Look For Other Ways To Meet College Costs

There are other options to consider if you have a savings shortfall and are unable to increase the contribution amount to your college savings account.

Invest monetary gifts. Using money from holiday and birthday gifts to fund a college savings account can make a meaningful difference.

Explore grants and scholarships.These awards are offered by federal, state and local governments, private and nonprofit organizations and most colleges. The best part grants and scholarships, in general, do not need to be paid back.

Research student loans. Student loans are offered by federal and most state governments and from private institutions, as well. Of course, student loans must be paid back along with any interest incurred.

Take advantage of your local community college. Beginning at a local community college before transferring to a university can reduce overall costs and provide access to an education that might otherwise be out of reach.

Contemplate other colleges. Run scenarios in our College Calculator using different schools to find other options that are a good fit for your family.

* Largest by assets, according to the Q4 2018 529 College Savings Quarterly Data Update from Strategic Insight. Source: American Funds. As of September 30, 2018, CollegeAmerica AUM is over $60B.

Visit for more information about college savings strategies, The CollegeAmerica 529 savings plans and American Funds College Target Date Series.

When Will Your Child Attend College And For How Long

Despite the growing interest in gap-year programs, our model assumes that students will attend college beginning at age 18 and graduate in a 4-year period. We assume that college costs continue to grow at 3% above inflation from now through the projected graduation date.

Our rule of thumb suggests a savings target of approximately $2,000 multiplied by your childs current age, assuming attendance at a 4-year public college , and your family aims to cover approximately 50% of college costs from savings. Remember, this rule of thumb is only a starting point to help you estimate your college savings goal and may change over time and based on your particular situation.

Know Your Savings Options

Depending on how you intend to use your savings, there are a few account types to consider. You can use each of these secure, low-risk accounts to stash your cash while earning a better return than a traditional checking or savings account.

- High-Yield Savings Accounts. These accounts are ideal for short-term savings or cash youll want to access in an emergency. Typically, you can make up to six withdrawals per month with no penalty. Look for a high-yield savings account from a traditional brick-and-mortar or online bank that offers a competitive interest rate to boost your savings even further over time.

- Money Market Accounts. Similar to high-yield savings accounts, money market accounts are highly accessible and may offer competitive interest rates . Some MMAs come with paper checks or debit cards to make accessing your money even easier, though you may be limited to the same monthly withdrawal limit as other savings accounts.

- Certificates of Deposit . CDs are the least liquid savings option on our list in exchange for leaving your money in the account for the full term you agree to upon opening , you can lock in a fixed interest rate which youll earn when the term is up. Generally, these interest rates are higher than a high-yield savings or money market account, but youll often find little difference in todays low rate environment.

Recommended Reading: How Do College Coaches Make Offers

Using This College Savings Calculator

After indicating your current college savings and inputting your financial assumptions, our College Savings Calculator estimates the grand total of funds required as well as the amount of money you need to save on a monthly basis or to invest as a lump sum in order to reach your college savings goals for each of your children. A summary bar graph illustrates your college need versus available net capital over time. You also can view a detailed data table with an annual breakdown of financial information to see a progression of your accumulation of capital.;Keep in mind that depending on the type of investment you select for college savings, your funds may not grow and can in fact lose money.

Next Steps To Consider

Trends in College Pricing and Student Aid 2020Trends in College Pricing and Student Aid 2020Trends in College Pricing and Student Aid 2020Note on Methodology

Investing involves risk, including risk of loss.

Please carefully consider the plan’s investment objectives, risks, charges, and expenses before investing. For this and other information on any 529 college savings plan managed by Fidelity, contact Fidelity for a free Fact Kit, or view one online. Read it carefully before you invest or send money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: What Colleges Take 2.0 Gpa

How We Calculate Your Savings

To use this savings interest calculator, there are a few details youll need:

- Initial contribution: How much you plan to deposit into your account upon opening. Some accounts require a minimum deposit, so its important to know how much youre able to invest in the beginning.

- Monthly contribution: Even if you only have a few dollars to spare, begin building the habit of contributing to your savings regularly. You can set up direct deposit from your paycheck or your checking account into your savings on a regular basis to simplify the process.

- Timeline: The number of months or years you have to meet your goal. If youre working toward a down payment on a house, you may have a specific time frame in mind. If youre building an emergency fund, your time frame may be more flexible.

- Annual interest rate: This is the APY offered on your savings account. Look into whether your account will compound interest monthly, quarterly, or annually. Use this detail to compare different accounts and see the differences in your potential interest earnings.

Bottom Line: Save As Much As You Can

When it comes down to it, you’ll need to reconcile your numbers with what you can truly afford. Saving for college is important, but it needs to work with your other priorities, like saving for retirement or building an emergency fund.

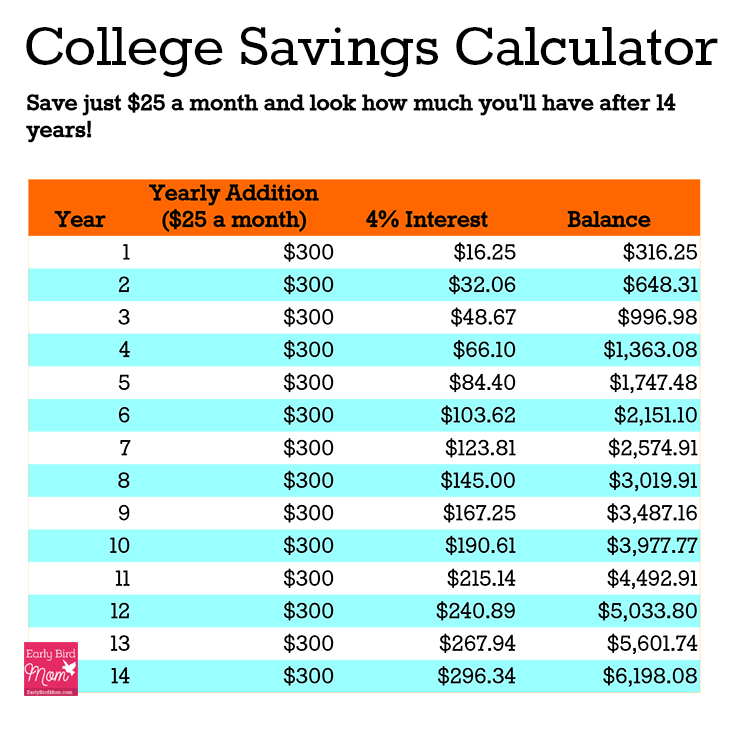

Be sure you’re doing all you can, though. Cutting expenses to save an additional $25 a week could have a huge impact in the long runand make it less likely that you’ll struggle financially when it’s time for college.

Also Check: What Is The Marine College

How Much Money Should I Save

The amount of money you should save depends on the purpose of your savings. Your retirement savings, for example, should be much higher than your savings for a new card, but will also take much longer to accumulate.;

Although these short- and long-term savings goals may vary, always make sure to have an emergency savings fund.

Your emergency savings account should have enough money to cover an unexpected expense or help sustain extended income loss. In general, experts recommend saving at least three to six months expenses, though some say you should consider aiming closer to nine or 12 months in the current recession.

If youre just starting to save, it can take time to save that amount, especially if youre already facing financial hardship. Start by developing a habit of saving any amount you can each month, each week, or whenever you have money coming in. Then, over time, watch the number grow as you begin reaching your savings goal.

Benchmarking Progress In Saving For College

Its never too late to start saving for college, since every dollar you save is a dollar less youll have to borrow. But, it is easier to save the sooner you start, since the monthly contributions will be smaller and theres more time for the earnings to compound.

For example, if you start saving for college when the baby is born, about a third of your college savings goal will come from the earnings. If you wait until the child enters high school, however, less than 10% of the college savings goal will come from earnings and youll need to save six times as much per month to reach the save college savings goal.

If you want to check how much you should have saved based on your childs age, multiply the childs current age by $3,000 for an in-state public 4-year college, $5,000 for an out-of-state public 4-year college and $7,000 for a private non-profit 4-year college.

See also:How to Help Pay for College Without Impacting Financial Aid

You May Like: Is College Free In Canada

Average Cost Of College

When some of the above questions cannot be answered , it’s common to base your plan on an average college cost. According to CollegeBoard.com, the average cost of tuition and fees in 2010 is $7,020 per year for in-state and $11,528 for out-of-state. Private four-year tuition and fees are in the neighborhood of $26,273. This College Cost Finder tool can help figure out approximate costs of public or private schools by entering the name of the college or state where your child will attend school.

Not all students begin their education at a four-year university. Students can obtain general education credits or;an Associates degree at junior or community colleges.;The average cost for a;two-year school tuition and;fees;is about $2,500 for the current school year. Most end up saving money when starting off this way. Another incentive is that kids can boost their GPA if needs be. Students will want to;make certain;the credits they; take with transfer to their future university.

Start Saving What You Can

If you cant save even $250 per month, start with a less ambitious amount. Most 529 college savings plans will let you set up an automatic investment or payroll deduction with as low as $25 per month.

529 plans have an added advantage. When you save in a 529 plan, your money grows on a tax-free tree, causing it to accumulate quicker. Your state may also offer an additional tax credit or deduction for 529 plan contributions.;

Once you get started with saving, youll find it easier to increase the amount you save per month. You will quickly get used to having less money in your checking account.

There are also natural opportunities to increase the amount you save. For example, once the baby is potty trained, you can contribute the money you were previously spending on diapers to the babys college fund. You can also invest windfalls, such as income tax refunds, inheritances and lottery winnings.

Wondering how your 529 plan may impact financial aid? Use our Financial Aid Calculator to estimate the expected family contribution and your financial need.

Don’t Miss: Do Technical College Credits Transfer To University

Estimate How Much To Save With The T Rowe Price College Savings Calculator

Many parents are overwhelmed by the cost of college. The good news? We’re breaking down the costs and funding methods to simplify things. A 529 plan is a great place to start your overall savings strategy, which can also include scholarships, current income, and financial aid. As an example, you may pay for;one-third of college with scholarships and/or financial aid and another third of college with your current income. A college savings plan can help you cover that last third. Use the calculator below to help understand future college expenses and to estimate how much to save in order to stay on track with your college savings goals.

Solving For The Monthly Deposit Amount

The college savings plan calculator is set up by default to calculate the monthly deposit amount based on what you have entered as the Initial Savings, Annual Deposits, Costs, and any Extra Annual Deposits made within the schedule.

NET Value: If this value is Zero then you will just break-even, or in other words, you will have saved just enough to cover all the costs. If you want to solve for an input other than the deposit amount, you can manually enter the deposit amount and then use Goal Seek or Solver to set NET to zero while changing one of the other inputs .

Years to Make Deposits: The calculation to solve for the deposit amount will only work if the years to make deposits is less than or equal to the year before the last payment.

Also Check: How To Get Into College Early

Funding Education With A 529 College Savings Plan

One way to approach your college education funding is to open a 529 college savings plan. Why is it called a 529? These plans are named after section 529 of the Internal Revenue Code and offer you some important tax advantages. First, your investment in a 529 plan grows tax-deferred and provides the student beneficiary with tax-free educational use of the money for qualifying expenses, which include tuition and fees, room and board, books and supplies. While you are not allowed to deduct 529 plan contributions from your federal income tax, some states permit deductions of all or some percentage of your contributions from your state income tax.When setting up a 529 plan, you can choose either a prepaid tuition plan or an education savings plan. With a prepaid tuition plan, you as the account owner purchase credits for a specific participating college at todays prices to apply toward tuition costs in the future. This kind of plan gets around having to worry about rising inflation. Alternatively, an education savings plan gives you more flexibility. These funds can be used for a variety of qualified educational expenses at any university or college your student decides to attend.Here are some additional 529 plan features:

Choose From Three Different Investment Approaches

American Funds College Target Date Series®: Select the target date fund closest to the year in which the beneficiary will | likely use the money. The portfolio automatically grows more preservation-oriented as college approaches; through periodic evaluation.

American Funds Portfolio SeriesSM: The Portfolio Series funds of funds available in CollegeAmerica are managed with specific investment objectives in mind: appreciation, balance or preservation. Select the option that best fits your time frame and risk tolerance.

The American Funds mutual funds: The individual mutual funds available in CollegeAmerica are good options if you want to build customized portfolios.

Read Also: Is Fox College An Accredited School

How Much Do You Need To Save For College

The answer to this question depends on several factors including the number of children you have, how much you plan to fund their higher education costs and ultimately where they decide to enroll for college . Obviously, the more children you have, the more you may need to save. If you have three or four kids, having a solid college savings plan;can be helpful. Our College Savings Calculator allows you to estimate your college funding needs for up to six children. You may decide not to fund 100% of your childs college education. You may want your child to assume part of this financial responsibility by getting a job or an education loan;to help pay for college. However, student loans can create years of financial stress for graduates as they repay this debt which is why many students have a game plan of zero student debt;these days. There are alternatives to student loans;to consider as well, including grants, scholarships and work-study programs.

Consider A Collegeamerica529 Savings Plan

CollegeAmerica offers the tax advantages, flexibility and control of investing in a 529 savings plan, plus built-in simplicity and quality investment options from the American Funds.

- Launched in 2002

- Chosen by more than over 114,000 financial advisors and more than 1 million families nationwide

- The countrys largest plan*, with assets over $60 billion

Also Check: How To Get Recruited For College Basketball

Teach Your Child The Value Of Money

Your child will value his education more if he has a part in paying for it. Have him contribute money toward his education, by putting a percentage of birthday and other holiday money and eventually his paychecks toward his education. He may not understand the meaning of what he is doing when he is young, but he will greatly appreciate his education later in life.

However, don’t start a savings account in your child’s name with the intent for her to save large amounts of money toward school. When it comes to financial aid, any money in a child’s name can be hurtful. Parents are expected to put 5.6 percent of assets toward a child’s education; students are expected to contribute 20 percent of assets.

How Much You Really Need To Save In A 529 Plan

Part 2 of that “scary” number that you need to save each month for your child’s college is that number is based on saving 100% of their college costs.;As a parent, you don’t need to pay for 100% of their school. Or, maybe you’ll pay for 100% of their public in-state tuition, and the rest is up to them. Or maybe you’ll just have a target savings number, and the rest is up to them.

It’s simply important to remember that you don’t have to save and pay for all their college. It’s THEIR college – not yours. Plus, there are tons of ways for them to find help paying for school, from finding scholarships, to getting student loans.;

So, instead of stressing out about saving $500 per month, I’m going to make the following assumptions and save based on that:

- I’m going to save for an in-state college that currently costs $10,200 per year

- I will contribute to all 4 years of college

- I will pay 50% of the projected college costs

- I’m done contributing to the 529 plan when my child is 18

- I expect college costs to continue to increase by 4% per year

- I expect to get 6% per year return on my investments in my 529 plan

With these assumptions, you should be saving about $96 per month for your child’s college, or $1,151 per year. Let’s see how that breaks down.

However, if you’re on the high end, and want to contribute to pay 100% of your child’s education expenses at a 4 year private college, I included that in the chart below too .

Recommended Reading: What Colleges Look For In High School Students