Then: How Much Do I Need To Save For College

Thats a question that my friend Kevin asked me probably around 3 years ago. It was a simple question. He had recently had a son and he wanted to put aside money to cover his education. Kudos to him for starting early. The question lead me to write this article: Saving for College An Exercise in Depression. In hindsight, it was a total cop-out as I never did answer his question.

Today, I think Im going to do better hopefully a lot better.

I have a vested interest this time around. My own son is four weeks old today and Im in Kevins shoes . I got in reminder about all this from CollegeAdvantage, the place I determined had the best 529 plan for my niece and nephew. Specifically their newsletter had this image on the right . The part that caught my attention is the bottom that assumed annual deposits of $2,400. For all practical purposes thats $200 a month.

This didnt answer Kevins question, but goes down the right track, giving me a good estimate of how much Id have if I saved roughly $200 a month. However, it didnt tell me how much college was going to be when Little Man is 18. Without this information I really cant know how much to save.

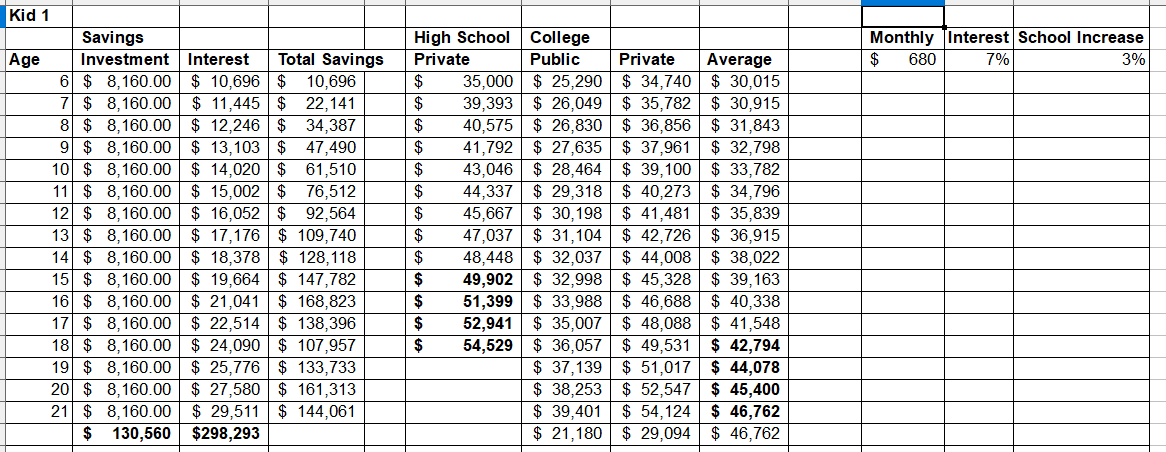

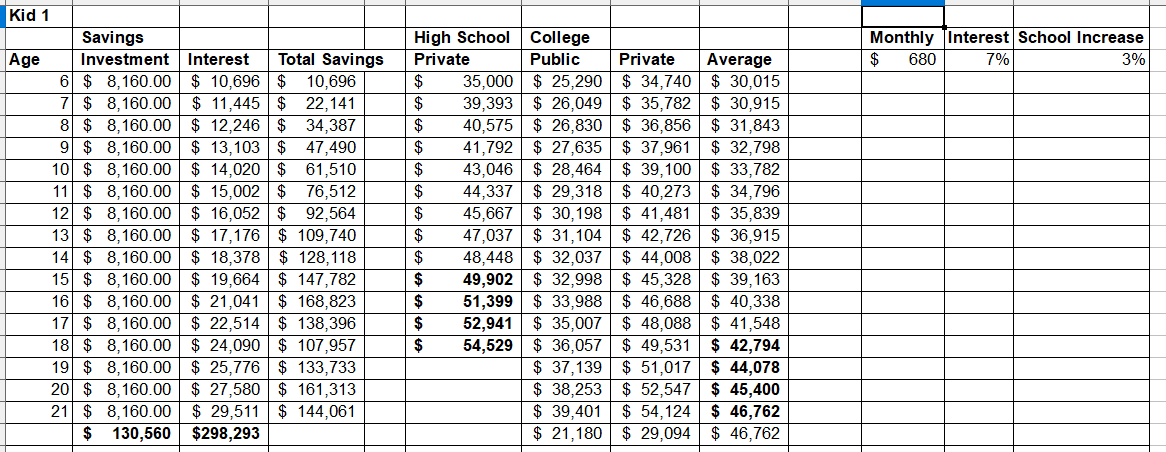

When in doubt, I fire up Excel and get nerdy with some math. Heres what my Excel spreadsheet looks like and Ill explain what I did here:

Why Should I Use A College Savings Plan Instead Of My Savings Account

If youre starting early, you can take bigger risks with your money in the hopes of growing it more quickly than it would in a standard low-interest savings account. Though there are days the markets go up and down, this is designed to be a long-term investment, and one that grows alongside the overall economy.

Though keeping money in a checking or savings account shields it from that volatility, its just a trickle of interest, Lee says. Plus it doesnt keep up with the inflation of college costs.

College Savings Planning Calculator

Use this calculator to help create a plan for saving for college.

This planner takes into account the current age of your child and when he/she plans to start college, your savings goals, the estimated future cost of college and other important factors. Explore different scenarios and find a plan that works for you. If you have more than one child, simply hit reset, clear the data, and start a new plan.

Based on your selected school and education cost inflation rate.

You May Like: What College Is In Terre Haute Indiana

Set The Right Monthly Goal

Is it a little too difficult to imagine the end goal, years from now? Consider walking it back to a monthly contribution amount. Just remember that how you save will make a big impact on how much you save by the time your child starts college.

Many experts recommend using a 529 college savings plan, a tax-advantaged investment account. A 529 plan offers tax-free growth and withdrawals for qualified higher education expenses, which include tuition and fees, room and board, books, computers, and special education expenses.

What does this mean for you? Choosing a 529 plan could mean a much lower monthly contribution since the money grows over time. With a 529 plan, solid monthly contribution amounts for a child born in 2017 would be about $165 for a public in-state school, $260 for public out-of-state, or $325 for a private university.

If you intend to save using a traditional savings account or a taxed investment account, youll want to adjust your monthly contribution accordingly. For example, the average interest rate on savings accounts as of June 2020 was 0.06% APY .

At that rate, in a savings account, youd need to contribute about $300 per month for 18 years to pay for a third of the projected cost of a public, in-state college around $500 for out-of-state and around $600 per month for a private university. Nearly double the required savings compared to a 529.

The Rule Of 10 Formula

This is an easy-to-remember formula that the Lumina Foundation developed. The Rule of 10 suggests that:

- Families save 10% of their discretionary income

- Families do this for a period of 10 years

- Students work 10 hours a week while in college

Discretionary income is usually defined as your after-tax income after all your basic expenses and financial obligations are handled. These priorities should also include your own retirement.

Don’t Miss: Rhema Bible College Tuition

How Much Do You Need To Save For College

This is a lot of math that is very specific to our family and our financial situation. I dont expect the numbers to mean much to you.

What Id like for you to take away from this is the process. It isnt perfect. It makes a lot of assumptions that will eventually be shown to be wrong. However, theres value in doing this exercise at least every few years. I learn something new every time I do it. Finally, I continue to get more data and that helps my planning over time.

Have you planned how much you need to save for college? Has the plan changed over time? Let me know in the comments.

How Much Do I Need To Save For College

With college costs increasing at twice the rate of inflation, it is important to start saving early. Interest working for you now in a regular savings program is much better than having interest work against you in the future in the form of education loans. Use our college savings calculator to determine how much you should be saving for college on a regular basis.

220 Donald Lynch Boulevard

You May Like: What Size Are College Dorm Beds

Start At Community College

Most people can attend their local community college basically for free with financial aid. Consider attending yours for your Associate degree, and then transfer to the larger institution of your choice.

Doing this can save you a lot of money those first two years, but there is an important fact to consider. Not all community college credits transfer well to other universities. Youll need to do some research to make sure youll be able to take most of your credits with you.

Determining How Much You Should Save For Your Childs College Education

After setting a savings goal, a family should determine how much they can commit toward that goal each month. But the family must also decide how to save that money. Fortunately, families have a variety of options at their disposal.

Two types of accounts are designed specifically for college savings. A 529 plan allows families to place money in investment accounts that rise and fall with the stock market. These plans, which are administered by the states, often carry tax benefits. There are no tax consequences as long as the money is spent on qualified educational expenses, such as tuition or room and board. However, there may be federal and state tax penalties for deductions unrelated to education.

A Coverdell Education Savings Account also allows families to contribute. While similar to a 529 plan in many ways, ESA investors have more control and can make riskier investments. Also, ESA contributions must be made in cash. Finally, unlike a 529 plan, which has a high cap on contributions, parents can only contribute $2,000 to an ESA each year.

Beyond college-specific accounts, parents can use regular savings accounts to save for college. These accounts do not carry the risks associated with investments, which can cause accounts to dip if the stock market tumbles. However, this also means that regular savings accounts will not grow as quickly. Yet, there are no penalties for withdrawing money from a normal savings account.

Read Also: How To Pay For College By Yourself

How Much Should You Save For Your Childs College Education

- How Much Should You Save for Your Childs College Education?

Every parent looks forward to milestones in their childs life. But high school graduation can also be a frightening time for families. During the 2016-2017 academic year, private universities cost an average of over $41,000. When facing the prospect of paying around $164,000 over four years, its understandable that parents and students alike worry about financing higher education.

Most parents worry about saving for college. Yet, many parents do not know how much money to save or how to set aside funds. Luckily, there are several ways to figure out how much you should save for your childs college education.

Other Advantages Of A 529 Savings Plan:

** Includes some information on the 529 Savings Plan Minnesota

- Favorable financial aid treatment: only a maximum of 5.64% of the value of parental assets are counted toward a students Expected Family Contribution, compared to 20% of the value of the students asset .

- The 529 savings plan has low fees . Below is the current fees for the Minnesota plan:529 savings plan Minnesota.

- There are many investment options, including age-based portfolios that automatically adjust the level of risk .

- Anyone can contribute to the account: grandparents, other family members, and friends.

Don’t Miss: College Scouts For Football

Figuring Your Own Cost

What your own net price is will depend on a number of factors, particularly your family income. When it comes time to start applying to colleges, youll want to fill out the U.S. Department of Educations Free Application for Federal Student Aid . The FAFSA is used to determine your eligibility for federal aid as well as to apply for it. If you arent at that stage yet, the department also has an online tool called the FAFSA4caster that you can use to see how much federal aid you might expect.

If it appears that youre eligible for federal aid, the departments College Scorecard provides average annual cost data for specific colleges and universities, based on each schools COA minus average grants and scholarships for federal financial aid recipients. If you aren’t eligible for federal aid, your net cost will be closer to the school’s COA.

But even if you don’t receive federal aid, you may not have to pay the college’s full, published cost. Another important cost factor is the college itself. In a classic illustration of supply and demand, schools that can afford to turn away large numbers of applicants are less likely to discount their tuition than those that are struggling to keep their lecture halls full.

Any number you arrive at will be a guess, of course, and the farther off college is, the more of a guess it will be. But at least its an educated guess.

If a student takes more than four years to graduateas many now docollege can become even more costly.

What If One Of Them Doesnt Want To Go To College

Another common scenario when saving for college for multiple children is that each child is unique. Even harder, you wont really know who they are until they are older. If you start saving when they are really young, and have a bunch saved, what do you do when one of them doesnt want to go to college?

There are variations on this as well what if one of your children becomes a star athlete and gets a free ride? Or what if they really just want to go to vocational school and you saved way too much for what they need?

Well, there are a lot of options here, and while none are perfect, its not like you lose the money you saved.

When a child isnt going to use their 529 money, you have a couple of options:

With a 529 college savings plan, you can change the beneficiary of the account to be used for another child . If one child isnt going to college, for whatever reason, you can simply use the money to pay for college for someone else. That might not sit right with some people, but its a viable option. If youre considering this path, I highly recommend getting the buy in of the child first.

You can also always withdraw the money. If youre pulling out the money and not using it for a qualified education expense, you will pay a 10% penalty on top of taxes on the gains. However, if you just want the money out, it can make sense to do this.

Read Also: What College Is In Terre Haute Indiana

How Much Money Should You Save In Your 529 Plan

I do not know how much college will cost when my kids go to school.

I looked at a few different websites and at a few colleges here in Minnesota to get an estimate. Currently, the University of Minnesota costs almost $26,000 per year for an in-state resident . Saint Cloud State is around $17,000 per year .

The average cost for public universities across the U.S. is similar, coming in between $20k-$25k for an in-state resident and around $35,000 for an out-of-state resident. Private colleges are significantly more expensive average cost around $45,000 per year.

For my husband and I, we are planning to start saving with an initial $1,000 investment and saving $100/month. There are many investment calculators out there, but as an engineer, I like to do the calculations myself .

Below, I used the future value function to project what we could save over 18 years with the following: an initial $1000 investment, $100 a month contribution, and a 5% and 7% annual rate of return for comparison.

| FV 5% return | |

|---|---|

| PV | -1000 |

This is a great way to save money. Over the 18 year period, we will have contributed $22,600.

Even with a modest 5% return, we will have almost doubled the amount of money we contributed to the 529. The best thing about the gains is that they are tax-free!

| Estimated Payment 5% return |

|---|

| 100000 |

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Also Check: What College Is In Terre Haute Indiana

College Savings Plan Guidelines

From the results, we can conclude that the goal for most people saving for college should be to have between $37,328 and $245,427 saved in the account. This is a huge range, no doubt. But remember what “low end” and “high end” mean.

The low end amount is for someone that wants to help their child pay for a public 4-year school. The high end amount is for someone that wants to fully pay for a 4-year private education for their child.

Parents should also remember that, even when saving for private school, many students who attend private schools get discounted tuition, or receive scholarships to offset the “real” tuition price. So, even that high end number might not make sense when saving for college.

In this scenario, the low end 529 plan will be able to pay out between $9,600 and $10,000 per year, for each of the 4 years of school. Given that the college costs will rise, that should be about 50% of a 4-year public school tuition in 18 years.

How Do I Open A 529 Plan

Getting started with a 529 doesnt need to be a complex and time-consuming process, Lee says. You can visit CollegeBacker.com to get going in just a few minutes.

No sit-down with a banker required once you do figure out which plan is right for you, you can both open your account and manage it online.

Recommended Reading: Can I Sell My College Books

How To Set The College Savings Goal

Since 3 x 1/3 = 1, that suggests that the college savings goal should be equal to the complete cost of a college education the year the baby was born. Saving this amount will yield enough money to cover about a third of the future college costs.

You might not be able to predict the specific college in which your child will enroll 17 years from now, but you might be able to predict the type of college, such as an in-state public 4-year college or a private 4-year college.

The College Boards annual Trends in College Pricing publication reports an average cost of attendance in 2017-2018 as follows:

- Public 4-Year College : $20,770

- Public 4-Year College : $36,420

- Private Non-Profit 4-Year College: $46,950

Assuming that the current inflation rates of 3.1%, 3.2% and 3.5% continue, the complete cost of a college education for this years college freshmen will be about $87,000, $153,000 and $198,000.

FREE TOOL: Calculate the cost of sending your child to college

Bottom Line: Save As Much As You Can

When it comes down to it, you’ll need to reconcile your numbers with what you can truly afford. Saving for college is important, but it needs to work with your other priorities, like saving for retirement or building an emergency fund.

Be sure you’re doing all you can, though. Cutting expenses to save an additional $25 a week could have a huge impact in the long runand make it less likely that you’ll struggle financially when it’s time for college.

You May Like: Fsaid.ed.gov Legit