Do I Have To Be Fluent In English To Attend University Of Phoenix

Students must meet the English Language Proficiency requirement . To meet this, a student must have completed high school in the U.S. or another English-speaking country, have 30+ transferrable semester credits from an approved English-speaking institution or pass an ELP exam from an approved testing agency . For more information, contact an International Enrollment Representative.

Does Your Teen Know When And How To Seek Help

When our kids live at home it is all too easy to tell them when they need to see a doctor or suggest to them that they seek extra help from a teacher. Once they are in college they will need to decide for themselves when to seek psychological services or tutoring.

Teens who have not learned to both assess their own problems and then seek appropriate help may falter when faced with inevitable problems.

Dr. Routbort emphasizes that freshmen need to have shown in high school that they can both learn and rebound from their failures and that they do not fall apart when they have setbacks.

She notes that it is important that students going to college can recognize when they are in some sort of trouble , asses the severity of their problems and that they are capable of reaching out for help on campus.

You May Like: What Size Are College Dorm Beds

How To Share A Room

For many students, college is the first time theyre expected to share a room. Make sure you and your roommate are able to effectively communicate with each other in order to avoid unnecessary fights. You also need to learn how to be aware of your belongings and how to respect the space of others.

Related: Getting Along With Your Roommate: What NOT to Do

Also Check: What Is Your Major Potential In College

The College Is Affordable For You And Your Family

Most students take on some debt in college, but there comes a point where excess borrowing doesnt make sense. Excessive loans can effect your financial health down the road. Try to cover as much of your college costs as possible with grants.

The less you have to pay for college, the better return you will get on your investment. Cost shouldnt be the only thing you consider when choosing a college, but it should cross your mind.

Its important to note that you should always compare colleges based on net price rather than the published cost of attendance.

The net price is what your family will actually paybased on your financial circumstances and academic meritand might be dramatically lower than the full cost.

Many times, academically qualified students are scared away from expensive colleges that have a price tag of $50,000, when in reality, their costs may have been less than attending an in-state public. If you want to see what your net price might be at a 4-year college in the U.S., use the College Raptor match search to compare costs.

Try Various Classes Or Subjects

High school electives can either be mandatory or optional. It all depends on the schools requirements.

In any case, taking electives in high school that seem to grab your attention more than others can help you ascertain which subjects you are truly interested in and which ones you can live without.

Check out the listing of available electives at your high school. Mark those that appeal to you the most. Skim through the course descriptions of each one and cross out those that are no longer as appealing as before. And if none of your high schools offerings seem interesting enough, you can always make allowances for available AP classes.

You can also count on this approach in college see just which gen-ed courses or electives spark your interests and get you inspired to succeed in a particular area in the future. After all, in most instances, you have the entire first two years of your higher education to make up your mind and declare a major.

Don’t Miss: How To Choose Your College

I Have More Than One Federal Student Loan Can I Combine Them Into One Payment Every Month

Yes. You can combine several federal student loans into one loan. That is called a Direct Consolidation Loan. It is free to combine your federal student loans into one loan.

Sometimes, companies might ask you to combine your federal student loans. These companies might charge you a fee. You do not have to pay to consolidate your federal student loans.

Do you have questions about consolidating your loans? You can call the Department of Educations Loan Consolidation Center: 1-800-557-7392.

What Is A Credit History

Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards. Companies also collect information about how you pay your bills.

You May Like: Does Real Estate Require College

How To Budget Your Money

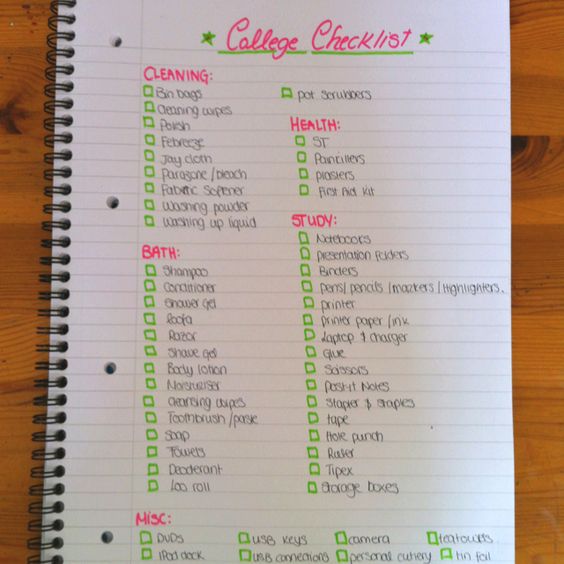

When youre living on campus, youll be responsible for buying everything from food and groceries to clothes. Whether youre paying for things with money you earn from working or with the money your parents put toward your meal plan, make sure to keep track of your purchases, and stay aware of how much youre spending.

Related: 5 Financial Strategies You Should Learn Before College

Do College Teachers Check For Plagiarism

Professors check for plagiarism using both technology and their expertise. Professors check for plagiarism when they grade, thus it is very important to know how they do it. In 2020, almost all universities use a learning-management-system that includes a plug-in which automatically checks for plagiarism.

Read Also: What Colleges Are Still Accepting Applications For Fall 2021

Also Check: Where Should I Apply To College

Is There A Way I Do Not Have To Repay My Whole Loan

Do you have a federal student loan? Sometimes, the government will repay some of your loan. That is called loan forgiveness. The government sometimes repays the rest of the money you owe on your loan if you work for the public sector or you work as a teacher.

You have to apply for loan forgiveness. There are strict rules and deadlines. Go to StudentAid.gov/forgivenessbefore you start repaying your loans.

Do you have a private student loan? Ask the lender if it offers loan forgiveness. Loan forgiveness is rare for private student loans.

Skylar Thompson Miami Dolphins

Skylar Thompson is another rookie quarterback serving as a starter this weekend. The Miami Dolphins turned to him after Tua Tagovailoas backup, Teddy Bridgewater, dislocated the pinky finger on his throwing hand during the teams Week 17 matchup against the New England Patriots.

Thompson, who, like Purdy, was taken in the seventh round of the 2022 NFL Draft, has logged one other start for the Dolphins this season and come in as a back-up in four other games.

Thompson has completed 54% of his passes this season for 382 yards, one touchdown and three interceptions. During his extended run this preseason, he led the NFL in passer rating and passing touchdowns, ESPN reported.

In the Dolphins Sunday game against the New York Jets, Thompson has the chance to be a hero. If Miami wins and the Patriots lose to the Buffalo Bills, the Dolphins will make the playoffs.

Coach Mike McDaniel said this week that hes confident Thompson can lead the Dolphins to victory, according to ESPN.

I think he has an athletic component to his game that sneaks up on people because he does most of his work in the pocket. He does have a knack of how to use his athleticism to extend a play, and the dude is fearless, he said.

Thompson played for Kansas State University in college.

Read Also: How To Transfer To Different College

Strategy : Reduce Financial Stress

One of the major considerations for adults returning to college is the cost of a college education. There are many ways to plan for the financial realities of going to college, including:

- Completing the FAFSA to ensure youre considered for grants and federal student loans.

- Asking if your employer offers tuition reimbursement for the cost of college courses.

- Planning ahead, making a budget and setting aside savings dedicated to your college education.

- Doing your research into the total cost of your college education, including tuition costs, additional fees, and textbook or software costs.

When considering the financial investment of a college education, keep the long-term benefits in mind.

Most people dont think twice before taking out a loan for a car, says Dr. Ross, They see it as essential and plan for the costs. An education, on the other hand, is less tangible and many people question taking out student loans. While loans shouldnt be your first option, an education only appreciates in value over time, while an investment like a car depreciates in value. As you evaluate your financing options, always take a long-term perspective and think about how an education will help you reach professional and salary goals.

Success Strategy: Choose an affordable online college that gives you the flexibility to work while you get a college degree.

Don’t Know What You Want To Do Yet Don’t Worry Big Decisions Take Time

You can go through all these tips carefully and still find yourself asking, “What do I major in?!” That’s perfectly OK. Take a lot of different classes early on that might help provide some clarity. You can also consider a double major. Find what works for you, even if that means taking extra time to figure it out!

Recommended Reading: How Do I Get Colleges To Email Me

What About Private Student Loans

Private loans come from:

- a state student loan agency

- sometimes, the school

Private loans:

- can have higher interest rates. Some have an APR of more than 18%. That makes them very expensive.

- can have variable interest rates. Those are interest rates that can change. That means you might owe more money.

When you apply for a private loan, the lender:

- often checks your credit history before they lend you money. Your credit history decides if you can get money, and your interest rate.

- often asks someone to co-sign the loan. Your co-signer is responsible for repaying the loan if you do not.

You might have to start repaying your private loan while you are still in school. When you start repaying your private loan, you:

- usually cannot put off repaying your loan.

- have to pay to combine or consolidate your private loan with other loans.

- can rarely get your loan forgiven, or repaid for you by someone else.

Design Your Own Major

Some institutions of higher education understand that different degree-seeking students have different interests and career goals. And its due to this why many of them allow their attendees to design their own majors.

Getting a major tailor-made is especially suited for those who have a certain course of study in mind that perfectly fits their academic and professional preferences. So, if a college allows the creation of individualized majors and you have an interdisciplinary interest that none of the existing majors can fulfill, go ahead and design one!

Here are some schools that give their students the opportunity to take personalized majors:

- California College of the Arts

- Columbia University

- The Gallatin School at NYU

- University of Connecticut

- University of Washington

You May Like: How Many Community College Credits To Transfer

How To Make Sleep A Priority

Students usually have different schedules every day at college, so its very easy to push off sleep if you have a late night or a late start in the morning. But getting enough sleep is important to both your health and academic success. Try to maintain a steady sleep schedule, and aim for at least seven hours a night in order to be fully alert and ready for the day.

How To Talk To Your Kids About Layoffs

Layoffs, we must remember, are a family affair. And facing the painful reality of job loss as a family is necessary. This doesnt mean your four-year-old needs to know the details of your household budget, or that your pre-teen needs to worry about transferring to a new school. But it does mean approaching conversations, and any problems you have, in a clear and age-appropriate manner. In this piece, the author offers advice on what to say when you break the news to your children as well as practical strategies to help your family weather the job loss together.

We all know that layoffs are hard. They create stress, worry, and financial instability, not to mention grief over a job that you loved, or colleagues you miss. Unfortunately, layoffs are fairly common. In the U.S., approximately 40 percent of Americans have been laid off at least once in their career. You dont even have to be laid off to feel anxious about it simply knowing that you could be next, or saying goodbye to colleagues can spark layoff anxiety.

Also Check: How To Know How Many College Credits You Have

How Do I Pay For College University Or Career School

Many people borrow money to go to school. Some peoples parents borrow money to help them. But you also can apply for grants and scholarships.

First, find out:

Next, find out the fees to drop classes or graduate. Also find out the cost for books, equipment, uniforms, and labs.

Then you know how much money you need. Now you can start looking for financial aid.

Your High School Years

Real talk: The best preparation for your college search is to do your best academic work throughout high school and take advantage of activities that are meaningful to you. This starts basically day 1 of freshman year.

However! If youre a junior or a senior, dont worry if your high school résumé isn’t perfect. And if youre a freshman or sophomore, dont go thinking the whole point of high school is getting into college. Your high school years are an important part of your intellectual and personal development, and spending too much time focused on college minimizes how much you get out of them.

Regardless of what year you arefreshman, sophomore, junior, or even senioryou can make the most of high school by doing the following:

Don’t Miss: Does The Navy Pay For Spouses College

Identify Preferred Coursework Rigor

Generally speaking, college courses are harder than high school courses. Thats because just about every topic or subject is more complicated and more fast-paced.

When choosing a college major, most students focus on the resulting degree and career opportunities. However, not a lot consider courses necessary for fulfilling the major requirement, some of which may not perfectly suit their interests, learning styles, available time, commitment to earning a college degree and others.

And if its rigorous coursework thats keeping you from determining what area you would like to concentrate in, you will be happy to learn that, despite college being harder than high school, some majors are comprised of easier courses.

Here are some of the easiest majors and the average hours of study per week required:

Talk To Your Parents Or Friends

No one said that you should figure out what you want to study after high school alone.

When it comes to choosing a college program or major, commonly, degree-seeking students consider their strengths. Alas, not all college-bound teens are well aware of the full range of their strengths. If youre one of them, you can obtain feedback from your family and friends, some of whom may possibly know you better than you know yourself!

Do they all agree youre a fantastic listener? Do some of them say youre a great problem solver, while others admit you have superhuman patience? Do they praise you for your creativity or attention to detail?

Interviewing those whose careers you find admirable or fascinating is a wonderful idea, too. Find out what major they took in college, how they find their current jobs or if they have always known theyd end up doing what they are doing now nobody can give better advice than those with real-life college and career experience.

You May Like: What Colleges Have Physician Assistant Programs

Here Are Some More Questions To Ask About Your Academic Preferences:

- What are your greatest academic strengths and weaknesses?

- Do you prefer learning in a small discussion group or in a large lecture class environment?

- What was your favorite class in high school?

- How do you do with academic struggles and pressure?

- Do you take a lot of advanced classes? Whats your GPA and how does it compare to other students at your school?

- Do you have any learning disabilities or concerns that might impact your academics?

Answering these questions will help you determine the type of academic environment that will suit you best in college. Based on your answers, you can look at the class sizes at schools that interest you to see if youll end up in mostly large or small classes. Your answers will also help you focus on a realistic range of colleges based on your GPA and ability to handle academic stress. Again, check to see if schools have academic offerings that align with what interested you most in high school even if you’re not sure that you’ll pursue that interest as a major. You want to be able to take classes that you feel are worthwhile experiences even if they aren’t a part of your ultimate academic concentration.

Academics may be the main point of college, but the majority of your time won’t be spent in classes. There are many other factors that will impact your comfort and happiness while at school.