Choose Investments For The 529 Plan

After the 529 plan has been opened and some funds have been deposited into the 529 plan, its time to set up the investments for the 529 plan. The number of investment options is limited, making it easier to choose.

Most people invest in an age-based portfolio, which starts off with an aggressive mix of investments and gradually shifts to a less risky mix of investments as the child approaches college age. If you start saving for college soon after the child is born, an age-based portfolio is a good starting choice. You can change the investment approach later.

Some 529 plans have just one age-based portfolio, while others have aggressive, moderate and conservative age-based portfolios. These portfolios usually differ according to the initial percentage stocks and the final percentage stocks .

Most 529 plans also offer static portfolios which may involve single-fund portfolios or multi-fund portfolios, as well as a money market portfolio. Options may include bond funds, U.S. large-cap, mid-cap and small-cap index funds and foreign stock funds.

You can change your investment strategy twice a year.

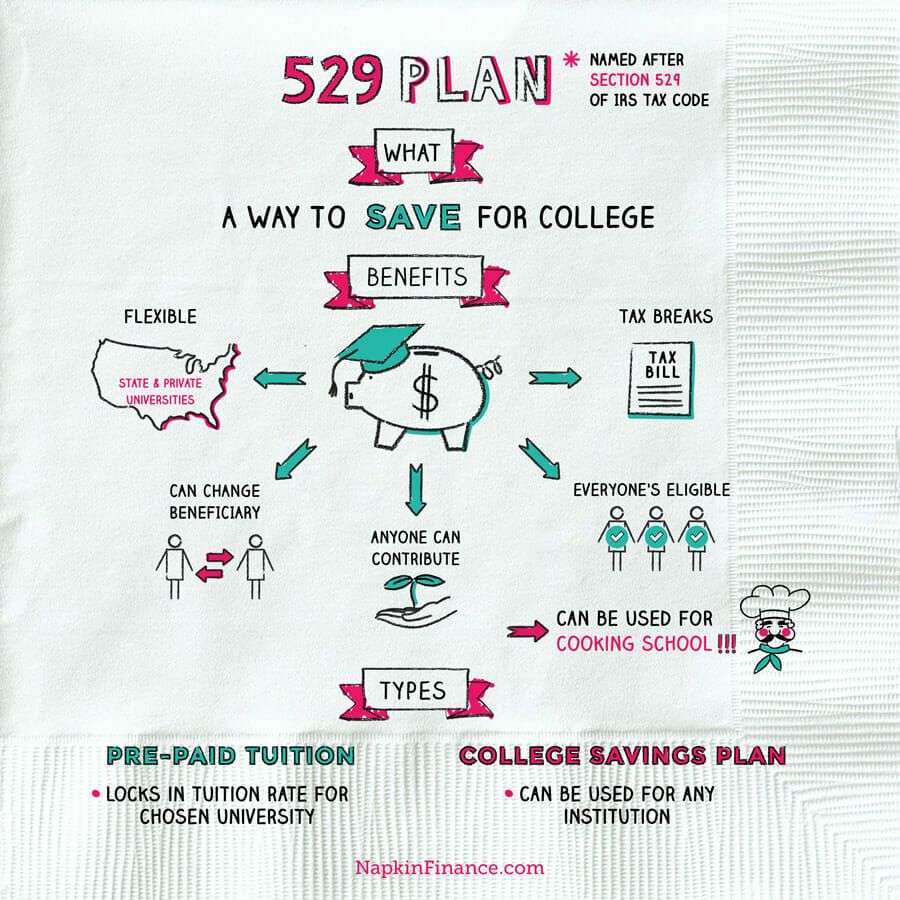

Education Savings Plans Vs Prepaid Tuition Plans

An education savings plan is an investment account sponsored by a state government that allows you to save money for a beneficiarys future education. Its funds can be used to pay for any qualified educational expenses, including tuition, fees, and room and board, and its earnings are not subject to federal tax.

Most of the time, people use these plans to save and pay for post-secondary education in the United States, but they can also be used in a more limited fashion to pay for public, private, and religious education on the elementary and secondary levels. Since these are investment funds, they benefit from having plenty of time to grow.

Prepaid tuition plans are a much less common form of 529. Rather than growing contributions through investment, these plans allow you to prepay tuition at some public and private colleges and universities. With most plans, contributors purchase credits or Tuition Certificates at current rates, and beneficiaries can then redeem them for equivalent credits or tuition in the future, no matter how much the cost of tuition per credit has gone up. Since these funds do not need time to grow, and can only be used at specific institutions, they can work well for beneficiaries who are already nearing college.

How To Open A 529 College Savings Plan In 3 Simple Steps

That is it. Free and easy. Literally in under 5 minutes, you can set up a 529 for your child. What a weight off your mind that will be! No degree in finances needed to figure it out how to open a 529 college savings! No minimums! So empowering!

Scholar Raise does all the heavy lifting and sets up everything for you. They have scoured the country for the best 529 plan based on a variety of factors . They provide you access to a great, easy to use dashboard where you can see your savings and earnings and share that information with your children as well to get them excited to save and earn!

You May Like: Ashworth College Construction Management

What Are 529 Education Savings Plans

Between normal, day-to-day expenses and long-term goals such as retirement, figuring out how and how much to save for your child’s education can be challenging.

One financial strategy you might consider? Setting up a 529 plan. A 529 plan is a state-sponsored education savings plan that can be used toward elementary, secondary or higher education expenses for the account beneficiary. 529 plans offer account owner tax advantages, flexibility and control.

Your Edward Jones financial advisor can help you determine how a 529 plan might work with your overall financial strategy, as well as think through specific questions you might have:

- Is a 529 plan a good fit for you?

- What is your family’s education savings goal?

- What investments might make sense for you and your education goals?

Choosing A 529 Savings Plan Over Other Types Of Savings Vehicles

Investing in a 529 offers several advantages over other types of accounts, like taxable brokerage or even high-yield savings accounts. For one, you get several tax advantages, which can help you save on both the cost of education and your income taxes.

A 529 plan, even with its contribution limits, can help save parents a lot of money, says Andrew Wang, a financial advisor and managing partner at Runnymede Capital Management.

“You can think of a 529 account like a Roth IRA account, except it’s for education purposes instead of retirement” he says. “You can save money by not paying taxes on your earnings and when you withdraw it for qualified education expenses like tuition and textbooks.”

In addition, parents and guardians have the potential of earning more compared to sticking their money in a savings account. While growth isn’t guaranteed, many 529 plans show an average rate of return that’s higher than what you’d find with deposit accounts.

Another option is opening a brokerage account, which may offer similar growth rates depending on your investment portfolio. Parents may like the fact that these types of accounts don’t necessarily have contribution limits, says Wang, compared to 529 plans, where individuals can contribute up to $15,000 annually before the gift tax exclusion phases out.

Don’t Miss: Hunter College Act Code

What Are The Tax Benefits Of 529 Plans

When used for qualified expensesa category that includes tuition, certain room-and-board fees, required textbooks, and computersstudents can withdraw money from a 529 plan tax free.

In addition, some states offer income tax deductions for residents who contribute to their plan. A few parity states extend those tax benefits even if you pick a 529 plan from another state.

Using The Funds In An Education Savings Plan

The funds from an education savings plan can be withdrawn at any time. There are no limits for yearly withdrawals to pay for post-secondary education, though you can only withdraw $10,000 per year for elementary or secondary education.

There is also no requirement that beneficiaries begin withdrawal of funds by a certain age, so there is no need to worry if your designated beneficiary chooses to wait a while before heading to college.

As long as the funds from these plans are used to pay for qualified educational expenses, they are not subject to federal tax. Qualified educational expenses include tuition, mandatory fees, books, supplies, and equipment, plus room and board for students attending half-time or more. This means that even if a beneficiary receives significant scholarships, the education savings plan can be used to pay for many things that scholarships often dont cover.

Moreover, leftover funds can be rolled into the plans of new beneficiaries, such as younger siblings, or even into a 529 ABLE account, a savings plan for Americans with disabilities. These are important options to remember, as any funds withdrawn that are not used on qualified educational expenses are subject to taxes on the plans earnings and an additional 10% penalty.

Recommended Reading: Colleges Accepting Applications For Fall 2020

Start Saving For Your Childs College Early

There are many suggestions when you need to start saving your child. It would be ideal if you start right away when the baby is born. Longer time and compound interest with the regular investment will ensure you bigger savings. When you start early to save, you allow the fund to grow for a longer time. With this approach, you dont need to put aside as much each month or year to reach your savings goal.

Perhaps the best part of these accounts is that funding can be modest. Many parents find that they can afford $ 25- $ 100 from each paycheck. That money can be automatically deposited into the college savings plan of their choice. Also, if you want, you can deposit some extra money.

Others can also contribute to a childs college funds by opening their own 529 plan accounts. Or simple they can make contributions to an established 529 account under the childs parents name if the plan that the parents use accepts third-party donations.

You must check this because some plans dont accept these contributions. In that case, its best to create a new account or gift the parents cash intended for deposit into the 529 plan.

Of course, the most important thing is to ensure the maintenance of a level of contribution, which in the future will guarantee payment of tuition and other educational expenses. This requires discipline, which will prove particularly useful if you have financial difficulties in the future

How Do I Fund A 529 Account

When you open a 529 account, you’ll be asked how you want to contribute funds. Your options include a one-time electronic funds transfer, mailing a check, scheduling recurring payments from your bank account or through payroll deductions. Some 529 plans may require minimum contribution amounts depending on the funding method.

You May Like: When Do College Credits Expire

Direct Plan New Yorks 529 College Savings Program

New Yorks Direct Plan offers low-cost options that use Vanguard Funds, a leader in keeping low investment costs. Like Wisconsins plan, it also has a very high maximum contribution, one of the largest in the country. Residents of New York can see state tax deductions up to $10,000 for joint filers . This helps offset the states high taxes.

Best For: Vanguard funds

- In-state tax deductions up to $4,000

Disadvantages:

- Higher fees for Advisor-sold plans

Contribution Limit: Ohios 529 plan requires a minimum investment of $25. The maximum contribution is $500,000. Fees for this plan range from 0.04% to 0.55%.

Rating: 8.5/10

Michigan Education Savings Program

California’s 529 plan allows account holders to invest up to $529,000. In addition to no application, cancellation or transfer fees, you’ll find the expense ratios extremely competitive. Plus, the management fees are extremely low, making this plan one of the most cost-effective 529s out there.

Funds are from reputable companies such as Dimensional Fund Advisors, T. Rowe Price and Vanguard. Portfolio options include enrollment-based, multi-fund and single funds. Both the enrollment year and multi-fund choices allow you to select from active or passive funds. Active portfolios primarily consist of actively managed mutual funds, which may result in higher fees. Compare this to the passive fund portfolios, which consist of index mutual funds, resulting in potentially lower fees.

All it takes is $25 to start investing, or $15 if you opt for payroll deductions.

Recommended Reading: Ways To Make Money Over The Summer For College Students

Where To Open A 529 Plan

Every year, Saving For College ranks the top 529 plans by their performance. However, as we discussed above, performance isn’t the only factor to consider.

A easy solution is to use a service like College Backer, that takes care of everything for you without thinking too much about it.

A few plans have continued to rank highly over time, and we wanted to share those with you below. If you’re considering opening a 529 plan, here are some of the best places to open a 529 plan.

What are your thoughts on where to open a 529 college savings plan?

Adding A 529 Plan To Your Existing Investment Strategy

Depending on your overall investment and portfolio strategy, you can choose between a static or age-based strategy when structuring your 529 plans investments inside the 529 plan account.

- Static portfolio options allow you to have control over the allocation of equity and fixed-income percentages by selecting among portfolios managed to a more specific stated investment objective.

- Age-based portfolio options are set up to reallocate over time and become more conservative as college enrollment approaches.

Don’t Miss: Uei College Pharmacy Technician

Determine The Type Of 529 Plan Account

There are two main types of 529 plan accounts: individual accounts and custodial accounts.

Most families will open an individual account with a parent as the account owner and a child as the beneficiary. Everybody can contribute to a parent-owned 529 plan account, including parents, grandparents, aunts, uncles and other relatives.

Typically, only one parent can be the account owner. If the childs parents are divorced, the account owner should be the parent who will be responsible for filing the Free Application for Federal Student Aid . If this parent has remarried, it is best for the account owner to be the childs biological parent, not the stepparent.

If money from a custodial bank or brokerage account, such as an UTMA or UGMA account, is used to fund a 529 plan, then the 529 plan should be set up as a custodial 529 plan. With a custodial 529 plan account, the child is both the account owner and the beneficiary. Since the child is a minor, a custodian will manage the account on behalf of the child until the child reaches the age of majority. Note that the beneficiary of a custodial 529 plan account cannot be changed.

529 plans that are owned by a dependent student or the students parent are treated more favorably by financial aid formulas.

See also:10 Easy Ways Grandparents Can Help Pay For College

How To Keep Market Considerations In Mind

Remember that funds contributed to 529 savings plans are invested in the market. This means the balance in your account may fluctuate as markets rise and fall. Market volatility is a fact of life for all investments, but keep in mind that the highs and lows tend to even out over the long term and provide you with decent returns.

If your child isnt planning on going to college in the next few years, you have time to wait out the market volatility currently taking place. If you have an age-based portfolio, your 529 plan gets more conservative the older your child gets. This is helpful if the stock market hits a downturn when the time comes to withdraw money. Youll have taken advantage of the markets strong performance in the past, while avoiding drops in your accounts value when it matters.

Read Also: I Want To Sell My College Textbooks

How To Get Help With A 529 Plan

You have a few options when it comes to finding help with a 529 plan.

If youre looking for some of the best plans, youll want to consider low costs, good benefits and a solid track record of investment performance. Here are some of the best 529 plans available.

If you invest directly with a state plan, youll have to manage the whole process yourself: registering, researching the investments and tracking the plan over time. However, you can also open a 529 plan through a broker, who can set you up with one of several state plans. This method also may allow you to use the advice of an investment professional, who can help you arrange the plan and oversee it through the years.

Finally, you can always turn to a certified financial planner, who can assist in choosing the right state plan for your needs and choosing the best investments. Look for a planner who has experience specifically with 529 plans and ideally one who is a fee-only adviser.

A 529 plan is not the only way to pay for college, and there are many unusual ways to stock away cash, while even getting a tax break in some cases.

S To Opening A 529 College Savings Plan

As tuition for college continues to risewhile financial aid fails to keep upyou may be wondering how you can save.

Setting up a 529 college fund can help families save big and reap tax benefits a simple savings account doesnt offer, but according to a study by investment firm Edward Jones, only 29% of Americans know what this savings tool even is. The same study shows that most people use their personal savings, scholarships, financial aid, and loans to help pay for higher education costs rather than incorporating a more specific tuition-saving strategy such as a 529 plan.

So what is a 529 college savings plan, anyway, and how exactly does it work?

As its name suggests, a 529 college savings plan is a tax-advantaged account that helps save for college expenses, such as tuition and fees, books, room and board, and so on. Contributions are after-tax and the money sitting in a 529 account will accumulate and can be withdrawn completely tax-free for any qualified education costs.

If youre interested in setting up a 529 college fund but youre worried about what could happen to the money if your child decides not to attend college, fear not! A 529 plan isnt a use-it-or-lose-it investmentthe money is always yours.

You May Like: How Much Is The Tuition For Berkeley College

Bright Start College Savings Program

Like Utah’s 529 plan, the Bright Start College Savings programs offers a myriad of investment options, many of which are from well-respected companies such as T. Rowe Price and Vanguard 11 in total. There are three investment portfolio options age-based, target and customizable. The age-based choices have varying risk tolerances, with asset allocations automatically rebalanced to more conservative investments the closer your child gets to college age. Target-based portfolios offer choices ranging from ones with safer securities all the way to equity-based investments.

We also like how easy it is to navigate the website. You can easily find out how much you may pay in fees administrative fees are 0.11% of your portfolio balance and expense ratios for respective funds. You don’t need a minimum opening balance to sign up for an account.