Do I Have To File The Fafsa Every Year

Yes. You will need to resubmit it each year of college to qualify for financial aid. The upcoming FAFSA will require financial details from the tax year 2020. Because of the coronavirus pandemic, some students saw their income or their familys income fluctuate. If the information on your FAFSA doesnt accurately reflect your current financial situation, complete the form but then, contact your colleges financial aid office to explain the situation, Mr. Williams said.

Two More Acronyms You Need To Know: Efc And Coa

FAFSA uses financial information about you and your parents to determine your financial need. That information is then shared with the colleges you’ve applied to. Once you’ve been accepted to a college or university, that institution will use the information on your FAFSA to determine your Expected Family Contribution . Theoretically, the EFC is the amount your family would reasonably be expected to pay for you to attend that school. However, there’s often a substantial gap between the EFC and what a family is actually able to pay, so don’t panic if your EFC is much higher than expected. The school will compare your EFC to the Cost of Attendance . The COA will differ for every school, but it generally includes tuition and fees, room and board, books, personal expenses, and travel.

The difference between your EFC and COA is what will determine your financial aid for each school you apply to.

See also: What Do You Need To Fill Out the FAFSA?

Am I Eligible For Federal Student Aid

Eligibility requirements for federal student aid include:

-

Financial need

-

Being a U.S. citizen or an eligible noncitizen

-

Remaining in good standing on any federal student loans you have

-

Being in or accepted for an eligible degree or certificate program

-

Maintaining adequate academic progress

How do I apply for Federal Student Aid?

Create an FSA ID account if youre going to submit your FAFSA online or track its status online. If youre going to submit a paper FAFSA by mail and wont be tracking its status, you wont need an FSA ID.

Know what happens after you submit the FAFSA. This includes:

Learning how to correct or update information on it.

Finding out how and when youll get your aid.

Know the Deadlines for Submitting the FAFSA

-

The federal deadline for submitting the FAFSA for the 2021-22 school year is June 30, 2022.

-

The federal deadline for submitting the FAFSA for the 202021 school year is June 30, 2021.

-

Many states and colleges use the FAFSA for their financial aid programs. Those deadlines vary.

You May Like: Is It Too Late To Go Back To College

What This Means For You

If you are receiving a college stipend, congrats on winning a scholarship! You should be sure to check in with your scholarship organization about any rules around your stipend. Be sure to find out whether you need to keep documentation of how you spent your stipend to satisfy requirements. And make sure to ask about how taxes will interact with your stipend. Some college stipends wont be taxed at all, but others will. Make sure beforehand that you are filling out the right tax information and that you know how much youll owe in taxes before tax-day rolls around.

Related: Everything you need to know about graduate assistantships

Types Of Financial Aid

Grants are financial aid dollars you dont have to pay back. You can get them from the federal government or your state government, and you typically have to have a financial need to qualify.

Scholarships also are financial aid dollars you dont have to pay back, but theyre typically based on your merit rather than your financial need. You can get scholarships from your college or university or private organizations, such as the local Elks Lodge.

Work-study is a federal program that funds part-time jobs for undergraduate and graduate students with a financial need. If you qualify for work-study, youll need to find an eligible work-study job on or near your campus and work to earn those dollars.

Federal student loans are fixed-interest-rate loans from the government. The direct loan program is the main federal loan program. Undergraduate students can borrow direct subsidized or unsubsidized loans. Graduate students can borrow direct unsubsidized or direct PLUS loans, and parents can borrow direct PLUS loans.

Private student loans are fixed- or variable-rate loans from a bank or credit union. To qualify, you typically need a good credit score or a co-signer who has good credit. Your rate will vary depending on your or your co-signers credit.

» MORE:How to get a student loan

Also Check: What College Is In Terre Haute Indiana

Learn More About Financial Aid At Collegefinancecom

The cost of a college education is high, and its only getting higher every year. Make sure you research the various programs that can help you pay for community college. Completing and submitting your FAFSA form is a great start.

Feel free to explore the resources and guides provided at CollegeFinance.com to help you prepare and get started on your FAFSA application. Our mission is to help you get the most out of your college experience by helping you make informed financial decisions.

Preparation And Filing Options

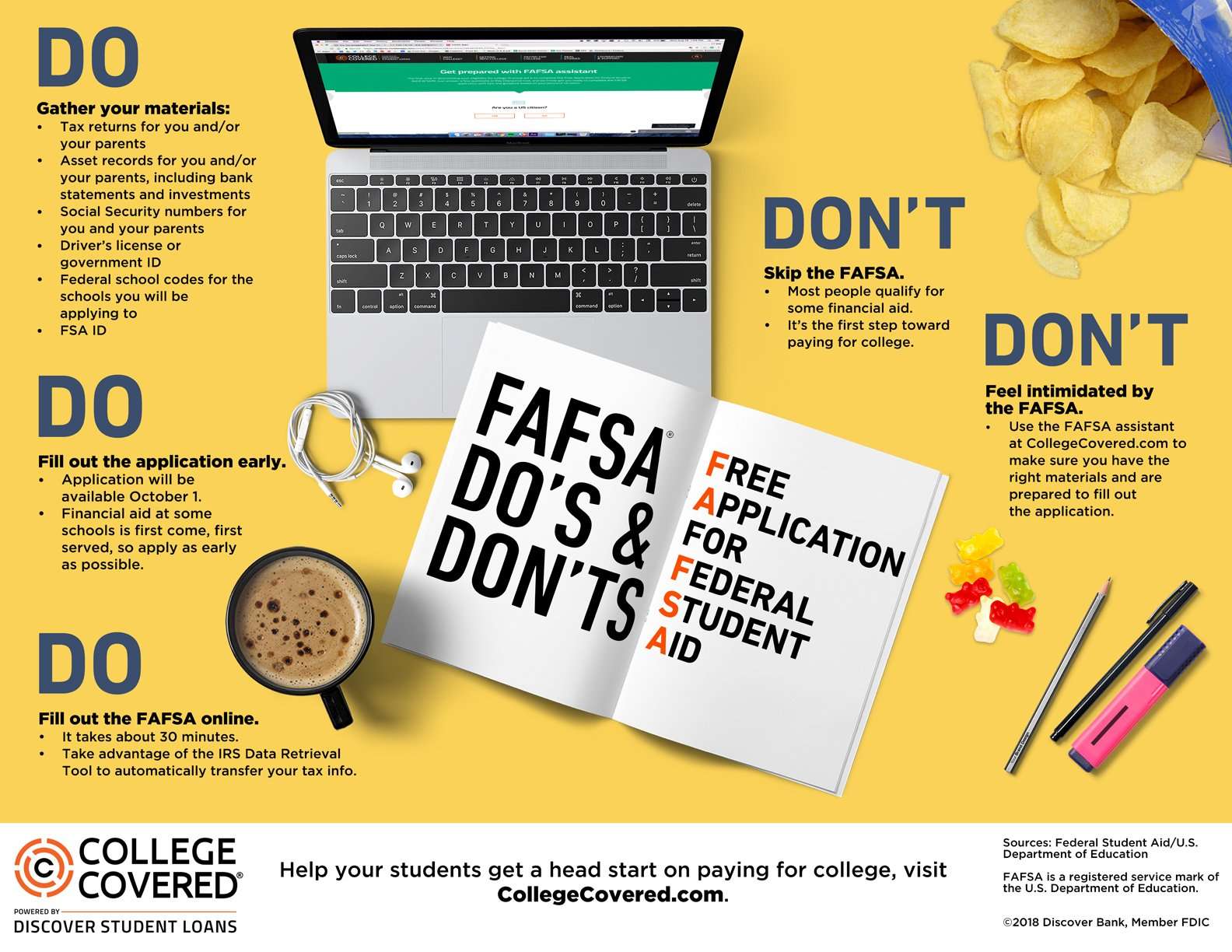

As of the 2017â2018 academic year, the FAFSA is made available to the public on October 1 every year for the future academic year. The 2016â2017 academic year was the final time the FAFSA was not made available until January 1. The US Department of Education made the FAFSA available earlier to more closely align the timing of the financial aid application process with the typical college application process. Additionally, 2-year old US tax information is used to complete the financial sections of the FAFSA beginning with the 2017â2018 academic year. This change in using “prior-prior tax year” information enables families to use the IRS Data Retrieval Tool in the FAFSA to verify their tax information without a delay from the IRS processing tax information. Some financial aid is provided on a first-come, first-served basis, and students are encouraged to submit a FAFSA as soon as possible.

According to the U.S. Department of Education’s website, students have three options for filling out the form:

- online at fafsa.gov

- in the myStudentAid mobile app

The Higher Education Opportunity Act of 2008 authorized fee-based FAFSA preparation. By law, fee-based FAFSA preparation services must on initial contact with students inform them of the free option and be transparent about their non-affiliation with the U.S. Department of Education and their fees.

| It has been suggested that FAFSA position be merged into this article. Proposed since April 2021. |

Read Also: How Many Years Of College To Be An Architect

How Much Does It Really Cost To Attend College

According to the College Board, the cost of attendance has increased over the decades. Students in 1990 paid an average of $3,800 for tuition and fees at a public four-year university, while students faced an average bill of $10,560 during the 2020-21 school year. Adding in room, board and added expenses, students might face a cost much higher than just tuition.

In terms of financial aid, the College Board estimates each full-time student received an average of $14,940 in aid, including grants, loans, work study and tax credits, during the 2019-2020 school year.

Students pursuing a bachelors degree will borrow an average of more than $28,800 in loans to pay for college, the College Board estimates.

For more information on the Free Application for Student Aid, including how to apply,

This article tagged under:

Who Qualifies For The Fafsa

To qualify for FAFSA awards, you must hold U.S. citizenship or be an eligible noncitizen. Because of these criteria, undocumented immigrants cannot apply for federal student aid.

While the FAFSA does not maintain an age limit or income cap, these factors affect your award package because the program bases funding on financial need. Any qualified student can access funding, regardless of whether they attend a four-year institution, a community college, or an online school.

Also Check: University With The Best Dorms

What To Expect When Getting Your Financial Aid

The financial aid office is in charge of applying your aid to the amount you owe your college. The rest of the money will be sent to you to spend on other school expenses.

To maintain your financial aid eligibility, you should have satisfactory academic progress. Completing your FAFSA form each year is also a must!

How Much Financial Aid Will I Get From The Fafsa

How much funding you’ll qualify for depends on a few different factors, like income and family size. It also depends on the cost of attendance and how much institutional aid a school offers. If the cost of attendance is higher at a particular school, you may qualify for more aid. Some institutions also provide more funding for low- and middle-income students than others.

Generally speaking, low-income families will qualify for the maximum amount of federal aid available through grants, federal work-study, and direct unsubsidized loans. Aid awards will vary for middle- and high-income families based on factors such as how many family members are enrolled in college, what assets a family has, and the cost of attendance for a student’s chosen university.

These calculations hinge on many different factors, which makes estimating financial aid a complicated process. Because most students are eligible for some form of federal assistance and additional state and institutional aid is available, all students should consider completing a FAFSA.

Filing as an Independent Student?

Also Check: How Much Does It Cost To Go To Berkeley College

You’ve Submitted The Fafsa What Happens Next

Completing the FAFSA is one of the biggest and most exciting steps students take towards making their college plans a reality. While it feels good to be able to put the paperwork behind you, you might be wondering what to expect next.

01Student Accepts or Declines Aid Award

After you complete the application, it goes to the U.S. Department of Education for processing. If you submit online, it should be processed within three to five days. If you mailed in a physical copy, it should be processed within 7-10 days.

You can check the status of your application by logging into fafsa.gov or the myStudentAid app. If you submitted online, the status of your application will be available right away. If you mailed in a paper copy, the status should be available online around 7-10 days after you mailed it. You can check the status to see if your application is still processing, has been processed, is missing signatures, or if there are any other issues that need attention.

The Department of Education will send you a copy of your Student Aid Report , either to your email or as a letter, which will include all of the information you submitted on the FAFSA form. Check this to make sure the information you included in your application is accurate. If you notice an error, you’ll need to correct your FAFSA. Your SAR will also include your Expected Family Contribution , which is used by schools to determine how much aid you qualify for.

Resubmitting the FAFSA

How Is Your Eligibility Determined For Financial Aid

Within 3-5 days of filing your FAFSA , youll be able to access your SAR, or Student Aid Report. Your SAR is a summary of the information you provided on your FAFSA and includes an EFC, or Expected Family Contribution. Your EFC determines your eligibility for financial aid.

The colleges you listed on your FAFSA will have access to your SAR and EFC. Colleges base your aid eligibility and offer on your EFC.

Don’t Miss: College Buzzfeed

Which Financial Aid Application Fits My Needs

Depending on the situation, Seniors can apply for financial aid one of two ways:

- If you have a Social Security Number, you will fill out the FAFSA

- If you do not have a Social Security Number or have a Social Security Number through DACA, you will fill out the TASFA

**Both applications are NOW Open for 2022-2023*

- Most Seniors will apply for FAFSA or TASFA as a dependent, meaning they will have to provide information about their parents. Wondering whether you’re independent or dependent?

Review The Types Of Federal Student Aid Are Available

While there are no overall FAFSA income limits, the type of aid youre eligible for and whether you qualify for need-based financial aid will depend on your familys finances.

Even if you dont think you qualify for need-based aid, though, it makes sense to fill out the FAFSA to see if you can get non-need-based aid. You have to complete a FAFSA each year to keep receiving federal student aid.

Below are the types of federal financial aid you can obtain as a result of filling out the FAFSA:

Read Also: Who Buys Back Used College Textbooks

Who Qualifies For A Fafsa Loan

The most general eligibility requirements to qualify for the various forms of federal student aid include that you have financial need, are a U.S. citizen or eligible noncitizen, and are enrolled in an eligible degree or certificate program at a college or career school. However, there are more eligibility requirements you must meet to qualify for federal student aid and these requirements are specific, based on the type of aid. The majority of students are eligible to receive some type of financial aid from the federal government to help pay for college or career school. The age of the student, race, and field of study are not taken into account when determining their eligibility.

Completing Your Fafsa Is Simple

Once you have applied for admissions to Presbyterian College, take the next step to fund your college education by completing your FAFSA.

Each years FAFSA is used for fall, spring, and summer semesters. For instance, for Fall 2021, Spring 2022, and Summer 2022 semesters, you will need to complete the FAFSA for 2021-2022. Follow the four steps below to complete your FAFSA.

Recommended Reading: College Scouts For Football

When Should I Fill Out The Fafsa

As soon as possible after it becomes available on Oct. 1, financial aid experts say. Many states and colleges use the form to determine scholarship aid, and some programs award the money on a first-come, first-served basis until available funds are depleted. A list of deadlines for both federal and state aid programs is available on the federal student aid website.

And note: While the federal deadline for filing a FAFSA extends into the summer after a given academic year, waiting until then means you will probably be eligible only for loans. The FAFSA for the current academic year, for instance, has a federal filing deadline of June 30, 2022.

What Are The Federal Codes For The Schools Im Applying To

University financial aid offices use the FAFSA to compile each students financial aid package, so youll need to indicate which schools your FAFSA should be sent to. The FAFSA asks for federal school codes, which you can look up here.

Even if youre not 100 percent sure about which schools youre applying to, come up with a shortlist of up to 10 schools and get your application submitted early you can always update it later.

You May Like: Norwich Kreitzberg Library

How To Get An Early Financial Aid Estimate

You can use the FAFSA4caster® to get an early estimate of the amount of student aid your children can receive. This is a good tool to use if youre not ready to fill out FAFSA® yet, or if youre looking for information to help you plan for college savings. Any student can use it to get an idea of their eligibility for aid. Parents of younger children can use FAFSA4Caster® to get early estimates of aid their children can get in the future so they can start college funding strategies.

Even adult students can use it to get an idea of how much aid they might be eligible to receive. Keep in mind that even if FAFSA4Caster® says your familys income and assets put your children out of range for grants, its still worth completing FAFSA®. This is because most colleges, foundations, and state scholarship agencies use FAFSA® to decide who theyre going to award scholarship money to and how much each student will receive. Finally, filling out FAFSA® automatically qualifies you for at least $5,500 in low-interest federal loans for one year.

Do I Need A Parents Help To Apply For Fafsa

If youre classified as a dependent for the FAFSA, you will likely need your parents help filling out the FAFSA, especially for the sections pertaining to their assets.

You might want to set up a time to sit down with them and fill out the application in one go.

But the mobile app allows students and parents to start the FAFSA on the app or a desktop computer, and finish it on another device. You dont have to be in front of the same computer at the same time to collaborate!

Don’t Miss: Do Native Americans Get Free College

The First Day You Can Access And Submit The Fafsa Is October 1

Be sure to complete and submit your application before the FAFSA deadline set by the colleges you plan apply to and by the deadline set by your state of residence. Filing the FAFSA as soon as possible after October 1 might put you near the front of the line for financial aid. To find FAFSA deadlines for your state, visit the Department of Education’s student aid deadlines page.

Fill Out The Fafsa And Get Your Financial Aid

Head over to the Department of Education website to start your FAFSA application. Youll need to have the following ready as you complete the process:

- Social Security number and, if applicable, Alien Registration number

- Financial account statements

- Federal income tax returns, W-2s and other records of money earned

Be aware that you may be able to pull in your tax documents via the IRS Data Retrieval Tool available within the FAFSA form.

While you dont need a Federal Student Aid ID to fill out the FAFSA, it can be a good idea to create an FSA ID. Having an FSA ID can make it easier to find your application once its started, as well as to access other information about financial aid throughout your college career. You can quickly pull up your student aid reports, as well as keep track of your direct loan servicers.

If you have your information together, its possible to complete your application in 30 minutes or less. Plus, you could complete the 2020-2021 FAFSA form on your phone via the myStudentAid app.

You can also use the FAFSA4caster tool to estimate your potential financial aid before you even start your application, so you can get an idea of where you stand.

FAFSA applications open on Oct. 1, 2020 for the following school year. Apply early since some of the money is handed out on a first-come, first-served basis. The earlier you apply, the better your chances of getting the help you need for school.

You May Like: What You Need To Get Into College