How Much Money To Save For Your Childs College

As parents, its up to you to determine how much of your childs college expenses you would like to pay for. It may seem like a daunting task to accurately estimate how much to save for your childs college, at any age.

To give you an idea of how much youll need, do some research on potential public or private universities and their projected costs. Take current projections from several universities and divide that by the number of months until your child goes off to college. That amount is how much you should be working into your monthly budget and saving for your childs future education.

Approximate First Year Baby Cost

Looking at the figures mentioned above, were sure that you have a greater appreciation of the need for financial preparedness. If we were to total all necessary expenses for one year, this is what you may be looking at:

- Hospital delivery costs for a vaginal birth: $7,782.72.

- One time expenses: $1,069.

- Toiletries: $252.

- Entertainment: $1,374.

The overall cost of raising a child for one year in the United States is $24,642.22. These figures are pretty steep and naturally, youll want to bring them down. We tackle how to do this in the next section.

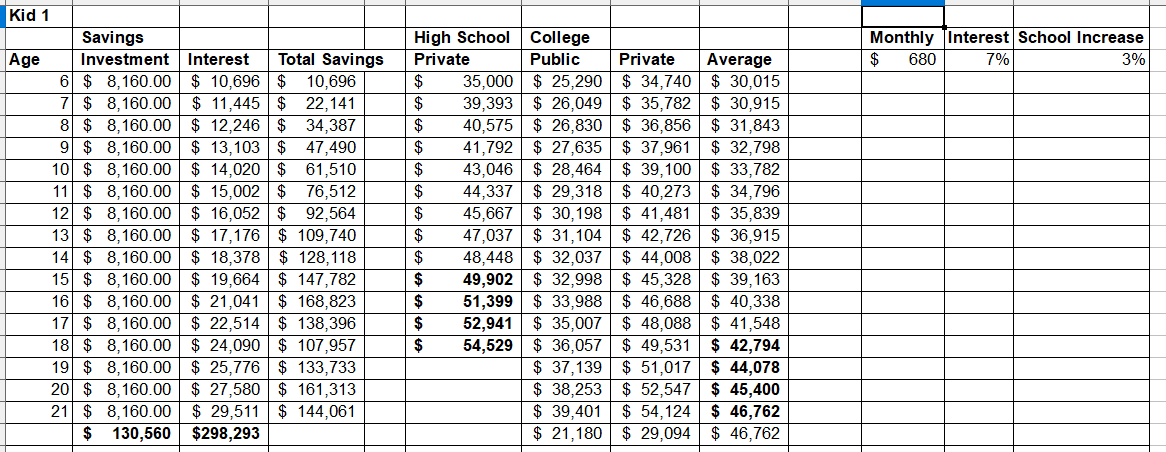

Looking At The Time Frame

Now that we have a figure to work with, you have to examine your own personal time frame.

Obviously the more years you have between when you start investing/saving and when your child is going to college, the better for your finances.

Let’s say you decided to just save the money and not invest it, here’s how it breaks down on a monthly basis:

- 18 years -> $129.63/month

- 5 years -> $466.67/month

- 4 years or less As much as you can!

A quick mention about investing versus saving- if your time frame is less than 5 years, it would be safer to save that money in a high interest saving and not invest that money.

You May Like: Does Brooklyn College Have Dorms

What Are Examples Of Education Savings Accounts That Will Help People Plan For College Expenses

A 529 plan is one of the best tax-advantaged ways to save for higher education. They come as either savings or prepaid tuition plans. Coverdell ESAs are another popular way to save. A plan can be set up at a bank or brokerage firm to help pay the qualified education expenses of your child or grandchild. Like 529 plans, Coverdell ESAs allow money to grow tax-deferred and withdrawals are tax-free at the federal level when used for qualifying education expenses

Our 529 Plan Performance Review

After superfunding my sons plan at the end of 2017 with $70,000, my wife contributed $45,000 between 2017-2019. My mother also contributed $30,000 between 2018-2019 for a combined total contribution of $146,500.

At the end of 2019, the 529 plan finished the year at $189,911.45. Therefore, $43,411.45 has been gained tax-free to pay for education-related expenses. Too bad 2018 was a down year. But still not bad for a little over two years of contributing.

The below chart shows the graphical representation of balances.

The follow chart shows the month-by-month performance changes plus corresponding deposit amounts in 2019.

Also Check: Bachelor’s Degree In Mortuary Science

The Cost Of Child Care

Child care is an expense you should plan for very early, even before delivery, because of the logistics and costs. Some places have a waiting list , which is something you need to get ahead of if you plan to send your children to day care, Burns said. According to the annual Care.com Cost of Care survey, the average weekly cost for an infant child is $211 for a day care center, $195 for a family care center and $580 for a nanny.

Start looking for options early to compare costs and secure your child a spot at a place you trust. To help with expenses, you may be able to claim the child and dependent care credit. The tax credit ranged from 20% to 35% of eligible care expenses. You may also be able to take advantage of a dependent care flexible savings account option, which is an account with tax perks offered by some employers. A tax professional can help you devise a tax plan thats most beneficial given your household size and income.

Shop Around For The Best Prices

Though getting a quote from a hospital is not easy, its worth a try. Teaching hospitals usually charge more while state hospitals charge less. Youll want to also consider the hospitals c-section rates, morbidity rates, and policies on birth interventions before making a decision.

Midwives fees dont fluctuate as much but its always worth comparing prices. Consider whether the midwife does a home visit after birth, which is a wonderful resource for new moms.

In general, midwives that practice at community hospitals tend to have much lower birth cost rates than those that practice at large teaching facilities.

Read Also: Cfcc Winter Classes

If One Parent Stays At Home

If one of you becomes a stay-at-home parent, there are important budget changes to considerthe most obvious is reduced family income. Despite the high cost of child care, the cost of one partner leaving an income behind to commit to full-time parenting can be much higher in terms of lost income, benefits, and investment.

This is compounded by diminished earning potential if that partner decides to resume their career. The decision to stay home can be personal or financialat lower income levels, even government programs cannot balance the high costs in some regions. If it is for personal reasons, however, a couple can at least try the one-income budget prior to the birth to get an idea for it while building an emergency fund with the second income at the same time.

Por Qu Abrir Un Plan De Collegeinvest 529

Una educación más allá de la escuela secundaria es invaluable, ya sea que prefiera una escuela técnica o un colegio universitario o una universidad. El Programa First Step busca ayudar a las familias de Colorado a comenzar a ahorrar lo antes posible. A medida que su hijo crece, sus ahorros tienen el potencial de crecer también, ampliando las opciones y oportunidades para su futuro.

¹ A nonqualified withdrawal is subject to federal and state income taxes on the earnings portions and a 10% penalty on the earnings portion. In addition, any state tax deductions for contributions may be subject to recapture in subsequent years. For a list of the qualified expenses

² Contributions to a plan by a Colorado taxpayer are deductible from Colorado state income tax in the year of the contribution, up to your Colorado taxable income for that year. These deductions are subject to recapture in subsequent years in which nonqualified withdrawals are made.

You May Like: Free Grammarly For Students

Pay Attention To 529 Plan Laws And Politics

Even though the SECURE Act passed, none of us are exactly sure how well be able to go about extracting our 529 funds to pay for things until we actually do. I fully expect to one day try and withdraw $100,000 and cant because I lost my password and forgot to account for some random law.

There is also an increasing chance that within the next 20 years, many more Americans will be able to attend reputable colleges for free. If the bull market continues, the wealth gap will continue to widen. As a result, a socialist might get elected President and many more socialists may be elected to Congress.

Saving and investing heavily for your childs future is a suboptimal strategy in a more socialist regime. Think about all those parents and students from Howard University who just missed a billionaire alumnis generosity of paying off all student debt for a graduating class. Or imagine if a new President decides to cancel all student debt. Good for those with debt, but not so much for those who worked and saved to pay for their own education.

If capitalists are in power, you should save and invest as much as possible. If socialists come to power, however, you should try to relax more and take advantage of government programs such as income-driven repayment plans with forgiveness.

Open A 529 Account Before Their Birth

Did you know that you can establish a 529 college savings plan for your child before theyre even born? Its simple. Every 529 account has an account owner, usually a parent, and the beneficiary, usually the child. To be named as the beneficiary, your child must have a Social Security number. Until that time, you can open a 529 plan and designate yourself as the owner and beneficiary. This way, you can contribute to your childs future college plans before they even arrive. Once you have your babys Social Security number, you can easily change the account to make them the beneficiary.

Recommended Reading: Ashworth College Fafsa

Baby Showers: Ask For The Gift Of College

There will be many showers to celebrate the impending arrival for your baby. And there are many items you will need for your child. However, why not ask for the gift of college at these festivities? Loved ones want to give presents that have significance and what gift can last longer than a college education or technical training? A 529 gift contribution lasts a lifetime.

Ohios 529 Plan has teamed up with Ugift to make receiving gift contributions simple. As the account owner of a CollegeAdvantage Direct 529 Plan, you can request a unique Ugift code, which allows the gift givers to donate online directly to your 529 plan without needing the account number. Gift givers use the Ugift code to contribute to the account at any time and as many times as they like.

If the gift giver would prefer to write a check, make sure its payable to Ohio Tuition Trust Authority and includes your childs CollegeAdvantage Direct Plan 11-digit account number.

What if a loved one wants to jump-start your childs college fund? Per federal 529 laws, an individual can give up to $16,000 or a married couple give $32,000 to each child annually without triggering a federal gift tax. Single filers can also make a one-time $80,000 contribution and married couples can give $160,000 per child to take advantage of five-years worth of tax-free gifts at one time. For more information, have them talk with their tax adviser or estate-planning attorney.

Ohios 529 Plan Can Be Used Nationwide

And dont worry you dont need to know where your baby will want to go to college when youre using Ohios 529 College Savings Plan. CollegeAdvantage 529 account can be used at any two-year or technical college, four-year college or university, trade or vocational school, apprenticeships, or certificate program nationwide that accepts federal financial aid.

You May Like: Uei Trade School

A Little Perspective On Costs

Did you know that the average car loan being around $26,300 ? Pretty close to the $28,000 estimate.

If you really want your kid to have their college tuition paid, then dumping your car loan looks like a great way to free up your money for it.

I’d also point out that if you get a tax refund, you could sock away some or all of that without hurting your monthly finances.

I just wanted to note that perhaps the reason some are struggling to save is because they have too many obligations with their money.

With a little fine tuning you may be surprised at how easy it is to save for your child’s college fund.

Who Is Eligible To Receive The $50 Seed Deposit

To be eligible to receive the $50 college savings seed deposit provided by BabySteps, a child must:

- Be a Massachusetts resident.

- Have been born or adopted less than one year ago.

- Adopted children must complete the Adoption Verification Form. Adopted children can be born before January 1, 2020, but the adoption must have taken place less than one year ago.

- Be named the Beneficiary on a U.Fund 529 College Investing Plan account within one year of birth or adoption.

Eligible U.Fund 529 plan accounts will receive their free $50 deposit approximately six weeks after opening the account. The account creator has 30 days from account opening to opt-out of the program if they do not want the $50 deposit.

Families of children born or adopted over one year ago, can open a U.Fund 529 plan account but are not eligible for the $50 seed deposit.

You May Like: Selling Back School Books

Will Insurance Cover Our Birth Cost

The good news is under the affordable care act maternity care is required to be fully covered even if you are pregnant when applying for coverage.

The bad news is, since the ACA was signed into law, insurance deductibles and premiums have risen dramatically. Many women have found that the cost of midwifery care is significantly lower than their yearly deductible. In this case or in the case of not having insurance, midwifery care is still the least expensive option for maternity care.

However, if you have private insurance through your employer and dont pay a high deductible, out of pocket costs between hospital birth and midwifery care may be similar.

If midwifery care is not covered under your insurance, you may pay less or a similar fee for a hospital birth. Keep in mind that when looking for providers covered by your insurance plan, it may be possible to deliver with a midwife who bills under collaborating OB-GYNs, which may drive your birth cost down.

Save For Education Costs

Education costs may not be at the top of your mind when youre waiting for the water to break, but the earlier you plan, the less financial burden youll encounter when its time for your children to go off to school. Every dollar saved is one less dollar borrowed, Furubotten-LaRosee said.

Savings may not cover the entire cost of tuition or college, but at least its something. You could save in a traditional brokerage account. Because its long term, you have 18 years to invest in some blend of stocks and bonds that youre comfortable with, Furubotten-LaRosee said.

Here are a few accounts to consider:

Uniform Gifts to Minors Act and Uniform Transfers to Minors Act accounts: The UGMA and UTMA are both custodial accounts you can use to invest money for your child. Accounts may be made up of mutual funds, stocks and bonds. UTMA accounts can also be used for real estate. You can generally contribute up to $15,000 per year per child without worrying about the gift tax. Couples can contribute up to $30,000 per year per child. The child typically gets access to the funds when theyre between 18 and 21, depending on the state where the account is opened. The money doesnt have to be used just for school.

Theres a lot to think about when saving for a baby. Adding another person to the family is a lifestyle change. Take a look at your spending and budgeting habits to make room for upcoming expenses for the child, and review the options above to make a smooth transition.

You May Like: Is Ashworth Accredited

When Should You Start Saving For College

As soon as possible! Thats if youve already taken care of Baby Steps 14.

Starting a college fund is a great goal, but its not the only goal. You need to pay off debt, have an emergency fund, and start saving for retirement before you jump into saving for college. There are other ways to pay for college too, like using grants and scholarships. Bottom line, you need to take care of your future first, then you can bless your kids. Its not selfish. Its smart.

If youre following the Baby Steps, you know that saving for college is Baby Step 5. That means there are four other steps you need to take before you even think about Juniors college education:

- Baby Step 1: Save $1,000 for your starter emergency fund.

- Baby Step 2: Pay off all debt using the debt snowball.

- Baby Step 3: Save 36 months of expenses in a fully funded emergency fund.

- Baby Step 4: Invest 15% of your household income in retirement or a Roth IRA).

Bottom Line: Save As Much As You Can

When it comes down to it, you’ll need to reconcile your numbers with what you can afford. Saving for college is important, but it needs to work with your other priorities, like saving for retirement or building an emergency fund.

Be sure you’re doing all you can, though. Cutting expenses to save an additional $25 a week could have a considerable impact in the long runand make it less likely that you’ll struggle financially when it’s time for college.

Saving more can have a huge impact

This hypothetical illustration assumes an annual 6% return, as well as a weekly deposit for 18 years, for all examples. This illustration does not represent any particular investment nor does it account for inflation. There may be other material differences between investment products that must be considered prior to investing.

Saving more can have a huge impact

This chart shows what your final balance might be if you save different amounts each week. If you save $25 a week for 18 years, you could have a total balance of about $42,600. Increase your contribution to $50 a week over 18 years and your balance could go up to about $85,200. See an even more dramatic spike in your balance when you contribute $75 a week over 18 yearsand boost your savings to about $127,800.

Read Also: Ashworth College Pharmacy Technician Review

How Much To Save For College

Unless your familys income is at the very top of the national average, your child likely wont have to cover the full published cost of attendance. In 2017-18, 86% of full-time first-year undergrads at four-year schools received some type of financial aid, according to the National Center for Education Statistics.

The average net price of a college is a more reasonable way to estimate how much to save. The net price is how much a student pays after taking into account any grant aid, which doesnt need to be repaid. The federal, state and school grant money your child is eligible for is determined using the information in the Free Application for Federal Student Aid and any state- or school-specific financial aid applications.

The grant aid your child receives will depend on your familys financial circumstances when you fill out these forms. Your income, the number of children you have in college at the same time and certain types of assets will all factor in. But you can use average net price numbers to set your savings goal.

Here is the average net cost of attendanceincluding tuition, fees, room, board, books, supplies and transportationfor full-time students across different college types, according to The College Board:

| Type of college | |

|---|---|

|

$33,220 |

$132,880 over four years |