How To Set The College Savings Goal

Since 3 x 1/3 = 1, that suggests that the college savings goal should be equal to the complete cost of a college education the year the baby was born. Saving this amount will yield enough money to cover about a third of the future college costs.

You might not be able to predict the specific college in which your child will enroll 17 years from now, but you might be able to predict the type of college, such as an in-state public 4-year college or a private 4-year college.

The College Boards annual Trends in College Pricing publication reports an average cost of attendance in 2017-2018 as follows:

- Public 4-Year College : $20,770

- Public 4-Year College : $36,420

- Private Non-Profit 4-Year College: $46,950

Assuming that the current inflation rates of 3.1%, 3.2% and 3.5% continue, the complete cost of a college education for this years college freshmen will be about $87,000, $153,000 and $198,000.

FREE TOOL: Calculate the cost of sending your child to college

Distribution Of Students By Tuition

The majority of four-year undergraduate students are paying between $6,000 and $15,000 for tuition and fees with a median of $12,090. However, as we look deeper into the data, mostly public college students pay these costs, while private nonprofit students are more spread out near the higher costs.

Public four-year institutions have a median tuition cost of $10,270, while private nonprofit four-year schools have a median that is over three times that amount at $35,260. The majority of students at private nonprofit four-year schools are paying roughly between $33,000 and $51,000.

How To Calculate The Cost Of Attending College

How much college is going to cost you really depends on your personal situation. But there are a couple of tools you can use to figure out how much youll have to pay:

- Net price calculator.Most schools have a net price calculator on their financial aid website that gives prospective students an estimate of how much your family is expected to contribute toward your education and how much financial aid you might receive.

- FAFSA4caster. The FAFSA4caster gives you an estimate of how much federal aid you might qualify for at a particular school including grants, loans and work-study as well as the potential net price.

You might want to use both to get a more accurate estimate. A schools net price calculator might have a more accurate reading of institutional scholarships and grants you might qualify for. But the FAFSA4caster can give you a better idea of how much federal aid you might receive.

Also Check: Central Texas College Online Degrees

How Much Money Do You Need

By no means am I saying that its easy to make money, but what I am saying is that you dont need much to live a comfortable lifestyle. And if you do need big amounts of money, its because you are putting the added pressure on yourself by buying fancy cars, a really big home, and a variety of material possessions that you dont need.

Making millions of dollars is never an easy thing to do. Its a lot harder to make money than it is to save it. For this reason, I am a big believer in living below your means so that you dont have to stress about making more and more money each month.

Heck, I even somewhat regret paying $3,000 a month for my home. I probably would have been better off paying $1,000 a month living in a 275-square-foot motel room .

Average Cost Of Books & Supplies

Some programs require more expensive materials than others, so the cost of books and supplies varies widely.

- At public 4-year institutions, students pay an average of $1,334 annually on books and supplies.

- Books and supplies at private, non-profit institutions average $1,308 at private, for-profit institutions, the average cost is $1,194.

- At public 2-year institutions, students pay an average of $1,585 each year for books and supplies.

- At private, nonprofit institutions, books and supplies average $1,061 at private, for-profit 2-year colleges, the average cost is $1,393.

Recommended Reading: Lowest Gpa Requirement For College

How Much Money Do I Need To Start The Semester

You did it. You received that highly anticipated bigger rather than smaller envelope in the mail stating you have been accepted into a college. Youre ecstatic. Then another piece of mail comes and its your tuition bill. Thats when it hits you. College is expensive, but just how expensive is it and what will you need to fork over for your first semester?

TuitionYour first order of business should be calculating your tuition costs, which vary greatly from state to state and are a huge factor in determining how much student loans you may need. According to the College Boards 2012-2013 Trends in College Pricing survey, the average cost for tuition and fees for in-state students at public four-year institutions was $4,327 a semester, while the average at private nonprofit four-year institutions was $14,528 a semester.

Room and BoardThe average cost for on-campus living for undergraduate students attending public four-year institutions is $4,602 a semester, and $5, 231 a semester if you attend a private nonprofit four-year school. If you live off campus without roommates, your living expenses can double.

BooksRenting textbooks is becoming increasingly popular among college students. Your total book costs depend on your major and other factors, but on average, if you rent your books, you could spend $300 a semester, which is significantly less than if you were to buy your textbooks.

Estimated Cost for Your First Semester of College :

Amounts For Each Type Of Spending Money

While some college students need a sizable clothing allowance each month, other students do some shopping in the summer and head to school with their wardrobe ready for the year. Likewise, some students participate in expensive activities while others do not. While both types of students will need a considerable amount of money to spend, calculating a total depends on the types of activities in which they participate.

Finally, the geographic region can heavily impact the amount of spending money a college student needs. Necessities like rent and groceries are more expensive in big cities, but students on rural campuses will spend more on gas or public transportation than those living in the city.

Also Check: Hunter College Act Code

How Much Does College Cost Per Year

College can cost anywhere from $18,000 to over $50,000 a year depending on where you go to school, if youre an in-state or out-of-state resident and if you attend a public or private university. Aside from tuition and fees, your schools cost of attendance usually also includes room and board, books, transportation and other personal expenses.

Here was the average cost of college for a full-time undergraduate student living on or near campus for the 20192020 academic year,according to a 2019 College Board study.

-

Average cost of college in 201920

Cost $26,590 $18,420

As these numbers show, tuition isnt the only number you should look at. Room and board is also a significant part of the cost of attendance.

It was a quarter of the cost of attending a private school or a public school as an out-of-state student during the 20192020 academic year. And it was around 45% of the cost of public schools for in-state students and public two-year programs.

Answers To Questions On How To Calculate College Cost Using A Calculator

The most important type of calculator is a net price calculator. The net price is the difference between total college costs and gift aid . This represents the real cost of the college and is needed to determine whether the college is affordable or not. If total resources is less than the four-year net price, the college is affordable, otherwise not.

The next most important calculator is a loan calculator that can determine the monthly payment, total payments and total interest paid over the life of the loan, given the amount borrowed, interest rate and repayment term.

The third most important calculator is a college savings calculator that calculates how much you must save per month, given a college savings goal, earnings interest rate, contribution frequency and duration of contributions . Also useful is a college savings growth calculator that shows how much money you will have given a particular savings contribution amount.

Families should start with the net price calculator, to determine the net price for several colleges their child will consider. Include a variety of college types, including an in-state public college and a private non-profit college. This will give you an idea of the current net price. If the child will not be enrolling in college for several years, assume that the net price will increase by 6% to 7% each year, on average.

Also Check: Pcdi Canada Reviews

How Much Money Should You Borrow

Many students borrow too much money and regret it later in the future. However, many people refuse to borrow money for school, and as a result, they never enter or finish college. It has been shown that people with bachelor’s and advanced degrees make more money during their working lives than non-college graduates.

Therefore, many financial experts agree that individuals interested in attending college but unable to pay for it themselves, or receive financial assistance from their parents, should borrow a reasonable sum of money. It’s usually recommended to borrow more than $5,000 dollars annually. Likewise, it’s advisable to obtain a part-time job to decrease the amount of money students must borrow. Most college students graduate with a little more than $20,000 dollars in student loan debt. Many financial experts believe this debt load is not too difficult for most graduates to handle.

However, many students with part-time jobs, student loans, and modest living expenses often need more money to pay for college. The question then becomes what is a reasonable amount of debt to accrue under these circumstances?

The following are tips for students finding themselves in this position:

Start with the feds : Students can avoid borrowing from private banks or credit cards with high interest rates by only taking out Perkins or Stafford loans. New government regulation caps monthly minimum payments on Stafford and Perkins loans at 15 percent of their monthly wages.

How Prevalent Are Development Cases At Elite Colleges

While it varies from school to school, 4%- 5% of accepted freshmen at Dartmouth were given special admissions consideration due to donations by their parents. Also, Duke admitted in the early 2000s to easing its admissions qualification to admit about 100 students each year due to their family’s wealth. I would guess this number is similar across all elite colleges, and development cases taking up 4-5% of the freshman class is very significant because it means 100-125 more qualified students did not receive admission.

With great money comes great power .

Read Also: Is Ashworth College Worth It

What Is Etiquette For Graduation Gifts

It is an etiquette myth that if you receive a graduation announcement you must send a gift. Announcements do not equal invitations to a graduation. You are not obligated to give a gift, although you may choose to do so. Whether or not you send a present, a card or note of congratulations is always appreciated.

People Who Need An Emergency Fund Money Peach

Because the entire idea behind most scholarships is that they last more than one year, you need to ensure that there is enough money to keep it going for several decades. But the amount of money you can raise ultimately depends on the effort that you, as an individual member put in, as well as how well the greater community, as a whole, performs.

Calculate how much you need to save in your emergency fund. A minimum management fee is generally around $3,500.

Do you need an emergency fund before you pay off debt in. According to a sallie mae 2018 report, families spent an average of $26,458 on college in the 2017 academic year.

Emergency fund how much should you save finance best. Although there are always exceptions, most families should expect to set aside at least $20,000 in order to establish a.

Emergency fund size how much of an emergency fund do you. Assuming you receive 26 paychecks over the course of the year, are earning the average household income of $62,000, and.

Emergency fund why do you need one and how to build it. Because the entire idea behind most scholarships is that they last more than one year, you need to ensure that there is.

Everything you need to know about an emergency fund. But the amount of money you can raise ultimately depends on the effort that you, as an individual member put in, as well.

How to start an emergency fund emergency fund emergency. Furthermore, three in five students rely on scholarships or grants.

Also Check: Grammarly Free For College Students

Saving More Can Have A Huge Impact

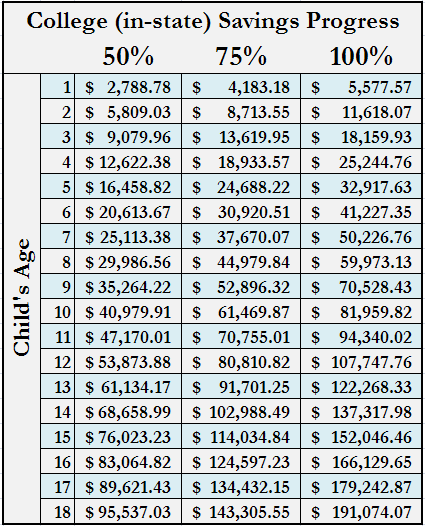

This hypothetical illustration assumes an annual 6% return, as well as a weekly deposit for 18 years, for all examples. This illustration does not represent any particular investment nor does it account for inflation. There may be other material differences between investment products that must be considered prior to investing.

Use Grants If You Qualify

A 2018 NerdWallet study found high school graduates who don’t complete the FAFSA leave behind billions of dollars in unclaimed federal Pell Grant money.

Dont make that mistake. As long as you submit the FAFSA and renew it each year youre enrolled in school, youll receive Pell money if youre eligible for it.

In addition to the Pell program, the federal government offers several other types of grants, which dont need to be paid back. Many states have grant programs, too. Use this map on the Education Department website to find the agencies in your state that administer college grants. Then look up and apply to state grant programs you may qualify for.

» MORE:Guide to grants for college

Read Also: Is Ashworth College Recognized By Employers

How Much Money Do You Need To Save For College

ROCHESTER, N.Y. The challenge of saving for college is a daunting one for many parents and independent students. CPA Kenneth Hall of the New York State Society of CPAs discussed what they should be doing to prepare.

A good goal is to save around 25 to 50% of what you believe will be the cost of college, Hall said. He recommends the following money-saving steps for high schoolers and their families:

Hall said parents of children already in college can still take cost-saving measures, including:

- Establish a monthly budget with the student.

- Determine personal/student covered expenses vs. parent-covered expenses.

- Encourage your student to look for deals on used books. Amazon has a thriving storefront that might save thousands over four years.

- Look at meal plans or the ability to opt-out if the student has other options.

- Review all insurance policies to make sure your student is covered for health, auto, and renters insurance. Also, check applicable laptop and cellphone warranties and insurance.

Parents should keep track of all the spending and sources of money, such as college savings accounts. The tax return reporting of these can be tricky. Your CPA should be a part of the process. This can also save thousands of dollars.

Next Calculate An Amount Based On Your Target

Our college savings planner makes it easy to see how much you’ll need to save per month in order to meet the goal you’ve set.

The college savings planner assumes that you’ll earn a specific rate of return on your college savings. So once you know which asset mix you’ll be investing in, you may want to come back and adjust your return expectations.

If the planner’s recommended contributions seem high for you, figure out whether you’ll be able to use some of your income to pay for college while your child is attending. If so, this amount can be deducted from what you’ll need to save.

Typically, the biggest way parents contribute to college costs is by using their current income. In 2014, parents used an average of $6,973 of their income to pay for college.

Read Also: Is Grammarly Free For College Students

How Much Money Do Parents Give Their College Students Weekly

The answer varies, but some clear trends emerge. A large percentage of parents told us they dont give their student any extra funds. These teens who are living on campus are expected to fund their own extra expenses.

Many families expect their students to fund their own entertainment and non-necessary expenses during the semester with money they earned during the summer or with an on campus job. Any extras beyond housing and campus meal plan are up to the student to pay. As one parent noted, Fun money is on them.

Some parents said that although they expected their teens to pay for extras like eating out with friends out of their own money, they gave their student a small amount of cash for necessities like shampoo, laundry and school supplies.

Some students were given money when expenses arose, rather than as a proscribed regular weekly amount.

The consensus among the hundreds of parents who did send their college students spending money was that the range should be between $25-$75 a week for a student living on campus. The most common answer was $50 a week or $200 a month. Students who had cars on campus needed more than those who didnt.

A smaller group of parents didnt give their teens cash on a regular basis but instead offered them access to their Amazon and Uber accounts to use as needed. Parents can monitor this spending in real time and note any excessive usage.