Financial Aid For International Students At Salem College Usa For Bachelor

- ;Bachelor

- $$;Tuition fee

Salem College is welcoming young women from foreign countries who are interested in attending college in the USA through its International Student Financial Aid.

The application is open for the academic year 2021-2022 towards any undergraduate or graduate degree study undertaken at Salem College. The programme fee of the winners will be sponsored.

Salem College is a liberal arts college for women in the USA. Ranking 136th among National Liberal Arts Colleges, this college is best known for its customized and personalized education system.

Why choose Salem College? Salem is very committed and dedicated to the growth and success of its students and therefore, develops their unique potential, and prepares them to change the world. Salem is the best choice for young women.

Application Deadline: Open

Also you can:

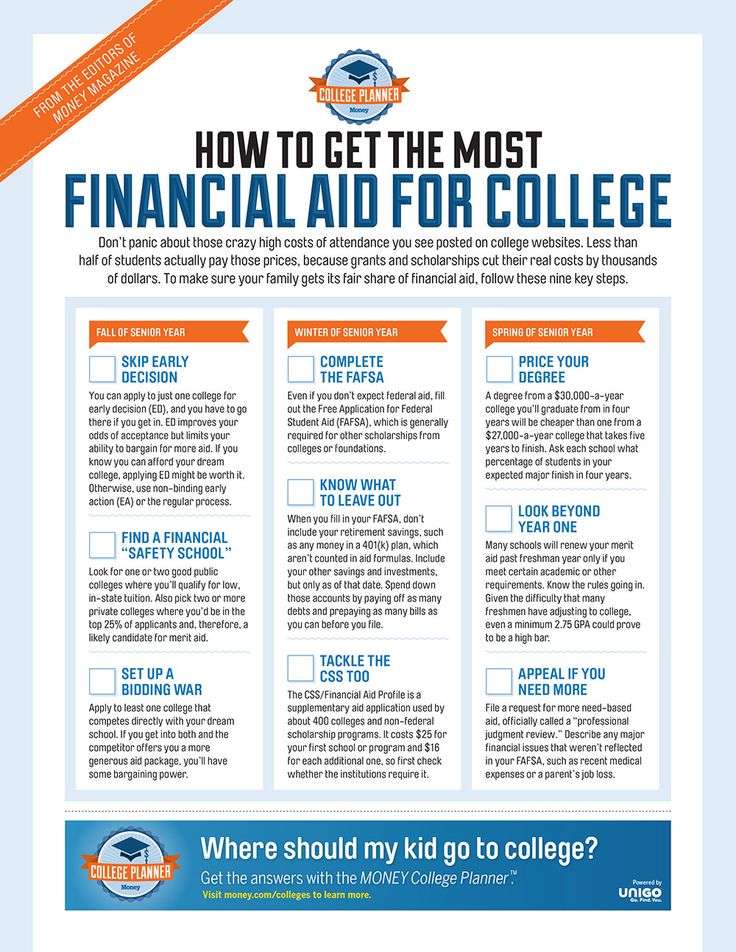

Genius Ways To Maximize College Financial Aid

Paying for a college education is increasingly an expensive endeavour. With sticker prices of top schools soaring over $200,000, figuring out how to pay for college is more important than ever.

The good news: there are some clever ways you can maximize your financial aid. Here are the 5 top ways to make the most of financial aid.

To be clear, none of this is professional legal, tax, or financial advice. You should always consult a professional advisor before you make decisions about your personal situation.

Colby College In Waterville Me

There is no fee associated with applying to Colby College, and all eligible financial aid recipients are automatically considered for grants.

Student Retention Rate: 93%Net Cost: $21,032

Founded in 1813, Colby College is a small school with 2,000 students from more than 70 different countries, as well as the twelfth-oldest private liberal arts college in the country. Every undergraduate major offers students research opportunities at this 714-acre college campus, which includes 30 residence halls, an extensive athletic complex, and the Colby College Museum of Art. The fourth college in the country to achieve carbon neutrality, Colby has given all admitted students the opportunity to graduate without any loans to repay by meeting 100 percent of their demonstrated financial need. Colby awards more than $45 million in financial aid through grants, which come from federal and state governments, the colleges funds and other outside agencies. This college also offers hundreds of student job opportunities, and it often matches student interest with specific employment openings on campus. Students, even those not receiving financial aid, earn $12/hour.

You May Like: How Do You Get College Transcripts

Minimize Your Taxable Income

The FAFSA is the main tool universities rely on to determine the applicants expected family contribution that is, the estimated amount the student and the student’s parents can kick in toward tuition and other expenses. All else being equal, a lower EFC will result in greater need-based aid.

When calculating the familys portion of expenses, the biggest factor is its income level. Needless to say, it helps to keep the amount of taxable income as low as possible in the base year.

Thanks to the 2021 Consolidated Appropriations Act, beginning in July 2023 the term “student aid index” will replace EFC on all FAFSA forms. In addition to some changes in the way the SAI is calculated, the change attempts to clarify what this figure actually isan eligibility index for student aid, not a reflection of what a family can or will pay for postsecondary expenses.

How can a family accomplish this feat without hurting itself in the short term? One way is to postpone the sale of stocks and bonds if they generate a profit, as the earnings will count as income. That also means holding off on early withdrawals from your 401 or IRA. Besides, ask your employer if you can defer any cash bonuses to when they wont have a negative impact on your childs financial aid.

Amherst College In Amherst Ma

Amherst Colleges campus is 1,000 acres and includes a wildlife sanctuary.

Student Retention Rate: 96%Net Cost: $16,339

A private liberal arts college founded in 1821, Amherst College is unique in that it doesnt have distribution requirements or a core curriculum, just 850+ courses and 1,855 students. Among the most comprehensive financial aid programs in the nation, Amhersts average yearly aid package is $53,192, and nearly 60 percent of students receive some form of financial aid. Accredited by the New England Association of Schools and Colleges , Amherst has a 7:1 student-to-faculty ratio, 40 fields of study and a 13 percent admission rate. It operates on a no-loan policy for all financial aid recipients, and its admissions is need-blind for domestic and international students. About 80 percent of Amherst graduates report that theyve gone on to attend graduate or professional school.

You May Like: Do Illegal Immigrants Get Free College

University Of Notre Dame In Notre Dame In

Not only do graduates of the University Notre Dame have a default rate of less than one percent, but students with no-need based assistance are still receiving grants or scholarships that average $5,678.

Student Retention Rate: 98%Net Cost: $30,536

Chartered by the state in 1844, the University of Notre Dame is a large, highly residential research university with Catholic traditions that claims to meet the fully-demonstrated financial need for all of its admitted students. Over 8,600 undergraduate students, who represent all 50 states and more than 100 countries, have the choice of approximately 75 different bachelors degree programs and NCAA Division I athletics on this beautiful 1,250-acre park-like campus with its striking collegiate Gothic architecture. Notre Dame is need-blind in its admissions and need-based in its financial aid policy, taking into account income, family size, number of children enrolled in undergraduate programs, private elementary and secondary tuition expenses, family assets and more when determining eligibility for financial assistance. Administering financial aid resources from institutional, private, federal, and state student aid programs, Notre Dame awarded nearly 70 percent of its students some type of financial aid last year. More than half of the incoming freshman class received around $40,000, on average, in need-based gift assistance the same year.

What Are The Cheapest Universities In The Usa

When your student thinks of affordability, they may associate it with schools with the cheapest college tuition. This is especially true if they intend to leave home to get their education, as finding an affordable out-of-state college option can seem daunting.

Luckily, there is a lot of data available about low-cost schools. Here is a list of some of the most affordable colleges in the country:

- Chadron State College â Chadron, Nebraska

- Minot State University â Minot, North Dakota

- Mississippi Valley State University â Itta Bena, Mississippi

- Dine College â Tsaile, Arizona

- Sitting Bull College â Fort Yates, North Dakota

- Berea College â Lexington, Kentucky

- California State University â Los Angeles, California

- Fayetteville State University â Fayetteville, North Carolina

- CUNY Lehman â New York City, New York

- Texas A&M University â Texarkana, Texas

- West Texas A&M University â Canyon, Texas

- Dickinson State University â Dickinson, North Dakota

- Mayville State University â Mayville, North Dakota

- Bemidji State University â Bemidji, Minnesota

- Southwest Minnesota State University â Marshall, Minnesota

- University of Texas of the Permian Basin â Odessa, Texas

- Central State University â Wilberforce, Ohio

- Alcorn State University â Lorman, Mississippi

Also Check: How Long Do Teachers Go To College

Bates College In Lewiston Me

On average, Bates College students who graduated in 2020 had just $14,117 in federal student loan debt.

Student Retention Rate: 94%Net Cost: $26,669

Founded in 1855, Bates College is a private, residential liberal arts and sciences school that is often recognized for its inclusive social character. The 1,832 students at Bates benefit from a 10:1 student-teacher ratio, non-selective student organizations, and a campus void of fraternities and sororities. Bates offers 36 majors and 25 minors, and it has been named a Fulbright Top Producer more than once, producing a college-record 18 Fulbright fellows in 2015. Bates is among the top college offering the most financial aid, providing more than $35 million annually in student grant aid. Over 40 percent of its students receive financial aid with awards averaging around $44,500 and packages including grants, loans, and student work. Bates partners with Tuition Management Systems to offer a 10-month payment plan to make tuition more affordable.

Pitzer College In Claremont Ca

Pitzer College has been recognized as being among the colleges with the least student loan debt, graduating students with an average loan indebtedness that was approximately $14,044 in 2020.

Student Retention Rate: 91%Net Cost: $36,552

Founded in 1963, Pitzer College is private liberal arts and sciences institution that enrolls approximately 1,000 students and is part of The Claremont Colleges, a unique consortium of five undergraduate colleges and two graduate schools. Pitzer students enjoy a 10:1 student-faculty ratio, 40+ majors, the option to create their own special majors and a campus location one hours drive from downtown Los Angeles, the desert highlands, and some of the tallest mountains in SoCal. About 48 percent of the entire Pitzer student body received financial assistance during 2018-2019. Financial aid packages can include Pitzer Scholarships. These funds are sourced from gifts, the schools endowment, and its current budget; theyre awarded on the basis of need. In the 2018 Best 382 Colleges,;The Princeton Review ranked Pitzer No. 20 for Great Financial Aid.

Don’t Miss: What Is The Worst College In America

Financial Aid Guide For University And College Students In Canada

By;Cameron Yee;on December 2, 2020

Post-secondary education costsfrom tuition and books to living expenses and extracurricularsadd up. The good news is that numerous grants, bursaries and loans are available to help shoulder the financial burden. Heres how to access them.

Financial aid is rarely an after-thought, but student debt is often a bigger problem than most university and college students in Canada anticipate. Rising tuition fees and expenses of going to college or university have become increasingly large burdens to bear for studentsmany of whom are already dealing with pressures from the cost of living on their own for the first time. Add on the economy-pausing pandemic, and its easy to understand why students are looking for financial help for school. A 2020 poll by conducted by CIBC showed that about 7 out of 10 students admitted their income has been affected by the COVID-19 situation.

School is expensiveeven without a pandemic. A 2018 Canadian University Survey Consortium survey of graduating students shows that, of the 50% of students finishing school with debt, the average amount owed is about $28,000. And for many that debt can be crippling. According to an eight-year;study by independent personal insolvency firm Hoyes, Michalos & Associates Inc., approximately 22,000 ex-students filed for bankruptcy in 2018 to address their student debt.

Financial Aid For Online Colleges

Search for online colleges by subject.

Financial aid, like FAFSA, helps online degree-seekers avoid student loan debt. Fortunately, online learners typically qualify for the same aid as on-campus students. This includes federal grants and loans, institutional financial aid for online college, and private scholarships. Many students also enroll in online programs for their potential cost savings.

Although online colleges and universities help learners save money, the average cost of a college education in the U.S. exceeds $35,000 annually. Many online students struggle to pay out of pocket. As a result, they must still navigate the financial aid process.

Fortunately, online degree-seekers typically qualify for the same aid as their on-campus peers. This includes federal grants and loans, institutional financial aid for online college, and private scholarships. Financial aid helps online degree-seekers avoid student debt, a challenge facing millions of working Americans in the 21st century.

You May Like: What Laptop Should I Buy For College

Estimated Costs Based On Annual Family Income

With the help of a college cost estimator , you can have an idea of how much your parents will have to pay yearly for college minus the need-based scholarship a school offers to eligible students.

Below, you will come across estimates of how much money your folks will have to shell out after being awarded with a grant . You will also find Low Estimates and High Estimates of the amount of cash your family will have to pay for your college annually.

The estimations below are based on basic financial questions such as:

- What is your familys total annual income before taxes?

- Does your family own the home in which you live?

- What is the current market value of your familys home?

- Do your parents have any cash held in a regular savings or checking account?

- Do your parents have any retirement or pension plans?

- Do your parents have any investments held in non-retirement accounts?

- Do you have any siblings in your household who will also be enrolled full-time in a four-year undergraduate institution in the same year that you plan to enter college?

One thing I want you to keep in mind is that the calculator I am using is very basic, and Ive only tested the variables listed above. Since the calculator itself is very basic, the answers, at best, are only estimates.

If you want a more specific college estimate for a specific school, then I recommend using the net calculator many schools have on their own webpage.

What Types Of Aid Are Available

There are three kinds of aid available through the federal government: grants, work-study, and loans. You don’t need to repay grants or work-study, but you’ll have to pay back loans.

- Grants: Often given based on exceptional financial need or if you belong to a designated group. Learn more about types of;federal grants here.;

- Work-study: Often given based on when you apply, your level of financial need, and the amount of money your school has available. Work-study is a type of financial aid that provides part-time positions for students with financial need to earn money for academic expenses.

- Loans: Subsidized loans are given based on financial need, while eligibility for unsubsidized and Direct PLUS loans isn’t based on financial need. You should consider loans after grants and work-study aid. Interest rates on federal loans are fixed.;

Recommended Reading: How To Get An Internship In College

Wake Forest University In Winston

Wake Forest University will cap loans at $6,000 per year for students whose families have annual incomes less than $40,000.

Student Retention Rate: 96%Net Cost: $24,800

Founded in 1834, Wake Forest University is a small, private, nonprofit and nonsectarian research university in eastern North Carolina with over 8,000 students coming from across the country and the world. WFUs six colleges and schools offer more than 40 undergraduate majors and programs, a 10:1 student-teacher ratio and some of the best study abroad programs, which in 2018 more than 60 percent of students were taking advantage of by heading to destinations away from the 340-acre campus. The average aid award for all undergraduate students at WFU was $37,534. Wake Forest students have been able to cover more than three-fourths of their total college costs with these awards, as well as need-based loans and a work-study job. While nearly half of undergraduates receive financial assistance, less than three percent of first-year applicants earn one of the merit-based scholarships, which are renewable through four years. WFU need-based award amounts are subject to change if students receive other outside scholarships.

How Does The Fafsa Work

Most colleges and universities use the information provided on the FAFSA to determine your financial aid package, which includes aid from both the government and your school. You can list up to 10 schools to your FAFSA application, though you may add or remove schools after you submit the form initially.;

You can fill out the FAFSA yourself or with the help of your parents. You never have to pay anyone to complete your FAFSA for you.;

Read Also: Is College Ave Student Loans Legit

How Many Students Pay Full Sticker Price

Based on 4-year college data from the Integrated Postsecondary Education Data System , a quarter of freshmen and a third of all undergraduate students pay full sticker price. Slightly less than half got no institutional grants.

At Ivy League colleges, half of freshmen and all undergraduate students pay full sticker price, and slightly more than half get no institutional grants. Generally, the percentage of undergraduate students paying full sticker price increases with greater selectivity. But, among the most selective colleges, fewer undergraduate students pay full sticker price at MIT, Stanford and Princeton.

Counter-intuitively, undergraduate students at 4-year public colleges and lower-cost colleges are more likely to pay full price than students at private colleges. Two-fifths of undergraduate students at public colleges pay full sticker price, compared with a quarter of students at private colleges.

Overall, a third of students at 4-year colleges pay full price, compared with almost half of students at community colleges.

The lower cost at public colleges causes fewer students to qualify for financial aid, especially among high-income students.

Family income affects where the students enroll.

- Students from high-income families enroll in colleges where three-fifths of undergraduate students pay full price

- Students from low-income families enroll in colleges where a third of undergraduate students pay full price

Appeal Your Financial Aid Package

So you got in to your dream school but you get a disappointing financial aid package. Its a gut-wrenching scenario, but it doesnt have to be the end of the line.

You can appeal and even negotiate your financial aid package.

If you had a substantial change to your financial aid or if other schools have awarded you wildly different aid packages, it may be worth contacting the financial aid office.

Remember, always remain grateful and courteous, while making a strong case for yourself. Be prepared to provided supplemental documentation supporting your claim as well as information requested by the school.

Read:How to Pay for College When Parents Cant Help

You May Like: What Colleges Take 2.0 Gpa