Should You Really Open Up A New Line Of Credit

Consumers these days have more credit from more sources than they used to, and credit scoring agencies have adapted to that. Opening up a new line of credit wont necessarily kill your FICO score, and they dont really punish you for multiple credit inquiries for home, auto, or student loans.

But getting several new credit cards within a short time can cause your credit rating to suffer. And if your credit rating isnt very good to begin with, getting more credit is never really the answer.

At the very least, people with credit problems should consider closing out other credit cards accounts when you get a new one, and shop around for a card that will save you money on interest and fees before you worry about rewards.

Maybe that other card wont be as cool as the Apple Card, but if youre trying to rebuild your credit, cool may not be a luxury you can afford.

How To Make Purchases Online

To use your Apple Card for mobile purchases, simply select Apple Pay at checkout. Double-click the side button on your iPhone to confirm the purchase, complete the authentication step and the transaction will process automatically. You can also make Apple Pay purchases on your iPad, Apple Watch or Mac.

Who Is This Credit Card Best For

- Diligently searches for the best products and delights in a good bargain See more cardsDeal Seeker

- Prioritizes sticking to their budget while buying what they want and need See more cardsSavvy Saver

The minimal fees make this a good, low-cost addition to your Apple Wallet, and thats the only place you should keep it. When making purchases outside of Apple or without Apple Pay, youre better off with one of the many no-annual-fee cards that pay 1.5% or 2% cash back on all purchases and have a variety of benefits. For example, theres no promotional purchase APR, which other cash-back cards often offer.

That said, with Apple Card Monthly Installments, you will get up to 24 months to pay off Apple products purchased from Apple interest-freewhile still earning 3% cash back. If you bought a MacBook Air at $1,000, you’d earn $30 cash back for one purchase and still get two years to pay it off without paying interest.

-

Exceptional rewards for Apple and partner-merchant purchases

-

Interest-free payment plans on Apple products

-

Great rewards rate on Apple Pay purchases

-

Financial-management tools

-

Low end of APR range is among the best

-

Only worth it for Apple users

-

Sub-par rewards rate on non-Apple and non-Apple Pay purchases

-

Few benefits

-

Limited integration with budgeting apps

Recommended Reading: Is Ashworth College Recognized By Employers

Does The Apple Card Help You Build Credit

If you use your Apple Card responsibly, it can help you build your credit over time. To improve your credit score with the Apple Card, focus on making regular, on-time payments and try to keep your credit card balance as low as possible. As of this writing, the Apple Card reports credit activity to TransUnion and Equifax two of the three major credit bureaus and Apple may expand reporting to Experian in the future.

Adding A Student As An Authorized User On Parents Card

Are they trustworthy with their debit card, cash, belongings, and work responsibilities? Do they generally follow through on what they say they will do? If so, parents can probably trust them with a credit card too.

If the student is always broke, late, or otherwise irresponsible, parents might want to wait to add the child as a user to their card.

Benefits of adding the student as an authorized user:

- An excellent start to building credit

- Parents can provide education, lessons, and answer questions

- Parents good credit passes on to the child, giving them a head start on a building a good credit history

Drawbacks of adding the student as an authorized user:

- The student can use the buying power to rack up high charges

- Parents are legally responsible for their childrens purchases

- Parents who pay the bill for students have higher balances

Parents should talk about credit limits and how their child will pay them back for charges made on the card. Heres an interesting finding from the study by Sallie Mae:

Students whose families pay their credit card bills carry an average balance nearly double the amount carried by students who pay their own credit card bills.

Takeaway? Put the responsibility of payment on the student. Its better for everyone involved.

Recommended Reading: Is Atlanta Technical College Nursing Program Accredited

What Is A Student Credit Card

Student credit cards are designed for people with limited credit history, whether theyre building credit while in school or theyre just a newcomer to the world of credit. Student credit cards differ from regular credit cards in a couple ways. For example, when compared to traditional rewards cards, student cards lack the large sign-up bonuses, the required credit score will usually be lower for a student card, and you wont start with as high of a credit limit. Finally, student cards will sometimes have special features specific to the needs of college students.

The specific features of student cards can vary greatly. For example, only 2 of the 11 student cards we surveyed offered a bonus worth more than $200, and one had a $50 sign-up bonus.

Still not sure why you should get a credit card? Because of the way scoring models are set up, the easiest way to build credit is with a credit card. In addition, credit cards are safer than debit cards because of federal protections that are in place.

Getting A Traditional Credit Card In Their Name

If a college student has proof of a steady income, they might qualify for a conventional credit card. Students may have higher interest rates and lower credit limits due to their limited credit history. When used responsibly, traditional credit cards are an excellent way to start building credit.

Some credit card companies will have more strict requirements.

They may need a more extensive credit history or a bank account with the company before issuing a card. If this is the case, the student can look at alternatives to a traditional credit card.

Don’t Miss: Universities With Rolling Admissions For Fall 2021

What Are Apple Card Benefits

This is where the Apple Card both shines and lags at the same time. The Apple card shines in many categories especially if you tend to buy Apple products rather frequently. Apple Card offers 3% cash back on purchases from Apple store or anything related to apple like iTunes, App Store, Apple Subscriptions, etc Apple Card also offers 2% cash back on all other purchases made with Apple Pay, and 1% on all other purchases made with its physical card you can opt in to receive for which I need another section to talk about below.

It also strives in few other areas that make this card more unique which are no fees, daily cash, very easy application process, great spending managment tool, and innovative security features. The cashback is unlimited and you receive cash back on daily basis, yes on daily basis! No more waiting until end of the month to receive your cash back.

The application process is very simple and done straight from your wallet app. Another unique feature is shining at is the spending managment tool where the card in your wallet will change colors based on what you are spending the money at as well as exact address and name of the business you used it at. Dont forget to sign-up for Acorns and get free money

Some other benefits include:

- Titanium Physical Card

Should You Get The Apple Card What To Know Before You Bite

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When Apple announced in 2019 that it was launching a new Apple-branded credit card, some fans may have hoped it would reinvent how we pay for things. But the product’s features make it the credit card equivalent of a Red Delicious: relatively ubiquitous and somewhat bland.

Still, despite a crowded market of cash-back cards, consumers may be able to find room in their digital wallets for another one that will earn rewards, especially on pricey Apple purchases.

As with all Apple product announcements , the important question to ask is: Is this product right for you?

» MORE: Apple Card Q& A: How it works and what to expect

Read Also: College Football Scouts

Wells Fargo Cash Back College Card Benefits And Features

At best, the Wells Fargo Cash Back College Card offers a mediocre rewards program and 0% APR period. However, it does integrate well with your Wells Fargo accounts, displaying all your account information on one page:

This makes it a convenient option for an existing Wells Fargo customer, since you can track all your spending from a single location. However, we’ll explain in the following section how the card falls short on many other features.

Are The Benefits And Rewards Worth It For Apple Fans

We publish unbiased reviews our opinions are our own and are not influenced by payments we receive from our advertising partners. Learn about our independent review process and partners in our advertiser disclosure.

If youre among the Apple faithful, its worth taking a look at the Apple Card. The card, issued by Goldman Sachs, reserves its best rewards for Apple purchases and transactions made using Apple Pay, which makes it less of a physical card than it is an incentive program for using Apples proprietary technology.

Read Also: Watch College Softball

What Is Apple Card

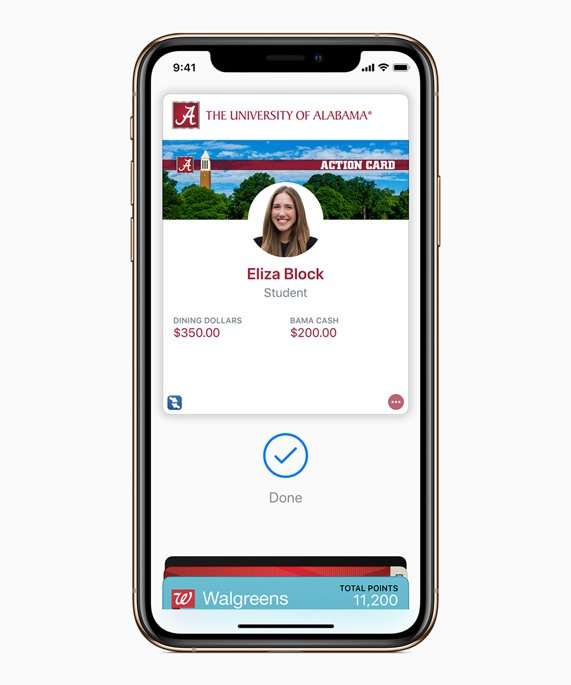

Back in march of 2019, Apple announced Apple Card at one of its major events of the year. Apple for the first time enters the credit card industry and Apple card is the first thats tightly integrated into the Wallet app on iPhone and offers exclusive cash-back benefits for Apple-related purchases. If you ever paid for something with your wallet app you have on your iPhone or you find yourself paying with Apple Pay rather frequently, you will find this card very beneficial in terms of convenience of not carrying your wallet and rewards.

Conditions That Might Cause Your Application To Be Declined

When assessing your ability to pay back debt, Goldman Sachs1 looks at multiple conditions before making a decision on your Apple Card application.

If any of the following conditions apply, Goldman Sachs might not be able to approve your Apple Card application.

If you’re behind on debt obligations4 or have previously been behind

- You are currently past due or have recently been past due on a debt obligation.

- Your checking account was closed by a bank .

- You have two or more non-medical debt obligations that are recently past due.

If you have negative public records

- A tax lien was placed on your assets .

- A judgement was passed against you .

- You have had a recent bankruptcy.

- Your property has been recently repossessed.

If you’re heavily in debt or your income is insufficient to make debt payments

- You don’t have sufficient disposable income after you pay existing debt obligations.

- Your debt obligations represent a high percentage of your monthly income .

- You have fully utilized all of your credit card lines in the last three months and have recently opened a significant amount of new credit accounts.

If you frequently apply for credit cards or loans

- You have a high number of recent applications for credit.

If your credit score is low

Goldman Sachs uses TransUnion and other credit bureaus to evaluate your Apple Card application. If your credit score is low ,4 Goldman Sachs might not be able to approve your Apple Card application.

Also Check: Do I Need Ged To Go To Community College

Do Student Credit Cards Graduate When You Do

There is really no reason to part with a student credit card once you graduate unless it carries an unusually high interest or fees. Indeed, theres actually a strong case to be made for hanging on to the account. Thats because an individuals credit score is based in part on the average age of their various credit accounts, and a student card account is likely to be the longest-standing piece of credit history most people will ever have. Card issuers often have a graduation strategy for student credit cards that essentially converts them into regular consumer cards with higher credit lines and other valuable features. In some cases, you can upgrade to a different card the issuer offers while retaining the same account, with its long and beneficial credit history.

Best Overall Best For Travel: Bank Of America Travel Rewards For Students

25,000 bonus points if you make at least $1,000 in purchases in the first 90 days of your account opening – which can be redeemed for a $250 statement credit toward travel purchases.

| Earn unlimited 1.5 points for every $1 you spend on all purchases everywhere. | |

| INTRO PURCHASE APR | 0% for 12 Billing Cycles |

| Balance Transfer Fee | Either $10 or 3% of the amount of each transaction, whichever is greater. |

| Foreign transaction fee |

- Why We Chose This Card:

- Pros & Cons:

The Bank of America Travel Rewards for Students is our pick for the best overall student card and best student travel card because of the high earning rate on its rewards program that you can then redeem for flights, hotels, vacation packages, cruises, rental cars, or baggage fees. It also has a long introductory APR on purchases and no annual fee which add to the card’s strong rating. Plus, the lack of foreign transaction fees makes this an ideal card for student travel outside the U.S.

-

Pay off purchases for 12 months with no interest

-

Friendly to foreign travel

-

Rewards aren’t transferable

-

No 0% APR balance transfer offer

-

Relatively high spending required for 25,000-point introductory one-time bonus

Read the full Bank of America® Travel Rewards for Students credit card review

Don’t Miss: Colleges With Rolling Admissions 2021

Discover It Student Cash Back

I reccomend this card to anybody that is getting their first card no matter what age, the benefits this card has is great. It is the perfect card for a student learning to handle credit. On top of the rewards, you get a free FICO score, low fees and forgiveness for your first late payment.

Earning Rewards

Intro Offer: Discover will automatically match all the cash back you have earned at the end of your firsrt year. So if you were to have $200 cashback after your first year you would be matched and it would make it $400, Theres no minimum spending or maximum rewards, its just a dollar for dollar match.

Earn 5% Cash Back: You will earn cash back on everyday purchases at different places each quarter discovery offers you a deal on different places, like Amazon.com, grocery stores, restrauntts and gas stations. The card incentivizes you to spend at these specific places to earn 5% cash back. This is my favorite part about this card, getting 5% back on gas is crucial for me especially with the prices on the rise.

Good Grade Rewards: You can earn a $20 statement credit each school year if your GPA is a 3.0 or higher for up to the next 5 years. I highly suggest you take full advantage of this, $20 isnt a lot but its still a great little perk for this card.

No annual fee: No late fee on first late payment. No APR change for paying late, compared to most other cards will make you pay for this, which gives discovery card a huge advantage.

Who Is It Really For

Apple Card offers some get perks for people that are looking for an everyday credit card with simple rewards system where Apple pay is available. On top of having no annual fees or any foreign transactions, you get 2% cash back on all purchases made with Apple Pay, and 1% on purchases using the titanium physical card.

Apple card gives a great opportunity for the future as well and Im sure there are going to be many more offers throughout the year by getting more cashback with purchases made with different businesses like 3% Uber and Uber Eats cashback it started offering.

This card is a great option for iPhone users who place high priority on security and convenience, but if you are looking to maximize the rewards, then there are better options out there.

Don’t Miss: Is Rhema Bible College Accredited

Apple Card Review Summary

The Apple Card is a rewarding option for people with good credit or better who regularly buy Apple products and services, as well as for iPhone, Mac and iWatch users who are comfortable making purchases using Apple Pay. Having the new Apple Credit Card from Goldman Sachs in your wallet doesnt have to cost you a thing, considering the cards $0 annual fee . But it can help you save money with elite rewards rates of up to 2% – 3% on select purchases, as long as you pay the bill in full every month.

The Apple Credit Card has some financing appeal for new Apple purchases. Apart from that, the card is not a good choice for people who plan to carry a balance from month to month, thanks to an APR that could be anywhere from 10.99% to 21.99% , depending on an applicants creditworthiness. There are much better credit card rates available to people with the good-to-excellent credit needed to be eligible for Apple Card approval.

The Apple Card is not the best everyday credit card for the average person, either. As popular as the Apple brand is, having rewards so dependent on Apple-centric spending means the population it would work well for is a lot more limited than it would be for a Visa or Mastercard with above-average rewards on all purchases, for example.

Thats the short story. If you need more information about the offer before submitting an Apple Card application, well break down its best and worst features in more detail below.