The Cost Of A Canadian University Education In Six Charts

Tuition is only part of the cost of going to university. There’s also the cost of books, food, travel and the occasional beer. Here’s how students finance their education.

By April 1, 2018

Students living at home spend $9,300 per year on average. For those who move away, its closer to $20,000. We asked 23,384 students how they pay for school and where they spend their money. Heres what they told us.

1. The total average cost of a post-secondary education

2. Where does the money come from to pay for school?

First, the good news: only half of students are in debt. Now the bad: parents are picking up the slackand not in a very efficient way. Nearly two-thirds of students say they dont have an RESP.

3. The cost of books by program

Course materials account for a fraction of the total cost of university, but they still add up. Heres how the least and most expensive programs compare on the cost of books.

4. Debt by year of study

The average level of debt by each year of study, based on responses from more than 11,000 indebted students.

5. Spending on food on campus in a typical week

6. How much do you spend on groceries in a typical week?

This is an update of a story originally published on October 19, 2017.

Students Taking A Full

Students who take less than 70% of the student contact hours and less than 66.6% of the courses required for the program of instruction in a given semester are considered part time for that semester and will be charged tuition based on the number of student contact hours in the courses they are taking.

- Canadian part-time students are charged $5.90 for post-secondary and $10.89 for post-graduate per contact hour for courses they are registered in

- International part-time students are charged $30.34 for post-secondary and $39.25;for post-graduate per contact hour for courses they are registered in

- Canadian and international part-time students are charged health insurance and Ancillary Fees. Ancillary Fees include student service fee, technology fee, student activity fee, and program incidentals.

Other Factors To Consider

The fact that even an in-state university jumps above $100,000 for four years with room, board, books, materials, transportation, and other personal expenses considered shows just how expensive college has become. However, even the numbers provided above wont necessarily tell the whole storyunless, perhaps, you have a college fund that can cover the full expense.

The biggest of the other factors that you need to consider are student loans. The average graduate of the Class of 2016 was carrying over $37,000 in student loan debt at the time of graduation. If you anticipate that you must take out student loans to cover the cost of college tuition, then you must consider the aftermath of college as part of your Cost of College calculations.

How much you will pay on your student loans depends on several factors, making it difficult to formulate a ballpark estimate for how student loan payments affect the overall cost of college. After all, some studentsusually with help from their parents or assistance through scholarshipscan escape college with no debt. Others have to take out loans for the entirety of their four-year tuition bill. Whether or not you have a job and a source of income throughout college can also impact how much debt you have when you graduate.

You May Like: Can I Sell My College Books

Average Cost Of Books & Supplies

Some programs require more expensive materials than others, so the cost of books and supplies varies widely.

- At public 4-year institutions, students pay an average of $1,334 annually on books and supplies.

- Books and supplies at private, non-profit institutions average $1,308; at private, for-profit institutions, the average cost is $1,194.

- At public 2-year institutions, students pay an average of $1,585 each year for books and supplies.

- At private, nonprofit institutions, books and supplies average $1,061; at private, for-profit 2-year colleges, the average cost is $1,393.

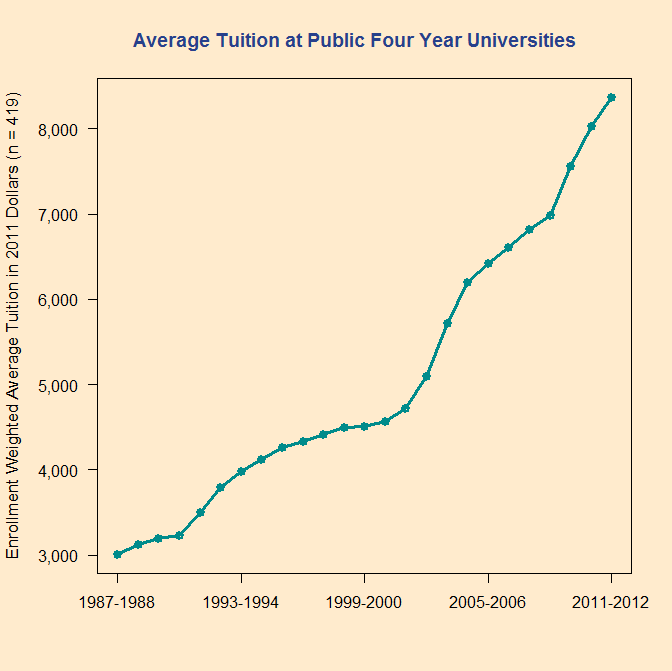

Estimated Future Cost And Expected Tuition Increase

What will it cost to send your child to CUNY Hunter College in the future? In the past four years, this school’s published in-state tuition and fee total rose from $6,030 to $6,930. This amounts to an average annual price increase of 3%. Nationally, university tuition prices are rising around 5% per year. Looking out five, ten, fifteen or eighteen years, these are CollegeCalc’s estimates how much you could expect to pay for a 4 year degree assuming tuition increases at the national average rate. Estimated future prices are based on the current in-state 4 year cost of $96,632.00. Use the college savings plan calculator below to perform a more comprehensive analysis on future costs and how much you will need to save for CUNY Hunter College.

| Annual |

|---|

College Cost Analysis.

- CollegeCalc is a source for students and parents seeking college pricing data and higher education cost calculation. Learn more.

- Terms of Service

- All school data is sourced from the U.S. Department of Education IPEDS Surveys for school years 2019-2020 and 2018-2019 and is in the public domain. Site data was last updated in January 2021 This site is not affiliated with or endorsed by the U.S. Department of Education. We believe the content represented on this website to be correct yet make no guarantee to its accuracy. CollegeCalc.org has no direct affiliation with the schools presented on this website and the school names are the property of their respective trademark owners.

You May Like: What Should I Bring To College Dorm

Value Of College Degree

The reality is that people with college degrees, on average, are more financially stable than those without them. For example, the average worker with just a high school diploma earns $30,500 annually, whereas the average college graduate with a bachelors degree earns $44,000 annually. The cost of college should be weighed against the value of what youre getting in return. After all, it is an investment in your future.Interesting College Degree Facts and Statistics

A college degree has three important factors to consider: education, earning potential, and career opportunities.

Earning Potential

On average, college graduates are twice as likely to make an additional $1 million in earnings.

Career opportunities

College graduates are more likely to gain an advantage in their careers than people without degrees. According to Glassdoor, the five highest-paying college majors include

1. Computer Science

Read More: 10 of the Highest Paying College Majors

There are many different factors to consider when calculating the true cost of college. For many students, it can be easy to overlook some of these expenses, and many of these unanticipated costs often take college students by surprise. Fortunately, students have several options when it comes to paying for college. With a mix of financial aid, grants, scholarships, federal and private student loans, students can pursue higher education and work towards their career goals.

How Much Does Four Years Of College Cost

Over the years, college has evolved from a choice made by some to an expectation for nearly everyone. At high school graduations, schools will even read off information about the colleges that students are planning to attend. Going to college has become the societal norm, to the point where it is almost strange, unwise, and often even unacceptable to decide against higher education.

There is an obvious reason for this trend. Many people believe that opting out of going to college will make it more difficult for a person to find employment, advance their career, and make money throughout their lifetime. A college degree, in comparison, opens up the job market, unlocks paths to advancement, and leads to higher salaries.

None of these beliefs are expressly incorrect. Many employers will make a four-year degree a prerequisite for most positions. These positions require specific skills and education that are usually not covered in high school. Employers are willing to pay extra for those skills, meaning that salaries areon averagehigher for college-educated professionals than they are for people who merely hold high school diplomas.

Also Check: How To Find Out How Many College Credits You Have

College Net Price Vs Sticker Price

While a college’s sticker price can give you an idea of your college costs, it’s important to consider a colleges net price,;which is the price students and families pay after factoring in financial aid. According to the College Board, the average “net price” families are paying for the 2020-2021 academic year is approximately:

- $33,200 at private colleges*

- $19,490 at public colleges*

*After subtracting financial aid and education tax benefits.;

The average grant aid awarded per student was $7,330 at public colleges and $21,660 at private schools.;

Source: College Board, Trends in College Pricing and Student Aid, 2020.

The cost of college may seem overwhelming, but a college education comes at many different price levels, and financial aid can reduce the total cost. Look at the Cost of Attendance as the maximum you and your family might pay. Your college net price can be much lower.

Just How Much Does College Cost

Well, that depends on what type of school you want to attend. An Ivy League school will likely be your most expensive option, but that doesn’t mean you can’t get an excellent education at a more affordable college.

Let’s take a look at the differences between costs of public and private colleges today and 18 years from now:

Read Also: What Colleges Offer Rn Programs

Cost Of Books And School Supplies

The average price of books and school supplies for students at both public and private colleges in 2020-2021 is $1,240.

Textbook prices have risen 812 percent since 1978, according to a 2019 report by Follet, an educational products company. Borrowing books from the library or purchasing digital or used textbooks can reduce your costs, but students still find budgeting for textbooks to be a major source of stress, according to a survey of current and former college students by textbook publisher Cengage. Thirty-one percent of the students surveyed said they took fewer classes to save on textbook costs, and 43 percent said they skipped meals or took out loans to pay for course materials.

Pell Grants And Other Grant Aid

84% of CUNY Hunter College students received grant aid in 2018/2019. The average total aid amount was $9,024. 61 percent of students received aid in the form of Pell Grants from the U.S. Federal Government. The average Pell Grant awarded for 2018/2019 was $5,223. To apply for a Pell Grant to attend CUNY Hunter College, the first step is to fill out the Free Application for Federal Student Aid .

| Financial Aid Summary |

|---|

| 2% more expensive |

Read Also: How Do College Credit Hours Work

College Savings Plan Guidelines

From the results, we can conclude that the goal for most people saving for college should be to have between $37,328 and $245,427 saved in the account. This is a huge range, no doubt. But remember what “low end” and “high end” mean.

The low end amount is for someone that wants to help their child pay for a public 4-year school. The high end amount is for someone that wants to fully pay for a 4-year private education for their child.

Parents should also remember that, even when saving for private school, many students who attend private schools get discounted tuition, or receive scholarships to offset the “real” tuition price. So, even that high end number might not make sense when saving for college.

In this scenario, the low end 529 plan will be able to pay out between $9,600 and $10,000 per year, for each of the 4 years of school. Given that the college costs will rise, that should be about 50% of a 4-year public school tuition in 18 years.

Why Is College So Expensive

As with everything else, several factors are contributing to the increased prices of colleges.;

First of all, it is the increasing demand: more than 5.1 million students attended college in 2017 compared to 2000. This number continues to grow, and with higher demand, come higher prices.

Second, colleges include many branches such as administrative branches, instructional, construction, maintenance, supplies, and with prices for living, in general, going higher, so do these expenses. Additionally, the dark side of colleges is that they are increasing their administrative branches and fees Education data reports explain that just between 1975 and 2005 the number of administrators in colleges has increased by 85% and of administrative staffers by over 240%. This means that while the prices are going up, you are not necessarily paying more to get a better education and teachers, a contrary, studies have shown that in 2018 almost 73% of all faculty positions were not held by college professors but by non-tenure-track who get paid lesser and have lesser experience and education; so these higher costs are going in the pockets of the administrators and administrative staffers who are rather working as college promoters and marketers. This is one of the biggest issues that college education in the states is facing, and as such, I feel we are obliged to mention it, considering that it is one of the biggest, main reasons for increased college expenses and tuition.;

Read Also: Does Beauty School Count As College

Cost Of Living In Canada

Although Canadian student visa requirements say you must have at least CA$10,000 on top of your tuition fees, youll likely need to budget much more than this for your living expenses. Your living costs will vary considerably depending on your location and spending habits, with large cities generally more expensive to live in. According to the 2019 Mercer Cost of Living Survey, ;Toronto was the most expensive Canadian city to live in, closely followed by Vancouver, with rent particularly high in both cities.

The three main types of student accommodation vary considerably in costs, with students paying around CA$3,000-7,500 for on-campus accommodation each year. Private shared accommodation can cost around CA$8,400 per year plus bills. University accommodation is often cheaper, with some universities offering meal plans to allow you to purchase food from the universitys food outlets.

Here are some examples of average living costs in Canada, taken from Numbeo in October 2019:

- Eating out at a restaurant: CA$16 per person

- One-way ticket on local public transport: CA$3

- Loaf of bread: CA$2.86

- Cinema ticket: CA$13.50

- Monthly gym fee: CA$48.25

You will need to purchase compulsory health insurance while studying in Canada. This will cost approximately CA$600-800 per year. You should also budget for extra costs, such as warm winter clothing if you dont already have any.

Canadian Workplace Orientation Fee

International students enrolled in a co-operative education program will be charged an additional, non-refundable, Canadian Workplace Orientation fee. ;Collection of the fees will commence with the semester in which the first Co-op Professional Practice subject is scheduled at the rate of $350.00 per work term. If a program contains more than one work-term, the co-op fee is billed in the semester prior to each subsequent work-term. The fee assist students to be more successful in their program prior to their first co-op semester so that more students can take advantage of this wonderful work and learn opportunity by meeting the eligibility requirements for the co-op semesters and continue to offer additional services through to graduation.

Also Check: How To Be Debt Free In College

How Much Will I Pay Per Year

You could pay anywhere from $18,000 to nearly $50,000 per year to attend college it all depends on your financial aid package. Sometimes schools with a higher cost of attendance have generous financial aid packages that lead to a lower net price the amount you pay after you receive financial aid. It all depends on how large your schools endowment is for offering scholarships and grants to incoming students.

Your school determines your financial aid package by looking at two main factors: Whether youre considered a dependent or independent student and your family income.

Heres how much the average student paid for the 20152016 academic year based on different income levels:

| Income level |

|---|

| $12,180 |

How much will I pay for four years of college?

Its difficult to predict how much youll pay for four years of college since it depends on your financial aid package and how much your schools COA increases from year to year.

Heres how much tuition increased over the past decade by school type:

- Private four-year school: 1.9%

- Public four-year school: 2.2%

- Public two-year school: 2%

Based on these percentage changes, you might expect to pay a net cost of $147,940.97 at a private four-year school and $41,898.01 at a public four-year institution in tuition and fees.

How much did college costs change last year?

- Private four-year school: 3.4% increase of $1,200

- Public four-year school, in-state: 2.3% increase of $230

- Public four-year school, out-of-state: 2.4% increase of $620

Average Cost Of College In America

Our researchers found that the average cost of college for the 20172018 school year was $20,770 for public schools and $46,950 for nonprofit private schools, only including tuition, fees, and room and board. Each year, school costs have continued to increase, even accounting for inflation. We took a look at higher education data from the College Board to provide a deeper understanding of the costs and the differences between states, school types and degrees.

Read Also: Does San Jacinto College Offer Bachelor Degrees

Estimated 4 Year Cost At Published Tuition

At the current published rates, an estimated total tuition, fees and living expense price for a 4 year bachelor’s degree at Hunter is $96,632 for students graduating in normal time. This methodology for estimating the 4 year cost is a straight multiple of the most recent reported annual total cost and does not factor in tuition increases during the time you’re in school. It also assumes you receive no grant or scholarship aid and pay the full list price.

A potentially more accurate but less conservative estimate of a degree cost can be made by using the school’s annual $6,893 in-state net price as the basis. Applying this cost over 4 would estimate the cost of a degree at $27,572**

If you end up on the “five year plan” and need an additional year to graduate, your five year cost could be as high as $120,790 or $34,465 using an average net price.

**Based on a 4 year multiple of Average Annual Net Price for in state students receiving grant or scholarship aid reported to the U.S. Department of Education’s 2018/2019 IPEDS Survey. Financial aid is only available to those who qualify. Consult this school’s net price calculator for further understanding of your potential net price.