How Long Does It Take For Fafsa To Process

First things first, the FAFSA becomes available in October of each year and you have a long time to submit your Free Application for Federal Student Aid. In fact, if you want to be considered for financial aid during the 2021 to 2022 academic year, the FAFSA for the year opened October 1, 2021 and will remain open until June 30, 2022 .

It should take you less than an hour to complete the FAFSA. And once you submit your forms they should be processed quickly — typically within:

- Three to five days if you completed your forms online and provided an email address

- Seven to 10 days if you submitted your forms online but didn’t provide an email address

- Three weeks if you file a paper FAFSA

After your FAFSA has processed, you will receive a Student Aid Report detailing your Expected Family Contribution. The schools you indicated you’re considering attending will also receive an Institutional Student Information Record. They will use it to prepare your financial aid package.

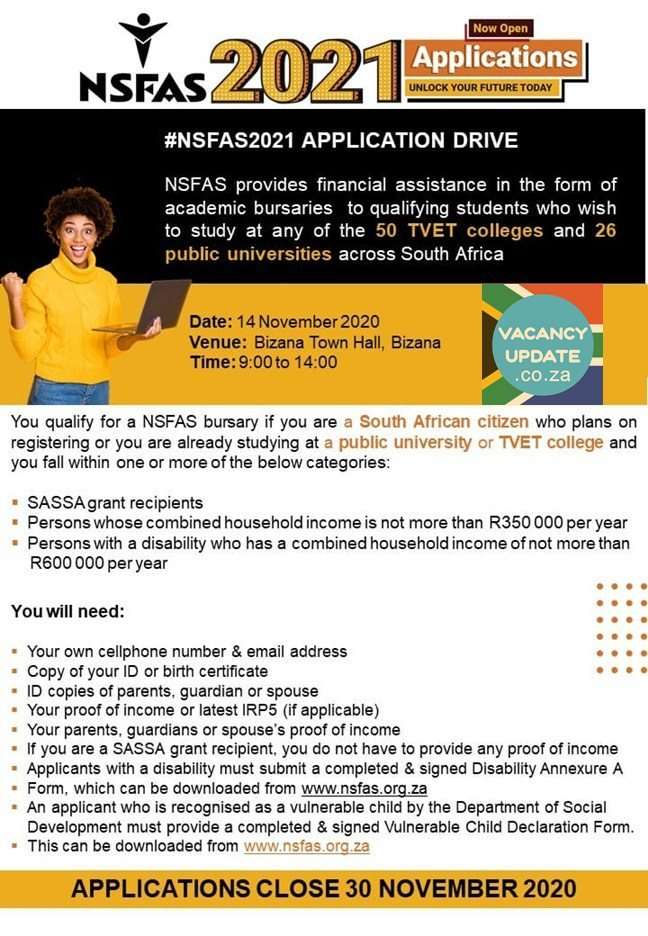

What Is The Income Limit For Pell Grant 2020

If your family makes less than $30,000 a year, you likely will qualify for a good amount of Pell Grant funding. If your family makes between $30,000 and $60,000 per year, you can qualify for some funding, but likely not the full amount.

Why Does It Take So Long To Receive The Money

Many people are applying for financial aid. But here’s a rough breakdown of the steps and the approximate time-frame for each:

-

After you have submitted the FAFSA and then submitting the requested documents to the Financial Aid Office: 2-3 weeks.

-

SMC to process your paperwork and awards your financial aid: 4 to 8 weeks.

-

The county to process your grant or loan check: up to 2 weeks.

Recommended Reading: Colleges That Offer Mortuary Science

Fafsa Money And Other Awards Are Disbursed Twice Per Year

With federal, state, and institutional financial aid awards, the college you attend will distribute this money. It will not be sent directly to you.

These awards are distributed in two installments, called disbursements. The school will take tuition and applicable fees out of these disbursements upfront. Any remainder intended to go to books, supplies, and living costs will be sent to you. To ensure you know how your money is disbursed, you can check online or receive a paper invoice for how the money is split and given to the school.

Disbursements typically occur at the beginning of a semester, or at the beginning and midpoint of the school year if you attend a college that does not use a semester system.

If you have federal money left over after tuition, housing, and related fees and expenses are covered by the school, the DOE requires colleges to disburse the remainder to you, so you can pay for books and other supplies on your own. If the school does not give you this money 10 days before the term begins, they are required to provide you with another way to pay for books and supplies by the seventh day into the term, so you can be prepared for your classes. If you receive federal financial assistance, you should not have to cover these costs yourself.

How To Qualify For Financial Aid

In order to qualify for any sort of federal aid, you need to complete the FAFSA online. The FAFSA will evaluate your financial need and award aid accordingly.

Youll need the following information to complete the form:

If youre applying for financial aid for the 2020-2021 school year, you can file and submit your FAFSA between October 1, 2019 and June 30, 2021.

Read More on How to Apply for FAFSA

Recommended Reading: What Size Are College Dorm Beds

How To Manage Financial Aid Money

Get a bank account if you dont have one already this is where your extra aid will go if there is leftover money after tuition and school expenses have been paid to your school. Remember that any money you receive as a loan will have to be paid back eventually.

If you find yourself with more money than you need, you can either request to return it from your financial aid office, make a payment directly to your loan servicer, or put the money aside so you dont spend it. For the following year, think carefully about how much aid to accept.

Another key tip is to create a student budget. Make a list of necessary expenses you know you will have, and ensure that you keep enough of your aid money to pay for those things. Necessary expenses include textbooks, rent, gas, food, supplies, internet, transportation, etc. Resist the urge to spend the money right when you receive it on things that you may use, but that will leave you unable to pay for the necessities.

How Long Can You Receive Financial Aid

< p> I have been going to community college for 4 years and received FA for all of those years. Next semester I plan on going to a Sam Houston State University. I only have 64 hours but I am afraid I wont get FA Because I have already received it for four consecutive years. So can any one tell me how long you can receive financial aid?< /p>

< p> It sounds like you have 2 or less years of college credit, and that you didn’t attend your community college full time. Typically, finaid is for four full time years of study. Many community college students transfer to four year schools of study and for many it takes longer than a couple of years to get a couple of years credits. If your college awards finaid to transfers from community colleges, I would think your number of years at the CC wouldn’t matter. If you are concerned, call the finaid office and ask them. You don’t have to say who you are…just an inquiry “I’m transferring 60 or so credits from a cc. Would I be eligible for financial aid from your school?”< /p>

Read Also: Is Central Texas College Regionally Accredited

How Should I Use My Refund

Financial aid is intended to go toward college expenses, so use it accordingly. As mentioned, returning any leftover funds is a good way to reduce your debt and cut down on interest charges.

That said, you probably need to use some of your student loan refund on textbooks or equipment and supplies such as a new computer. If you live off campus, maybe you need to use your refund for rent, utilities or groceries.

In other words, use your student loan disbursement for things you really need or cant cover with a part-time job. To help you figure out what that is, get yourself a basic college budget.

Meredith Simonds contributed to this report.

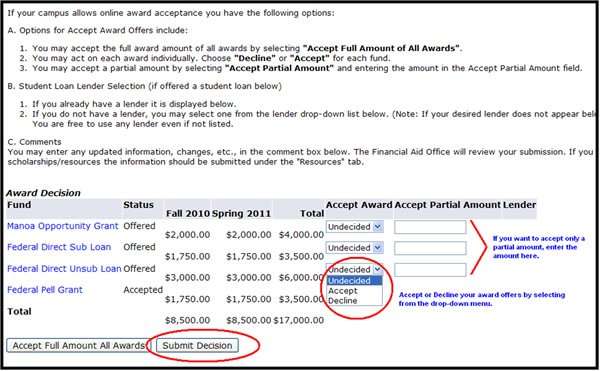

How Do I Get A Financial Aid Award Letter

- Incoming students will get their Award Letter emailed to them after we have received their FAFSA and reviewed their file.

- Continuing students can use the Financial Aid Portal on Corsair Connect as their Financial Aid Award Letter. We have designed the Financial Aid Portal to encompass all the Financial Aid information needed for outside use.

Also Check: How Much Is Berkeley College Tuition

So How Long Does It Take To Receive Financial Aid Exactly

The length of time it takes to receive your financial aid money depends on when and how soon you apply how you submit your FAFSA how quickly your school acts and the type of aid you’ve accepted. In general, though, you should have the funds you need right around the time each semester, trimester, or quarter begins.

In some cases, the FAFSA will not provide enough money for you to live on and to cover all of your educational costs. If that’s the case, you can consider additional options such as private student loans. Often, you can be approved quickly for private loans and can get funds above-and-beyond what your school or the Department of Education is willing to provide.

Unlike federal loans, though, private loans don’t just come at one standard rate. Rates and terms can vary dramatically from one lender to another and based on your financial credentials. If you are interested in private student loans, Juno can help you get the best possible rates by grouping you with other students and negotiating with lenders on your behalf.

Understanding The Disbursement Amount Compared To The Awarded Amount

Recommended Reading: What Colleges Are Still Accepting Applications For Fall 2021

Why Do You Need To Submit A Fafsa Form

FAFSA stands for Free Application for Federal Student Aid. As the name implies, it wont cost you anything to fill out. This application helps the government determine your eligibility for need-based and non-need-based financial aid.

If you fail to fill out the FAFSA, you will be leaving free money on the table.

Many students and their families fail to fill out the FAFSA because they dont think theyll qualify for financial aid. Its worth a shot! You may be surprised at the funds you qualify for. Some scholarships based on academic merit will require you to submit the FAFSA anyway.

Other common reasons that some students dont fill out the FAFSA are that the form is too difficult to complete and takes too much time.

On the contrary, the FAFSA requires tax information from older years, so youll already have access to it. The whole application usually takes under 30 minutes to complete. A half-hour of your time is worth years of potential financial aid.

There are certain deadlines for the FAFSA, depending on when you plan to enter school. Make sure you meet these deadlines, so you dont put your financial aid at risk.

How Are Private Student Loans Disbursed

Similar to federal student loans, private student loan money is typically sent straight to your school around the beginning of the semester, which then applies it to tuition and fees. It will also usually be sent on a semester basis, rather than all at once for the full year. Your school should then send any remaining amount to you. Since each private lender is different, though, its worth checking with yours to find out exactly how and when it will disburse your loan money.

Also Check: Who Buys Back Used College Textbooks

I Need Help With The Fafsa What Should I Do

Students and families can get free assistance and answers to their FAFSA questions at www.fafsa.gov or 1-800-433-3243. FAFSA help sessions are also available at high schools and colleges throughout Florida. Visit UF Student Financial Aid and Scholarships and social media channels to find out about help sessions and other events.

What Does Fafsa Processing Notification Mean

It typically takes three to five days to process a Free Application for Federal Student Aid form that was submitted using fafsa.gov or using the myStudentAid mobile app. If you provided a valid email address on your FAFSA form, youll receive an email notification that includes a link to your electronic Student Aid Report at fafsa.gov. Check Corsair E-Docs to find out requirements for receiving your financial aid at SMC.

You May Like: Charis Bible College Dc

More Issues To Consider Related To Marital Status

- If you submit your FAFSA when you are single but then you marry, you can submit an update to the form so that your ability to pay for college is accurately reflected by the government calculations.

- You can submit a change to your FAFSA should you or your spouse lose your income or have a reduction in income during the academic year.

- You need to report your financial information and your spouse’s information on the FAFSA even if you file taxes separately.

- Keep in mind that you and your spouse’s assets, not just your income, are used to calculate your aid eligibility. Thus, even if you and your spouse have low income, you might find that your expected contribution is high if you or your spouse has significant savings, real estate holdings, investments, or other assets.

Getting Your Financial Aid Results

To answer, How much financial aid will I get?, you will receive an award letter from your college or university that outlines the amount of aid youve been awarded. Since many offers are tied directly to the schools youve applied for, the date you receive the offer will vary. Most offers are sent in the winter or spring before the start of the school year. Your financial aid award letter will likely include a combination of federal, state, and school-specific aid. Make sure you read it closely before you decide which aid to accept.

The only way to know exactly how much financial aid you will get is to complete the FAFSA. You should fill out the FAFSA as soon as it becomes available to ensure that you get the most financial aid.

Recommended Reading: Who Buys Back Used College Textbooks

What Happens If I Run Out Of Financial Aid

Call your schools financial aid office immediately.

Your colleges financial aid officers are trained to help you solve this problem. If you have some of the money you need to pay for the semester, but not all, your college may allow you to pay the difference over the course of months instead of upfront.

Financial Aid Disbursement: When And How You Will Get It

Fill out the form below to send a copy of this article to your email.

Its time to get ready for your academic year. You may have questions about how you receive your financial aid. And maybe youve already heard about aid disbursements, but what does that even mean? You were awarded aid for the full academic year, but there are different methods schools need to follow when it comes to how and when that money is disbursed.

Don’t Miss: How Much Is My College Book Worth

Direct Loans: Subsidized And Unsubsidized

Both subsidized and unsubsidized loans are granted at the beginning of a semester, and neither is required to be paid back until after you graduate . No matter which year the loan covers, once youre out of school, your payments begin.

The big difference between subsidized and unsubsidized loans is when you start paying interest.

An unsubsidized loan gains interest just like a private loan would: starting the day you take it out. The dont-pay-until-you-graduate grace period only applies for your loan payments. Interest payments are still required throughout your time in school.

However, if you take out a subsidized loan, the government pays interest for you while youre in school. Your personal interest payments will begin only after you graduate, along with the rest of your loan payments.

If youre going to take out a federal student loan, Rebecca recommends pursuing a subsidized one.

I remember the difference by saying unsubsidized is uncool, Rebecca said. Paying off the interest on an unsubsidized loan can be very stressful for students, especially if they arent earning much on the side while theyre in school.

Plus, she mentioned, if you are earning an income while in school, you would be better served by putting that money toward paying for your next semester upfront and skipping the loans altogether rather than paying down a growing debt.

The fewer loans you take out, the less interest you pay. The less interest you pay, the cheaper college will be.

Consider Getting A Job

Juggling a full course load and a part-time job isnt ideal, but getting a job or enrolling in a work-study program could help you offset some of your expenses.

See if you can find any job openings on campus or search local businesses nearby to see if any are hiring. Consider other revenue streams like freelancing online, tutoring, or picking up a side gig.

> > Read More: How to make money in college

Also Check: Where Can I Sell Old College Books

How Long Does It Take To Receive My Financial Aid Check

Your aid will typically be sent to your school to cover tuition and fees at the beginning of each semester. Once that amount has been applied, your school will send the leftover funds, called a credit balance, to you. Schools must send this credit balance to you directly within 14 days, but you can contact your schools financial aid office to find out its exact disbursement schedule.

Does Fafsa Cover Full Tuition

The financial aid awarded based on the FAFSA can be used to pay for the colleges full cost of attendance, which includes tuition and fees. While it is possible for student financial aid to cover full tuition, in practice it will fall short. However, most full need students will be left with a gap of unmet need.

Read Also: Can Colleges Look At Your Social Media

What Is Fafsa Vs What Is Financial Aid