You Put In The Work Now Reap The Rewards

- Variable Rates between 1.87% – 5.41% APR1

- Fixed Rates between 2.30% – 5.94% APR1

- No application or prepayment fees

- Cosigner release with 24 consecutive on-time payments2

- Show more info »

1Interest Rates

Fixed interest rates range from 2.30% APR to 5.94% APR . Your interest rate will depend on your credit qualifications. The fixed interest rate will remain the same for the life of the loan.

Variable interest rates range from 1.87% APR to 5.41% APR . Your interest rate will depend on your credit qualifications. Variable rates may increase after consummation. The variable interest rate is equal to the One-Month London Interbank Offered Rate plus a margin. The One-Month LIBOR in effect for each monthly period will be the highest One-Month LIBOR published in The Wall Street Journal Money Rates table on the twenty-fifth day of the month immediately preceding such calendar month. The Annual Percentage Rate for a variable interest rate loan will change monthly on the first day of each month if the One-Month LIBOR index changes. This may result in higher monthly payments. The current One-Month LIBOR index is 0.09% as of November 1, 2021.

2Cosigner Release. A request for the cosigner to be released can be made by either the borrower or cosigner when each of the following conditions has been met:

Refinance Loan Limits:

Penfed Student Loans Powered By Purefy

- Refinance federal and/or private student loans at lower rates with no fees.

- Choose a 5, 8, 12, or 15 year term to best fit your needs.

- Each applicant receives a personal loan advisor to help them through every step in the process.

- Spouses can refinance their loans together. Parents can refinance their loans too.

- Show more info »

1Rates and offers current as of April 1, 2021. Annual Percentage Rate is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of payments. Fixed Rates range from 2.99% APR to 5.15% APR and Variable Rates range from 2.15% APR to 4.45% APR. Both Fixed and Variable Rates will vary based on application terms, level of degree and presence of a co-signer. These rates are subject to additional terms and conditions and rates are subject to change at any time without notice. For Variable Rate student loans, the rate will never exceed 9.00% for 5 year and 8 year loans and 10.00% for 12 and 15 years loans . Minimum variable rate will be 2.00%.

How Will Cosigners Affect Student Loan Interest Rates

A cosigner is essentially someone who will join you on your loan application. This person will take on the responsibility for your loan in the case that you cannot repay your loan. As a result, your loan becomes their loan, so entering this agreement is a personal, as well as a financial one.

If you find yourself in a position where you cannot make monthly payments on your loan, this will have a negative effect on your cosigners credit as well as your own. Keep this in mind as you consider including a cosigner on your student loan application.

That said, if you have access to a cosigner who you are comfortable with entering a financial relationship, that person can be of great benefit to your loan application. Ideally, youll want to select a cosigner with a long and positive credit history, which can be a boon to your own credit status.

This can be especially helpful if, as an incoming college student, you dont have a long credit history or any credit history at all.

Here are a few scenarios where you can see the difference in rates between applications with and without cosigners:

- Borrower credit score 610

- Interest rate without cosigner: 12%

- Interest rate with cosigner: 7.6%

Recommended Reading: What College Accepts The Lowest Gpa

Interest Rates On Private Loans

Private student loans do not have the same interest rates as federal student loans. A private student loan lender determines your interest rate based on factors such as your credit history, the school you are attending, and your course of study.

Private student loans may have a variable interest rate that changes over time, so your payments may not be the same from month to month. A fixed interest rate loan will not change over the life of the loan, so your interest rate and payment will not change.

Your lender must tell you about your rates. If you already have a loan, log in to your student loan account on your lenders website or call your loan servicer to find out your interest rate information.

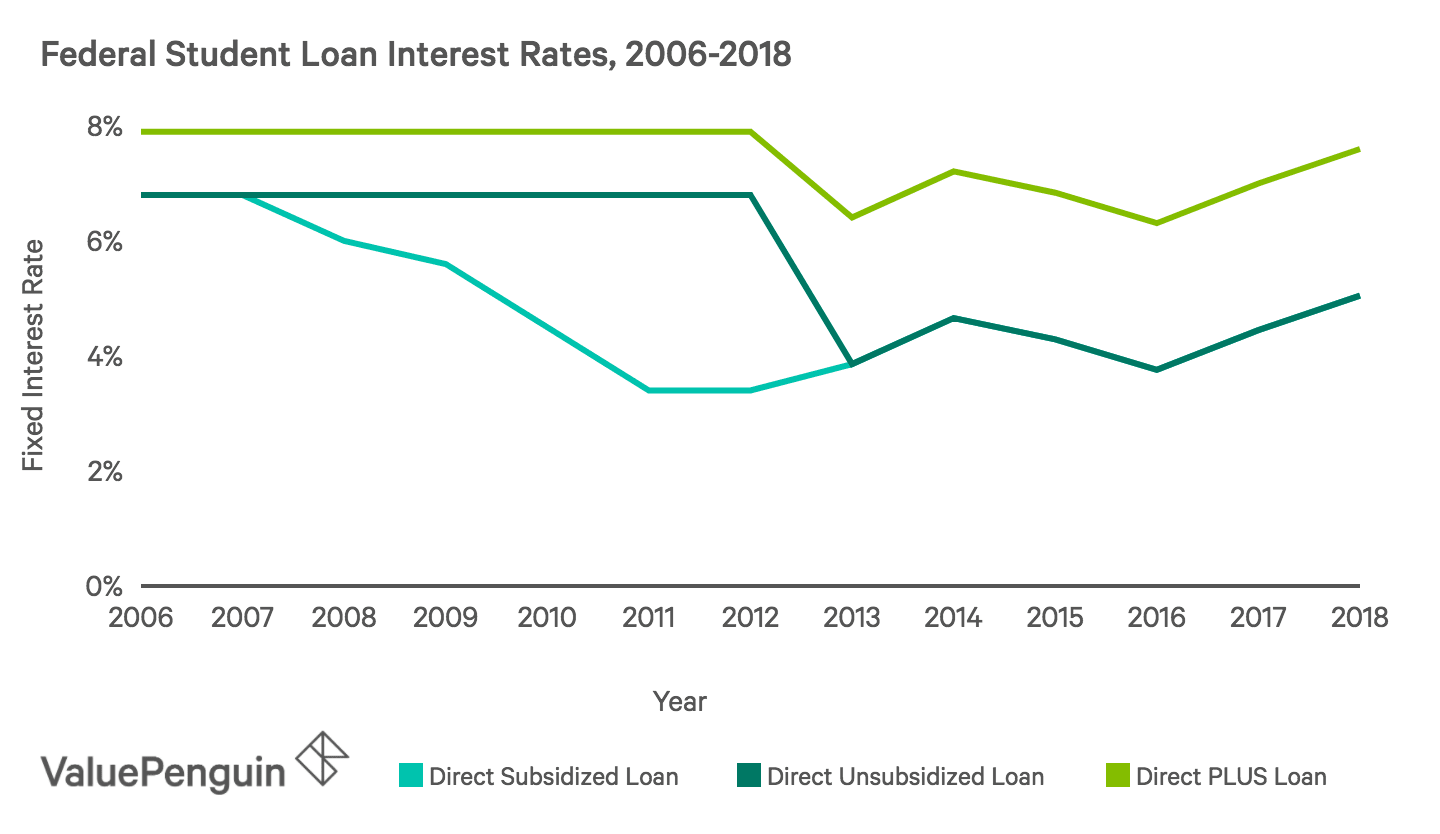

What Affects Federal Student Loan Rates

Here are some factors that contribute to your interest rate:

- What type of student loans youre getting. Direct subsidized and unsubsidized loans carry the lowest federal student loan rates, while PLUS loans cost more.

- What type of borrower you are. On direct unsubsidized loans, undergraduate students pay rates that are 1.55 percentage points lower than those for graduate or professional school borrowers.

- When you take out a loan. Federal student loan interest rates are decided annually on June 1 and take effect from July 1 to June 30 of the following year. Your loan will be assigned the federal student loan rate based on the date of the first disbursement.

- Recent 10-Year U.S. Treasury yields. The formula for federal student loan rates is based on the 10-year Treasury yield, plus a fixed add-on amount. When U.S. Treasury yields rise or fall, student loan rates track along with them, up to a rate cap set by law.

Theres little that you can do to control the rates on your federal student loansyou and everyone else taking out the same types of loans in the same period will have the same interest rate.

Fortunately, federal student loan rates tend to beat what youd pay on private student loans or other forms of debt, making them a fairly affordable way to finance a college degree.

Recommended Reading: How To Change Student Email For Apple Music

What Are Direct Subsidized And Unsubsidized Loans

Direct subsidized, and unsubsidized loans are federal student loans that are eligible to students, such as college graduates and undergraduates. These loans are equipped with a fixed interest rate that’s set by Congress.

These loans are used as a way to provide money to help cover the cost of tertiary education at a four-year university or college, technical school, career, trade, or community college. This is one of the best ways for those who don’t have a history with credit to gain direct finance for their undergraduate or graduate college degrees.

These types of loans are available for undergraduates, graduates, professionals students, and parents of an undergraduate student. However, the interest rates provided for these different individuals vary. These are the statements from July 1, 2019:

· Direct Subsidized and Unsubsidized loans for undergraduates were at an interest rate of 4.53 percent.

· Direct Subsidized and Unsubsidized loans for graduate and professional individuals were at an interest rate of 6.08 percent.

· Direct PLUS Subsidized and Unsubsidized loans for graduate, professional student, and parents of a college undergraduate or graduate student were at an interest rate of 7.08 percent.

Moreover, student loans are linked to any tangible asset that can be taken away if the person doesn’t pay their repayments. This, along with the lack of credit associated with applicants, are the primary reasons for the interest rates not being lower.

Current Student Loan Interest Rates

Depending on the kind of student loan you have or are looking to get, interest rates vary. About 90 percent of student loan debt is comprised of federal loans, with interest rates ranging from 3.73 percent to 6.28 percent. Average private student loan interest rates, on the other hand, can range from 1.49 percent to 12.99 percent fixed and 0.99 percent to 11.98 percent variable. While federal student loan rates are the same for every borrower, private student loan rates vary widely based on the lender, the type of interest rate and the borrower’s credit score.

Recommended Reading: Is Central Texas College Accredited

What Affects Private Student Loan Rates

With private student loan fixed rates ranging from 4.25% up to 12.59%, it can be tricky to know what you can expect to pay. The following factors can impact private student loan rates:

Which lender you choose. While many lenders offer comparable and competitive rates, some can provide a better deal than others. Collecting rate quotes can help you find the lender offering the best deal for you.

How creditworthy you are. Youll typically need a good credit score to qualify for a private student loan. Lenders also tie student loan rate offers to your credit score, so having better credit will net you lower rates. If your credit score doesnt meet this standard, you can add a co-signer to your application.

The private student loan terms you choose. The options you select for your loan will impact the interest you pay. Variable-rate student loans tend to have lower rates initially, for example, but can rise or fall in repayment. Fixed rates, on the other hand, can be higher at first but are locked in through repayment and wont change. Many lenders also offer lower rates on shorter student loan terms.

The general rates environment when you originate a loan. Similar to how federal student loan rates are tied to U.S. Treasury yields, private student loan rates are also affected by whats happening in the larger markets and economy. As overall rates rise or fall, you can expect private student loans to reflect those trends.

Best Parent Loans For College: Parent Plus And Private

Dont take on debt for your child unless youre in a strong financial position yourself.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Parent PLUS loans are federal student loans that are issued to parents. Parents looking to borrow money for their child’s education can also look to private loans offered by banks and online lenders. Private loans generally don’t come with fees, unlike federal parent PLUS loans.

When deciding between a PLUS loan or private loan, think about your current financial situation and employment outlook.

Before taking out parent student loans, make sure that:

-

Your child has maxed out federal student loan options.

-

Youre saving enough for retirement.

-

Youve paid off high-interest debt, like credit cards.

» MORE: Should parents pay for college?

If you decide to move forward, here are our picks for the best parent student loans and information on financing your child’s education.

Parent PLUS loans are federal student loans that are issued to parents. Parents looking to borrow money for their child’s education can also look to private loans offered by banks and online lenders. Private loans generally don’t come with fees, unlike federal parent PLUS loans.

Also Check: Should I Take Summer Classes In College

What Are Private Loan Interest Rates

Although the federal loan interest rates will generally be less than private loans, the federal loan amounts may not be enough to cover your entire college tuition. In this case, many students turn to private loans. Currently, the industry average for these loans is 9% to 12%, but in many cases, lower rates may be found.

Its also vital to check if the private loan has a fixed or variable APR. A fixed interest rate will not change over the lifetime of the loan while a variable rate will change over time with the market. In some cases, variable interest rates can actually be as low as 3% at first, less than a federal loan, but they wont stay this rate. For example, they may jump to 10% in a few years. It is possible to find low fixed interest rates, but this really depends on your or your cosigners ability to pay back the debt.

What Happens If You Dont Pay Your Stafford Loan Interest

When you take on a federal student loan, its super important that you stay up-to-date on all of your interest repayments.

You may find yourself in a situation where you decide you dont want to pay the interest thats built up on your loan .

For example, you might choose to defer your loan for a period of 12 months. But if youve signed on to take out an unsubsidized Stafford Loan, youre still responsible for the interest on your deferment period.

Any time you’re responsible for interest payments on a Stafford Loan but fail to pay, your unpaid interest is usually going to be capitalized.

What is loan interest capitalization?

Capitalization is the process in which a lender or loan servicer adds more unpaid interest to the principal balance of your loan. Translation: if you fail to pay off your loan interest, your loan provider will keep adding more interest onto your outstanding balance.

Generally speaking, your monthly loan payments should cover all of the built-up interest on your loan between monthly payments. That means you shouldnt have any unpaid interest to worry about.

That being said, there are a few different scenarios in which your unpaid interest can start to build up and cause problems.

For example, if you defer your student loan, you arent going to be required to make monthly payments during that deferment period. Unfortunately, the same cant be said of your interest if you have an unsubsidized Stafford Loan.

Recommended Reading: Does Cape Fear Community College Have Dorms

Which Is Better: Fixed Or Variable Interest Rate

Whats the best option for you? Assessing which interest rate option is better is a personal decision.

A fixed interest rate loan has the same interest rate for the life of the loan whereas, a variable interest rate loan changes based on changes to the index . With a variable interest rate loan, you benefit if the interest rate index remains the same or decreases. With a fixed interest rate loan, you dont benefit from decreases in the interest rate index, but you would also never face an increase in rate.

You should carefully consider your options and determine which rate is more appropriate for your situation.

Best viewed in landscape mode

How Are Student Loan Interest Rates Set

Since 2013, federal student loan interest rates are set each year based on the 10-year Treasury note rate following the May auction .

There is a set margin of 2.05 percentage points for undergraduate student loans, 3.60 points for graduate student loans and 4.60 points for PLUS loans. Rates are fixed for the life of the loan, although rates for new loans are set each year.

Here are the calculations for 2017-18:

- Undergraduate student loans 40 rate plus 2.05 percentage points equals 4.45% interest rate.

- Graduate student loans 40 rate plus 3.60 percentage points equals 6.00% interest rate.

- PLUS loans 40 rate plus 4.60 points equals 7% interest rate.

The current interest rate system was established in 2013, when President Barack Obama signed the Bipartisan Student Loan Certainty Act. After July 1, 2013, all annual percentage rates were linked to the 10-year U.S. Treasury Rate. The law also capped all Stafford loan rates at 8.25% and 9.50% .

U.S. Sen. Richard Burr said the law has saved borrowers about $58-million in student loan interest since it was enacted.

Also Check: Is Ashworth College Recognized By Employers

So What Is A Good Student Loan Interest Rate

Finding a good student loan rate may be difficult. The government, banks, and credit unions will give you different options. Look further than the given principal loan amount and interest rate. Dont take the first loan presented to you. By doing your research, you can find if it is the best option available for you and your family.

Use College Raptors free Student Loan Finder to compare lenders and interest rates side by side!

Public Service Loan Forgiveness

The borrower is eligible to get some form of student loan forgiveness if he or she works for the government or qualifying non-profit selling products and services. It’s important that borrowers aren’t selling these products and services for their own personal gain but rather for a charitable cause.

The borrower needs to have made 120 qualifying on-time payments on the loan and typically work full-time for the organization. However, with all that being said, many applicants, unfortunately, find the process of applying for such loan forgiveness exceptionally challenging. In addition to this, not all non-profit or government forms of work qualify for this loan forgiveness.

Don’t Miss: What Colleges Offer Mortuary Science

How To Get A Federal Loan

You can get the lowest interest student loans by applying for a federal loan. You must file a Free Application for Federal Student Aid , which is used by the federal government and most college and universities to determine the eligibility of a student applying for non-merit based financial aid.

Filing a FAFSA form is the first step in applying for more than 90% of aid money. Merit-based aid, which accounts for the other 10%, is awarded based on talent.

All applicants must:

- Have a valid Social Security number

- Have a high school diploma or GED

- Be registered with the U.S. Selective Service

- Be enrolled or accepted for enrollment at an eligible degree or certification program

- Not owe refunds on federal student grant

- Not be in default on student loans

- Not be guilty of the sale of illegal drugs while federal aid was being received

The FAFSA consists of approximately 130 questions related to the students and parents assets, investments, income, taxes paid, household size and number of dependent students in the family attending college or graduate school.

A student is considered a dependent and must include parental information on the FAFSA until he or she:

- Turns 24 years old

- Becomes an orphan or ward of the court

- Becomes a veteran of active military service

- Has one or more dependent children