How To Pay For It

Older students have most of the same options as younger ones when it comes to paying for college. If you can afford to pay for it out of your savings, great. But for many people, it will mean borrowing. While taking on debt may not be ideal, especially later in life, federal and private student loans can often provide the funding you need.

To be eligible for federal student loans or other assistance, youll need to complete the Free Application for Federal Student Aid . Filling out the FAFSA form will be different because youre using your income, not your parents’, says Joseph. You’re also reporting your own assets. Theres no age limit to apply for federal aid, and your won’t affect your ability to qualify for loans.

Tax Breaks For Education

Depending on your income, the expenses you incur, and other factors, you may also be eligible for a tax credit or deduction for a portion of your costs. The American Opportunity Tax Credit offers a maximum annual credit of $2,500 for the first four years of higher education.

The Lifetime Learning Credit offers an annual credit of up to $2,000 for undergraduate, graduate, and professional degree courses, and there is no limit on the number of years you can claim it.

The interest you pay on a student loan may also qualify for a tax deduction. Note that if you’re eligible, you can take a student loan interest deduction as an adjustment to income, even if you don’t itemize deductions on your tax return.

The American Rescue Plan passed by Congress and signed by President Biden in March 2021 includes a provision that student loan forgiveness issued between Jan. 1, 2021, and Dec. 31, 2025, will not be taxable to the recipient.

How Much Money Do You Really Need

Everyday I run into new entrepreneurs who tell me about their business venture that is going to change the world. After they share this with me, I immediately ask them this one simple question:

Why are you an entrepreneur?

You can probably guess what the most common response is:

I want to be rich!

When I start digging deeper to find out why they want to make a lot of money, its almost always because they want to live a comfortable lifestyle so they dont have to worry about money.

Thats when I usually think to myself, how much money does one really need to live comfortably?

Dont get me wrong, I am also an entrepreneur because I want to make money, but I quickly learned that you dont need as much money as you think to live comfortably.

Also Check: Central Texas College Online Degrees

How Much Money Do You Need To Immigrate To Canada

When it comes to immigration costs, Canada is still fairly affordable compared to other popular immigration destinations such as Australia, the UK, and the USA. A family of four immigrating to Canada is looking at paying approximately CAD $11, 000 less than a family of four immigrating to Australia. Thats a significant amount saved!

Immigrating to a new country is an intricate and lengthy process that comes with a hefty price tag but the outcome is surely worth it: a brand new life filled with better opportunities and a promising future for you and your loved ones.

The amount of money you need to immigrate to Canada depends on the size of your family, and the type of immigration program you apply for. It further involves settlement funds, visa processing fees, the collection of required documents and even bringing your pet over.

Take a look below for a breakdown of Canada’s immigration fees and how much money you actually need to immigrate to Canada with your spouse or family.

Start Your Journey Now

How Can An Older Person Afford To Go To College

For most people, a mix of loans and grants will be needed to pay tuition. A third potential source of money are employers, since many companies offer tuition reimbursement, scholarships, or repayment assistance for student loans. The first step is to fill out and file the Free Application for Federal Student Aid, known as the FAFSA.

Read Also: Colleges That Accept 2.5

College Textbooks And Supplies

College textbooks and supplies are a necessary part of any college education, and theyre not cheap! According to the National Association of College Stores, the average textbook for the 2015-16 year cost $80 new and $51 used for the 2016-17 year, students paid an average of $579 for school supplies. While these averages cover a wide variety of students and college majors, theyre still a good benchmark for your own textbook budget.

Take a look at your anticipated course load for the upcoming semester to estimate the types of supplies and textbooks youll need. You may be able to cut costs by going used or taking advantage of free resources. And dont use your campus bookstore as a one-stop shop: Go online and comparison shop, check used booksellers and technology vendors, connect with local groups on Freecycle, and take advantage of the library, language lab, and other free or low-cost on-campus and community resources.

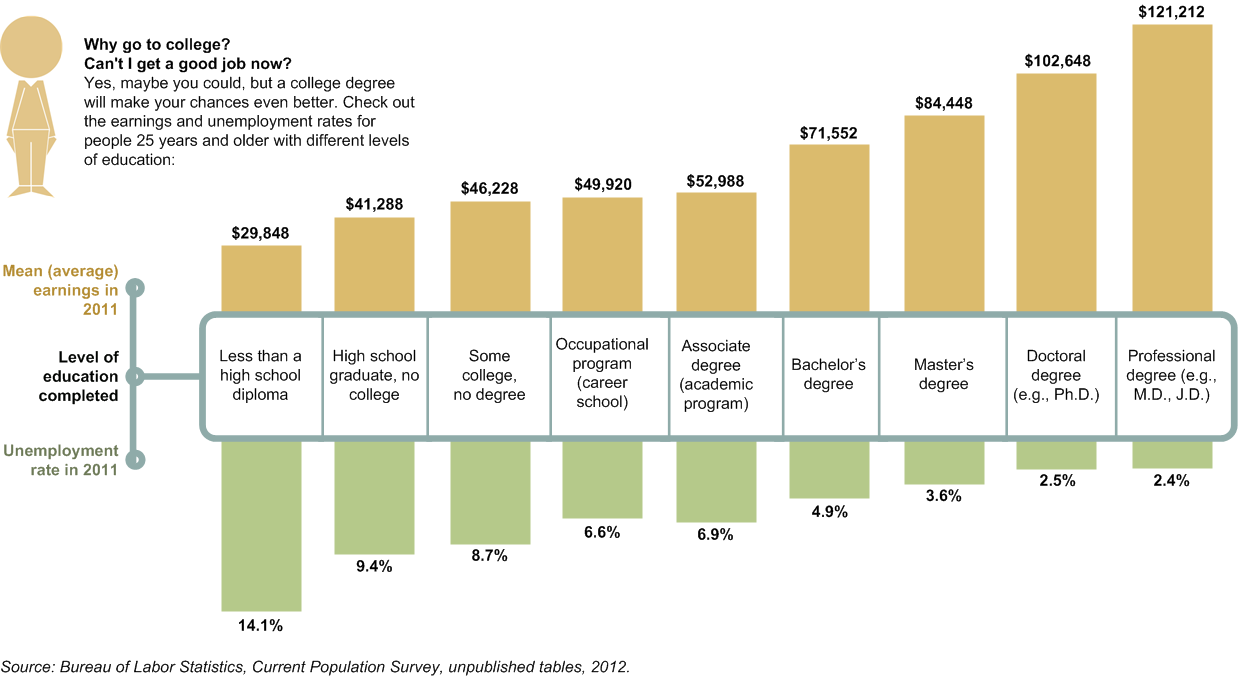

Higher Likeliness Of High Quality Benefits

As the economy improves, companies find it harder and harder to attract top talent. The reason why is that, as the economy improves, businesses need to hire more. That puts highly qualified employees in high demand. In turn, these employees are more easily able to say no to one company in favor of another.

This is especially true with a college degree, which prepares employees with a number of skills that make them more highly qualified. The more highly qualified, the more likeliness that theyll be in high demand. To lure these kinds of employees, businesses will often try to lure them incentives other than just good pay. These incentives include benefits packages that include more vacation time and better healthcare options.

One of the best parts of getting your college degree is the access it gives you to high quality benefits and perks. Employers will often offer to cover more healthcare costs or offer more vacation time to lure highly qualified employees. In other cases, they may offer better retirement investment options that will make life after retirement easier. These kinds of packages take some of the responsibility for saving for a rainy day off of the shoulders of these employees.

Recommended Reading: Take One Class At Community College

Why Did I Go To College And What Did I Major In

My parents both went to college and my dad graduated with a chemistry degree. My sister who is ten years older than me went to college and eventually ended up with a doctorate in physics. It was expected that I would go to college and get a degree in something. In fact, it never even crossed my mind that I would not go to college. I was always good at math, but I was by no means a straight A student. I did not have the greatest attention span in school and I had a few embarrassing moments in class when I woke up from a day-dream realizing the teacher was repeatedly calling my name waiting for an answer to some unknown question.

Because I was good at math I thought civil engineering would be a good fit for me. I ended up being accepted to the University of Colorado in civil engineering and thoroughly hated it as soon as I started. I realized when I was in engineering school that I was really good at basic math and numbers, but I was not good at high level math like calculus or at least I did not have the attention span to learn it. I decided my freshman year that I did not want to spend the rest of my life doing high level math problems and transferred to business school.

I decided an emphasis in finance would be a good choice in business school, because I liked money . Business school was a breeze after going through engineering. I took summer school to catch up after changing majors and ended up graduating in four years.

The True Cost Of College

The federal government requires that all U.S. colleges and universities publish their annual cost of attendance . The COA includes tuition and fees, room and board, books and supplies, transportation, and personal expenses. If you already have a list of colleges in mind, knowing their COAs can give you some idea of how their costs compare.

But its important to note that a colleges official cost of attendance is like the suggested retail price of a product thats frequently sold at a discount or like the sticker price on a new car. The reality is that many students and parents pay considerably less.

Whats more useful to know is the colleges net price, after taking into account any grants and scholarships for which the student may be eligible. While student loans are also touted as financial aid, unlike grants and scholarships, they eventually have to be paid back with interest. Rather than reducing your cost, student loans increase it in the long run.

The College Boards annual Trends in College Pricing report shows the stunning difference between what many colleges say they charge and what they actually charge. For the 2019-2020 school year, for example, the average published tuition, fees, and room and board at four-year public and private colleges looked like this:

- Public four-year : $21,950

- Private nonprofit four-year: $49,870

But the average net prices, after accounting for grant aid and tax benefits, looked like this:

- Public four-year : $15,380

Recommended Reading: Volunteer Work For College Applications

Do You Get Paid For Going To College In Uk

Studying in the UK doesnt come cheap. The cost of attending a college in the UK is relatively high and many students fear that they cannot afford the bill. So you might have asked yourself how do Brits manage to go to college?

This is mostly because many of you are not aware of many funding resources created in UK to help students ease their financial struggles. If youre one of them, keep reading below as we present a complete set of information about student finance schemes in UK and ways these funds can be reached.

Literally, you dont get paid to go to college in the UK. But you will receive plenty of financial support during your studies to cover education-related costs in the forms of bursaries, the majority of which dont need to be paid back. Even if you claim a college student loan, then only a small rate of interest will be charged.

Study at The University of Law

Be one step ahead with a globally recognised university in the UK!

The UKs education authorities have created flexible student finance schemes to help students from different backgrounds get equal chances of following their education dreams.

Following the completion of the compulsory stage of education at 16 years of age, young Brits have two options ahead:

- Start Working

- Start College

Note that in UK theres a difference between College and University as we explained in this article.

- Student Awards Agency for Scotland

- Student Finance England

- Student Finance Northern Ireland

Does Rich Equal Happy

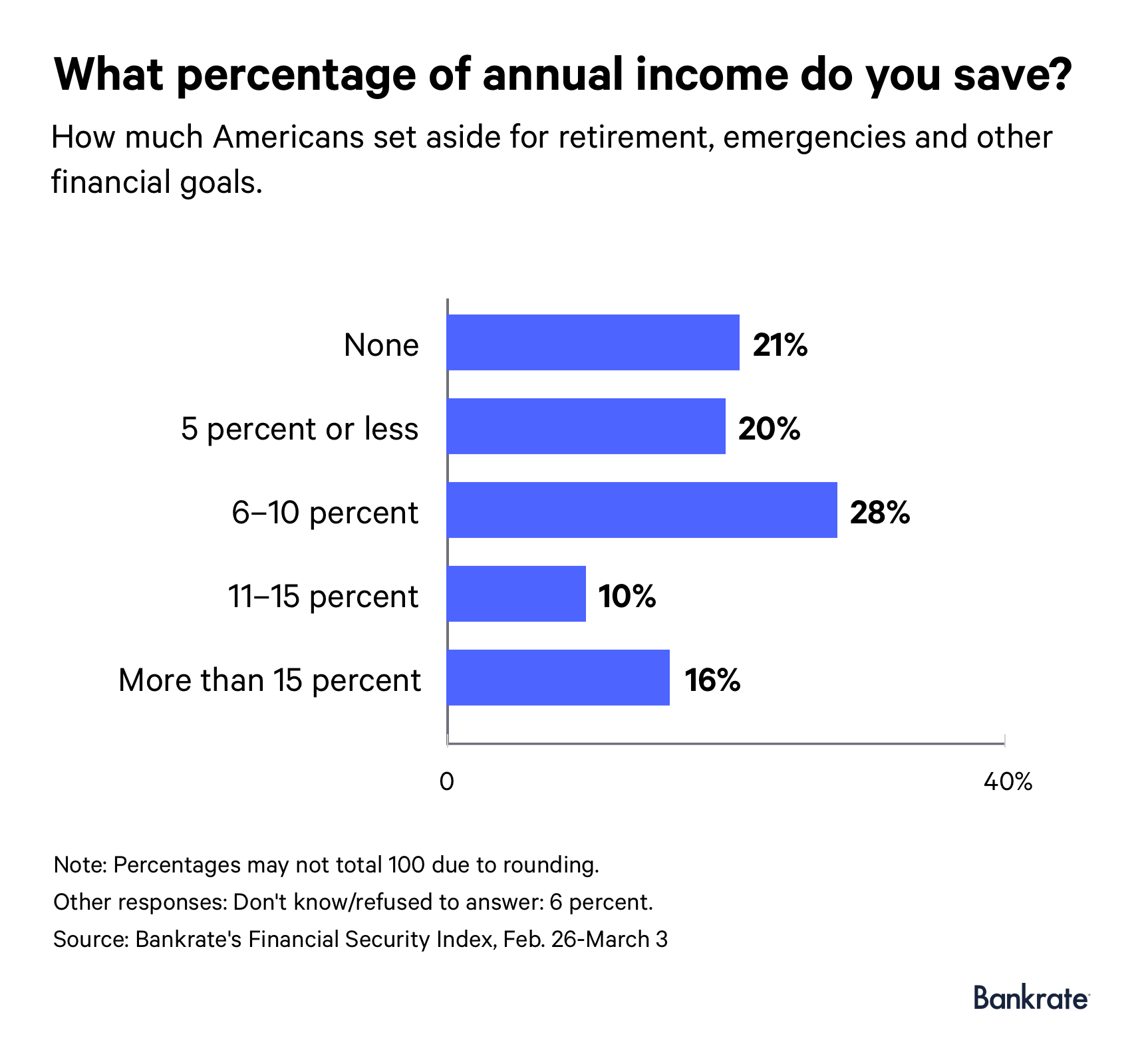

Rich can be a state of mind: 72% of the respondents in Schwab’s survey said their definition of wealth is based on the way they live their life rather than a specific dollar amount. If so, how much does it take to be happy?

Studies show that personal well-being tops out at an annual income of $75,000, and life satisfaction at $95,000. That figure is almost 50% higher than the median household income of $67,521 in 2020.

Purdue researchers found that once that threshold is reached, well-being and satisfaction decrease even if income rises. They theorized that once basic needs are met and debts repaid, the quest for more money results in the sorts of social comparisons that actually decrease well-being. The money, in other words, fuels the sort of “keeping up with the Joneses” that springs from a feeling of lack, even with a full bank account.

People may be more satisfied by the perceived trajectory of their life, not necessarily their absolute income. For example, a person who goes from making $25,000 a year to $150,000 a year may feel more satisfaction than a person who goes from making $600,000 a year to $500,000 a year, even though the latter is still among the highest-earning households in the United States and earns far more than the former.

Recommended Reading: Colleges That Accept Low Gpa Students

College Savings Plan Guidelines

From the results, we can conclude that the goal for most people saving for college should be to have between $37,328 and $245,427 saved in the account. This is a huge range, no doubt. But remember what “low end” and “high end” mean.

The low end amount is for someone that wants to help their child pay for a public 4-year school. The high end amount is for someone that wants to fully pay for a 4-year private education for their child.

Parents should also remember that, even when saving for private school, many students who attend private schools get discounted tuition, or receive scholarships to offset the “real” tuition price. So, even that high end number might not make sense when saving for college.

In this scenario, the low end 529 plan will be able to pay out between $9,600 and $10,000 per year, for each of the 4 years of school. Given that the college costs will rise, that should be about 50% of a 4-year public school tuition in 18 years.

Why Is It Important To Know The Net Cost Of A College Education

Remember that a colleges official cost of attendance is like the suggested retail price, and that there are discounts available. Many students and parents pay considerably less. The net price takes into account grants and scholarships that cut the cost of tuition. The College Boards annual Trends in College Pricing report shows the stunning difference between what many colleges say they charge and what they actually charge.

Don’t Miss: Danielle Nachmani Age

Textbooks And Course Supplies

We might be living in a digital era, but expensive textbooks are still very embedded in the college system.

If youre enrolling at a public 4-year college, you can expect to pay an average of $1,334 every year on textbooks and other course supplies. That cost is about the same at private colleges, too.

There are admittedly some ways you can cut corners here. For example, you can try to find some second-hand textbooks online or from friends that have taken the course previously. Just make sure youre getting the right edition, as textbooks are often updated every few years.

How Can I Save Money

Websites such as FastWeb and Scholarship.com can help you find and apply for scholarships for which you are eligible.

Filling out the FAFSA, which every college applicant is required to do, will determine if you are eligible for financial aid.

College students can save a lot of money on textbooks by buying them used. Sites such as and AbeBooks.com can help however, make sure you shop by the ISBN and not by the title as there are many editions of each textbook and professors are usually specific about the one they use.

Consider taking the route of a community college first. Community college credits can easily transfer over to a state college. By going this route, youll be able to save during your first two years of school.

Advertising Disclosure: This content may include referral links. Please read our disclosure policy for more info.

Read Also: Selling College Books Online

School And Activity Fees

Annual fees are typically less than $500, but they should still be included in your budget. Fees vary by school and cover extra charges for parking stickers, extracurricular activities, gym access, cable TV and sports. Before you enroll, ask your school for a schedule of all fees to assist with budgeting. Greek societies also have dues.

Developing an annual budget can be a painstaking process. Sticking to it can be even harder. However, its also rewarding. If you have a budget, youll be more prepared than some of your peers, and it will be easier for you to stay on track and minimize unnecessary spending. In many ways, youll be learning new things before college starts.

Comparing The Net Price

Colleges and universities are required to have a Net Price Calculator on their websites that give you the real picture of how much college will cost. Rather than just give you a list of college expenses, the Net Price Calculator tells you how much the average student actually pays out-of-pocket. It does this by disclosing how much federal financial aid and other scholarships you are likely to receive at the school to reduce the cost of attendance, which includes tuition and fees, room and board, books and supplies and other expenses.

Don’t Miss: Lowest Gpa Colleges

Some College Majors Promise Better Future Than Others

A degree in art might not lead to a career with a six figure salary but where would society be if everyone became an engineer. We need artists too, don’t we? Does it really matter what college major you pursue? Well, a lot of people didn’t think so until recently. Due to falling post-graduate employment numbers and rising cost of tuition, many people are beginning to rethink the value of certain majors and degree programs. Many researchers are now investigating which majors provide a decent return on investment and which don’t. Not surprisingly, you could probably guess what researchers have discovered.

Without fail, students who major in STEM fields – science, technology, engineering and math – find jobs quicker, earn more money, and experience more job stability than students who earn degrees in liberal arts and humanities fields. In a tight job market, or during a recession, recent graduates with degrees in social sciences, humanities or liberal arts can find it challenging to find gainful employment.

A study produced by the Employment Department for the state of Oregon corroborated the findings published by GPPI – job opportunities for nursing, engineering and computer science majors were substantially greater than those who majored in architecture, arts, and related fields.

Read also: