits of federal loans, such as income-driven repayment plans or student loan forgiveness.

Here are the student loan refinance rates from several lenders.

| Lender |

To compare your options, check out our picks for the best student loan refinance companies.

You May Like: Does Florida National Guard Pay For College

Federal Student Loan Interest Rates: 2019

Student loan interest rates will decrease for the 2019-2020 school year for all federal loan types disbursed between July 1, 2019 and July 1, 2020. The disbursement date for any student loan is the date on which you receive payment from the lender. Below, we have listed the current student loan rates on the available types of federal loans. Note that these percentages represent the amount of interest you will pay on an annual basis.

| Loan Type |

|---|

| 4.236% |

Whats The Average Student Loan Interest Rate

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

With college tuition on the rise, students may take out student loans as they pursue their education. Student loans come with interest and sometimes other loan fees. As you repay student loans, that interest can add up.

While there are options like scholarships, grants, and work-study, sometimes student loans can be necessary to help students fill the gaps as they finance their education. Before borrowing student loans, its important to understand how they work, what the average student loan interest rates are like, and how interest rates impact your loan.

Don’t Miss: Can I Sell My College Books

Should I Refinance Or Consolidate My Loans

You should consider refinancing if your finances are stable and youre able to qualify . Refinancing is best for borrowers who are looking to lower their interest rate, restructure their debt or combine multiple loans into one. Since refinancing is typically done through a private institution, you should only refinance federal loans if you dont need federal repayment plans or programs.

If youre looking to combine several federal student loans into one loan, consider direct loan consolidation. This federal option helps you simplify repayment and apply for a new repayment plan, but it wont result in a lower interest rate. Also check out direct loan consolidation if you want to combine your federal loans while maintaining access to federal repayment plans.

Interest Rate Vs Apr: Key Distinction

- An interest rate, which is reflected as a percentage of your principal does not include other fees and charges.

- An includes the interest plus any fees and charges.

That said, different lenders might define an APR and its associated charges in different ways. Likewise, many loans have all the above interest rates, fees, and charges but some lenders might only list one rate, while others might list both.

This article will dig a little deeper into how student loan interest rates and APRs differ, so you can better assess and compare the true costs of your student loan options.

Also Check: Can I Sell My College Books

How Congress Sets Federal Student Loan Interest Rates

Have you ever wondered who sets the interest rates on your student loans? The answer is Congress, which passed the Higher Education Act in 1965 and has subsequently renewed and amended it several times.

The law governing the setting of rates on federal student loans is set down in the U.S. Code, in Sections 20 U.S.C. § 1077 and § 1087. Congress passes legislation to set the rates, which are updated every year and apply from July 1 of Year 1 to June 30 of Year 2.

In August 2013, the Bipartisan Student Loan Certainty Act was signed into law, tying federal student loan interest rates to prevailing market rates.

In their current form, the interest rate levels for the various types of federal student loans are based on the yield of the 10-year Treasury Note auction, plus an increment.

Additional resources:

Average Loan Interest Rates: Car Home Student Small Business And Personal Loans

Depending on the type of loan you get, the average interest rate youll pay can vary from 0% to more than 200%. To calculate the interest rate for each type of loan, lenders may use your credit score, your credit history, loan size, term length, income, location, and various other factors relevant to the lenders investment and the borrowers risk.

Recommended Reading: Who Buys Back Used College Textbooks

What Is Your Average Student Loan Interest Rate

If your loans were provided by the government, the rates on each loan may be found on the chart above. If you have more than one loan with different interest rates, your average interest rate will be somewhere in between.

If you combine your government student loans into a single federal Direct Consolidation Loan, you wont get a lower interest rate. Your interest rate will be the weighted average of the rates on your existing loans, rounded up to the nearest 1/8th of a percentage point.

Your average interest rate may depend on your field of study, profession or loan provider. Graduate students tend to have loans with higher interest rates.

You can also consolidate private and federal student loans by refinancing them, potentially at a lower interest rate.

Average Student Loan Interest Rates In 2021

Edited byAshley HarrisonUpdated October 7, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

From 2006 through 2021, average federal student loan interest rates were:

- 4.66% for undergraduates

- 7.27% for parents and graduate students taking out PLUS loans

Are your rates higher than average?

See what rates you could get using Credibles rate estimator

*Rates displayed above are estimates based on your self-reported credit score and should only be used for informational purposes.

You May Like: Is Ashworth College Recognized By Employers

Comparing Private Student Loans

When comparing private student loan options, take a close look at the overall cost of the loan. This includes the interest rate and fees. Its also important to consider the type of help the lender offers if you cant afford your payments.

If you have good or excellent credit, you have a better chance at landing the best interest rates.

Experts generally recommend that you borrow no more than what youll earn in your first year out of college. While some lenders cap the amount of money you can borrow each year, others dont. When comparing loans, figure out how the loan will be disbursed and what costs it covers.