Start By Taking Baby Steps

You dont have to save the full cost of college. If you set your goal to save 100% of your childs college education costs, you may get sticker shock. The sheer magnitude of the cost of attendance might cause you to give up in dismay.

Instead, set your sights a little lower and break up the college savings goal into baby steps, such as how much you need to save per month instead of one big lump sum. If you start saving from birth, the monthly contribution is about 0.3% of the college savings goal.

If you cant save even $250 per month, start with a less ambitious amount. For every $10,000 in college costs, you need to save only about $25 to $35 per month from the day your baby is born.

Once you get started with saving, youll find it easier to increase the amount you save per month. You will quickly get used to having less money in your checking account.

There are also natural opportunities to increase the amount you save. For example, once the baby is potty trained, you can contribute the money you were previously spending on diapers to the babys college fund. You can also invest windfalls, such as income tax refunds, inheritances and lottery winnings.

Start Contributing To A 401k

Ideally your company will offer a 401k plan that you can easily enroll in. But if you do not have the option to enroll in a company 401k, you need to open an individual retirement account with your first paycheck. Again, time is the name of the game here. The sooner you start earning interest, the sooner that interest starts earning interest. You should aim to save at least 10 to 15 percent of your pre-tax income in your 401k. That may sound daunting, but if your employer matches your contribution, you only need to save 5 percent, which, with your companyâs match, gets you to 10 percent. More is more here, so if you feel comfortable saving more than 10 to 15 percent, you should.

Invest Your Savings Tax

Nearly 7 in 10 parents arent familiar with a 529 college savings plan and they should be.

Putting it simply, a 529 college savings plan can help your savings go further. Its a tax-advantaged investment account that works like a Roth IRA, offering tax-free growth and tax-free withdrawals. And yes, parents can open a 529 plan for their childs college savings. Its not just for grandparents!

Most 529 plans also offer a passively invested, age-adjusting portfolio option that starts with higher growth investments and becomes more conservative as your child approaches college. This means your money grows over time, but youre also reducing risk as it becomes time to pay for college.

What difference do these tax savings and investment gains make? If you have a 4-year-old child targeting a private university, your monthly savings goal might be $700/month using a savings account versus $400/month with a 529 college savings plan. Thats a big difference!

There are a lot of 529 plan options, but investing doesnt have to be complicated. Here are a few guidelines in case youre doing the research yourself:

Also Check: Colleges That Accept 2.5

Have A Realistic Goal In Mind

If your blood pressure is a little high right now, take a deep breath. That total may not be how much youll actually pay. Remember: Every familys financial situation is different, so you need to be realistic about how much you can contribute to your kids college expenses.

If youre up to your eyeballs in debt and retirement is only 10 years away, your college savings goal will be different than a couple in their 30s who are debt-free and already putting 15% of their income toward retirement every month.

If youre married, you need to sit down with your spouse and look at your financial situation. What are your long-term goals? How much debt do you have? Whats your plan for getting rid of your debt? How much have you saved for retirement? Can you put money toward retirement and put money away for college expenses? Dont hold back on retirement savings just because Junior wants to go to an Ivy League or out-of-state school.

These questions will help you determine how much to save for college. Once you have answers to these, its time to set a reasonable goal. Yes, you want to help your children. But you may not be able to pay for all of itor any of it. And thats okay. There are other options for covering college expenses besides the Bank of Mom and Dad or student loans. But more on that later.

Starting To Save Early Can Make A Big Difference

While there may be many ways to help pay for college, starting to save early is one of the smartest strategies. Which brings me to a 529 savings plan. A 529 is a state-sponsored program that allows parents, family membersanyoneto invest in a child’s education. You open the account in your name with the child as beneficiary. Contributions are then made in the name of the child.

Why consider a 529 and not some other type of savings account? Several reasons, including:

- Tax-deferred growth

- Tax-free withdrawals for qualified education expenses

- Possible state income tax deductibility or credit for 529 contributions

- Low impact on financial aid eligibility

- Low account-opening minimums

- Can be used to pay up to $10,000 tuition per year for K-12 schools, and up to $10,000 in student loan payments

On the other hand, 529 plans include a 10% withdrawal penalty on earnings on top of ordinary income taxes if money is not used for qualified educational expenses.

Most plans make it easy to invest by offering a number of pre-set portfolios you can select based on your child’s age and your feelings about risk. A 529 is also flexible. If your child doesn’t go to college, the money can be used for certain other types of post-secondary education. Plus you can change the beneficiary from one child to another . That said, you may want to consider opening a separate 529 for each child.

Read Also: How To Get Noticed By College Scouts

What Are The Benefits Of A 529 Account

You often hear 529s are a great way to save for college, but why is that? Its simple, tax-free growth and tax-free withdrawals if you play by the rules. This makes 529s stand out from most other types of investment accounts. The dollars you contribute are invested and grow tax-free. The withdrawals are also tax-free if they meet the requirements for qualified education expenses. These are things like tuition, books, fees, room, and board. In 2019 the IRS allows you to contribute up to $15,000 into a 529. There is also a lesser known 5-Year election in which you can contribute up to $75,000 into a 529 account at one time.

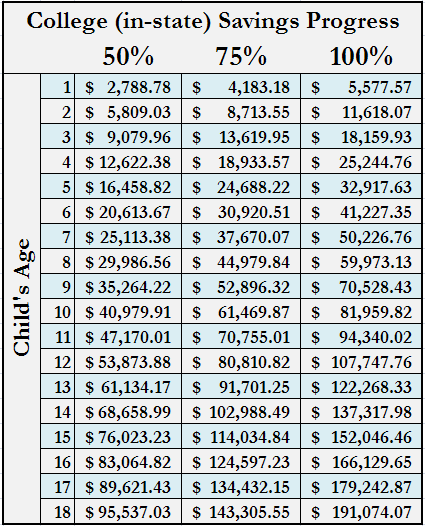

How Much Should You Have In A 529 Plan By Age

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

The 529 College Savings Plan is one of the best ways to save for college. But most people aren’t taking full advantage of them. And I’m not going to lie – I’m one of them.

So let’s dive in and see how much you should have in a 529 plan.

Don’t Miss: How To Get Accepted Into Any College

Bottom Line: Save As Much As You Can

When it comes down to it, you’ll need to reconcile your numbers with what you can afford. Saving for college is important, but it needs to work with your other priorities, like saving for retirement or building an emergency fund.

Be sure you’re doing all you can, though. Cutting expenses to save an additional $25 a week could have a considerable impact in the long runand make it less likely that you’ll struggle financially when it’s time for college.

Saving more can have a huge impact

This hypothetical illustration assumes an annual 6% return, as well as a weekly deposit for 18 years, for all examples. This illustration does not represent any particular investment nor does it account for inflation. There may be other material differences between investment products that must be considered prior to investing.

Saving more can have a huge impact

This chart shows what your final balance might be if you save different amounts each week. If you save $25 a week for 18 years, you could have a total balance of about $42,600. Increase your contribution to $50 a week over 18 years and your balance could go up to about $85,200. See an even more dramatic spike in your balance when you contribute $75 a week over 18 yearsand boost your savings to about $127,800.

Just Before You Start Saving For College

A dollar you save for your childs college education is a dollar less you will have to borrow when its time for him or her to work on a degree. And the sooner you start saving a dollar each time, preferably the moment your future college student is born, the better it is for your peace of mind and pocket, too.

But it doesnt mean that you have to save for the entire sticker price of college. By following the one-third rule mentioned above, saving for college doesnt have to be burdensome and overwhelming.

Oh, and scrap the idea, too, that saving for college harm need-based financial aid.

LEGAL DISCLAIMER

College Reality Check is owned and operated by Kirrian One LLC, a Maryland limited liability company. Kirrian One LLC is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. Kirrian One LLC also participates in affiliate programs with other sites and is compensated for referring traffic and business to these companies.

Don’t Miss: Is Uei College Accredited

Its Time To Get Serious About Saving For College

Its never too early to start thinking about a college savings plan. Whether your child is a teenager or toddler, the best time to start a college fund is now .

Making the right plan for your childrens future starts with understanding all of your investment options. Connect with a qualified investment professional for free through SmartVestor. These are people we trust to take care of you and your childs college investment.

Want to learn more about how to go to school without loans? Debt-Free Degreeis the book all college-bound studentsand their parentsneed to prepare for this next chapter. Grab a copy today or start reading for free to get plenty of tips on going to college debt-free!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Open A College Savings Account

If your parents or guardians didn’t open a college savings account for you, consider opening one yourself. Putting money aside specifically for college means you won’t be tempted to pull out the money for other purposes, like a vacation.

A 529 plan, for example, remains a popular option among college students.

“The great thing about a 529 plan is that you do not pay taxes on its value as long as you use the money for educational expenses,” explains Barnhardt. “So if you are going to use savings to pay for your college expenses, it might make sense to put the money into a 529 plan instead.”

College savings accounts differ from normal savings accounts and have certain eligibility requirements. These requirements differ depending on the type of account. Some may maintain annual contribution limits, while others may set certain income requirements.

Recommended Reading: Ashworth College Hvac Reviews

How Can Parents Save For College

One way for parents to save money for college is by using college saving plans, such as the 529 plan. Getting a Coverdell education savings account or a UGMA or UTMAis an option, too. Using a Roth IRA or opening a traditional savings account may work better for some parents.

Earlier, we talked about how much you should save. And now, lets talk about how you can save.

Its a good thing that there are many different options available for parents who wish to begin preparing for the college of their kids way before their little ones learned how to walk or talk. Picking one from the handful of choices is all about deciding which one suits your needs and preferences the most by considering the pros and cons.

Here are some of the college savings vehicles that you might want to consider:

Become A Pro At Budgeting

When it comes to personal finance in general, budgeting is essential. And it’s especially true when you’ve got a big expense on the horizon, like college. Budgeting may sound overwhelming for beginners, but you can find online budgeting guides to help break everything down.

Consider following the 50-20-30 budget rule. Under this plan, you’ll dedicate:

- 50% of your after-tax income to financial needs and obligations

- 20% on savings and debt repayment

- 30% on anything else

Don’t Miss: How To Attract Students To Your College

My Parents Want To Help Contribute To A 529 Is It Better For Them To Open Their Own Account Or Contribute To Our 529 Account

So, I always tell clients this depends on what the parent or grandparent is trying to accomplish. There is the right tax answer, financial aid answer, and then there is the right answer for the family dynamic. The three of these don’t always align. Here are some things to consider:

-

Sometimes, grandparents prefer to have more control and don’t want to hand over ownership of the account to their child. In this case, the grandparent should be the owner. It’s their money and therefore their choice.

-

If control and oversight of the funds is not an issue, grandparents can contribute directly to the parent owned 529.

-

Theres lots of talk about grandparent-owned 529s and their impact on financial aid eligibility. Its true, they are viewed differently on the FAFSA. Distributions count as income to the beneficiary in the year taken, which lowers eligibility, so timing is important. For example, if grandparent funds are used senior year there are no more FAFSAs to file and therefore these income distributions wont need to be listed and won’t impact aid.

-

Who wants the tax deduction , if it’s offered in the state? Remember it needs to be a Virginia owned 529 in order to qualify for the state specific tax deduction. Again consult your tax advisor here for more details on eligibility.

Saving For College Will Give You Choices

Research shows that, across income levels, students who have savings designated for college are more likely to attend and graduate. Overall, the study showed that children who were expected to attend college prior to graduating from high school and have at least $500 in college-designated savings are twice as likely to graduate from college than students with similar expectations but no savings.

The results vary by income groups but show results even with very modest savings accounts. For example, a student from a low- to moderate-income household with savings between $1 and $499 is three times more likely to attend college and four times more likely to graduate than a student from a similar household with no savings.

Ms. Garcia says she hears about the savings penalty myth all the time, so much so that she recently took to her blog to try to explain it away with some numbers …Not saving for college penalizes you a whole lot more, she said.

How to Save for College Rules of Thumbs

So, how much should your family save? Here is my rule of thumb. Or rules of thumbs.

Heres how.

If you are not contributing to retirement at all, you should also not be contributing to college. Instead, any spare dollar you have needs to go to retirement. College savings should only be funded through extras tax refunds, bonuses, gifts and the like.

Making a college savings plan that actually works

Why Saving Early for College is So Important

| Start Age |

|---|

Recommended Reading: Does Ashworth College Accept Financial Aid