Q Is College Worth The Money Even If One Has To Borrow For It Or Is Borrowing For College A Mistake

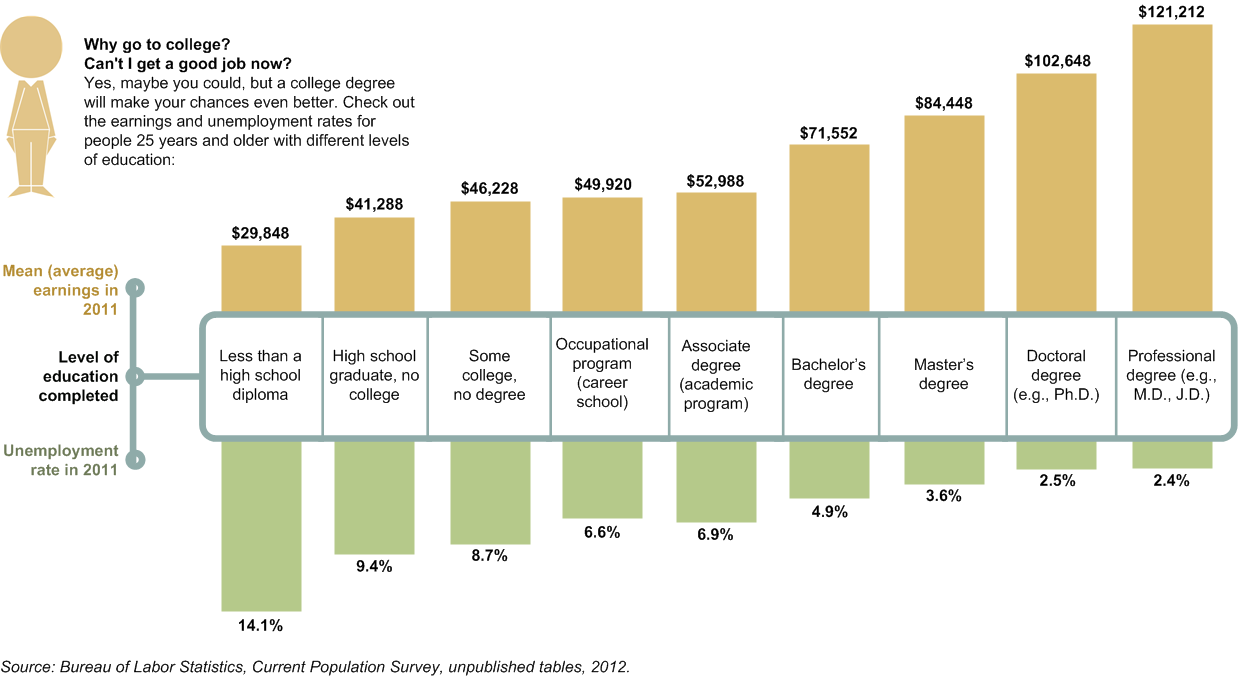

A. It depends. On average, an associate degree or a bachelors degree pays off handsomely in the job market borrowing to earn a degree can make economic sense. Over the course of a career, the typical worker with a bachelors degree earns nearly $1 million more than an otherwise similar worker with just a high school diploma if both work fulltime, year-round from age 25. A similar worker with an associate degree earns $360,000 more than a high school grad. And individuals with college degrees experience lower unemployment rates and increased odds of moving up the economic ladder. The payoff is not so great for students who borrow and dont get a degree or those who pay a lot for a certificate or degree that employers dont value, a problem that has been particularly acute among for-profit schools. Indeed, the variation in outcomes across colleges and across individual academic programs within a college can be enormousso students should choose carefully.

Go To Community College First

All over America, including your hometown, we have these wonderful schools known as community colleges. And I love them. Want to know why? Because they allow people to get valuable college credits on their way to a degree at much cheaper rates than if theyd enrolled in a four-year school right out of high school. They can knock out the basics at a community college for two years, then transfer to a school that offers bachelors degrees for years three and four.

And while Im on the subject, let me deal with a myth I run into all the time. A lot of people seem to think doing their first two years at a community college will hurt them when they go to interview for jobs after graduation. The truth is that few employersif anyeven notice it when applicants only attended two years at the school they graduate from. The main thing theyre looking at is whether you have a degree, and after that, what you studied.

Employer Tuition Assistance Programs

Many large companies offer tuition assistance programs, also known as tuition reimbursement plans, which cover the cost of college classes for their employees.

According to the IRS, employers can provide up to $5,250 per year in educational assistance tuition, fees, books, equipment, and supplies to their employees without counting it as part of their wages. That means that you dont have to pay taxes on it.

Check with your human resources department to find out if your employer has a tuition assistance program. If it does, get a copy of the written plan to learn details like:

- What kinds of classes it covers

- How it handles payments

- Whether you must get a specific grade in the class to qualify

- Whether you need approval from a manager

- How to enroll

You May Like: Universities That Accept Low Gpa For Masters

Personal Savings And Financial Help From Parents Or Other Relatives

If you or your family have savings, tapping into savings is often the next best option to pay for college after youve exhausted scholarship and grant opportunities.

You and your family are expected to contribute if you have assets available and, in fact, when you complete college financial aid forms, you need to provide information about you and your parents income and financial accounts to determine your expected family contribution.

However, while using savings is a good way to cover college costs, parents typically shouldnt compromise their retirement security by foregoing retirement savings or cashing in retirement accounts to cover college costs. While there are loans available to pay for a students education, no loans are available to fund retirement and parents dont want to be broke as seniors because theyve spent all their savings on college.

Average Cost Of College Statistics And Key Findings

- Average Total Cost of Public Colleges: $25,290 $40,940

- Average Total Cost of Private Colleges: $50,900

- More than 19.9 million students are projected to attend American colleges and universities in fall 2018, with around 6.7 million going to two-year institutions and 13.3 million going to four-year institutions.

- The majority of students pay between $6,000 and $15,000 in tuition for both public and private schools in the United States.

- New England has the highest tuition cost for both two-year and four-year public schools, with an average of $5,370 and $12,990, respectively.

Read Also: Study Com Transfer Credit

Find Out About Income

One of the more recent trends in paying for college is the income-share agreement . Unlike a traditional loan, theres zero interest accruing onto what you owe.

Some schools, like Purdue University, help students set up ISAs as a form of student aid.

Depending on the situation, ISAs can be beneficial. An ISA can lessen the chance of default, and many agreements are capped at 10% or 15% of income, ensuring affordable payments.

The downside, though, is that students could end up paying more, especially if they start a career with a high-paying job. That means income-share agreements make sense for some professions over others.

| Would you pay more on an ISA or a student loan? | |

|---|---|

| Say you sign an ISA for eight years and 15% of your income. If you graduate and earn $50,000 a year, youll repay your investor $60,000. | Now say you borrow $30,000 in student loans. Even with 4.45% interest, repaying $30,000 over 10 years results in a total repayment of $37,223, according to our student loan payment calculator. |

| Be sure to do the math and research your options before signing an ISA. |

How To Talk To Your Parents About Applying For Financial Aid

If your parents can’t or won’t pay for college expenses, they may be wary about filling out a FAFSA or giving out financial information for need-based scholarships. It’s important to assure them that submitting a complete FAFSA with their financial information does not obligate them to help you pay for college. The FAFSA has nothing to do with your bills or college expenses…it’s simply an aid application.

Bottom line: if they refuse to help you with your FAFSA, they’re not protecting themselves. They’re just impeding you from qualifying for financial aid.

What if, though, they’re just overwhelmed by the process of completing and submitting a FAFSA?

If this is the case, you can let them know that the FAFSA only takes 2-3 hours to complete. You could even do it on your own if you have your family’s financial information handy:

- Social Security Numbers for you and your parents

- Alien Registration Numbers

- Recent federal tax returns, W-2s, and other records or income for both you and your parents

- Any records of untaxed income

The sooner you submit your FAFSA, the better, so don’t put off having these discussions with your parents or guardians!

You May Like: Mortuary Schools In Missouri

Q Whats With All These Proposals To Forgive Student Debt

A. Some Democratic candidates are proposing to forgive all or some student debt. Sen. Elizabeth Warren, for instance, proposes to forgive up to $50,000 in loans for households with less than $100,000 in annual income. Borrowers with incomes between $100,000 and $250,000 would get less relief, and those with incomes above $250,000 would get none. She says this would wipe out student loan debt altogether for more than 75% of Americans with outstanding student loans. Former Vice President Joe Biden would enroll everyone in income-related payment plans . Those making $25,000 or less wouldnt make any payments and interest on their loans wouldnt accrue. Others would pay 5% of their discretionary income over $25,000 toward their loan. After 20 years, any unpaid balance would be forgiven. Pete Buttigieg favors expansion of some existing loan forgiveness programs, but not widespread debt cancellation.

Forgivingstudent loans would, obviously, be a boon to those who owe moneyand wouldcertainly give them money to spend on other things.

But whoseloans should be forgiven? What we have in place and we need to improve is asystem that says, If you cannot afford your loan payments, we will forgivethem, Sandra Baum, a student loan scholar at the Urban Institute, said at aforum at the Hutchins Center at Brookings in October 2019. Thequestion of whether we should also have a program that says, Lets alsoforgive the loan payments even if you can afford them is another question.

Easing The Financial Burden

As noted, rising college costs can make higher education seemingly unattainable for low-income students. They are more likely to forgo higher education entirely due to perceived financial constraints.19 It is no surprise that low-income families are more likely to find financial assistance critical in selecting a college, particularly in light of the high price of a college education.20 These students college choices may be limited to what they can afford rather than the best fit. For high performing, low-income students, this may mean sacrificing selectivity.

Once enrolled in college, low-income students are more likely to leave without obtaining a degree. Insufficient funds to meet basic needs and the requirement to work while in school contribute to the increased rate of attrition.21

Schools can help to ease the burden of financial stress and support low-income students in multiple ways, outlined in strategies 6 through 9 below.

Strategy 6: Prioritize need-based institutional grants

Over the last 20 years there has been a shift towards merit-based scholarships and away from need-based aid. In 1995, the majority of institutional award dollars were need-based.²² However, by 2003 the majority of institutional award dollars were merit-based.

You May Like: Selling Used College Books

How To Actually Land A College Scholarship

Getting a college scholarship is a numbers game, yes. But its also more than that.

In order to actually LAND some scholarships and put money in the bank, youll need to get smart about your strategy.

At the foundation of this strategy are two things:

- Powerful letters of recommendation

- Strategically unique essay answers

Apply For State Grants

While scholarships are usually merit-based, grants are typically awarded based on your financial need. If your family income isnt especially high, consider state grants for college.

In Indiana, for example, there are grant programs available for:

- Undergraduates with financial need

- Adults returning to school

- For attending trade schools

Like scholarships, grants are a form of gift aid that almost always doesnt need to be repaid. You should always prioritize this type of cash for college over other options, especially student loans.

You can learn about grants available in your state by contacting its higher education authority via the Department of Education. Here are some opportunities organized by situation:

| Read up on grants for |

|---|

| Paying off student loans |

Don’t Miss: Is College Worth It Book

Saving For Future College Costs

It can seem insurmountable to even think about saving over $40,000 for college costs on top of all your other financial responsibilities. A common recommendation is to pay off your own student loans before putting significant amounts of money towards college savings. Some parents find that refinancing their own student loans if they havent paid them off already allows them to save moneygiving them more financial wiggle room to start saving up for future educational expenses.

How can refinancing help you save on your student loans so you can start saving for your kids education? Student loan refinancing allows you to trade in all your student loans for one new loan with a potentially lower interest rate and more favorable repayment terms.

What is the benefit of trading in old student loan debt for a new loan? When you refinance your student loans, the refinancing lender looks at your current financial situation, including your credit score, income, and future earning potential to calculate an interest rate that could potentially be lower than what you might be paying to the federal government or a private student loan lender.

How Do You Get Your Student Loans Forgiven

The U.S. government will currently forgive, cancel, or discharge some or all of an individual’s student loan debt only under a number of specific circumstances. Teachers in low-income schools and public service employees may be eligible for forgiveness of a portion of their debt. People who are disabled may be eligible for discharge of the debt. In August, the U.S. Department of Education said it would cancel $5.8 billion in student loans for borrowers who qualify as having a total and permanent disability.

The Federal Student Aid office indicates that those who think they may qualify for loan forgiveness should contact the student loan servicer for their loans. That is the company that handles the loan payments.

As noted above, a federal emergency relief measure suspended student loan repayments from March 2020, and the deadline has now been moved to May 1, 2022. Collections on payments that are in default also were halted. This is a suspension of repayment, not a cancellation or even a reduction of the debt.

Read Also: What Colleges Are Accepting Applications For Fall 2021

Paying For College With Tax Reductions

The government offers tax breaks for higher education. These allow some taxpayers to subtract certain college-related expenses from the tax they owe.

Tip: Get to know the government’s rules for these programs. You can take only one credit or deduction per year, in addition to the student loan interest deduction.

Ascent Student Loans Disclosures

Ascent loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding.com/Ts& Cs.

Rates are effective as of 10/01/2021 and reflect an automatic payment discount of either 0.25% OR 1.00% . Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates.

1% Cash Back Graduation Reward subject to terms and conditions, please visit AscentFunding.com/Cashback. Cosigned Credit-Based Loan student borrowers must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs are available for the most creditworthy applicants and may require a cosigner.

Also Check: Do College Classes Expire

Next: Write Your Application With Unique Answers Instead

When you take a step back and consider the common answers to the prompt, youll be able to come up with an answer that will subvert the judges expectations and keep their attention. In my case, while other students wrote about historical figures, I chose Chris Rock, the famous comedian.

My essay went on to argue that though hes perceived simply as a comedian, hes actually a highly astute social commentator. His jokes revealed the things we want to say but wont articulate because were afraid to. I even deconstructed one of his jokes and went into an in-depth analysis of why it was an examination of the racial attitudes our society holds.

And it worked.

My approach was offbeat yet professional. When looking for unique angles, you shouldnt make it offensive or inappropriate. Instead, aim to make it deep, personal, and a little bit against the grain.

How Financial Need Is Determined

Schools determine your financial need based on the cost of attending the school menus your expected family contribution . In other words, the amount of college money you need depends on the total cost of attending that school, which includes tuition as well as other costs, and the amount of money your family has on hand to contribute.

You May Like: What Schools Are Still Accepting Applications

Age Differences In Student Loan Debt

According to an analysis by CNBC, when broken down by age, the highest student debt loads are carried by adults between the ages of 25 and 49, with the lowest debt loads carried by adults aged 62 and older.

As of 2021 approximately 7.8 million Americans below the age of 25 carry student loan debt, with an average balance of almost $15,000. Within the group with the largest amount of student debt, adults between the ages of 35 and 49, the average individual balance owed exceeds $42,000, with the average debt load for adults between the ages of 50 to 61 being only slightly lower. These balances are composed of the balance of the debt that adults owe for their own education, and additional amounts they borrow in order to finance their children’s college educations.

Using Student Loans To Pay For School

The average U.S. college graduate has about $29,000 in student debt after graduation. If you’re paying for college without the help of your parents, you may end up with more than the average amount of student debt, especially if you are responsible for paying the “parental contribution.”

Student loans aren’t inherently bad, and you’re not a failure if you graduate with student debt . If you’re smart about the types of loans you take out, your debt should be pretty manageable over the long run.

Recommended Reading: Miller Motte Classes Online

How To Pay For College: 6 Ways To Cover Your College Costs

Everyones financial situation is different. Attending college is a big financial decision for you and your family. Being accepted into your school of choice is cause for celebrationso dont let the price tag damper your excitement. When its time to start planning how to pay for college, there are many resources to help you find a financial plan that works for you and your family and help you pay for college.

Most students qualify for . Whether you come from a military family, have stellar grades, or demonstrate financial need, there are loans, grants, and scholarships that are designed to help you achieve your goals.

To get a better idea of your options, check out our list of six ways to pay for college: