Choose An Affordable School

Paying for college will be exponentially easier if you choose a school thats reasonably priced for you. To avoid straining your bank account, consider starting at a community college or technical school.

If you opt for a traditional four-year university, look for one that is generous with aid. Focus on the net price of each school or the cost to you after grants and scholarships. Use each schools net price calculator to estimate the amount youll have to pay out of pocket or borrow.

Just because one schools sticker price is lower doesnt mean it will be more affordable for you, says Phil Trout, a college counselor at Minnetonka High School in Minnetonka, Minnesota, and former president of the National Association for College Admission Counseling. For example, if a $28,000-a-year school doesnt offer you any aid, and a $60,000-a-year college offers you $40,000 in aid, the school with the higher sticker price is actually more affordable for you.

» MORE:How to use a net price calculator

Where Can I Get Help With The Fafsa

Your high school counselor can help you submit your FAFSA. You can also use our FAFSA DIY kit for Students and Families.

DO NOT;use any website or app other than;FAFSA.gov;or myStudentAid to submit your FAFSA. There are other sites that will try to get you to pay in order to submit your FAFSA. It does not cost you any money to submit your FAFSA!

You must have a FSA ID in order to sign and submit your FAFSA. If you are a dependent student, at least one of your parents will need a FSA ID as well. Only create your own FSA ID! Create your FSA ID on the Federal Student Aid website.

Ask Your School For Additional Funding

Once youve settled on your school of choice, dont necessarily settle on the initial financial aid award package.

It may behoove your family to contact your campus financial aid office and ask for more support. According to experts, there are three occasions when you could successfully negotiate your aid package:

If you receive aid packages from multiple schools, compare them side by side to confirm which offer is the most generous.

You May Like: College Terre Haute Indiana

Hunt For Student Research Positions

Students might also be able to work on certain projects as undergraduate researchers to help cover college expenses. Not only does research pay some of the bills, but it also provides real-world experience that can help students land jobs after graduation.

Look for research positions in an area you have experience. Also check with your professors and other teachers for anyone looking for undergraduate researchers. Organizations outside of your school, such as hospitals, research institutions and community-based organizations often look for students to fill research positions that are backed by grants.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Don’t Miss: College With Best Dorms

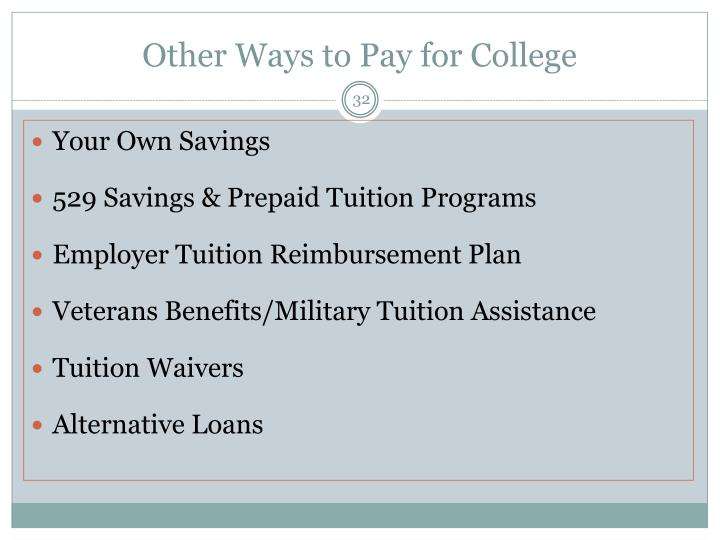

Ways To Fund A College Education

Posted by Shelby Barone on Sep 23, 2021 in Family |

College fees can be very expensive. Its important to weigh up your different options when it comes to funding your education. Below are just 5 different ways to fund a college education.;

Use savings

Many parents will save up for their childs tuition over the years. This prevents students from having to pay for their own education but requires a lot of forward-planning.

Of course, a lot of students dont have access to such funds. An alternative option could be to accumulate your own savings towards your education. Even if youre unable to fund your entire education through savings, being able to put some savings towards can help to reduce the overall cost.

Take out a loan

A lot of students take out a loan to cover tuition fees. Federal direct loans are paid back over many years in small installments. There are different types of federal direct loan some dont accrue interest while in college and others have fixed low interest rates.;

You can also look into private loans and other alternative forms of borrowing such as student credit cards. International student loans could be useful for those wanting to study abroad. Always compare interest rates and check application requirements.

Work and study

Consider scholarships, grants and company-sponsored courses

Consider other forms of financial support

How Old Is Too Old To Start A Radiography Program

Im just going to throw this out there since I hear this question/excuse a lot too. Can you be too old at some point to start one of these programs?

- Bachelors graduated at age 27,

- Radiography graduated at age 34,

- Sonography graduated at age 37,

- Masters graduated at age 46

Believe it or not, Im currently looking at a doctorate program. It has nothing to do with my career or a promotion. It is a dream I have had since I was much younger. At this point, I figure I made it this far why not? The real question isHOW AM I GOING TO PAY FOR IT

Do you have other methods to add to how you paid for school? Add it in the comment section for future students to benefit from it.

Additional Information:

If you are curious about the career of radiography, I have written some articles on various topics:

Also Check: Charis Bible College Dc

Apply For Private Student Loans

Private student loans are another way to cover the cost of college. However, theyre generally considered to be the last resort option, even compared to federal student loans. Private loans typically require a credit check to get approved, which means that it can be tough to qualify as a college student with little or no credit history.

Even if you get approved, your interest rate is based on your creditworthiness, so your loans could be expensive.

With that said, most lenders allow co-signers, which can help you qualify and get a low interest rate. However, this also means the loans show up on the co-signers credit report, which could make it difficult for them to get approved for credit in the future.

Even so, if youve exhausted your allotment of federal student loans, which are capped on an annual and aggregate basis, private student loans can be a much better option than higher-interest options like credit cards and personal loans.

How To Deal With Student Loan Debt After College

If you have a federal student loan, you may be eligible for programs like Public Service Loan Forgiveness, which forgives your remaining student loan balance after 120 consecutive payments, or income-driven repayment plans, which could lessen the amount you have to pay each month.

Borrowers who have private loans might consider refinancing their loans after finishing college in order to receive a lower interest rate or better repayment terms that fit their needs. You can also refinance your federal loans into a private loan if you spot a particularly good interest rate, though keep in mind that youll lose the benefits of the federal program.

The key is that you create a plan for your student loans based on your goals and budget. With the right strategy, you could end up paying off your debt early, saving money on interest and even getting some or all of it forgiven.

Don’t Miss: Do Colleges Offer Health Insurance

Use This Information As Well As The Paying For College Guide To Help You Explore The Different Funding Options Availablefrom Scholarships And Grants To Work

Grants

Grants are usually provided by the state or federal government. They don’t have to be repaid and are based on financial need . One of the most common grants is the Federal Pell Grant.

Student Loans

Student loans are money you borrow for college that you have to pay backeven if you dont graduate.

If youre eligible to receive grants or take part in the work-study program, always use those funds first. Apply for as many scholarships as possible and use college savings before deciding to borrow student loans. If you do decide to take out student loans, explore federal student loans first , as they often have lower interest rates and more flexible repayment options compared to private loans.;

Scholarships;

Scholarships are financial awards you apply for based on criteria such as academic achievement, talent, financial need, etc.;

The State of Utah offers four major scholarships. These scholarships include two academic scholarships, the Regents Scholarship, and New Century Scholarship; one need-based scholarship called Utah Promise; and one scholarship for future educators, theT.H. Bell Education Scholarship.

*Undocumented students, with and without Deferred Action for Childhood Arrivals , can attend college in Utah! Utah high school graduates do not need to provide proof of citizenship to qualify for privately funded scholarships. For a comprehensive list of privately funded scholarships in Utah, visit educate-utah.org.

Custodial Accounts Under Ugma/utma

Pros:;

- Money saved in a custodial account can be spent on anything cars, airline tickets, computers, etc, as long as the funds are used for the benefit of the minor.;

- There is no limit as to how much you can invest.

- The value of the account is removed from donors gross estate.;

Cons:;

- Earnings and gains are taxed to the minor and subject to the kiddie tax unearned income over $2,100 for certain children through age 23 is taxed at the marginal rate applicable to trusts and estates .;;

- The student will gain rights to the account once he or she reached legal age, and can use they money at their own discretion.;

- Custodial accounts are counted as a student asset on the FAFSA, which means they can reduce a students aid package by 20% of the account value.

Pros:;

- U.S. savings bonds are federal tax-deferred and state tax-free.;

- Series EE and I bonds purchased after 1989 may be redeemed federally tax-free for qualifying higher education expenses.;

- Bond owners are investing in interest-earnings bonds backed by the full faith and credit of the U.S. government.;

Cons:;

- The maximum investment allowed is $10,000 per year, per owner, per type of bond.;

- The interest exclusion phases out for incomes between $117,250 and $147,250 for married couples filing jointly or $78,150 and $93,150 for individuals.;

- If bond proceeds are not spent on tuition and fees, interest earned will be included in federal income and subject to tax.;

Pros:;

Cons:;

Don’t Miss: Who Buys Back Used College Textbooks

The Nuclear Option: Student Loans

I strongly recommend you stay away from these unless absolutely necessary. If you miss a few payments and these end up in default, it can affect your life for the next ten years or more.; Interest rates are usually pretty low but interest is interest. The CT Tech who trained me in CT when I was a student had a $25,000 student loan that he used for radiography school. At age 65, he had paid on it for over 15 years and still owed over $10,000. As a Vietnam veteran, he wrote to his Congressman asking for relief. None came. He is still paying to this day.

There are several types of student loans and each carries its own unique set of rules. You have two options when you graduate: start repaying them or apply for a deferment of payment. Federal student loans offer deferment for situations like going back to school or loss of a job. Theres also a forbearance that will put your payments on hold until a set future date. These can be had for a number of reasons, usually financial burden. Just remember, the payments may be on hold but the interest keeps growing. The only good thing about student loans is that they die with their owner. My student loan debt cannot be passed to my wife or children upon my death.

Pay Student Loan Interest Payments

Even though you dont have to start making student loan payments until you graduate college , its still a good idea to pay the interest on unsubsidized and private student loans if you can. By paying the interest while in school, you can avoid having your loan balance grow larger due to interest accruing.

Find out whether your lender offers the option to pay the interest due on your student loans. By keeping your balance as low as possible, it will be easier to afford monthly student loan payments after graduation.

Read Also: How To Build Credit In College

Different Ways To Pay For Radiography School

This is an important question that stops a lot of people from going into the field of radiography and many other fields, I would imagine. It is one of the top ten questions I get asked as a licensed radiographer/administrator. Here are the 10 different ways that I know of to pay for your schooling:

A Practical Guide: The 5 Best Ways To Save For College

So you want to be proactive and save for college. Maybe youre a high school student who wants to build up a college fund for yourself, or maybe youre a parent or family member who wants to save for a young loved one.;No matter your situation, youre taking a proactive step in making college a little bit more affordable.

In this post, Ill discuss the things you need to know in order;to build, keep, and grow college savings. We’ll discuss the five;best ways to save for college to lower student debt on graduation and take a load off your mind.

First, though, I’ll talk about the question you should be considering before you implement your savings plan: how much should you be putting away in the first place? Read on to find out!

Don’t Miss: Which Meningitis Vaccine For College

Complete Micro Tasks Online

If you like taking surveys but also want to get paid to watch videos, play games, and search the web, you can get paid by Swagbucks for the activities you do for free right now.

Swagbucks also lets you test products or do micro-tasks that only take a couple of minutes to complete so you can get paid for working online with minimal effort.

You can redeem your points for gift cards for as little as $3 to your favorite restaurants and online stores like Amazon. Swagbucks also offers PayPal cash payment too.

Ways To Pay For Your Education If You Dont Have Money

Scholarship as a form of financial aid is awarded to only deserving students and applicants and it is always based on various criteria given by the donor of the scholarship awards. Scholarships are the most common and well-known form of getting financial aid. There are various types of scholarships and different ways in which they are awarded by various organizations and individuals. Some of the common types of scholarships are outlined below:

Often called need-based scholarships or gift aid. The grants or bursaries are basically money free, that is, the financial aid rendered is not to be paid back. These types of financial aid are usually based on the financial circumstances of the person who is requesting, but there may also be other factors which can be considered before been awarded the grant. These other factors could be the physical state or mental disabilities of the person requesting. In the US, the Department of Education offers countless federal grants to students who are attending a four-year course in colleges or universities or even career schools, for example, catering schools. Also in Germany, different types of Bursaries or grants are awarded. Each institution awarding the merit grants are to decide the number of grants to be given out and the duration as well.

Also Check: Fsaid Ed Gov Legit

Sell Your Old Tech And Movies

College students might have more tech gadgets and movies than most adults. If you or your roommates have movies, video games, or electronic devices that are gathering dust but still have a useful value, try listing your items on .

Decluttr offers next-day payment via PayPal so you can get money quickly.