Next Steps To Determine How Much Financial Aid You Can Get

Once you have an idea of how much financial aid you can expect, you can better determine your debt load to pay for college.

A good rule of thumb is to borrow no more than 10% of projected after-tax monthly income in your first year out of school. For example, if you expect to make $40,000 in your first year out of college, borrow less than $21,000 to keep your payment affordable. Use a student loan affordability calculator to figure out how much to borrow.

I’ve Completed My Fafsa Now What

If you listed Delta College on your FAFSA, we will receive your information electronically about 2 weeks from the date you completed your online application.

Once your FAFSA is received, an e-mail will be sent to your Delta College E-mail account, to login to your MyDelta Student Portal and check your Financial Aid tile. From here, you will be able to check your financial aid status and find your Financial Aid Specialist, who will serve as one your main point of contact.

If you find you do not see any Financial Aid information in your MyDelta Portal, it’s likely that the College hasn’t received your FAFSA yet. Feel free to call 954-5115 to check.

How Much Financial Aid Should I Expect

So you are pondering how much money, if any, your child will receive from the colleges they are applying to, and are coming up empty handed on a response. How much financial aid should you actually expect? The amount of financial aid will differ depending on the student, the generosity of the college as it relates to the student, how generous they are in general, as well as the familys financial standing as it relates to the college to which the student is applying. More detailed explanations are outlined below.

Recommended Reading: Study Com Partner Schools

I’m Having Trouble Completing My Fafsa

We understand that filling out your FAFSA can be a daunting process. As a result, we have a number of options to help students complete their FAFSAs.

- Visit us at our DeRicco E-Services Lab

- Email us at with your questions

- Call us at 954-5115

- Attend one of our available workshops. For dates, click financial aid workshops.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Recommended Reading: Danielle Nachmani Age

What Is The Expected Family Contribution And How Is It Calculated

So lets start at the beginning and speak in greater detail about Expected Family Contribution . This is the core and base for a college to determine how much financial aid you will be awarded for college and what a college says your family can pay for one year of your college education. This doesnt mean that it is actually what you feel you can pay, but it is what they say you can pay. This can be a big difference! Your EFC is based on a number of financial factors. It is a heavily income-driven calculation where the majority of your EFC amount is based on this. But, your assets are also included , the number of family members in your household, the age of the students parents, and some other factors.

Federal Direct Plus Loans For Parents

Like the name says, this loan is intended for parents to take out on behalf of their child. That is, the loan will be in the parents name.

Unlike some of the other loans, there is no fixed dollar amount on a Parent PLUS loan. The maximum you can borrow is the cost of attendance minus any other financial assistance received.

Recommended Reading: How Long Do Your College Credits Last

A Wide Range Of Efcs Exists

In general, the wealthier the family, the higher the EFC.

The lowest possible EFC is $0.

An EFC of zero means that the financial aid formula has determined that the family cannot afford to pay anything towards college. Families with adjusted gross incomes of $25,000 or less have an automatic EFC of $0.

The EFC for the average American household with an AGI of $55,000 will often range from $3,000 to $4,000. These families have significant financial aid needs.

Can You Get Financial Aid For Community College

Enrollment at community colleges is growingand for good reason. Many community colleges offer a quality education for a much smaller price tag.

You might think that because community college typically costs less, you can’t receive financial aid to attend. But fortunately, that’s not the case. You’re eligible for the same types of financial aid at a community college that you would be at a four-year institution.

Even better, attending community college can provide an opportunity to save not just on tuition but also on the associated costs of higher educationbooks, housing, meals, and transportation.

Also Check: Arlando College Hill

How Does Financial Aid Work

The process of applying for financial aid can be confusing and overwhelming, but it doesnt have to be. Heres a basic overview of how financial aid works and what you need to do to apply for it:

You may be required to take out a student loan to cover the cost of your education. Before taking out a loan, make sure you understand all the terms and conditions, including interest rates, repayment options, and deferment or forbearance provisions. You can also use scholarships and grants to help pay for college. Scholarships and grants are types of financial aid that you dont have to repay.

Average And Maximum Financial Aid

| Type of Aid |

| $5,999 $5,775 |

These figures do not include military student aid, state aid and institutional aid. They also do not include the Federal Direct Parent PLUS loan, which is available up to the full cost of attendance minus other aid, and the TEACH Grant, which provides up to $4,000 per year to students who commit to pursuing teaching careers in national need areas.

If you dont receive enough financial aid to pay for college, you might consider taking out a student loan. Interest rates on private student loans vary, so be sure to compare lenders before you borrow.

See also:

Also Check: Central Texas College Majors

What Types Of Aid Can You Get After Submitting The Fafsa

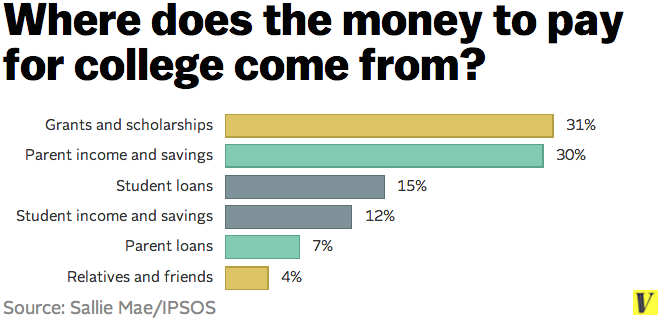

Your financial aid package will be broken up into several parts: Grants, scholarships, work-study, and loans.

- Grants: Often given based on exceptional financial need or if you belong to a designated group. Pell Grants, which are offered to students with significant financial need, have a maximum award of $6,495 for the 202122 award year . The maximum award for the 2022-23 school year has yet to be announced. Learn more about types of federal grants.

- Scholarships: Aren’t usually given based on your EFC, but rather on factors such as academic merit, athletic achievement, or volunteer experience. You might even net a full ride, where your entire cost of school is covered.

- Work-study: Your total package is based on when you apply, your level of financial need, and the amount of money your school has available. Work-study is a type of financial aid that provides part-time positions for students with financial need to earn money for academic expenses.

- Loans:Direct Subsidized Loans are made to students with financial need, and the government will cover the interest on the loans while you’re in school and during a six-month grace period after you graduate. Direct Unsubsidized Loans aren’t made based on financial need, and interest will accrue once loan funds are dispersed. Here are the maximum loan amounts you can receive from the government:

The Amount You Get Isnt Enough To Cover All The Expenses File An Appeal With Donotpay

If the offer from your dream college isnt as satisfying as you expected, DoNotPay gives you a chance to send an appeal letter to the institution quickly and efficiently! Instead of writing it yourself, give us the basic info, and we will compose and send it on your behalf in only a few taps!

Heres what you need to do:

Our learning base features many practical guides that will teach you everything about the financial aid application for many well-known universities, including:

You May Like: Cheapest Colleges In Maryland Out Of State

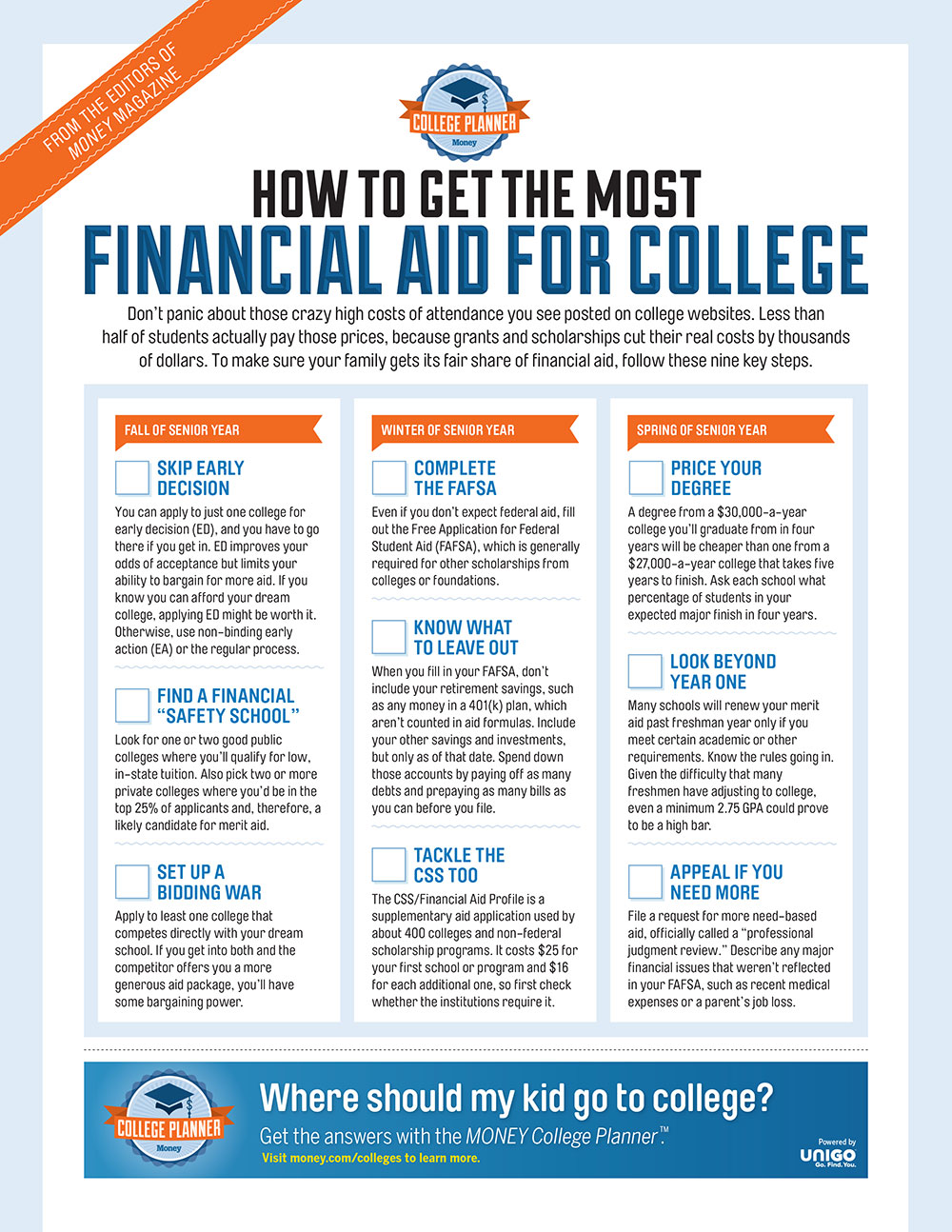

Complete The Fafsa Application

The Free Application for Federal Student Aid is a form that every student must complete if they want to take advantage of federal aid programs. You’ll have to fill out and submit the form annually for as long as you need financial aid, but there are online FAFSA guides to walk you through the process.

Your completed form provides all the necessary information for the federal government to determine whether you are eligible for federal financial education assistance. Some forms of assistance are available to any student enrolled at least half-time at an accredited school and some are only available to those who exhibit financial need.

It’s important to note that many schools use the FAFSA to award other kinds of financial aid, such as state or institutional assistance, so it’s important to fill out the FAFSA even if you think you won’t qualify for aid.

Certain states provide their own financial aid programs and may have their own application processes. To find out whether you are eligible for any state programs, check our state-specific resources database and contact your school’s financial aid office.

Why Students Take Summer Classes

Whether you plan on taking classes at your current university or at a nearby community college, summer classes can be beneficial. You can retake classes you struggled with in the past to improve your grades, knock out core or elective course requirements and fast track your degree.

If you graduate early, you can reduce how long youre in school by a semester or even a full academic year. It also helps lower how much youll have to spend on tuition, fees, and room and board for every term that you reduced while in college. And, you can start working to earn full-time income sooner.

You May Like: Which School Do I Belong To

How Financial Aid Awards Are Determined

It is important that you understand what your Expected Family Contribution is since this is the critical starting point of how any school calculates the financial aid that is awarded to a student. This amount is what the federal government and/or institution says you can pay for one year of your childs college education. So, as an example, if your Expected Family Contribution is $30,000 and the cost of attendance for a particular school is $60,000, your calculated Financial Need is $30,000 . Most schools will not cover this gap in totality and the percentage that they do will vary by student and by school. Some may cover 80% of your need, but some may just cover 20% of your need, or none of it. The amount of financial aid you receive will depend on the school as well as where your child falls in their applicant pool. Very few schools cover 100% of a students financial need, so dont expect to receive it.

Carrying this out to a different scenario, if your Expected Family Contribution is $75,000 and a schools cost of attendance is $65,000, your child wont get any financial aid awarded since your Expected Family Contribution is higher than the schools cost of attendance.

Important Application Forms: Fafsa And The Css Profile

There are two primary pathways to financial aid as you enter college. One is the Free Application for Federal Student Aid sponsored by the U.S. Department of Education and required for you to be considered for federal aid as well as for most college and state assistance.

The second, known as the CSS Profile, is sponsored by the College Board and used by roughly 400 mostly private colleges and universities to allocate non-government financial aid from those institutions.

Each form has its deadlines and procedures You should submit the FAFSA even if you don’t believe you will qualify for federal financial aid. That’s because you may be wrong, and even if you’re right, the FAFSA is also required for most local, state, and individual school financial aid, including merit scholarships. Whether you should submit the CSS Profile probably depends on whether the financial aid you are interested in or the school you plan to attend requires it.

Recommended Reading: National Guard College Pay

What Are Trade Schools

A trade school is an educational program beyond high school that provides training for a specific career or job. Also referred to as vocational, technical, or career schools, these schools instruction typically leads to an occupation-specific certification, licensing process, or apprenticeship.

From carpentry and computer coding boot camps to cosmetology schools and community colleges, a variety of trade schools provide training in a wide range of fields. Most trade school programs last two years or fewer, offering a chance to boost employability with less time and money invested than with a four-year degree.

Workers who earned an occupational degree, for example, are found to be more likely to be employed full-time than those who didnt. And those with an associates degree earn 17% more than those with only a high school diploma, according to the U.S. Bureau of Labor Statistics .

While many trade schools can help students get ahead, be wary of offers that sound too good to be true. Do your own research on the career field youre hoping to enter, the demand and pay for this type of work, and the trade schools reputation so you can make an informed decision.

When Will You Know How Much You Will Receive

You will eventually receive a financial aid award letter from all colleges you applied to via your FAFSA or your CSS Profile. When the letter will arrive depends on the school, but generally, you can expect it at about the same time you receive your acceptance letter from that school.

The amount of aid offered can range from zero to the full cost of attending college. It will be broken down into three categories: free money you don’t have to pay back, earned money , and borrowed money .

Also Check: How To Build Credit In College

How Do You Calculate Your Estimated Expected Family Contribution

I use the Expected Family Contribution calculator on Big Future through the College Board Big Future Expected Family Contribution Calculator. This will calculate your EFC for both the Federal Methodology as well as the Institutional Methodology . The output is only as good as the inputs, so be sure you gather the information you need to enter so the results are as accurate as possible.

Check Open Dates Not Deadlines

Procrastinators beware! Although the FAFSA, the CSS Profile, colleges, and universities all have deadlinesthe last date you can apply for aid each yearthe most important date to remember is the open datethe first date each year you can apply for financial aid.

As noted above, the open date for the FAFSA and the CSS Profile is Oct.1 of the calendar year before the academic year for which you are applying for aid. The open date for the academic year 2022-23, for example, is Oct. 1, 2021.

You can apply for federal aid through the FAFSA for the academic year 2021-22 anytime between Oct. 1, 2020, and June 30, 2022. However, keep in mind that state and college/university aid open dates and deadlines, including those through the FAFSA and the CSS Profile, are typically much earlier than June 30, with some states and schools instructing you to apply “as soon as possible” after the Oct. 1 FAFSA/CSS open date. Others set their deadline sometime between January and March of the next year and a few even follow the FAFSA June 30 deadline. State deadlines are available on the FAFSA deadlines webpage.

Recommended Reading: Does Trade School Count As College