Tuition And Fees Deduction

You claim this deduction on Form 1040 and Form 8917, even if you don’t itemize your deductions, meaning that you can use it together with the standard deduction. The maximum deduction from your taxable income is $4,000 per tax year. You can’t claim the Lifetime Learning Credit or the American Opportunity Credit if you claim the tuition and fees deduction, but this deduction is useful if you are ineligible for education tax credits. You cannot claim the deduction if if your modified adjusted gross income exceeds $80,000 — $160,000 if you file a joint return.

References

Who Qualifies For Education Credits

There are possible education credits if you are claiming your college student as a dependent. For instance, there is a Lifetime Learning Credit or the American Opportunity Credit that you could possibly take advantage of. Just be aware that there are income limits that are in place with these types of credits. If your household exceeds that threshold limit, your child could still qualify for these credits if you arent claiming them as a dependent.

When Claiming A Child As A Dependent May Not Be Useful

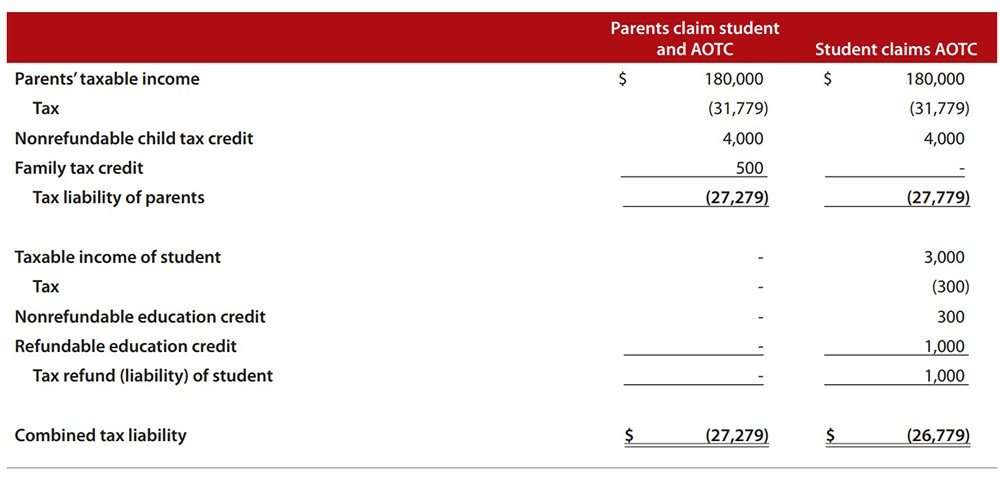

The requirements for claiming children as dependents are fairly simple until they go off to college. At that point, dependent rules start to become more complex, especially when the student has a job and pays for a portion of support. It is important for families to understand whether a college-age child qualifies as a dependent since this impacts eligibility for tax exemptions, credits, and deductions. However, the more fundamental question that rarely gets asked is should I claim my child as a dependent?

Taxpayers are historically trained that additional real estate taxes, state income taxes, tax preparation fees, investment fees, or number of dependents will reduce taxable income and resultantly reduce federal income taxes. The reality is that many financially successful families those with annual earnings between $200,000 and $500,000 are likely to fall into the trap of alternative minimum tax and resultantly obtain no benefit from these traditional federal tax savings. This income range of the AMT trap widens for families in high income tax states , families with high value real estate, families with large miscellaneous itemized deductions, and families with several children. Moreover, families with even higher income also tend not to benefit from many of these traditional tax breaks because of recently renewed limitations .

Don’t Miss: How Many Majors Are There

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money.

College Tuition Itemized Deduction

The college tuition itemized deduction is equal to the amount of your qualified college tuition expenses paid, up to a maximum deduction of $10,000 for each eligible student.

Qualifying tuition expenses are defined as net of scholarships or financial aid. Institutions of higher education include business, trade, technical or other occupational schools, recognized and approved by the Regents of the University of the State of New York, or a nationally recognized accrediting agency accepted by the Regents, which provides a course of study leading to the granting of a postsecondary degree, certificate or diploma.

The Federal government also offers tax credits and deductions in the form of the American Opportunity Tax Credit and the Federal Education Loan Interest Deduction.

Consult your tax advisor for more detailed information.

You May Like: College With The Best Dorm Rooms

Q15 Where Do I Put The Amount Of My Education Tax Credit On My Tax Return

A15. To claim the American opportunity credit complete Form 8863 and submitting it with your Form 1040 or 1040-SR. Enter the nonrefundable part of the credit on Schedule 3 , line. Enter the re-fundable part of the credit on Form 1040 or 1040-SR, line 18c.

Or To claim the lifetime learning credit complete Form 8863 and submitting it with your Form 1040 or 1040-SR. Enter the credit on Schedule 3 , line 3.

Are There Any Tax

Yes. If your child is not in college yet or if you want to start thinking about saving for your next student, you may want to consider a 529 savings plan or a Coverdell college savings account. Both grow tax-free from both federal and state income tax. And funds that are withdrawn for education purposes are not taxable.

The information in this article is current through tax year 2021 .

Recommended Reading: College Terre Haute Indiana

Scholarships Are Taxable And Nontaxable For College Students

Most scholarships are not considered taxable income. For example, scholarship and fellowship money used to cover tuition, books, supplies, and equipment while pursuing a degree are all tax-free.

On the flip side, those payments are taxable if you must perform a service as a condition of the scholarship.

Tuition Education And Textbook Amounts

Schedule 11 is the central hub of a students tax breaks and credits, says Shaw. This can only be filed with the students tax return, though unused tax reductions, up to a maximum, can be transferred to qualifying family members, such as a spouse, parent or grandparent. Students receive tax forms from their schools , which declares tuition and months of full- and part-time study. Schedule 11 takes the information from the T2202A and calculates tuition, education and textbook amounts for the current tax year. Schedule 11 also declares surpluses transferred or carried forward. This form also stays with the students return. It is not forwarded with a transferred amount. Thats done using the transfer part of the T2202A form.

The federal education and tax credits have been eliminated as of 2017, however, depending upon your province, you may still have other qualifying education credits. The tuition tax credit was not affected, nor was the ability to carry-forward any unused amounts from years prior to 2017.

Recommended Reading: College Book Price

Can I Claim My 19 Year Old College Student As A Dependent

Can I claim my 19 year old daughter if she is a full time college student? You can claim her as a dependent as long as you can answer YES to these questions. Your child must be under age 19 or, if a full-time student, under age 24. There is no age limit if your child is permanently and totally disabled.

If You Graduated Started Working Or Turned 24 Years Old In 2020

Many college students in 2020 mightve turned age 24, particularly if theyre in a graduate degree program. Another group mightve received their diploma, gotten married or started working a full-time job, supporting themselves entirely and moving out of their parents house.

If any of those situations apply to you or if youve had a lifestyle change, youd most likely be eligible for a $1,800 retroactive stimulus payment . Thats because your tax situation changed between 2019 and 2020.

But as always, you have to make sure you fall into the income eligibility requirements to receive your $1,800 check: earning up to $150,000 as a married couple or $75,000 as a single adult. Payments subtract by $5 per every $100 over that income threshold. In the first round, you wouldnt get any stimulus payment at all if you earned more than $99,000 as a single filer and $198,000 as a couple. For the second round, checks were cut off at annual incomes of $87,000 and $174,000 for individuals and married filers, respectively.

Read Also: Who Buys Back Used College Textbooks

Education Tax Credits For Undergraduate And Grad Students

Planning and saving for your childs college is something that many parents start thinking about even before their children are born. Questions such as, where will they go to college? and how will we pay for school? are usually top of mind.

Whether you have a child still in diapers or a high school student preparing for the next chapter in their educational career, theres always something parents can be doing to prepare for the financial impact of college. You can open an NC 529 Account and make regular monthly contributions, and when theyre in college you can apply for financial aid for each year theyre enrolled. Another financial option you may want to explore is claiming eligible tax credits on your federal tax return.

While youre likely more familiar with 529s and financial aid, you may not be aware of federal education tax credits. So, heres a closer look at education tax credits that you may be eligible to claim to cover common student expenses for you, your spouse, or a child you claim as a dependent.

Can You Deduct College Tuition On Your Federal Income Tax Return

There are several options for deducting college tuition and textbooks on your federal income tax return, including the American Opportunity Tax Credit, Lifetime Learning Tax Credit, Tuition and Fees Deduction, and Employer-Paid Educational Assistance, as well as tax-free distributions from a college savings plan.

There is no double-dipping. Each dollar of qualified expenses can be used to justify only one tuition tax break. There are also coordination restrictions that prevent taxpayers from claiming both the American Opportunity Tax Credit and Lifetime Learning Tax Credit for the same student, even if the qualified expenses do not overlap.

The American Opportunity Tax Credit is the best of the tuition tax breaks. It is worth more per dollar of qualified expenses than any other tuition tax break, even a tax-free distribution from a 529 college savings plan. Generally, taxpayers should claim the American Opportunity Tax Credit first, unless they want to preserve its availability for future tuition expenses.

All of these tax breaks can be claimed even if the taxpayer does not itemize.

College tuition may be eligible for a tax deduction or tax credit on your federal income tax return.

getty

Don’t Miss: Who Buys Back Used College Textbooks

Q24 I Am A Nonresident Alien Can I Claim An Education Tax Credit

A24. Generally, a Nonresident Alien cannot claim an education tax credit unless:

- You are married and choose to file a joint return with a U.S. citizen or resident spouse, or

- You are a Dual-Status Alien and choose to be treated as a U.S. resident for the entire year. See Publication 519, U.S. Tax Guide for Aliens for more information.

College Tuition Tax Credit

The college tuition credit is a tax credit allowed for qualified college tuition expenses paid for an eligible student. For taxpayers with allowable expenses of $5,000 or more, the credit equals the applicable percentage of qualified tuition expenses multiplied by 4 percent. The maximum amount of allowed qualified college tuition expenses is $10,000 therefore, the maximum tuition credit is $400 per eligible student.

If your total qualified college tuition expenses for all eligible students total less than $5,000, the credit is equal to your qualified college tuition expenses or $200, whichever is less.

Recommended Reading: Does Cape Fear Community College Have Dorms

Student Loan Interest Deduction

If you meet income requirements for claiming the student loan interest deduction, it could help offset up to $2,500 of interest paid toward a qualified student loan.

To be eligible for the full deduction, the claimants modified adjusted gross income must be less than $65,000 . If your MAGI is between $65,000 and $80,000 your deduction will be reduced. And if your MAGI is $80,000 or more , you wont be able to take the deduction at all.

You also cant take this deduction if your filing status is married filing separately.

Start with this question: Who took out the loan? The person claiming the student loan interest deduction must be legally obligated to pay the interest, cant be listed as a dependent on someone elses return, and their income must fall below the MAGI limits. If all of this is true, then the student can claim the deduction, even if someone else pays the bill for them.

If the students parents took out the loan or co-signed on it, they can claim the deduction as long as they also claim the student as a dependent. Of course, their income must fall below the income limits.

You claim this deduction on Form 1040, but you may need to complete additional worksheets depending on income sources.

Can I Claim A College Student As A Dependent

College Education Expenses

Colleges work in academic years, while the IRS works incalendar years. So the reality is, it takes you 5 calendar years to get that 4year degree. With that said:

– Scholarships and grants are claimed/reported astaxable income in the year they are received. It does not matterwhat year that scholarship or grant is *for*

– Tuition and other qualified education expenses arereported/claimed in the tax year they are paid. It does not matter what yearthey pay *for*.

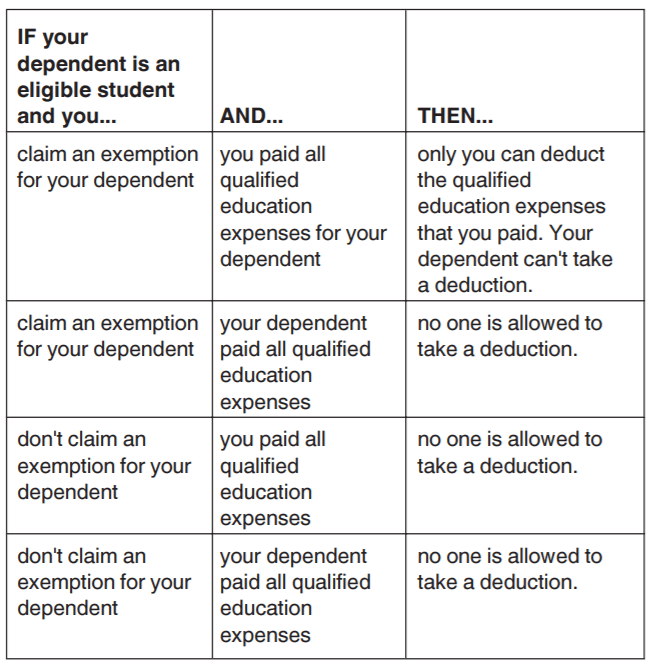

Understand that figuring out who claims the student as adependent, and determining who claims the education expenses & credits, istwo different determinations. It depends on the specific situation as outlinedbelow. After you read it, I have also attached a chart at the bottom. You canclick on the chart to enlarge it so you can read it. If its still to hard toread on your screen then right-click on the enlarged image and elect to save itto your computer. Then you can double-click the saved image file on yourcomputer to open it, and it will be even easier to read.

If the student:

Is under the age of 24 on Dec 31 of the tax year and:

Is enrolled in an undergraduate program at an accreditedinstitution and:

Is enrolled as a full time student for one academicsemester that begins during the tax year, and:

the STUDENTdid NOT provide more that 50% of theSTUDENTS support

Then:

The parents will claim the student as a dependent on theparent’s tax return and:

1099-Q Funds

Don’t Miss: Where Can I Sell Old College Books

Q5 What Are Qualified Tuition And Related Expenses For The Education Tax Credits

A5. In general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post-secondary educational institutions . The expenses paid during the tax year must be for an academic period that begins in the same tax year or an academic period that begins in the first three months of the following tax year.

The following expenses do not qualify for the AOTC or the LLC:

- Room and board

- Student fees, unless required as a condition of enrollment or attendance

- Same expenses paid with tax-free educational assistance

- Same expenses used for any other tax deduction, credit or educational benefit

Several Tax Breaks Can Ease The Financial Blow Of College Costs Whether Youre Saving To Send Your Kids To College Paying Tuition Bills For A Child Or Yourself Pursuing Graduate Work Or Repaying College Loans

Thinkstock

Several tax breaks can ease the financial blow of college costs, whether youre saving to send your kids to college, paying tuition bills for a child or yourself, pursuing graduate work, or repaying college loans. And some new tax laws have changed the rules and expanded some breaks for education. The following six tips can help you take full advantage of these tax breaks.

1 of 6

Also Check: What College Accepts The Lowest Gpa

Can A Student Could Claim Their University Residence Fees

Fees for student residence are not eligible tuition fees but, if you are applying for a provincial benefit such as the Ontario Trillium Benefit, the residence fees can be used.

In the Provincial section, on the screen titled Apply for 2018 Ontario Trillium Benefit, select Yes to the question Did you live in a designated university, college, or private school residence during 2017?

What Is An Education Tax Credit

Education tax credits were created to increase college attendance and reduce the cost of higher education for Americans. An education tax credit can either decrease the amount of money you owe to the IRS when you file your taxes or increase the amount of your tax refund if youre getting money back. To qualify for an education tax credit the student must attend an eligible institution that participates in the federal student aid program.

There are two education credits available to taxpayers. The American Opportunity Tax Credit and the Lifetime Learning Credit . Lets start with the AOTC.

Read Also: How Much Is Berkeley College Tuition

American Opportunity Tax Credit

If youre eligible to claim it, the American opportunity tax credit can be worth $2,500 per eligible student per year for the first four years of the students college education. Thats 100% of the first $2,000 you paid toward qualified education expenses and 25% of the next $2,000. Plus, if the credit reduces your tax liability to zero, the IRS can refund 40% of the remaining amount back to you.

To qualify for the American opportunity tax credit, your MAGI must be less than $90,000 if single or $180,000 if married and filing jointly. The credit is gradually reduced if your MAGI is between $80,000 and $90,000 for single filers or $160,000 and $180,000 if you file a joint return.

Whether the parent or student claims this credit, the student must be

- Within the first four years of higher education

- Taking classes at least half time

- Enrolled in a degree or certificate program

- Free of felony drug convictions

To claim this credit, you must complete Form 8863 and attach it to your 1040.