Consider An Online Savings Account

Saving early and often is always the best practice when planning for higher education. As an adult learner, it may be difficult to pinpoint where you can make cuts in your budget. Thats okay.

Whatever you can save can help you out of a tight jam while working and going to school. Many FDIC-approved online savings accounts offer high-yielding interest rates. Use those. That interest rate will help your money make money.

Another hot tip? Plan out your tax return ahead of time. Take a chunk of your tax return and dedicate it to investing in your education.

When To Start Saving For College

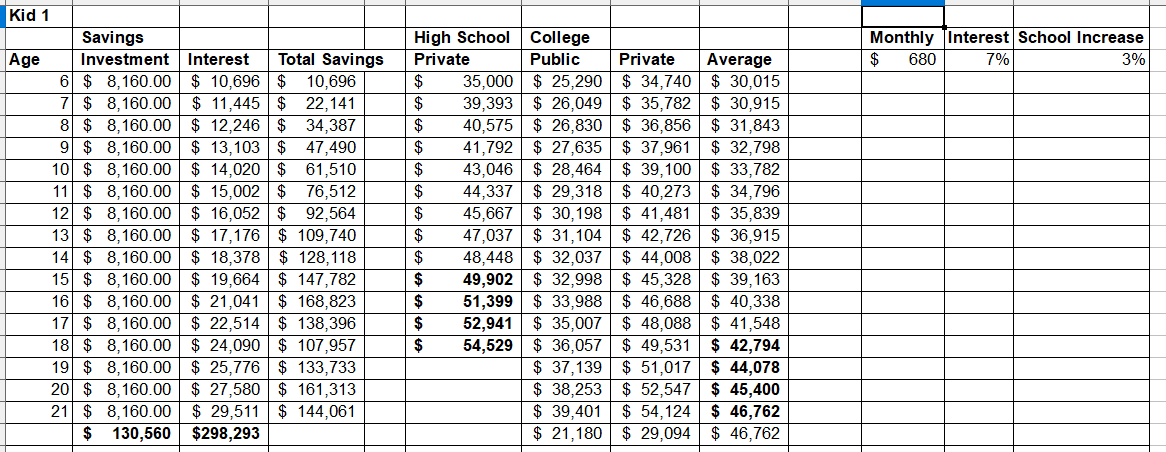

The key to saving for college is to save early and often.

Time is your greatest asset. Start saving for college as soon as possible. The sooner you start saving, the more time there’ll be for your savings to grow and the earnings to compound.

You can even start saving before the baby is born. To save before a baby is born, open a 529 plan account with yourself as the account owner and beneficiary, then change the beneficiary to the baby after it is born and has a Social Security Number or Taxpayer Identification Number .

If you start saving at birth, about a third of the savings will come from the earnings.

If you wait until the child enters high school to start saving, less than 10% of the savings will come from the earnings.

Where Are Costs Headed

It’s hard to say whatll happen to overall college costs in the future, but they generally increase an average of 8% a year.* Over time, that adds up. That’s why it’s so important to start saving early and make saving a priority.

How much does college cost and how much will it cost in the future?

Calculate an amount based on your target

Our college savings planner makes it easy to see how much you’ll need to save per month to meet the goal you’ve set.

The college savings planner assumes you’ll earn a specific rate of return on your college savings. So once youve determined your asset mix, you may want to come back and adjust your return expectations.

If the planner’s recommended contributions seem high for you, figure out whether you’ll be able to use some of your income to pay for college while your child is attending. If so, you can deduct this amount from what you’ll need to save.

How much does college cost and how much will it cost in the future?

Rate of return

The profit you get from investing money. Over time, this profit is based mainly on the amount of risk associated with the investment. So, for example, less-risky investments like certificates of deposit or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return.

Asset mix

Keep in mind:

Recommended Reading: Low Gpa Universities

How Much Does University Cost

Though you may use your RESPs funds for many post-secondary paths, university education is typically the most expensive route. Based on data from Statistics Canada, the average cost of a four-year university degree starting in 2022 is $96,004 for students in residence, or $48,074 for students living at home . Of course, some schools and cities are more expensive than others, as are certain areas of study but this should give you a general sense of what to expect.

And as you can see below, costs are expected to rise every year for the foreseeable future:

How much will university cost my child?

How much can I save?

While situations can change over time, this handy tool will give you a picture of how much and how often you need to save to meet your savings goal.

How To Save For Your Child’s College Fund

Start saving early — and harness the power of compounding.

Mandy Sleight

Mandy Sleight is a freelance writer and has been an insurance agent since 2005. She creates informative, engaging, and easy-to-understand content on the topics of insurance, personal finance, sustainability, and health and wellness. Her work has been featured in Kiplinger, MoneyGeek and other major publications.

Americans hold a staggering $1.7 trillion in student loan debt, and though some students may have part or all of their student loan debt forgiven, many will not be so lucky.

The average parent plans to cover about 70% of their child’s college expenses — but less than 30% are on track to do so, according to Fidelity Investments’ 10th Annual College Savings Indicator. The best time to start saving for your kid’s college education is right now, and perhaps the best way to do it is to just start doing it. The earlier you start, the better: Compounding interest makes a powerful tailwind. And there are some specific tools and services that can help you reach your goal faster, including 529 accounts, scholarships or a custom plan laid out by a financial adviser. The bottom line: It’s never too late to start, no matter where you are in your savings journey.

Also Check: What Classes Do You Take Freshman Year Of College

Five: Consider An Educational Trust

For most savers, the 529 plan is the easiest and most cost-effective way to save for college. But if youve saved a considerable amount, can afford an attorneys setup fees and want more flexibility, consider an educational trust.

When does this make sense? Perhaps you want more investment options than your 529 offers. Maybe you want to fund a gap year. And should you need money for an expense not reimbursable by a 529 such as medical or travel expenses an educational trust could provide the right workaround.

Use Free Transportation If Possible

If you need to get around, use free transportation if possible. Many college campuses have free buses and shuttles that help students get around campus and even to nearby apartments.

Some apartment complexes even have shuttles for students to get to campus.

Depending on your school, see if you can leverage free transportation to get around.

You May Like: Reviews For Ashworth College

How Much Do You Need To Save For College In Total

College costs tend to increase by a factor of three over any 17-year-period. Basically, from birth to college enrollment.

If youâre following the one-third rule, that means you should be saving the full cost of a college education in the year that the child was born.

Keep in mind that this amount will vary depending on a couple of factors:

- Whether the child in your life decides to attend an in-state or out-of-state college.

- Whether the school they attend is a public or private institution.

So, to some degree, youâll need to predict which type of college the child is most likely to attend.

Ways To Save Money In College

So you have already looked for scholarships, grants, and loans and are still finding it hard to pay your way through college? It goes without saying that the typical college student is either broke or financially hanging in the balance most of the time. Weve assembled a long list of both practical and creative ways you can save some green while youre going to campus.

Also Check: How Long Do Credits Last In College

Make A Budget & Cash Flow Statement

I cannot stress enough how important it is to budget and make a cash flow statement when saving for college. Many people think that a budget is the same as a cash flow statement and interchangeably use the terms.

In reality, a cash flow statement shows how much money is coming in and out. Establishing your fixed and variable expenses budget is used after assessing your cash flow statement and deciding where you can trim some dollars to add to your savings.

Check out this video to see how to create an incredible cash flow statement so you can start to budget.

Setup Flight Monitoring For Regular Flights

Do you have a “regular” flight in college? This might be your regular flight home – the one you take at Christmas, and home for the summer?

If so, use to setup a price monitor for your main flight and dates you know you want to fly. This can help you save money by alerting you when prices change, and saving you money on the flights you know you’re going to be making.

Recommended Reading: Best Mortuary Science Programs

Use Travel Websites To Find Amazing Deals

Every college student wants to travel . But travel can be really expensive unless you find great deals. This can be a full time job in itself, but if you’re diligent, you can find great travel deals and take advantage of them.

Checking the main travel sites will give you a great baseline as to where to start your travel search. These sites include:

- CheapFlights: This searches most of the major travel sites for you

- Hotels.com: The is one of the best hotel search engines

- Orbitz: Another good overall search engine

Check out our full guide on 5 Easy Steps To Get The Cheapest Vacation to get started.

How To Save Money On Basic Amenities

There are certain things that college students need to have while living away from their homes. These may include furniture items, refrigerator, utensils, crockery etc. Instead of buying all these things from the market you may check within college campus if there are some unused things left behind by the old students. Apparently, the old students may have made use of these things without paying for them. You too could find out at the school premises if there are offers for free amenities that you could use during your stay. Alternatively, you may check the storage space of your college where all such things are piled up. After taking permission from authorities you can get these things for free or at cheaper rates.

Don’t Miss: How To Transfer Colleges Cuny

How Much Money To Save For College: Preparing For The Future

Home » Learning » How Much Money to Save for College: Preparing for the Future

Rich Fettke

Summary: In this article, we will share how much money to save for college. Topics also include when to start saving for your kids college, how much to save if you get a late start, tracking your savings progress, helpful college savings calculators and tools, and college savings tips for students.

Be Mindful Of Your Utilities

Another off campus expense that can get you are your utilities. You need to be mindful of your utilities and how much it costs to run your air conditioning, how much your internet costs, and more.

If you’re not paying attention, you could find your electric bill skyrocketing from $50 per month to $400 per month! It happens, and it can seriously harm your college student budget.

Recommended Reading: Penn Foster Vs James Madison

Protect Your Security Deposit

Your security deposit is one of your biggest “investments” in college. You usually have to pay $1,000 or more to ensure you don’t mess up your apartment. That’s a lot of money that you can lose if you’re not careful in protecting your apartment.

So, make sure you protect your security deposit by keeping your apartment in great condition.

An alternative to your security deposit is using security deposit insurance. This is an alternative where you pay a company and never have to worry again. Check out Jetty for their security deposit insurance.

Become A Pro At Budgeting

When it comes to personal finance in general, budgeting is essential. And it’s especially true when you’ve got a big expense on the horizon, like college. Budgeting may sound overwhelming for beginners, but you can find online budgeting guides to help break everything down.

Consider following the 50-20-30 budget rule. Under this plan, you’ll dedicate:

- 50% of your after-tax income to financial needs and obligations

- 20% on savings and debt repayment

- 30% on anything else

Don’t Miss: What Classes Should I Take Freshman Year Of College

Have A Solid Plan For Your Classes And Degree

One of the best ways to save money in college is to simply have a solid plan for you classes and degree program. I’m a big believer that college isn’t the time to “find yourself”. It’s too expensive!

You should be going to college with a specific purpose – and ensuring that your taking the right classes and progressing to your degree on time is a great way to save money in college. Every extra class and semester costs money!

Even better, if you can get college credit in high school – by taking AP or IB classes, taking community college classes in high school, or any other means – do it! If you can knock out a lot of classes or credits early, you might even be able to graduate early .

Overwhelmed By These Savings Strategies

This info should hopefully keep you grounded.

Whether your child is heading off to college next year or 18 years from now, the thought of saving up enough money can be pretty daunting. This is a lot of information to take in, so here’s a breakdown of simple steps you can take to get started with a successful college savings plan:

- You don’t have to orchestrate some complicated strategy all at once in order to save for college. If you want to start saving but don’t have time at the moment to research different savings or investment accounts, it’s okay to put that stuff on the back burner. Just spend a few minutes opening a simple savings account at your current banking institution – that’s all you have to do to open a dedicated college fund. Once you have more time, you can start looking at savings plans that will help you grow your money most effectively.

- You don’t have to throw all your extra funds into college savings from Day 1. Managing a household budget is a delicate balancing act for many families. If you are ready to start a college savings plan, begin by putting aside 5% of your income. If that’s too much , you can adjust as necessary. Remember, you can always contribute larger lump sums if you have extra funds available.

You May Like: How Fast Can You Graduate College

Start Saving For Your Childs College Early

Ideally, the best time to start a college fund is when your child is born. With compound interest and regular investments made monthly or yearly, the funds have an opportunity to grow over a longer period of time, and you dont need to put aside as much each month or year to reach your savings goal.

Your funding can be modest, and many parents find they can afford $25$100 from each paycheck, automatically deposited into the college savings plan of their choice. If you get a raise or bonus, that money can also be allocated toward college savings.

Family members can contribute to a child’s college savings by opening their own 529 plan accounts. They can also make contributions to an established 529 account under the child’s parents’ name, if the plan that the parents use accepts third-party contributions.

Some plans don’t accept these contributions, in which case it’s best to create a new account or gift the parents cash intended for deposit into the 529 plan. Regardless of how the plan is set up, its important to maintain contribution levels that will ensure you can afford tuition and other costs. Such discipline can be particularly useful if you face additional financial obligations later.

No matter what plan you choose, starting a college savings fund for your child is a big investment. Let a Nationwide financial professional help guide the process.

Mistake #: Assuming Your Money Will Grow

A 529 plan might be called a college savings account, but dont let the word savings fool you. Like a 401, your money isnt guaranteed to grow, and your plans performance depends on your investment selection, as well as market conditions.

Its important to note that your investments can fluctuate, and you can lose money in a 529 plan. Your purchasing power can also decrease due to inflation, which means your investments may not keep up with the cost of college.

You can help mitigate these risks by starting a 529 plan early so that you have more time to potentially recover from market losses, choosing a diversified portfolio of investments based on your risk tolerance and time horizon, and taking advantage of potential compounding growth over time.

Also Check: Ashworth College Graduation Requirements

Where Should You Invest Your Money

If you’re investing for college you should consider opening a 529 savings plan or a state-sponsored investment account exclusively used for investing for school. With 529 savings plans, individuals can use the money they withdraw for college and K-12 tuition and other qualified educational expenses without paying income tax on any investment gains.

529 savings plans contain a variety of different funds such as mutual funds, bonds funds and ETFs. They are generally recommended for investing for college because of the tax benefits people get from them: You can contribute up to $15,000 tax-free and your earnings will grow tax-free.

States offer different 529 savings plans, and you don’t need to be a resident of that state in order to qualify for an account. However, certain states may offer tax benefits for in-state contributions. For example, in New York, in-state residents have tax-deductible contributions, so residents can reduce the amount of their taxable income if they invest in a 529 savings plan.

You can also opt to invest for your child’s education using a brokerage account or a 529 prepaid tuition plan. These, however, are less popular options.