How Do College Students Afford Apartments Find A Couple Of Roommates

Of course, one of the easiest ways to be able to afford an apartment as a college student is to have roommates.

Most apartments will be set up to accommodate several roommates in one space.

With one or two or even three roommates you can share expenses and your monthly obligations will greatly decrease.

Just be sure you find roommates that you can live with and get along with. Otherwise, you may find yourself looking for a new place in the middle of the term or being miserable with people you thought were your friends.

Dont Miss: Texas College Accreditation

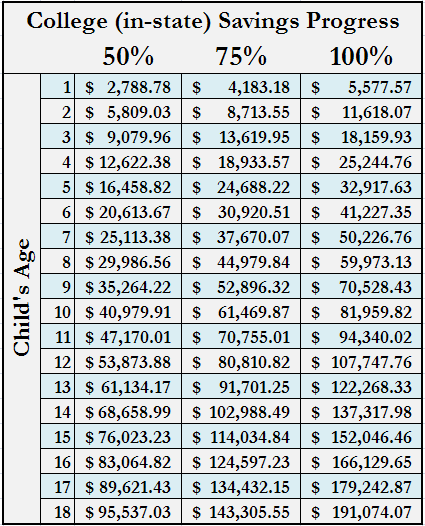

How Much To Save For College By Age

You can use online resources to help you see if youâre saving enough for the child in your lifeâs college education. These online resources usually create calculations based on the childâs age.

Here are Saving for Collegeâs estimates of how much money you would need to save per month in order to cover 100% of college costs for a child in your life:

The earlier that you start saving for college, the less it will end up costing you overall.

Thatâs because your initial savings will start to generate interest as a child grows up. Itâs no wonder why 42% of people say they wish they started saving for college earlier.

Fidelity Investments has a handy calculator to help you to see if youâre on track to meet your college savings goals. Simply plug in the childâs age and a few other details.

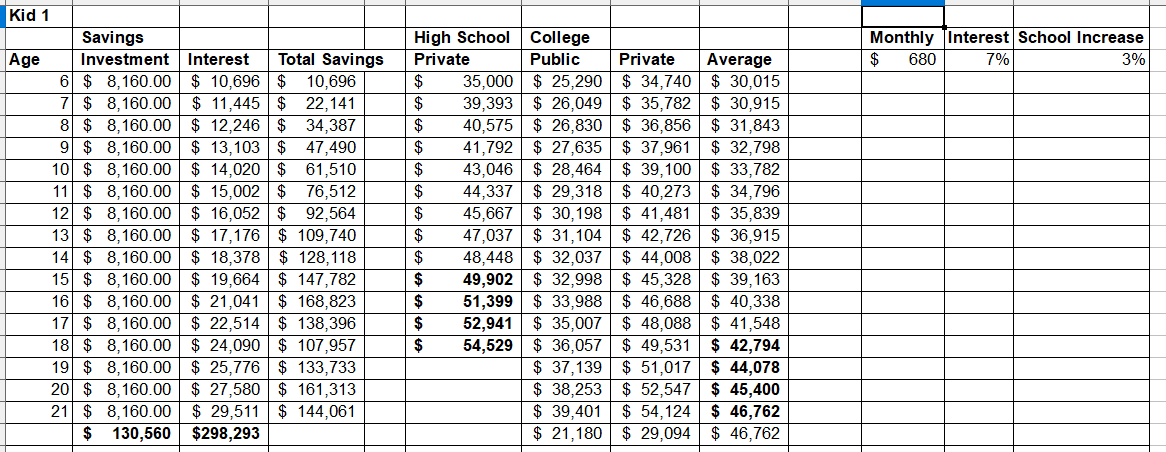

Using Fidelity Investmentsâ college savings calculator, we can see that:

If you started saving for a child born today and want to cover 50% of their public college costs, you would need to save about $200 per month.

If you were to start saving for a child thatâs currently 10 years old, and you have no money saved so far, youâd need to contribute about $350 per month to be on track to meet your goal.

Making a college savings plan early and sticking to regular contributions will help you to hit your savings goal.

In the next section, weâll discuss some popular rules of thumb that help people determine how much to save for the student in their life.

How Much Does College Cost

In the absence of a crystal ball, there’s no telling what college will cost in a decade from now or more. Though there’s talk of the college bubble eventually bursting, you should know that college costs have climbed roughly 5% per year over the past 10 years. If we apply today’s numbers, we can get a sense of what college might cost down the line.

According to The College Board, tuition and fees for the 20162017 school year averaged:

- $33,480 at private colleges

- $9,650 at public in-state colleges

- $24,930 at public out-of-state colleges

These numbers, however, don’t include room and board, which can add $10,000 or more per year to the cost of higher education. But if you’re looking at in-state tuition only at a public school, you might pay close to $16,000 per year for your child to attend in 10 years’ time.

Now if the situation seems hopeless, you’re not alone. Many parents struggle to save for college, and the amount you’ll ultimately need will depend on the number of children you have and their specific educational choices. But if you save your money efficiently and start doing so when your kids are young, you stand a good chance of making a respectable dent in those tuition bills.

Also Check: Can You Apply To Multiple Colleges

Best Ways To Save For College

Instead of saving in a traditional bank account, there are plenty of options for investing your money so you can take advantage of compound returns. An important college savings caveat is that, depending on the strategy you use, investment earnings will add to your total savings.

A 529 plan, for instance, is a tax-advantaged education investment account that individual states offer. Some states give residents a tax break for using their home account, but you can choose any plan you like. As you would in a 401 or an individual retirement account, you can typically choose your own funds to invest in or opt for a mix of funds targeted toward your childs anticipated college start date. That will ensure your investments arent too risky or too conservative.

If you save each month in a 529 plan, you could contribute less per month and save the same total amount when your child goes to college. In our example from above, youd have to save $209 per month for 13 years to reach about $44,000 in savings, if your investments receive a 6% average annual returna reasonable goal based on historical stock market returns. Thats about $96 less per month than if you didnt invest your money.

Dont Forget About Scholarships And Grants

For a lot of Americans, thinking about the cost of college is stressful. And if youre in that boat, you might be forgetting about a little ray of sunshine called scholarship and grantsalso known as free money.

But heres the catch: You have to complete the FAFSA every yearand every state has its own deadline for completion.

The FAFSA is used to figure out how much you can get in federal grants and state grants. Even if you think you make too much money, do it anyway. Many colleges, foundations and corporations use it to award scholarships.

Filling out the FAFSA probably isnt how youd like to spend a rainy afternoon, but if you dont, you might be leaving cash on the table. A third of undergrad students dont file the FAFSA, and of those, 2 million would have qualified for a grant!5 Spending a day filling out these forms sounds worth it now, doesnt it?

In addition to grants, you need to go after all the scholarships you can. We repeat: all the scholarships. And in todays digital age, apps like Scholly and websites like CareerOneStop make finding and applying for those scholarships much easier. So, theres really no excuse for not going after every penny you can find.

You May Like: How To Get College Discount On Apple Music

How Much Will Your Childs College Cost

The cost differences between public and private schools can be significant. The College Board estimates the current yearly cost of a public 4-year college at $22,1803 versus $50,770 for a 4-year private college.4

Our 2K rule of thumb assumes the student is attending a public 4-year college using the College Board estimate: $22,180 per year for 4 years, though the college savings calculator allows you to create a customized estimate if your costs are different.

Every Family Has Different Savings Goals

Our 2K rule of thumb is an easy way to see whether you are on track, especially if your children are still young and you are not sure where they will ultimately choose to go to college, says Andrey Lyalko, a vice president at Fidelity. Because this approach may not apply to all situations, make sure to develop a robust college savings plan and be mindful that college costs are a variable that can dramatically change over time.

So what if your situation differs from the norm? Perhaps you are hoping for a sports scholarship for your aspiring student athlete. Or maybe you are looking to cover 100% of college costs and are not expecting any scholarships or grants. You may also believe that your child will go to a private college, where the costs could be substantially more than the average public university.

The college savings math can still work for you:

|

|

You May Like: Easy Colleges To Get Into In Virginia

Invest Your Savings Tax

Nearly 7 in 10 parents arent familiar with a 529 college savings plan and they should be.

Putting it simply, a 529 college savings plan can help your savings go further. Its a tax-advantaged investment account that works like a Roth IRA, offering tax-free growth and tax-free withdrawals. And yes, parents can open a 529 plan for their childs college savings. Its not just for grandparents!

Most 529 plans also offer a passively invested, age-adjusting portfolio option that starts with higher growth investments and becomes more conservative as your child approaches college. This means your money grows over time, but youre also reducing risk as it becomes time to pay for college.

What difference do these tax savings and investment gains make? If you have a 4-year-old child targeting a private university, your monthly savings goal might be $700/month using a savings account versus $400/month with a 529 college savings plan. Thats a big difference!

There are a lot of 529 plan options, but investing doesnt have to be complicated. Here are a few guidelines in case youre doing the research yourself:

College Saving: Part Of Your Overall Financial Planning

Once you have a sense of your college savings needs, make sure you are investing the money appropriately. Among several available college savings options, a great place to start is to open and contribute to a 529 college savings plan account. Its popular with parents and grandparents alike because there are few restrictions and the benefits are plentiful. You can potentially reduce your taxes, and retain control over how and when you spend down the money.

As you watch your kids grow up and get ready to leave the nest, remember that staying invested appropriately is key, says Assaf. 529 plans often include age-based investment options that potentially help you stay on track. These investment options automatically shift your investment mix from more aggressive to more conservative as your child approaches college age. That can help mitigate the effects of a market downturn by moving the portfolio to a more conservative asset allocation soon before those tuition bills start to hit your inbox.

Tip: Public and private college costs can vary greatly by location. For public colleges and universities, your state of residence is one of the most influential cost factors. If you find that your savings are not on track, widen your search and consider applying to less expensive colleges or those known for providing generous aid or merit scholarships.

Don’t Miss: Fundraising Ideas For College Tuition

How Much Of The Bill Do Parents Plan To Pay

Findings from Fidelity Investments’ 2020 College Savings Indicator Study5 also reveal that although many parents plan to pay the total cost of college and are increasingly on track, they need to start saving earlier: Fewer parents are starting to save before their child reaches the age of 233%, down from 37% in 2018but are on track to meet 33% of their college funding goals. The good news: This important college savings indicator is up from 28% in 2018.

Weve seen the percentage of costs parents intend to cover grow over the past several years, even as college costs continue to climb. Parents want to help minimize the burden of potential student loans, explains Rita Assaf, vice president, Retirement and College Leadership at Fidelity Investments. Despite these good intentions, fewer families today can realistically reach these lofty savings goals.

Any way you look at it, parents are on the hook to pay the lions share of college expenses. To keep things simple, our 2K rule of thumb methodology assumes that parents, on average, are expecting to cover 50% of college costs from savings. Thats the starting point for our college savings calculator. Your own situation might vary, so weve added the flexibility to let you input the percentage of college expenses that you expect to pay from savings.

Use Your Student Id For Discounts

Many stores and restaurants allow a student discount on their products and services with a valid student ID. This is an easy way to save money on the items that you were going to purchase anyway, like your school laptop or tickets to an art museum. Make sure you always carry your student ID to receive student discounts in college.

Read Also: Cape Fear Community College Tuition

Recommended Reading: How To Attract Students To Your College

Top Ways To Make Money In College

Its also possible to work off-campus and potentially earn more money than working on-campus. On-campus jobs dont always pay the highest because they are convenient and have more applicants.

After all, who doesnt want to walk across three minutes across the student commons to work for a few hours in the computer lab?

To be the big fish in the little pond, look for off-campus opportunities that might require a little more hustle, but can have a more flexible work schedule and a higher income potential.

Recommended Reading: Who Buys Back College Textbooks

What Can I Do If I Start Saving For College Late

Look for ways to trim your budget so you can free up money to save. You can also ask friends and family to make contributions to your childs college savings as birthday gifts. You might also encourage your teen to consider starting at a two-year community college, where they can earn credits at a fraction of the cost of a four-year programand may be able to transfer those credits to a four-year school later on. While youre spending less on tuition for those introductory, transferrable credits, the bulk of your childs college fund can have the potential to continue growing.

Read Also: What College Is In Terre Haute Indiana

Start A Dropshipping Business

While this last idea is a bit more intense than the others, you can also look into dropshipping, where you act as a middleman between manufacturers and customers to sell products at a markup.

You can ship right from your manufacturer to your customer without ever having to handle shipping yourself. This is easy to set up using platforms like Shopify, but youll need to market the products and take on some financial risk if your items dont sell.

Peters is a good place to head for more information on setting up a dropshipping business.

As a broke student looking for quick ways to make money in college, the main thing you need is determination. Whats ultimately important is that youre willing to put yourself out there and invest your time and effort to build a variety of income streams. After all, the opportunities are all around, and its up to you to seize them.

Read Also: Study.com Partner Schools

What About 529 And Coverdell Plans

Thanks to a recently passed tax law, the best way for families with young kids to save for college is through a 529 plan, named for the section of the Internal Revenue Code under which the plans were created. These investment accounts — similar in many ways to a 401 — allow you to put money into mutual funds, where it can grow and compound tax-free. “Then, when it comes time to pay for college, you can use the money, tax-free, for qualified education-related expenses,” explains Joseph Hurley, CEO of Savingforcollege.com, a Web site that provides information on investment options.

The 529 plans are offered by 48 states and the District of Columbia, though they are usually run and administered by brokerage firms like Wells Fargo, Vanguard, and T. Rowe Price. No matter where you live, you can invest in any state’s plan, though 29 states and the District of Columbia now offer extra tax advantages to their own residents. So be sure to investigate your home state’s plan first.

Also, most prepaid plans only cover tuition — not room and board, which is usually a big chunk of college fees — so you probably would need another 529 account to cover those. Talk to a financial advisor to determine what’s best for you , or go to savingforcollege.com, where there’s a tool for comparing various options.

You May Like: Who Buys Back Used College Textbooks

Carry Only Large Bills

An article by International Banker, covers the denomination effect, or the cognitive bias that people are more willing to spend money when they are paying with smaller bills. For example, it is more likely that someone wont think about spending ten $5 bills as opposed to spending one $50 bill. Carrying only large bills can help you prevent mindless impulse buying.

How Else Can I Pay For College If I Cant Save Enough

Families pay for college by using several sources. In 2018, 47 percent of tuition payments came from parent and student income and savings, Sallie Mae notes. Other sources, including scholarships, grants and loans, help pay the rest. A variety of government and private sources, including the schools themselves, offer these.

Ask your child to meet with their high school guidance counselor about how to qualify for aid and any local scholarships. Cultural, professional and religious organizations in your areaand perhaps even your employermay offer aid that you werent aware of. And if you and your child have started looking at schools, contact each schools financial aid offices to learn about resources and opportunities they might have.

Tip: The federal government awards about $120 billion in grants, work-study funds and low-interest loans each year. To tap into that aid, you must fill out a FAFSAthe Free Application for Federal Student Aid.

Also Check: How To Get College Discount On Apple Music