Apply For Financial Aid

Students can apply for financial aid before applying for admission to Broward College. We offer a combination of aid programs including grants, scholarships, work-study, and loans. Based on eligibility, students may qualify for funding from one or more of these programs.

Students must be admitted to an eligible degree or certificate program of study in order to receive financial aid. To maintain eligibility, students must meet Satisfactory Academic Progress standards. Enrollment can affect aid amounts, and only classes that are recognized by the U.S. Department of Education as being required for degree completion will be used to calculate eligibility for Title IV funds.

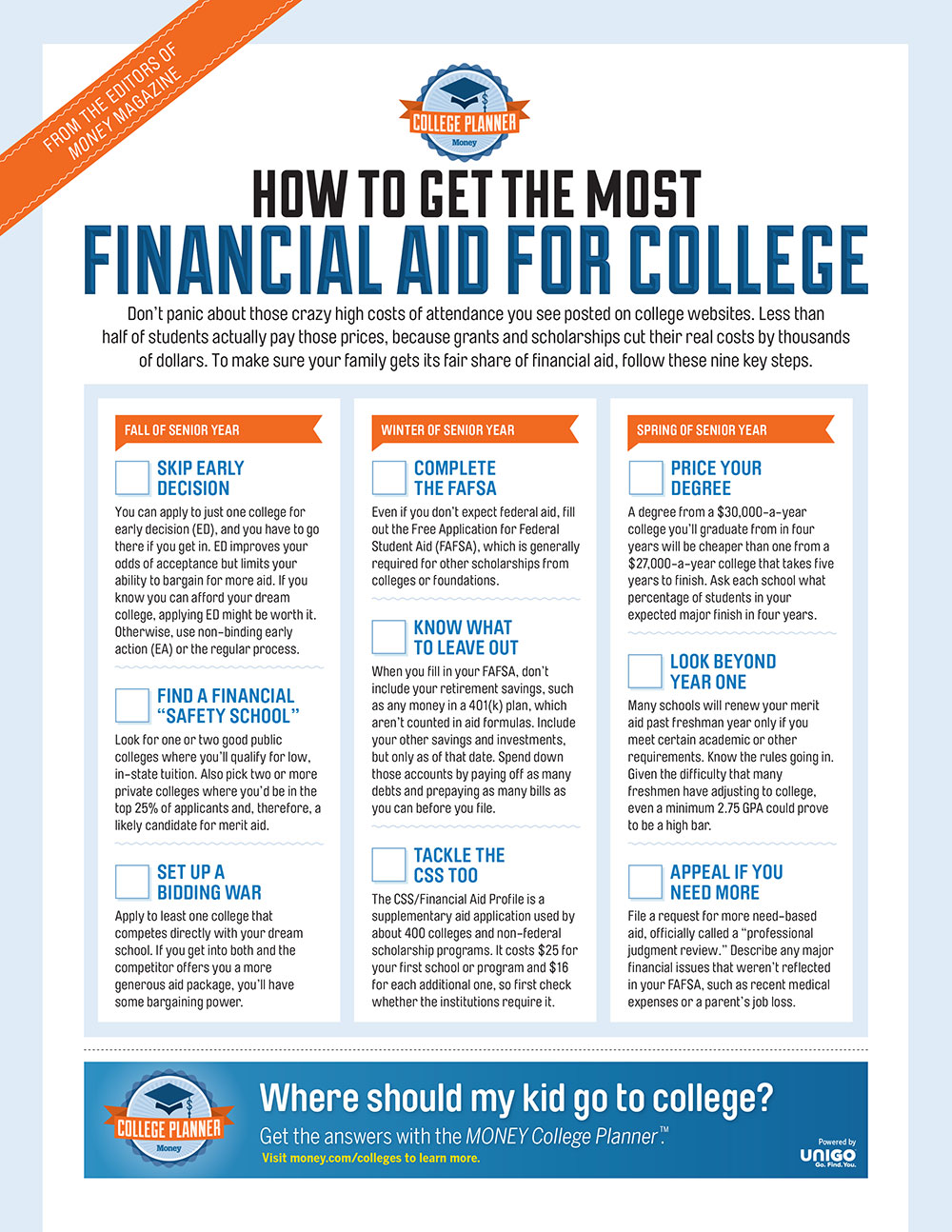

The Free Application for Federal Financial Aid is free to file and you should only use the application found at www.studentaid.gov to complete this process. Do not ever pay to file for financial aid.

Review your MYBC portal for updates about your financial aid status

Before your financial aid can be processed, students must fulfill all outstanding requirements. These requirements are displayed as red flags on your myBC account and should be resolved as soon as possible. Red flags mean that your financial aid will not be processed until all documents are received by the Financial Aid office.

FATV is easy your education is priceless

Direct Loans: Subsidized And Unsubsidized

Both subsidized and unsubsidized loans are granted at the beginning of a semester, and neither is required to be paid back until after you graduate . No matter which year the loan covers, once youre out of school, your payments begin.

The big difference between subsidized and unsubsidized loans is when you start paying interest.

An unsubsidized loan gains interest just like a private loan would: starting the day you take it out. The dont-pay-until-you-graduate grace period only applies for your loan payments. Interest payments are still required throughout your time in school.

However, if you take out a subsidized loan, the government pays interest for you while youre in school. Your personal interest payments will begin only after you graduate, along with the rest of your loan payments.

If youre going to take out a federal student loan, Rebecca recommends pursuing a subsidized one.

I remember the difference by saying unsubsidized is uncool, Rebecca said. Paying off the interest on an unsubsidized loan can be very stressful for students, especially if they arent earning much on the side while theyre in school.

Plus, she mentioned, if you are earning an income while in school, you would be better served by putting that money toward paying for your next semester upfront and skipping the loans altogether rather than paying down a growing debt.

The fewer loans you take out, the less interest you pay. The less interest you pay, the cheaper college will be.

Learn More About How To Pay For College

My conversation with Rebecca was more helpful than I could have hoped for, but it left me perturbed. When grant money is so difficult to come by and loans are so easy, it can be tempting to assume student loans are the best way to pay for college.

But thats just not true.

At Accelerated Pathways, we believe college shouldnt be a debt sentence. We help students avoid the need for student loans altogether by lowering their college costs through the use of affordable online courses. Id encourage you to make a smart financial decision and avoid federal student loans. Learn more about how Accelerated Pathways can help you save money on your education and graduate debt free.

Special thanks to Rebecca Decker, one of our amazing admissions counselors, for taking the time to chat with me about this topic.

Also Check: What Are The Six Military Colleges

A New Agreement May Help You Get The Most Aid

Historically, many colleges and universities have been criticized for encouraging college candidates to commit early with the understanding they could not switch colleges, even though the understanding was not legally binding. For the candidates, early commitment could mean passing up a better financial aid package from another school.

Now, however, students will have recourse. Action taken in Sept. 2019 by the National Association for College Admission Counseling to strip provisions from its Code of Ethics and Professional Practice lets college counselors recruit students even after they have committed to another school.

Furthermore, NACAC members are now allowed to encourage enrolled students to transfer to a school with a better financial aid package, offer perks , and recruit students beyond the traditional May 1 deadline, giving those students more time to choose the best financial aid package.

The NACAC’s action, in the form of a consent decree, came in advance of a U.S. Department of Justice lawsuit filed in Dec. 2019 charging the NACAC with violating antitrust laws. The NACAC has said it will follow the restrictions outlined in the consent decree, although it believes the deleted provisions of the CEPP did provide substantial aid and protection to students.

Understanding how this process works is the best way to establish as much control and choice over financing college as possible.

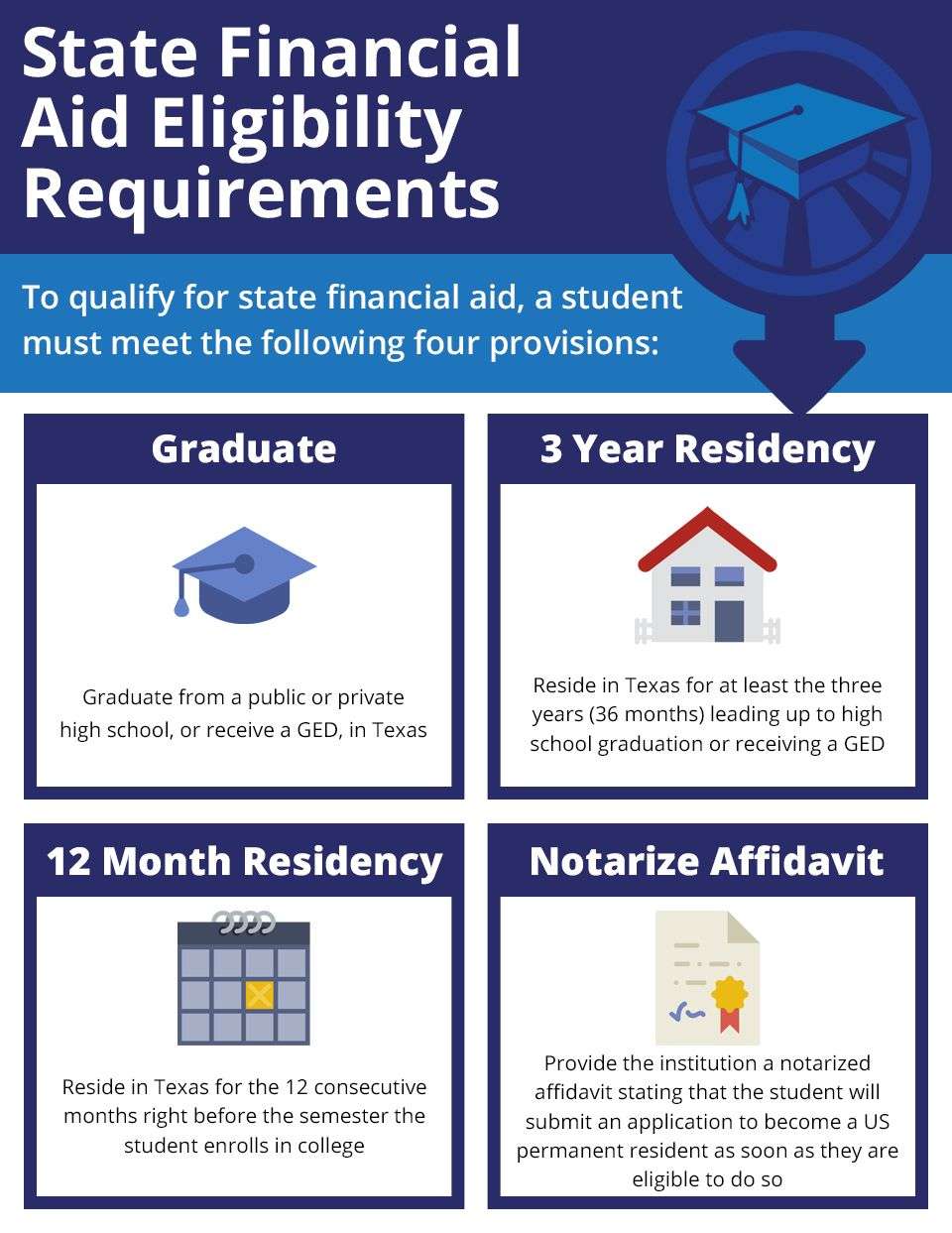

Eligibility For Federal Student Aid

Eligibility for federal student aid is based on financial need and on several other factors such as U.S. citizenship or eligible noncitizenship, enrollment in an eligible program, satisfactory academic progress in college, and more. The full list of our basic eligibility criteria is on our student site.

Tip: A quick URL to share with your students for information on federal student aid eligibility criteria is StudentAid.gov/eligibility.

Talking point: There is no such thing as an income cut-off for federal student aid. Eligibility is based on a number of factors, including a complicated mathematical formula. No student should assume that he or she won’t qualify for federal aid. Filling out the FAFSA form is the only way to find out. And please remind your students that the FAFSA form is also an application for state and school aidand many schools won’t consider a student for their aid unless the student submits a FAFSA form.

Don’t Miss: What Good Paying Job Without College

The Fafsa Is A Prerequisite For Federal Loans

Even if a student will not qualify for grants, filing the FAFSA makes them eligible for low-cost federal student loans, which are usually less expensive than private student loans. Even wealthy students will qualify for the unsubsidized Federal Direct Stafford Loan and the Federal Parent PLUS Loan. The Federal Stafford Loan is a good way for the student to have skin in the game, since they are unlikely to over-borrow with just a federal student loan.

How Is Financial Aid Awarded

Most of the details of obtaining financial aid take place at the college or university level. Importantly, while there are lots of similarities in the ways colleges award aid, each school has its unique process when it comes to open dates, deadlines, procedures, and the actual awards process.

It’s especially important to understand the differences between scholarships, grants, and loans when you read your financial award letter. Some schools, for example, promise to cover 100% of your financial aid needs but do so by including student loans.

Others package financial aid with no loans and some even raise your financial aid package each year to cover tuition increases. It pays to know not only what you will get but also how it will be packaged. A big part of the financial aid awards process has to do with you and your family’s ability to pay for collegethat is, your expected family contribution .

Keep in mind, however, that beginning in July 2023, the term “student aid index” will replace EFC on all FAFSA forms. In addition to some changes in the way the SAI is calculated, the change attempts to clarify what this figure isan eligibility index for student aid, not a reflection of what a family can or will pay for postsecondary expenses.

Also Check: I Want To Sell My College Books

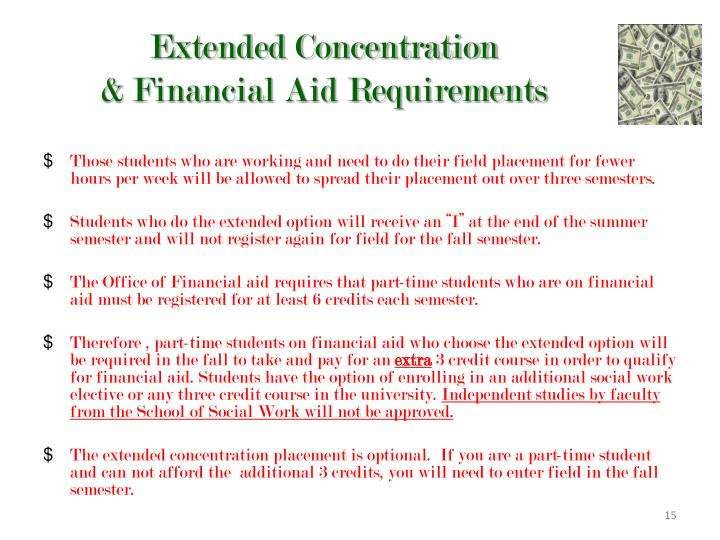

Enrollment In An Eligible Degree Or Certificate Program

Only students enrolled in eligible degree or certificate programs will be offered federal financial aid through filing a FAFSA®. The good news is this covers nearly all two- and four-year college programs.

You do not need to be a full-time student to be eligible for financial aid. Part-time students demonstrating progress towards a degree or certificate are also eligible, although the amount of aid they receive will be based on the credit hours they are taking.

How You Could Lose Fafsa Eligibility

Youll no longer qualify for aid if you cant meet the basic eligibility requirements listed above. You could also lose eligibility if you:

-

Dont maintain satisfactory academic progress in your program, according to your schools standards. This might include a grade-point average minimum or number of credits completed.

You May Like: Del Mar College Transcript Request

Where Can I Get Aid

You can explore your options before applying for assistance at three popular websites for financial aid information using the links on this page. You can also contact the financial aid office of the college you wish to attend for more information. When you’ve seen enough to get started, go ahead and apply for the two most popular forms of financial assistance below, the FAFSA and the California College Promise Grant.

- icanaffordcollege.com | Brought to you by the California Community Colleges.

- FinAid.org is the national student aid website, which also offers a list of online resources in Spanish.

- CaliforniaColleges.edu provides financial information for all colleges in California.

- Contact a California community college directly. The college you want to attend may have additional aid available, and can help you find the financial aid available to you.

How Do I Apply For Federal Student Aid

Create an FSA ID account if youre going to submit your FAFSA online or track its status online. If youre going to submit a paper FAFSA by mail and wont be tracking its status, you wont need an FSA ID.

Complete and submit the FAFSA.

Know what happens after you submit the FAFSA. This includes:

Learning how to correct or update information on it.

Finding out how and when youll get your aid.

Know the Deadlines for Submitting the FAFSA

-

The federal deadline for submitting the FAFSA for the 2021-22 school year is June 30, 2022.

-

The federal deadline for submitting the FAFSA for the 202021 school year is June 30, 2021.

-

Many states and colleges use the FAFSA for their financial aid programs. See the state deadlines. Check with your college for its deadline.

Don’t Miss: Sue Your College

Financial Aid Deadlines For Continuing Reed Students

To meet the May 1 application deadline, you must:

- File the FAFSA with the federal processor by April 15

- File the Profile with CSS by April 15

- If you receive an IDOC email notification from College Board requesting tax and other supporting documentation, submit your packet to IDOC within two weeks of receiving the email.

General Eligibility Requirements For Federal Assistance

- Demonstrate financial need this means that your cost of education is greater than your estimated family contribution

- Be a student enrolled or accepted for enrollment in an eligible program at an eligible institution

- Register for at least six credit hours of study

- Have a high school diploma or a GED certificate, pass an approved ability to benefit test , enroll in a school that participates in an approved state process, or complete his or her states requirements applicable to home schooling

- Not be simultaneously enrolled in elementary or secondary school

- Be a U.S. citizen or national, or an eligible non-citizen

- Have a valid, correct Social Security Number

- Be registered with Selective Service

- Not be in default of a Federal loan or owe an overpayment on a federal grant or Federal Perkins Loan

- Not have borrowed in excess of the annual or aggregate loan limits

- Be in good academic standing and maintaining satisfactory progress towards completing a degree

- Not be convicted of possessing or selling illegal drugs while receiving financial aid

- Provide documentation to verify the information on the FAFSA if its requested

- Students will be limited to a maximum of 12 terms of full-time Pell payments or its equivalent for part-time study

In addition, a students eligibility for federal funds may be affected by such factors as:

- Prior degrees earned

Don’t Miss: Berkeley College Price

To Be Eligible For Federal Financial Aid You Must:

- Be a United States citizen or eligible non-citizen.

- Be registered with the Selective Service if required by law.

- Be admitted and enrolled in a program leading to a degree.

- Be making satisfactory academic progress.

- Not be in default on a federal educational loan and not owe a refund on a federal grant.

- Be qualified to receive federal financial aid if you were ever convicted of possessing or selling illegal drugs while receiving financial aid.

To be fully eligible for financial aid and scholarships, you must be enrolled at the time of disbursement and participate in your courses through the end of the term.

What If It’s Not Enough

If you feel your federal financial aid award is inadequate, you can request a professional judgment review by the awarding school. However, you will need a legitimate reason to convince the school your award is insufficient.

One way would be to demonstrate that your family’s financial situation has changed for the worse. If that’s the case, the school will typically ask you to submit a letter summarizing the new circumstances. This could include a divorce, a death in the family, a job loss, or sudden high medical costs.

If another school has offered you a larger award, you could try contacting the school offering the lower award and ask if they will match the larger offer.

Read Also: How Much Does One College Class Cost

How Does Fafsa Work

What kind of aid you qualify for is based almost solely on your tax information . This is the broad measuring stick the government uses to determine your eligibility for various levels of financial aid. The more you make, the less aid you qualify for, essentially. While your state, school choice, and a few other elements are factored in this decision, theyre all secondary to your yearly taxes.

It should also be noted that if you or your familys financial situation has changed significantly from whats reflected on your most recent tax return, you may be eligible to have your financial aid package adjusted.

Financial Aid From The College

Many colleges offer financial aid from their own funds. Direct your students to visit a school’s financial aid website for information about aid available at that school. For students with an interest in a particular area of study, encourage them to inquire about any available scholarships in that area or department.

Talking points:

- When a student submits the FAFSA® form, he or she is automatically applying for aid from not only the federal government but also the state andin many casesthe college he or she has listed on the FAFSA form.

- Students should be sure to meet any financial aid deadlines the school may have.

You May Like: Arielle Charnas Net Worth

Failed Withdrawals Incompletes And Repeated Courses

- Failed courses are not considered completed units. However, they will be included in the students cumulative GPA calculation and their units attempted. Grades of MW will not be included in GPA or units attempted.

- Courses with Incomplete , Excused Withdrawal , Withdrawal , Failed to Withdraw and Fail are considered unsatisfactory grades and are included in attempted units.

- Repeated courses will be counted each time they are taken.

What Is Financial Aid

Financial aid is any college funding that doesn’t come from family or personal savings or earnings. It can take the form of grants, scholarships, work-study jobs, and federal or private loans. Financial aid can be used to cover most higher education expenses, including tuition and fees, room and board, books and supplies, and transportation.

Aid can come from a variety of sources. This can include federal and state agencies, colleges, high schools, community organizations, foundations, corporations, and more. The amount of financial aid you receive will depend on rules set by the various sources as well as federal, state, and university guidelines.

Recommended Reading: What Schools Are Still Accepting Applications

Putting Your Dreams Within Reach

The staff in the Waubonsee Financial Aid Office will assist you with the application process and answer any questions about your financial aid eligibility.

And don’t forget about our awards! Priority deadline is Feb. 7, 2022!

Free Application for Federal Student Aid Alternative Application for Illinois Financial Aid

Money Matters Financial Education Program

Avoiding Financial Aid Scams

Financial aid scams are less prevalent now than they were 10 or 15 years ago, but you’ll still want to remind students to keep their eyes open as they look for financial aid for college. Refer them to StudentAid.gov/scams for tips.

Talking points:

- You can find plenty of sources of financial aid without paying anyone for help or paying an application fee for the aid.

- The first F in “FAFSA” stands for “Free.”

Also Check: How To Choose An Online College

Financial Aid For Students

If you need help paying for college, technical, or career school, check out the options you may be eligible for from the federal government and other sources. Learn why federal student loans are generally preferable to private loans, and how to complete the Free Application for Federal Student Aid, or FAFSA.

Qualifying For The Fafsa: Basic Eligibility Requirements

Start by reviewing and understanding the basic eligibility criteria for federal financial aid. At minimum, you must:

- Be a U.S. citizen or an eligible noncitizen and have a valid Social Security number.

- Have a high school diploma or GED certificate.

- Be enrolled or accepted as a student in an eligible degree or certificate program.

If youre unsure if youre someone who qualifies for the FAFSA, check with a college counselor at your high school or reach out to the financial aid office at the colleges youre interested in. For residents who arent U.S. citizens, for example, your eligibility might depend on your specific immigration or visa status.

Certain aid programs have additional qualifying criteria. To get federal direct student loans, for instance, you must be enrolled in school at least half-time. Some types of financial aid require you to show financial need, like direct subsidized loans, while others, such as direct unsubsidized loans, do not.

You May Like: Berea College Sat Scores