How To Get Financial Aid For College

Students and parents sometimes dont know where to look for financial aid for college and how to apply. Financial aid can be intimidating because it involves an alphabet soup of acronyms, almost like speaking a new language. However, there are just a few simple steps you must take to get the money you need to pay for college.

To get money to pay for college, file the FAFSA, search for scholarships, look for education tax … benefits, and ask your employer.

getty

Eligibility for college financial aid can be based on financial need or merit.

What Is The Expected Family Contribution

The EFC is a number that financial aid offices use to determine how much financial aid you will receive.

The formula to calculate EFC is complicated, but it takes into account factors such as your familys income, assets, benefits, family size, and number of family members attending college during the year.

It is not the amount your family will have to pay for college or the amount of aid you receive. Rather, it factors into financial aid calculations.

Latest News & Updates

NOTICE: Students who are in the process of completing their financial aid will not be dropped for the Fall Semester. It is important to check your insideBC regularly for updates and complete all document requirements as soon as possible to avoid delays.

Financial aid is happy to speak to your students on a variety of topics, such as:

- FAFSA Completion

- Types of Aid

- Satisfactory Academic Progress

Recommended Reading: Do College Applications Cost Money

Ascent Student Loans Disclosures

Ascent loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding.com/Ts& Cs.

Rates are effective as of 01/01/2022 and reflect an automatic payment discount of either 0.25% OR 1.00% . Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates.

1% Cash Back Graduation Reward subject to terms and conditions, please visit AscentFunding.com/Cashback. Cosigned Credit-Based Loan student borrowers must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs are available for the most creditworthy applicants and may require a cosigner.

Student Loans And Grants

If youre receiving student loans or grants, your school will usually first apply the money toward your tuition, fees, and room and board if youre living on campus. Any money you might have remaining after that will go toward your other expenses.

Some schools will let you decide whether youd like that left over money paid to you in cash, check, or directly to your bank account. If you receive your loan money and then realize you dont actually need it, youre able to cancel the loanwithin 120 days of disbursement, and you wont have to pay any fees or interest.

For PLUS loans, payment distribution is similar, however, remaining funds will go to your parents if you are an undergrad student.

You May Like: Grammarly Teacher Discount

The Amount You Get Isnt Enough To Cover All The Expenses File An Appeal With Donotpay

If the offer from your dream college isnt as satisfying as you expected, DoNotPay gives you a chance to send an appeal letter to the institution quickly and efficiently! Instead of writing it yourself, give us the basic info, and we will compose and send it on your behalf in only a few taps!

Heres what you need to do:

Our learning base features many practical guides that will teach you everything about the financial aid application for many well-known universities, including:

Should You Apply For Financial Aid

You should absolutely apply for financial aid unless youre 100% comfortable paying full sticker price. There are rarely any hard income cutoffs, so its better to fill out the paperwork to determine your eligibility.

To get started applying for financial aid and to learn more about the different forms you need to complete, check out our complete guide to financial aid.

Don’t Miss: What Colleges Accept A 2.5 Gpa

How Much Do I Get Disbursed

Colleges and universities disburse financial aid in at least two installments each year. At most institutions, youll receive funds at the start of the fall semester and again at the start of the spring semester.

For example, say that your financial aid award equals $15,000.

Fall Semester: The college will apply $7,500 to your student account to cover tuition, room and board, and related fees . Anything left over gets refunded to you.

Spring Semester: The college will apply $7,500 to your student account to cover tuition, room and board, and related fees . Again, anything left over gets refunded to you.

The total amount will equal the amount listed on your accepted financial aid package. If you notice a discrepancy, reach out to your colleges financial aid office.

Financial Aid From The Irs

You can also qualify for some financial aid by filing your federal income tax return. Education tax benefits include the American Opportunity Tax Credit , Lifetime Learning Tax Credit and Student Loan Interest Deduction.

- The AOTC provides a partially-refundable tax credit worth up to $2,500 based on amounts paid for tuition and textbooks. Eligibility for the AOTC is limited to four years of postsecondary education per student.

- The LLTC isnt as valuable as the AOTC, but it can be claimed for an unlimited number of years.

- The Student Loan Interest Deduction is an above-the-line exclusion from income for up to $2,500 in interest paid on federal and private student loans.

- There are also college savings plans, such as 529 Plans, Prepaid Tuition Plans and Coverdell Education Savings Accounts, which allow earnings to grow on a tax-deferred basis and to be entirely tax-free if used to pay for qualified higher education expenses. Some states provide a state income tax credit or deduction based on contributions to the states 529 plan.

Read IRS Publication 970 for additional details.

Read Also: 120 College Credits

Financial Aid Calculator: Do You Earn Too Much To Qualify

When identifying affordable colleges, your first step should be to determine your Expected Family Contribution.

An EFC is a dollar amount that the widely-used federal financial aid formula says your family should be able to pay for one year of college.

When deciding how much financial aid to award a student, colleges pay attention to the applicants EFC.

For instance, lets assume that a households EFC is $25,000.

A college would expect a students family to pay at least $25,000 towards one year of schooling.

How Much Financial Aid Can You Get For College

To get an idea of the approximate financial aid amount you can receive, you must consider two crucial factors:

| TEACH Grant | $4,000 |

Read Also: Ashworth College Degree Worth It

Gather The Required Information

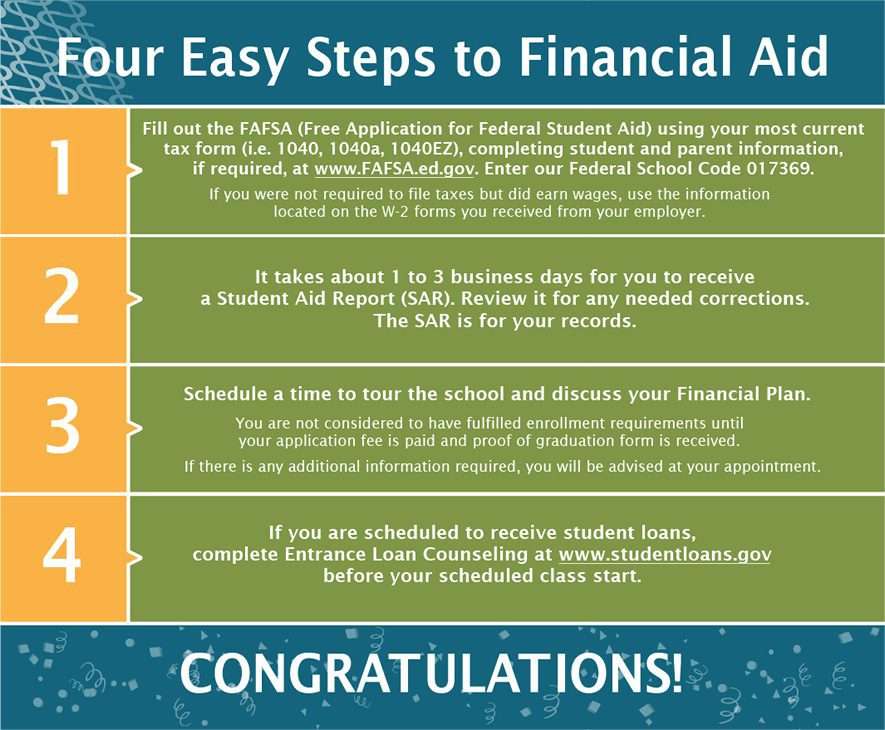

The actual process of filling out the FAFSA doesnt take long. The most time-consuming part is gathering all the necessary information.

For this reason, take some time to collect the following info before you fill out the FAFSA:

- Your Social Security Number

- Your parents Social Security Numbers

- Your drivers license number

- Your Alien Registration Number

- Federal tax information or tax returns. Typically, this will be your Form 1040 unless youre living abroad or in a U.S. territory. If youre filing as a dependent student, youll also need your parents tax information.

- Records of untaxed income. This includes child support, interest income, and veterans noneducation benefits. If youre filing as a dependent, youll need this info from your parents as well.

- Information about cash and assets. This includes savings/checking account balances investments in stocks, bonds, or real estate and business and farm assets. If applying as a dependent, youll also need this information from your parents.

As you can see, finding this information could require you to sort through a lot of paperwork. For this reason, its best to begin the FAFSA early.

Also, if you cant find all of this information at once, dont worry. You can complete the FAFSA in multiple sessions, saving your progress as you go.

Daca Financial Aid: How Dreamers Can Get Help Paying For College

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Also Check: How To Get Recruited For College Cross Country

Apply For Financial Aid

Students can apply for financial aid before applying for admission to Broward College. We offer a combination of aid programs including grants, scholarships, work-study, and loans. Based on eligibility, students may qualify for funding from one or more of these programs.

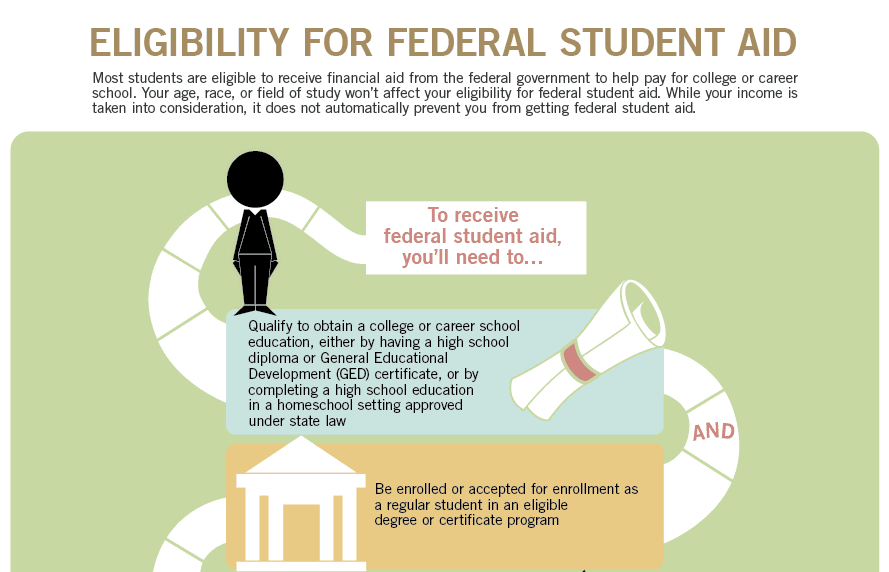

Students must be admitted to an eligible degree or certificate program of study in order to receive financial aid. To maintain eligibility, students must meet Satisfactory Academic Progress standards. Enrollment can affect aid amounts, and only classes that are recognized by the U.S. Department of Education as being required for degree completion will be used to calculate eligibility for Title IV funds.

The Free Application for Federal Financial Aid is free to file and you should only use the application found at www.studentaid.gov to complete this process. Do not ever pay to file for financial aid.

Review your MYBC portal for updates about your financial aid status

Before your financial aid can be processed, students must fulfill all outstanding requirements. These requirements are displayed as red flags on your myBC account and should be resolved as soon as possible. Red flags mean that your financial aid will not be processed until all documents are received by the Financial Aid office.

FATV is easy your education is priceless

A Wide Range Of Efcs Exists

In general, the wealthier the family, the higher the EFC.

The lowest possible EFC is $0.

An EFC of zero means that the financial aid formula has determined that the family cannot afford to pay anything towards college. Families with adjusted gross incomes of $25,000 or less have an automatic EFC of $0.

The EFC for the average American household with an AGI of $55,000 will often range from $3,000 to $4,000. These families have significant financial aid needs.

Also Check: Apartments Near Cape Fear Community College In Wilmington Nc

Need Help Understanding Your Sap Status

At the end of each term, after grades are posted, a process is run to determine what your Satisfactory Academic Progress status is. Students are notified by email of their status and can also check it by logging into InsideBC and checking the Financial Aid tab.

Below is a simple chart to help you understand what your status means for your financial aid

| Status | Effect on Financial Aid |

|---|---|

| Satisfactory Progress | None. You will still be eligible to receive aid if you continue to maintain a cumulative GPA of 2.0 or higher, complete at least 67% of units you attempt overall, and have below 90 attempted units. |

| Warning or Warning Not Enrolled | None. You will still be eligible to receive aid if you continue to maintain a cumulative GPA of 2.0 or higher, complete at least 67% of units you attempt overall, and have below 90 attempted units. |

| Approaching Maximum | None. You will still be eligible to receive aid if you continue to maintain a cumulative GPA of 2.0 or higher, complete at least 67% of units you attempt overall, and have below 90 attempted units. |

| Suspended or Max Units for Program | You can continue to receive the CA College Promise Grant and some scholarships. You are ineligible for all other forms of State or Federal Aid. If you have extenuating circumstances you may file an appeal. |

The Student Success Completion Grant

The Student Success Completion Grant is a new grant which began in Fall 2018 for Cal Grant B and C recipients attending a California Community College full-time . Students will be automatically reviewed for eligibility if they meet the eligibility requirements below. The SSCG provides students with an additional $1298 $4000 annually depending on the number of units they enroll in. A student must complete a FAFSA or a Dream act application.

Recommended Reading: Mortuary Schools In Virginia

How To Apply For Financial Aid

Now that you understand the general types of financial aid, its time to start the application process.

Depending on the type of financial aid youre trying to receive, the steps of this process will vary. If youre trying to get scholarships, for instance, you may need to write essays, complete interviews, or attend tryouts.

But regardless of the financial aid you seek, it all starts with filling out the Free Application for Federal Student Aid . This is the document that determines your eligibility for federal, state, and college student aid.

Filling it out is free and shouldnt take long .

The small amount of time and paperwork is trivial in comparison to the financial benefits you could receive. So dont skip filling it out because you dont have time or dont think youll qualify. It can only help you.

But how do you fill out the FAFSA, exactly? Heres an overview:

Student Loansfor Undergraduates Graduate/professional Students And Parents

Student loans can help cover the gap between the financial aid you can access through grants and scholarshipsand the full price of higher education. Student loans may appear as part of the financial aid offers you receive from schools. But loans must be paid back with interest , so its important to compare your optionsincluding VSACs student loans and parent loansand keep track of how much money youre borrowing.

To help students be loan-smart, VSAC publishes My Education Loans a no-nonsense guide that walks students and families through the borrowing process and ways to avoid taking on too much debt.

Don’t Miss: Michaela Nachmani Age

Federal Direct Graduate Plus Loan

The Federal Direct Graduate PLUS Loan is a federal loan available to graduate students. You must submit an application and undergo a credit check to apply for a Graduate PLUS Loan. Like the interest rate on the Federal Direct Student Loan, the Graduate PLUS Loan interest rate is fixed for the life of the loan, though each academic year’s new loans have a new interest rate determined by the 10-year Treasury note rate and an additional percentage. The loan is unsubsidized. You may borrow up to the school’s full cost of attendance minus any additional aid received.

Visit our Financial Aid Applications page to learn about applying for financial aid for students.

Next Steps To Determine How Much Financial Aid You Can Get

Once you have an idea of how much financial aid you can expect, you can better determine your debt load to pay for college.

A good rule of thumb is to borrow no more than 10% of projected after-tax monthly income in your first year out of school. For example, if you expect to make $40,000 in your first year out of college, borrow less than $21,000 to keep your payment affordable. Use a student loan affordability calculator to figure out how much to borrow.

You May Like: Brandon Charnas Katz Deli

What Is Financial Aid

Financial aid is money given or loaned to you to help pay for college. Most full-time college students receive some type of financial aid, which makes college more affordable.

The four main types of financial aid are grants, scholarships, loans, and work-study. Financial aid often comes from the federal government, state governments, colleges and universities, and private organizations.

How To Get Your Disbursement

All financial aid disbursements will be made electronically using BankMobile*. How Financial Aid Gets To You 21/22 provides information on disbursement dates for this academic year.

* Our school delivers your refund with BankMobile Disbursements, a technology solution, powered by BMTX, Inc. Visit BankMobile for more information or view our BankMobile contract.

Don’t Miss: Take One Class At Community College